Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

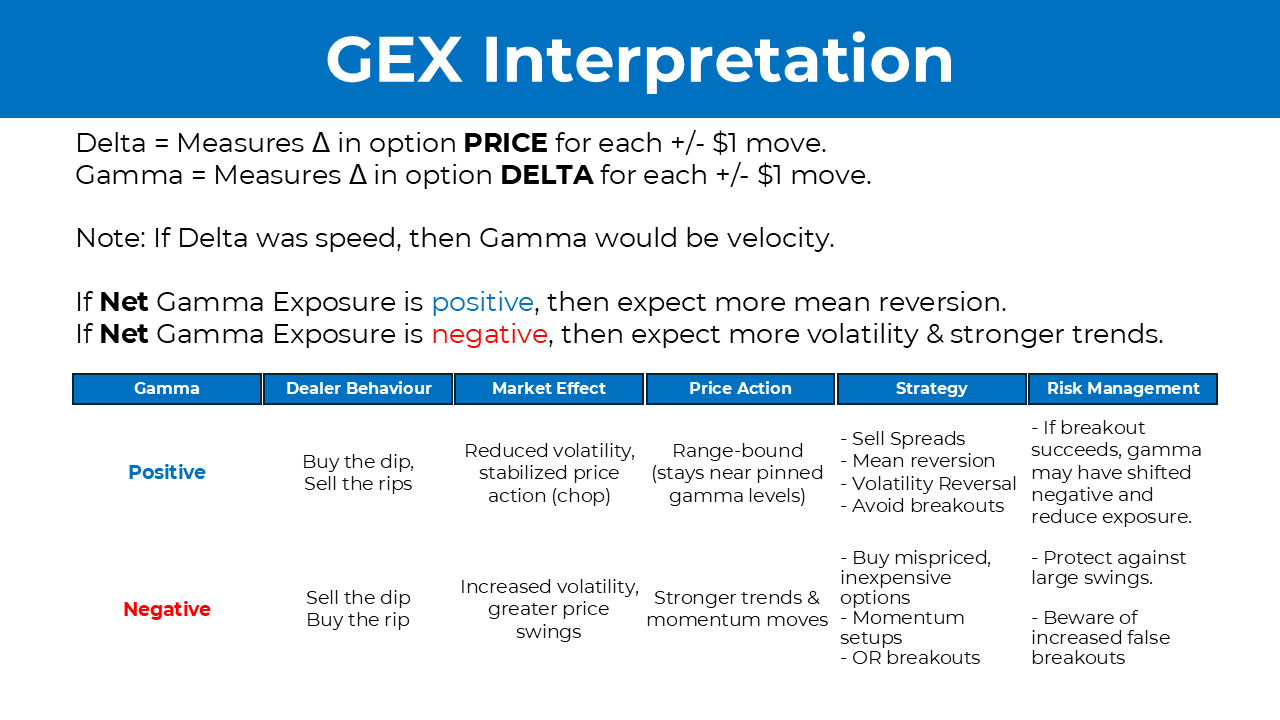

Gamma Exposure (GEX) is a crucial concept in options trading, particularly in understanding how large market participants (like market makers and institutions) hedge their positions and how this impacts overall market movements.

What is Gamma (Γ) in Options?

Gamma measures how much the delta (Δ) of an option changes in response to a $1 move in the underlying asset. Delta represents the sensitivity of an option’s price to changes in the underlying asset’s price. In essence:

-

High Gamma means delta is highly sensitive, leading to rapid changes.

-

Low Gamma means delta changes more gradually.

What is Gamma Exposure (GEX)?

Gamma Exposure (GEX) is the aggregated gamma from all outstanding options contracts in the market, showing whether market makers need to buy or sell shares to hedge their positions as the underlying price moves.

-

Positive GEX: Market makers are “long gamma,” meaning they will buy stocks as prices fall and sell stocks as prices rise. This dampens volatility and stabilizes price action.

-

Negative GEX: Market makers are “short gamma,” meaning they will sell stocks as prices fall and buy stocks as prices rise. This exacerbates volatility and can lead to sharp price swings.

How Does Gamma Exposure Impact Market Movement?

-

Low Volatility (High Positive GEX)

-

Market makers act as stabilizers by counteracting price movements.

-

Example: If the S&P 500 drops, they buy shares to hedge, reducing downside pressure.

-

-

High Volatility (High Negative GEX)

-

Market makers act as amplifiers, increasing price swings.

-

Example: If the S&P 500 drops, they sell shares to hedge, adding fuel to the selloff.

-

-

Gamma Flip Points

-

The market often reacts sharply when moving from a positive to negative GEX environment, leading to increased volatility.

-

The “zero gamma” point, where GEX transitions from positive to negative, is a key level traders watch for potential reversals or breakouts.

-

Why Does GEX Matter for SPX Traders?

For traders using the SPX Income System, understanding GEX helps in:

-

Identifying potential volatility shifts that can affect credit spread pricing.

-

Knowing when the market is likely to remain stable (high positive GEX) versus volatile (high negative GEX).

-

Timing trade entries and exits to avoid whipsaws and unexpected spikes.

Final Thoughts

Gamma Exposure is like the invisible force behind market liquidity and volatility. When traders understand GEX, they can align their strategies to capitalize on price stability or avoid the chaos of high-volatility environments.

Common Interpretations of GEX

These are well-known and widely used strategies by professional traders and market analysts.

1️⃣ High Positive GEX → Low Volatility (Mean Reversion Trading)

-

Market Makers Are Long Gamma:

-

If GEX is highly positive, market makers hedge by buying when prices fall and selling when prices rise, which suppresses volatility.

-

This often results in range-bound price action where large market moves revert back to equilibrium levels.

-

-

Trading Strategy:

-

Look for support and resistance plays within the trading range.

-

Sell iron condors, credit spreads, and iron butterflies to capitalize on low volatility.

-

Buy dips in stable trends because large selloffs get absorbed.

-

2️⃣ High Negative GEX → High Volatility (Momentum & Trend Following)

-

Market Makers Are Short Gamma:

-

When GEX is deeply negative, market makers sell into falling prices and buy into rising prices, amplifying market swings.

-

This is a high-volatility environment where large price moves are common.

-

-

Trading Strategy:

-

Look for momentum breakouts instead of mean reversion.

-

Use straddles or strangles to profit from large moves.

-

Avoid countertrend trades, as volatility spikes can be unpredictable.

-

3️⃣ GEX Flip Zones → Volatility Inflection Points

-

Gamma Flip Level:

-

The point where GEX shifts from positive to negative (or vice versa).

-

This acts as a critical pivot level in price action.

-

-

Trading Strategy:

-

If price is above the flip zone, expect lower volatility (favoring range-bound trades).

-

If price is below the flip zone, expect higher volatility (favoring momentum trades).

-

Monitor this level for potential trend reversals or breakout setups.

-

4️⃣ Extreme GEX Levels → Market Exhaustion

-

High Extreme Positive GEX:

-

Indicates that market makers are fully hedged and unlikely to provide further support.

-

Suggests potential for mean reversion or a slowdown in trend momentum.

-

-

High Extreme Negative GEX:

-

Indicates high fragility, meaning a minor catalyst (news, earnings, economic data) can cause massive swings.

-

-

Trading Strategy:

-

At extreme positive GEX levels: Consider selling options (iron condors, spreads) to take advantage of compressed volatility.

-

At extreme negative GEX levels: Consider long volatility plays like straddles or directional plays in the trend’s direction.

-

Uncommon & Advanced GEX Interpretations

These are less conventional but can provide additional edges for traders looking for deeper insights.

5️⃣ GEX Divergence → Implied Volatility vs. Market Price

-

Concept:

-

Compare GEX trends with actual market movement.

-

If SPX is rising but GEX is declining, it suggests that volatility might increase soon, leading to a market pullback.

-

If SPX is falling but GEX is rising, it suggests volatility might decrease, leading to a potential reversal.

-

-

Trading Strategy:

-

Use this as a contrarian signal to time entries into reversals.

-

Look for volatility expansion trades when price rises but GEX declines.

-

6️⃣ Intraday GEX Shifts → Short-Term Scalping

-

Concept:

-

Gamma exposure can shift significantly intraday, especially near major expiration dates (OPEX, quad witching).

-

Sudden shifts in dealer hedging flow can create unexpected reversals or short squeezes.

-

-

Trading Strategy:

-

Monitor GEX changes throughout the day for short-term scalping opportunities.

-

If GEX shifts from positive to negative intraday, consider momentum trades.

-

If GEX shifts from negative to positive intraday, consider mean reversion trades.

-

7️⃣ GEX-Weighted Open Interest → Pinning Effects

-

Concept:

-

Certain option strikes with high gamma can attract price movement, creating “pinning” effects around those levels.

-

This is especially relevant on option expiration days.

-

-

Trading Strategy:

-

Watch for key max gamma strikes on OPEX to predict potential market magnets.

-

Avoid trading against key strike levels near expiration, as price tends to gravitate towards them.

-

Use these levels as profit-taking zones or scalp setups.

-

8️⃣ GEX & Macro Events → News-Driven Volatility

-

Concept:

-

GEX levels can indicate how the market will respond to macro events like FOMC, CPI, or earnings releases.

-

A high positive GEX before an event suggests that volatility will likely be absorbed post-announcement.

-

A high negative GEX before an event suggests massive moves are likely due to dealers being short gamma.

-

-

Trading Strategy:

-

Sell options ahead of an event if GEX is high (expecting a muted reaction).

-

Buy straddles/strangles ahead of an event if GEX is low (expecting a volatility explosion).

-

9️⃣ GEX & Volatility Skew → Hidden Liquidity Pockets

-

Concept:

-

Compare GEX positioning with volatility skew (the difference in IV between out-of-the-money and at-the-money options).

-

If GEX is positive but IV skew is rising, it suggests that the market expects volatility even though dealers are hedging.

-

If GEX is negative but IV skew is falling, it suggests that dealers are driving the price action rather than real market sentiment.

-

-

Trading Strategy:

-

If IV skew and GEX conflict, avoid trading blindly in one direction.

-

Look for hedging-driven reversals when IV skew is extreme.

-

Final Thoughts & Key Takeaways

-

Positive GEX → Low volatility, mean reversion setups (credit spreads, iron condors).

-

Negative GEX → High volatility, trend-following setups (momentum trades, straddles).

-

Gamma Flip Level → Inflection point where volatility shifts.

-

Extreme GEX Levels → Market exhaustion or potential reversals.

-

GEX Divergences & Intraday Shifts → Advanced scalping and timing trades.

-

GEX on Expiration Days → Watch for pinning effects and dealer hedging flows.

-

GEX vs. Macro Events & Volatility Skew → Predicting how markets will react to news.

Dealers hedge in specific time windows, not continuously.

-

First 30 mins: Volatility-driven hedge balancing.

-

Midday lull: Little movement unless driven by news.

-

Final hour: Gamma ramps. This is where pinning, gamma squeezes, or snapbacks happen.

If you’re placing trades, time your entries before or after those windows depending on your goal (fade, momentum, breakout).

Expiration Week (OPEX) = GEX Chaos

During expiration week:

-

Options roll off, and GEX can change massively overnight.

-

The removal of large open interest positions flips dealer hedging behavior, which causes gap opens, false breakouts, and fadeable rallies.

-

Fridays (esp. Monthly and Quarterly OPEX) can create pinning at key strikes due to gamma gravity.

Using GEX to Time SPX Income Trades

For you specifically, this is pure gold:

-

If GEX is positive, your SPX credit spreads are safer – you can lean into short premium strategies like put credit spreads or iron condors.

-

If GEX is negative, use smaller size, tighter risk controls, or consider long premium if expecting expansion.

-

Watch the gamma flip level: If SPX is bouncing off it – it’s your “invisible support/resistance” for your trading setups.

Final Expert-Level Insight: GEX as a Narrative Filter

When everyone panics on CNBC or FinTwit, GEX helps you stay calm.

-

Is the move real? Or just dealer hedging?

-

GEX shows whether the market move is dealer-induced flow or real investor conviction.

This helps filter the noise, so you can follow your system – not your emotions.