Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Some days, the best trade is no trade at all.

It’s Thursday, the kettle’s on, the charts are up… and I’ve done absolutely bugger all from a trading perspective. Not out of laziness (though I do love a good sit-down), but because nothing’s screaming “go”. And when nothing’s screaming, I don’t go running.

We’re smack-dab in the middle of the “flip zone” – right around 5700. The market’s pacing like a nervous cat, pretending to pick a direction, but mostly just knocking things off the shelf to keep us on our toes. And honestly? I’m good with it. Because when the market hesitates like this, it’s usually winding up for something worth waiting for.

Stick with me and I’ll show you how to turn “nothing happening” into “something smart”.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Deeper Dive Analysis:

Today felt a bit like turning up to a party early and realising no one’s there yet. Just me… and the punch bowl.

I’ve barely done a thing trade-wise. And I’m perfectly happy about it. Because when there’s no clear setup, the smartest thing you can do is absolutely nothing.

Here’s why:

-

The 5700 level continues to act like the social bouncer of this range – nobody gets through without a convincing ID. It’s the pivot point where bulls and bears are circling, eyeing each other like it’s a West Side Story dance-off.

-

Bear pulse bars? None yet. So while price has dribbled downward in that slow, lazy style, we’ve had no real confirmation of fresh bearish momentum.

-

Bull pulse bars? Not exactly punching through the ceiling either. For that, we need to see solid moves above 5720 and, ideally, a breakout-pullback pattern to load up a fresh bull swing.

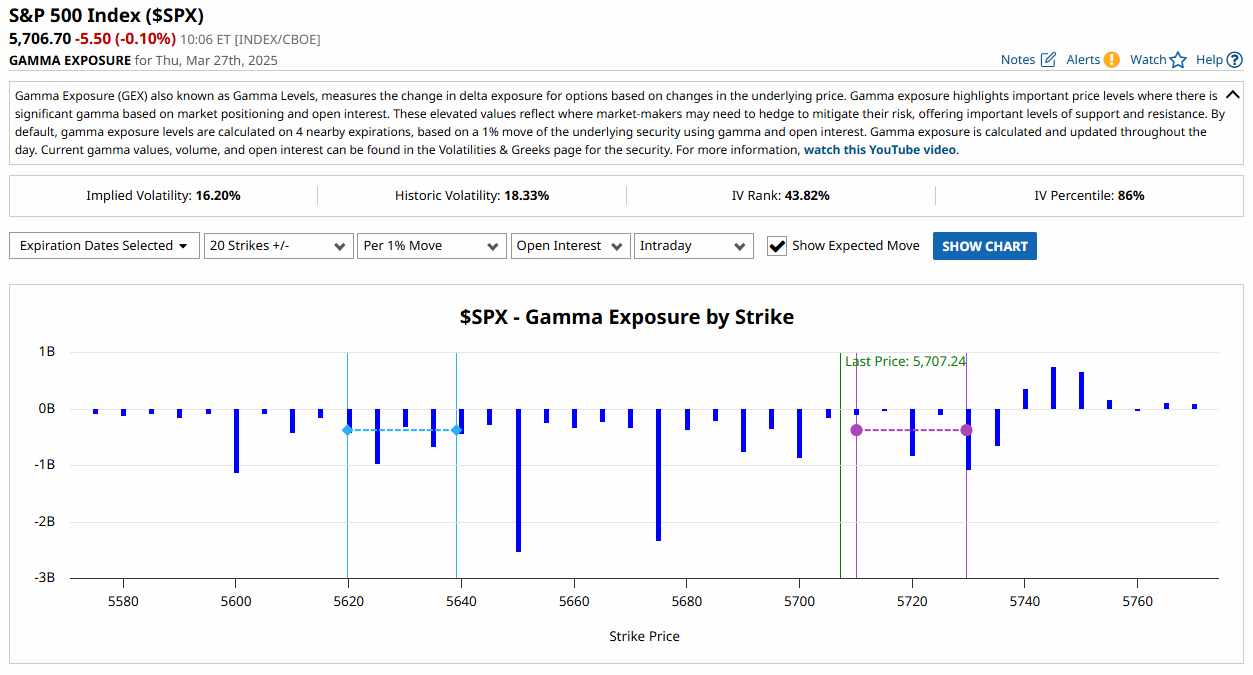

What’s more interesting is the GEX (Gamma Exposure). This week’s setup highlights 5700 as the flip point, reinforcing what we’ve already seen in price behaviour. When the options market lines up with technicals, I start paying even more attention.

The ES futures chart (with overnight data) shows the same range boundaries a little more clearly. It’s painting a picture of compression. And as you know from experience, compression always precedes expansion.

I’ve said it before and I’ll say it again: patience pays.

We’re in the eye of the storm – the kind where people get twitchy, traders get emotional, and portfolios get wrecked… unless you’re working the system.

So here’s the play:

-

No new bear trades until pulse bars form below 5700.

-

Bull trades only trigger on solid breaks above 5720.

-

Until then? Watch. Wait. Brew tea.

Because I’d rather miss the first 10 points of the move than get slapped for trying to be clever.

GEX Analysis Update

Support at 5680 remains key, especially as it’s flirting with the gap-fill zone from earlier this week. On the flip side, 5745 is shaping up as the likely high of day, and speculative butterfly plays targeting a pin around that level could offer a tasty risk-to-reward profile—if price cooperates.

Fun Fact

There’s a stock ticker called YUM. Yes, really.

YUM Brands – owner of Taco Bell, KFC, and Pizza Hut – trades under the very appropriate ticker: YUM. Now that’s branding you can taste.

YUM Brands spun off from PepsiCo in 1997 and has since become a global fast food empire. With over 50,000 restaurants in more than 150 countries, it’s been gobbling up global market share like it’s a late-night snack. The ticker symbol “YUM” is one of Wall Street’s more deliciously accurate tickers – and proves that branding doesn’t stop at the menu.

KFC was once known as “Kentucky Fried Chicken” until the name got a trim for health-conscious times. Go figure.

Video & Audio Podcast

Insert video here… if this were 1987 and I had a camcorder.

Audio & video will return shortly – probably with better lighting.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece