Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Here’s the thing no one tells you in all those shiny guru ads…

You don’t need perfect entries.

This week’s trade is living proof.

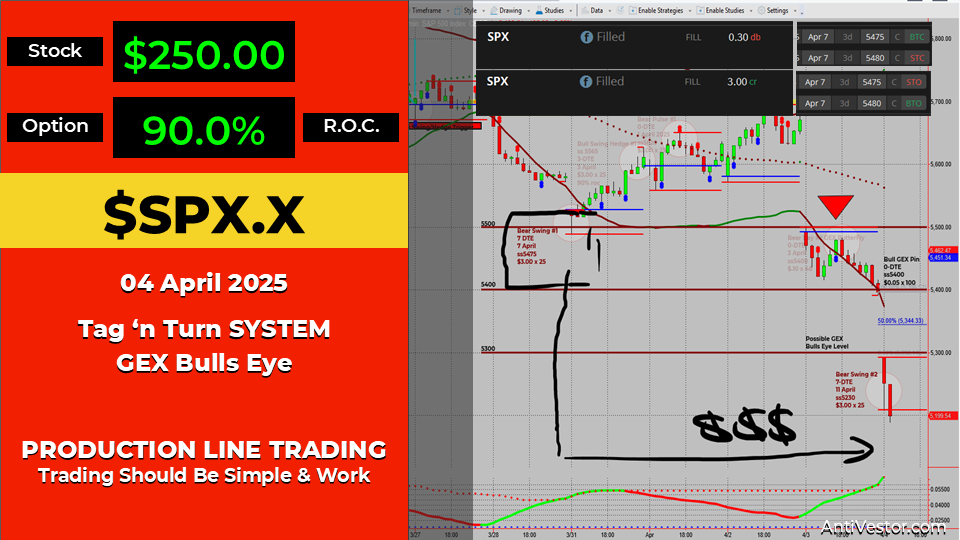

On Monday, I saw the market gap lower and provide a Bollinger Band breakout.

Bearish structure.

Momentum shift.

Bull hedge trigger hit on Friday

Sometimes you need to: “Just get the trade on.”

Was it timed perfectly?

Nope.

Could I have waited?

Absolutely.

Did it still pay off?

You bet your bear slippers it did.

Fast forward to Friday, and that same trade just hit my buy-back order for $0.30 – giving me a solid 90% profit on a $3.00 premium.

That’s not luck. That’s the system doing its thing.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Trader’s Eye View – When Good Enough Is Great

Let me take you behind the scenes of my mental chatter on this one:

“Hmm… not the cleanest entry. But the thesis is sound. Market structure supports it. Just get it on.”

✅ Trade placed.

✅ Premium in.

⏳ Wait and see.

Then the market slides like it’s got buttered socks on.

Perfect? No.

Effective? Absolutely.

The beauty of options income swings is this:

You don’t need to nail the top or catch the knife.

You need:

-

A working setup

-

A sound directional bias

-

A clear exit plan

-

And the patience to let it work

That’s what turned a slightly early bear swing into a 90% winner.

Expert Insights – Good Entries Are Optional, Structure Isn’t

The most common mistake I see from traders?

❌ Obsessing over the perfect entry

✅ Ignoring the setup’s structure

Here’s the truth:

-

A perfect entry without structure = hope

-

A decent entry with structure = probability

So instead of trying to time perfection…

- Focus on stacking edge with repeatable setups

- Trust the system – entries will average out over time

- Use options to buy time when direction is on your side

Fun Fact

The Bollinger Band was created by John Bollinger in the 1980s – and believe it or not, he originally called it the “trading envelope.”

It became popular when traders started seeing it as a “volatility hug” – letting you spot breakouts in price with a visual edge.

Moral of the story?

Even your indicators can get rebranded… just like trades that go from “meh” to “money.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s.Want to Trade Like This?

I teach this strategy step-by-step in the SPX Income System – a rule-based approach for generating income using short-dated credit spreads.

-

No guesswork.

-

No chart-hopping.

-

No 3am doomscrolling.

Just simple, structured trades…

That can potentially pay you $250 to $1,000+ per week.

- Option 1: The Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% Off

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

Join today and I will personally hop on a quick start call with you to get setup and running in my system in less than 45-mins.

- Options 3: Join the Fast Forward Mentorship – 50% Off

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.