Bear Breakout Pop ‘n Drops to Target, Fresh Tag ‘n Turn Bull Trigger Active

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

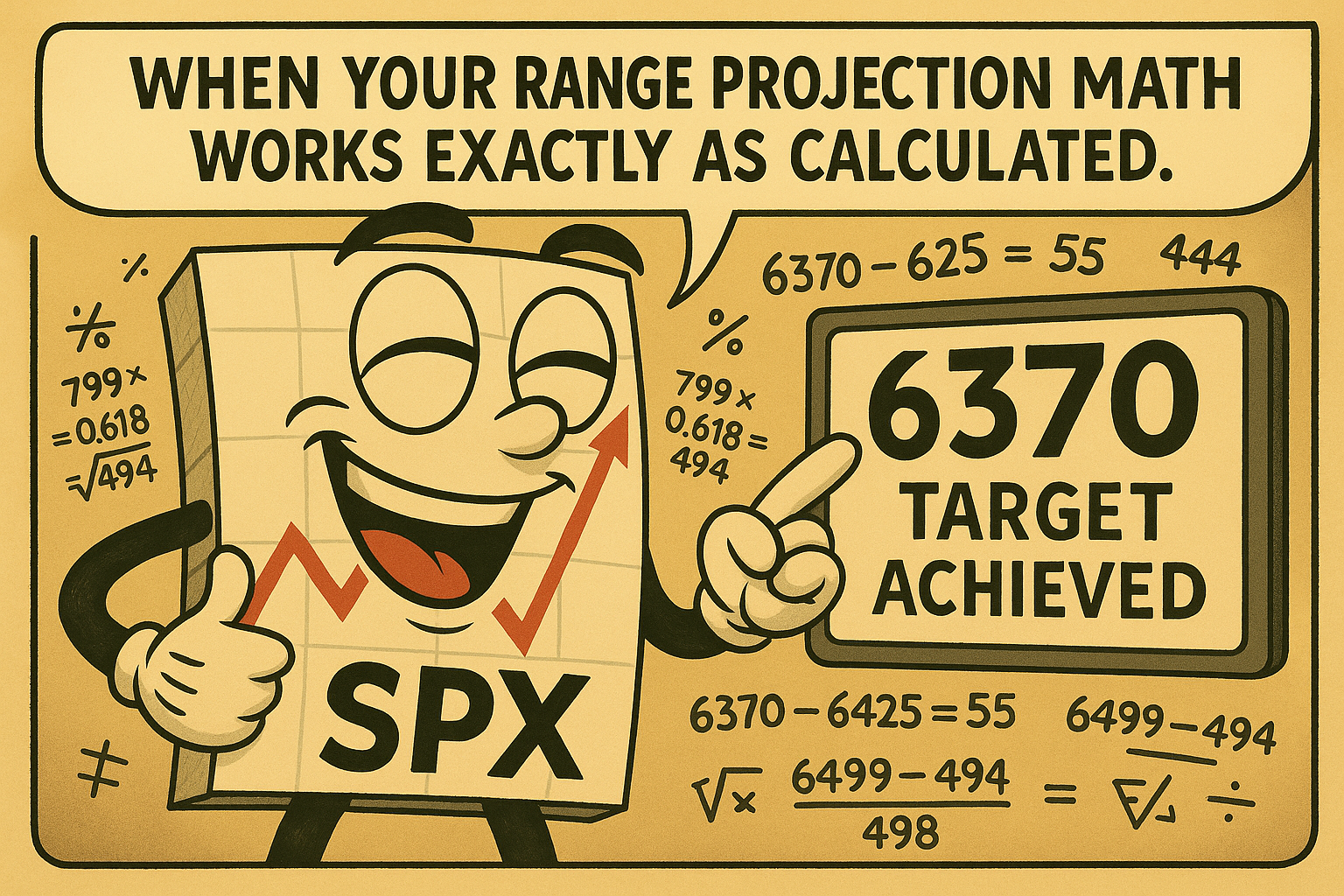

Well, it’s Thursday and the bear breakout trade very quickly pop ‘n dropped to its target, so we’re back to a basic Tag ‘n Turn setup – now bullish with fresh bull trigger and PFZ levels.

The Premium Popper scalper produced a fast profit and the Lazy Popper misfired. Such is the way of things when you’re running systematic approaches – some work, some don’t, but the process remains constant.

With back-to-back wins for the first two weeks of August and almost three weeks of success, we’re due a little shenanigans. This is where those who watched the win streak get confidence to live trade one or more setups, and inevitably that’s when they start seeing the few small losses the system gives.

I know this because those are some of the messages I’m getting – classic new trader syndrome when joining a proven system.

Keep scrolling for the win rate reality check and fresh bull setup…

Most Trade SPX Blind. You’ll Trade It Like You Designed It.

Pulse bars flip the lights on. You see it. Trade it. Bank it.

SPX Market Briefing:

The chart delivered exactly what systematic trading promises: clear target achievement followed by fresh setup activation. No guessing, no hoping, just mechanical precision.

Current System Status:

- Bear Breakout: Target achieved with pop ‘n drop execution

- Tag ‘n Turn: Fresh bullish trigger active with new PFZ levels

- Premium Popper: Fast profit delivered as designed

- Lazy Popper: Misfired – normal system variance

The really hard part isn’t the trading – it’s not jumping ship after literally one or two losses and sticking with the system to hit that glorious 80% success rate and inevitable win streaks.

Win Rate Reality Check:

As an aside to the aside: an 80% win rate doesn’t mean 8 wins then 2 losses then 8 wins again.

We all know it doesn’t work like that.

I could equally have 8 losses then 2 wins in such a small sample.

It’s over hundreds, if not thousands, of trades that you see these win rates play out – just like any other real-world business.

Funny how that works out.

Today’s Systematic Plan:

Tag ‘n Turn – I’m bullish until I’m bearish. Assessing what happens around the prior range level as this is a known area of significance. It also makes for a good short-term target to monitor.

Premium Popper – Waiting for another scalp at the open from the software.

Lazy Popper – Yesterday’s L is not impacting today’s trading decision. I’m waiting for the software to fire off an entry pattern and will simply “pop it on” when conditions trigger.

New Trader Psychology: The messages rolling in perfectly illustrate new trader psychology: watch wins, gain confidence, jump in live, hit first loss, panic about system validity. The discipline challenge is trusting the process over small sample sizes rather than emotional reactions to individual outcomes.

In Other News…

FinNuts Market Flash

FUTURES HAVING A PROPER MELTDOWN

E-mini S&P face-planted to -0.22% by 9:25 AM like Kash discovering the coffee’s decaf. Nasdaq diving -0.26% while Dow managed a pathetic -0.15% – collectively performing worse than Percy’s karaoke night. Markets shuffling around like hungover teenagers waiting for Fed officials to tell them how to feel about their life choices.

ENERGY FLEXES WHILE EVERYONE ELSE WHIMPERS

Brent crude strutting around like it owns the place, dragging energy stocks along for the victory lap while airlines immediately started hyperventilating about fuel costs. Banks getting frisky with wider spreads because apparently making money off other people’s misery never goes out of style. Tech sector having an identity crisis – AI hardware cowering like scared children while software pretends everything’s fine.

EARNINGS CONFESSIONAL GETS JUICY

Intuit bragging about small-business spending then immediately crying about wage costs because paying humans is apparently optional now. Cisco dropping bombshells about export license delays pre-market like corporate gossip at the water cooler. Mid-cap retailers gushing about back-to-school shopping then sobbing about freight budgets – because moving boxes apparently costs actual money now.

CROSS-ASSET REALITY CHECK INCOMING

Dollar index pumped to 98.05 like it’s been hitting the gym, while ten-year yield parked at 4.35% pretending nothing happened. Gold flatlining near $3,338 like it’s given up on life entirely. Brent hit 67.10, WTI at 63.00 – oil prices moving faster than Wallie avoiding actual work. Credit spreads tighter than Mac’s grip on office supplies, though single-B tech names widening because even garbage has networking standards.

-Hazel

Expert Insights:

New trader syndrome typically manifests when transitioning from observation to live execution. The psychological impact of a first loss often outweighs the logical understanding of win rate statistics over larger sample sizes.

Prior range levels serve as natural assessment points for continuation versus reversal. These areas often provide the cleanest mechanical signals for position management decisions.

Systematic variance includes both winning and losing sequences that don’t follow predictable patterns. The edge comes from consistent execution rather than perfect prediction of individual trade outcomes.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted creating a “Win Rate Reality Chart” using his desk pigeons to demonstrate statistical probability over small samples.

“Watch this,” Percy announced while arranging birds in groups. “Eight pigeons, then two pigeons, then eight pigeons again – that’s not how statistics work! Sometimes you get ten pigeons, sometimes zero pigeons, but over hundreds of pigeon formations, the pattern emerges!”

Hazel immediately updated her new trader education protocols to include “Statistical Patience Training” while muttering something about “emotional reactions versus mathematical reality.”

Mac raised his morning whisky and declared, “My dear chaps, true systematic brilliance reveals itself not in perfect sequences, but in persistent execution despite temporary setbacks!”

Kash tried to explain how win rates were “basically like yield farming but with actual probability math,” while Wallie just nodded approvingly at the hundreds-of-trades requirement, saying, “Finally, someone understands that real business results require real sample sizes.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

According to research by Johns Hopkins Carey Business School, the volume of 0DTE (zero days to expiration) options on S&P 500 stocks more than doubled between 2021 and 2024, and accounted for more than 43% of the total daily options volume on those stocks as of 2024.

[Source: NerdWallet – “0DTE: What Investors Should Know About Zero-Day Options”]

Meme of the Day:

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.