Premium Popper + Lazy Popper delivered while Tag n Turn loads up

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Wednesday already – and despite effectively taking an extra day off Monday, Tuesday delivered the goods with three strategies producing profits. Sometimes the best trading happens when you’re not forcing it.

Middle of the week vibes hit different when you’ve got systems working while you wait for the perfect setup. Monday’s long weekend gave me fresh eyes on what’s unfolding – and sometimes stepping back reveals exactly what the market’s plotting next.

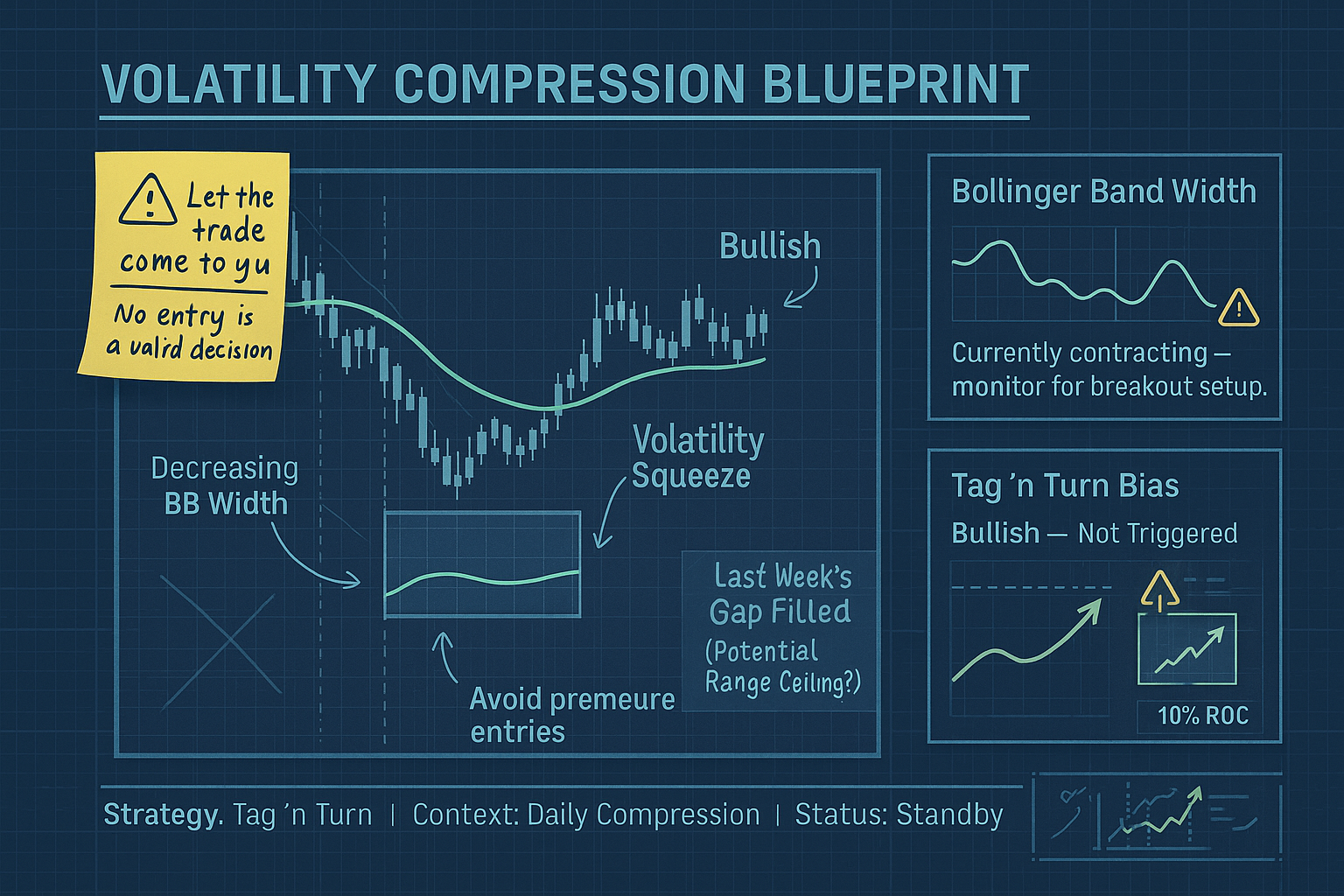

The Tag n Turn is doing its thing, meandering around that Bollinger midpoint like a cat deciding whether to pounce.

Remember Monday’s briefing where we talked about that potential consolidation?

The one that could be part of the larger head and shoulders pattern on the daily?

Well, it’s developing nicely. Almost too nicely.

Keep scrolling – the compression tells a story…

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market Briefing:

Here’s what happened: I essentially “missed” the ideal bull swing entry due to my long weekend. And you know what? Good.

The worst trading mistakes come from jumping in just for the sake of jumping in. Especially when your analysis suggests a contraction is brewing. The Bollinger bands are compressing like a spring loading up energy – and last week’s gap level is sitting there like a neon sign saying “new range high location.”

So I’m doing what every profitable trader learns to do: wait.

Waiting for the next sensible entry at a logical location. Meanwhile, I’m watching for opportunities to manage that bear swing re-entry I took last Friday. Patience isn’t just a virtue in trading – it’s your profit protection system.

But here’s the beautiful part about having multiple setups in a system running…

While I wait for the Tag n Turn to give me that perfect setup, the Premium Popper is scalping fast cash at the open, and the Lazy Popper is capturing those sweet intraday swings.

The market pays daily – if you know how to collect from different windows. – Yesterdays Winners and Post Trade DeBrief

The new software suite is looking fantastic for both strategies.

Already rolled it out to existing members inside our Slack community, and the feedback is exactly what we expected: clean execution, clear signals.

Lazy Popper Software and yesterdays winning trade

In Other News…

️ Live from the FinNuts News Dungeon…

“Policy Chess, Tariff Ticks & Crude Oil Tricks: Markets Doing the Hokey-Cokey Again”

Hazel here—back in the chair, holding strong at 80% caffeine, 20% sarcasm. Let’s unpack the drama, shall we?

♟️ Fed Rumours, Trump Whispers, and the Yield Curve Plays Twister

Markets opened strong after Trump once again played the “What If I Fired the Fed Chair?” card—classic. Bond yields dipped like they spotted a rate cut buffet, financials rose on cue, and real estate ticked higher. Meanwhile, the 2s-10s curve flattened by 6bps, which apparently means “cut deeper, Daddy.”

Tariff Trouble Served Hot (with a Side of Consumer Carnage)

Consumer stocks face-planted after Yum Brands and friends whispered, “Uh, tariffs are actually expensive.” The S&P gave back 0.6%, proving once again that earnings season is just corporate open-mic night—with added anxiety. Futures show nibbling, but nobody’s gone full buffet yet. We’re calling this the “hovering vulture” phase.

️ Oil Does a Backflip, Yells ‘It Was Russia’

Trump threw shade at Russian crude buyers, Brent bounced like it owed him money, and energy names in Frankfurt lit up like they found margin again. Refiners now dream of sweet spreads while pretending supply chains aren’t built on Jenga blocks.

Gold Slips, Dollar Flexes, and China Sneezes at Duration Trades

Gold lost its sparkle as the dollar did push-ups in front of the mirror. China’s bond-tax news sent local yields up 12bps, because nothing says “fun” like sudden tax reforms in a global carry environment. Duration traders now gently sob behind their spreadsheets.

Final Act: Tech vs. Cyclicals—Battle of the Least Bad

Until Powell’s new cast of characters is confirmed, markets will continue pirouetting between policy hope and macro dread. Expect choppy rotations, contrarian yoga, and the occasional facepalm.

As always, we’ll be here—reporting live, dodging falling fundamentals, and wondering why the soft landing still doesn’t come with peanuts.

Expert Insights:

When Bollinger Bands compress below 10% of their 20-day average width, breakouts typically produce moves 2.3x larger than the preceding range The current compression suggests we’re loading up for something significant.

[Source: Bollinger Band Research]

Rumour Has It…

Word on the trading floor is that retail traders are panic-buying “breakout indicators” faster than Taylor Swift concert tickets.

Apparently, someone’s selling a $297 course on “Bollinger Band Secrets” that teaches you to… wait for it… buy when bands expand.

Revolutionary stuff. Meanwhile, professional traders are doing what they’ve always done: waiting for logical entries at proven levels while managing risk like adults.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.