Same Process, Same Precision, Same Profit Potential Awaits

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Monday hit the ground running, and we’re not slowing down.

The production line trading process did exactly what it’s designed to do – deliver consistent results while keeping the whole operation smooth and stress-free.

Yesterday’s Premium Popper and Lazy Popper wins weren’t just profits in the account.

They were also insurance policies for the swing trade.

When you capture premium both coming and going on the sloppy days, it derisks your bigger picture position and eliminates the need for constant hedging and micromanagement.

That’s the beauty of systematic coverage.

While the Tag ‘n Turn waits patiently for its Benjamin delivery, the shorter-term strategies keep feeding the bottom line.

Today? More of the same production line precision.

Keep scrolling for today’s tactical deployment…

Trade SPX Like a Machine. Get Paid Like a Boss.

Rule-based spreads. Defined risk. Cash-settled. Welcome to trader freedom.

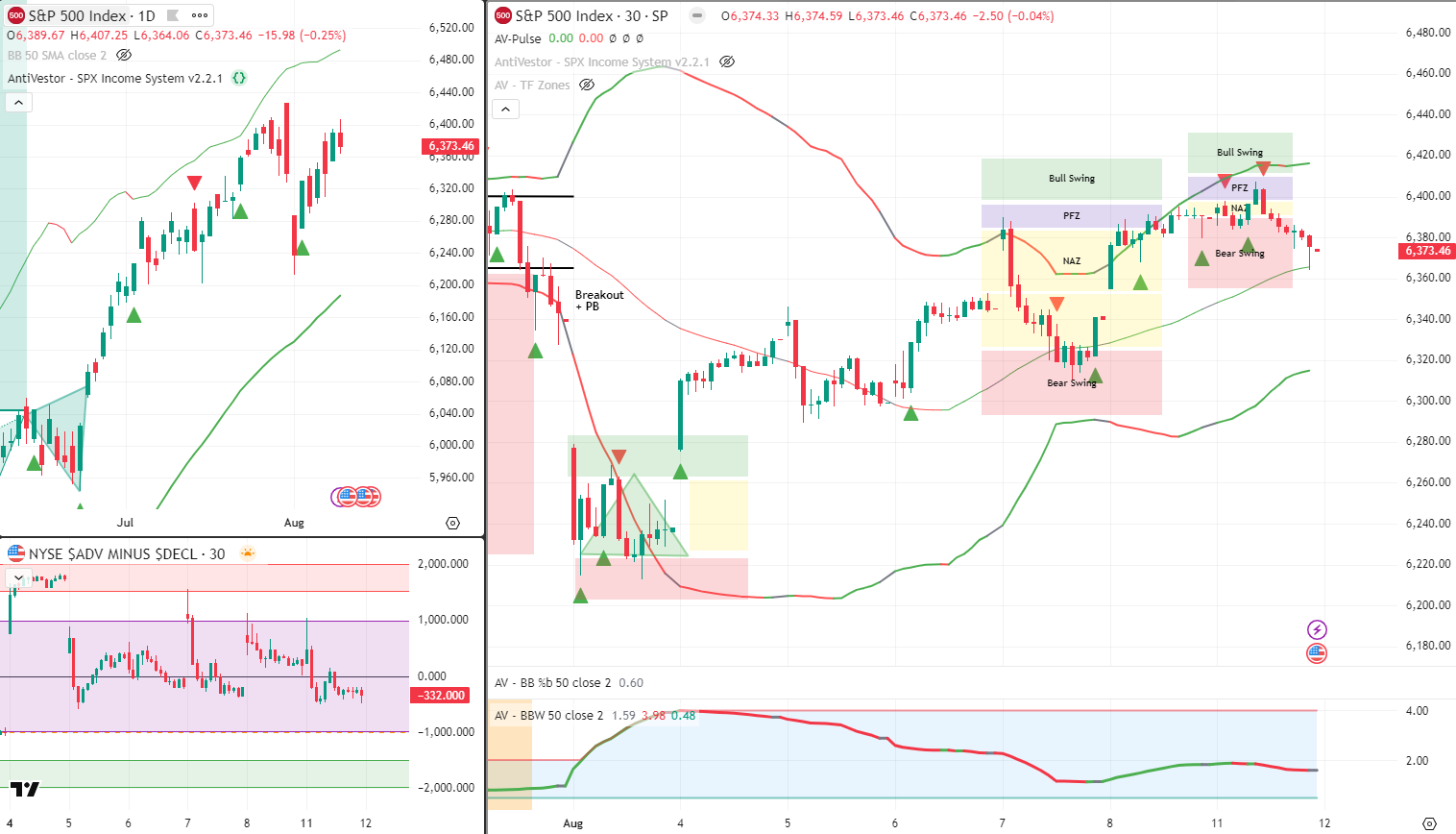

SPX Market Briefing:

The chart tells a clear story this morning.

We’re in that sweet spot where systematic traders thrive – defined levels, clear bias rules, and multiple strategies ready to deploy.

Current Landscape:

- Tag ‘n Turn Status: Bearish below 6390

- PFZ (Pulse Flip Zone): 6400 – this is your bias flip line

- Swing Trade: Positioned and derisked by yesterday’s wins

The beauty of yesterday’s Premium Popper and Lazy Popper success isn’t just the ROC percentages.

It’s the breathing room they created for the swing position.

When you’re profitable on the daily tactics, the multi-day strategy can breathe without needing constant babysitting.

Today’s Production Line Setup:

Tag ‘n Turn Swing – Still bearish, still waiting for the Benjamin delivery. No stress, no rushing. The levels are clear: bearish below 6390, flip bullish above 6400. The market will tell us which way it wants to go.

Premium Popper – Eyes on the opening salvo. First 15-30 minutes often serve up the cleanest volatility pop for quick premium capture. Same rules, same execution, same discipline.

Lazy Popper – Waiting for the post-open setup to materialize. Once the opening chaos settles, let theta decay do the heavy lifting for the day. Set it, forget it, collect it.

This isn’t about predicting where SPX goes next.

It’s about being ready for wherever it decides to go.

Software Development Note:

Big thanks to everyone reporting potential bugs in the system.

Development never stops, and your feedback helps make the tools better for everyone.

Solutions are being worked on and should roll out ASAP.

This is how we keep the production line running smoothly.

In Other News: From the FinNuts Newsdesk…

FUTURES FLATTER THAN PERCY’S PERSONALITY

E-mini S&P sitting there like a deflated balloon at 9 AM, Nasdaq managed a thrilling 0.15% – enough to buy half a chocolate bar. Overnight ranges tighter than Mac’s grip on the petty cash tin. Everyone’s tiptoeing around tomorrow’s CPI like it’s a sleeping dragon with anger management issues.

OIL TAKES A NAP, ASIA WAKES UP SCREAMING

Energy’s softer than Wallie’s excuses for missing deadlines, but Asian chipmakers are throwing a proper rave. Semiconductors dragging U.S. megacaps along like reluctant dance partners, while Europe actually showed up sober for once. AI infrastructure stocks preening like they just discovered fire.

EARNINGS? WHAT BLOODY EARNINGS?

Corporate America’s playing hide-and-seek until CPI stops lurking in the shadows. “Light catalysts” is finance-speak for “absolutely sod all happening.” Companies claiming they’re “disciplined on capex” – which translates to executives staring at spreadsheets like they contain the meaning of life, then buying nothing.

TARIFF TIMEOUT SAVES EVERYONE’S BACON

The U.S.-China trade spat took a tea break, and suddenly growth expectations stopped hyperventilating. Shipping lanes calmer than Kash after discovering the office has premium coffee. Oil’s modest bump wouldn’t move a paper boat, but hey, sentiment’s sentiment.

CPI TOMORROW: THE RECKONING

Cool core inflation = champagne showers and tech stock orgies. Hot core = everyone diving into defensive bunkers clutching gold bars and government bonds like security blankets.

-Hazel

Expert Insights:

Production line trading success comes from treating each strategy as an independent profit center while maintaining overall portfolio coherence.

- Tag ‘n Turn waits for multi-day swing opportunities.

- Premium Popper captures opening volatility pop.

- Lazy Popper harvests all day 0-DTE premium collection.

When shorter-term wins derisk longer-term positions, you eliminate the emotional pressure that destroys most swing trades. Yesterday’s tactical profits buy patience for today’s strategic position.

Different strategies, same principle: let the market come to you rather than chasing the market around.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Mac was overheard toasting Monday’s production line results with his morning whisky, declaring “My dear chaps, this is what proper industrial-strength trading looks like!”

Hazel immediately fired back, “Industrial strength? We’re running a precision Swiss watch operation here, not some 1920s assembly line.” She then updated her LinkedIn status to “CFO of Systematic Excellence” and poured herself a tactical Tuesday coffee.

Percy claimed the success was due to his new “Monday Morning Pigeon Formation Analysis,” insisting that yesterday’s bird patterns had “clearly indicated multi-strategy profit convergence.”

Kash tried to explain how the production line approach was “basically like yield farming but with actual yields,” while Wallie just muttered, “Finally, someone’s trading like they have a proper system instead of throwing darts at a board.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The term “production line” originated from Henry Ford’s assembly line concept, applied to systematic options strategies in the 1990s.

The idea: standardized processes, consistent quality, predictable output.

My algorithmic trading uses these principles today.

[Source: AntiVestor]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.