Stability Signs – GEX Turns Net Positive

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

It feels like we have been grinding through bearish mud for months – when in reality, it has only been a few weeks.

Now, the tides are shifting.

This week marks a clear new direction on the cards. The monthly chart is gearing up to print a hefty rejection candle – and that kind of signal tends to pack a serious punch.

But do not expect smooth sailing just yet. We are still in a market where price action is as rough as a sailor’s language during a tariff war.

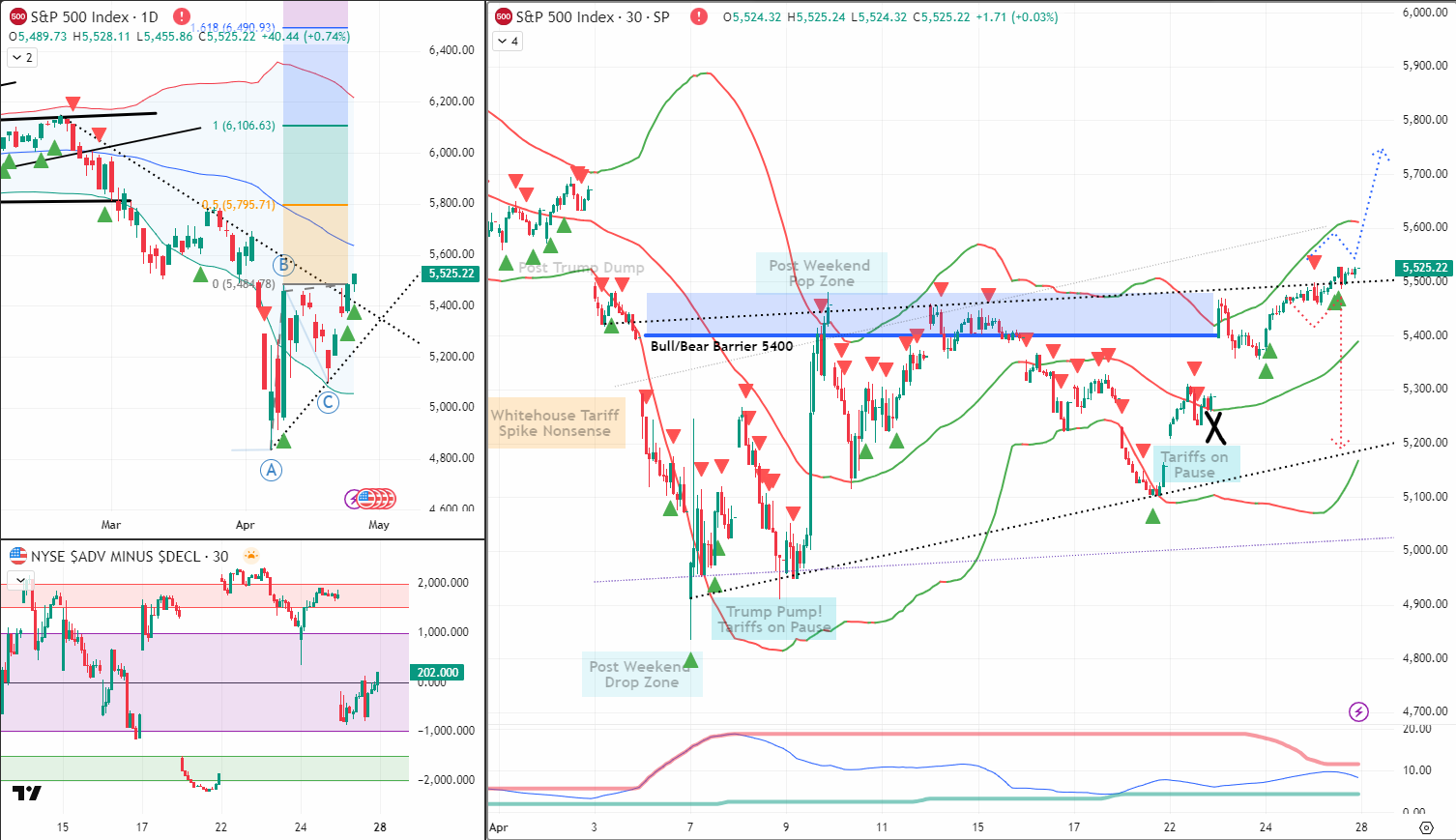

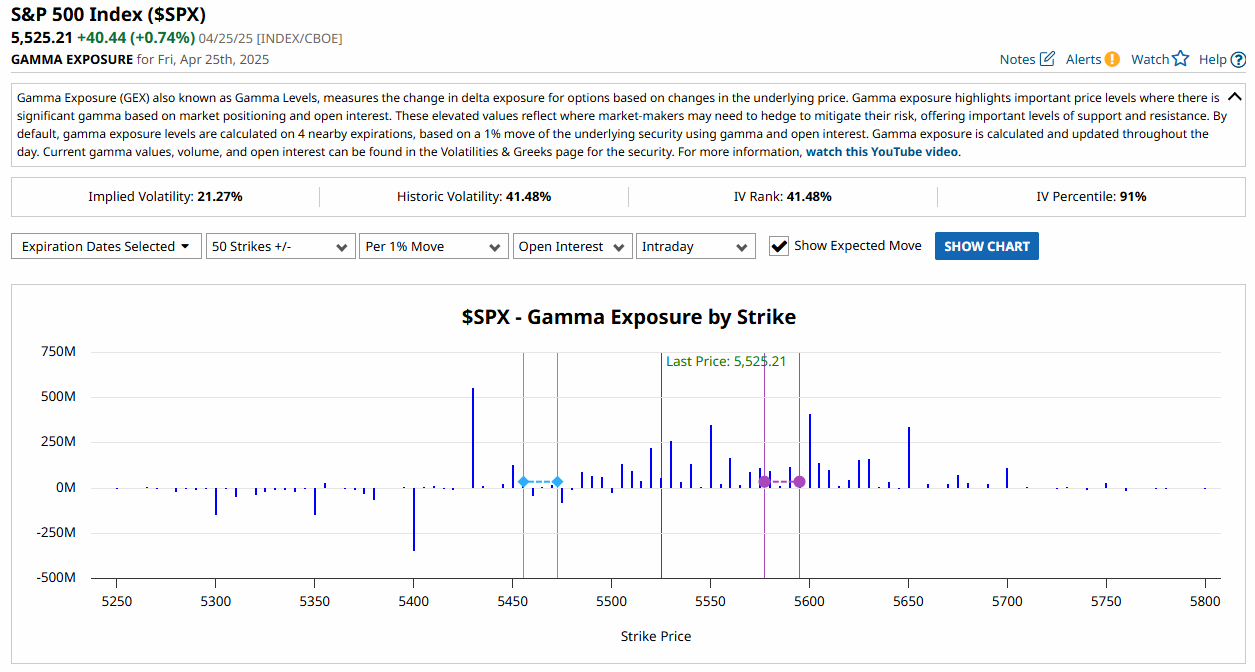

The good news? Stability is starting to show. GEX has turned net positive. Volatility looks set to stabilise. And on the daily charts, the bulls have smashed through a rising channel, completing a v-shape 123 reversal that we flagged last week.

Fun times ahead. Let’s get into it.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Trade SPX Like a Machine. Get Paid Like a Boss.

Rule-based spreads. Defined risk. Cash-settled. Welcome to trader freedom.

SPX Market View

For several weeks, bearish sentiment has weighed heavily across the board.

Every bounce felt like a trap. Every rally faded before it even got going. Traders were stuck in a rinse-and-repeat cycle of hope and disappointment.

But now the setup has shifted.

-

The monthly chart is building a massive rejection candle.

-

GEX has flipped from negative to positive – a key sign of market makers leaning bullish, not defensive.

-

Volatility is showing early signs of calming down.

Short-term, this suggests a phase of upward bias, even if the moves remain erratic. Expect sharp intraday swings, but with a bullish tilt.

On the daily chart, the real magic is happening:

-

We just broke out of a tight rising channel.

-

That channel formed part of a 123 reversal v-shape we identified last week.

-

Classic breakout pattern – and now we have confirmation.

It is not about “straight up only” action from here.

It is about higher lows, stronger rebounds, and sellers getting squeezed a little more each day.

Until proven otherwise, the bull is on.

For several weeks, bearish sentiment has weighed heavily across the board.

Every bounce felt like a trap. Every rally faded before it even got going. Traders were stuck in a rinse-and-repeat cycle of hope and disappointment.

But now the setup has shifted.

-

The monthly chart is building a massive rejection candle.

-

GEX has flipped from negative to positive – a key sign of market makers leaning bullish, not defensive.

-

Volatility is showing early signs of calming down.

Short-term, this suggests a phase of upward bias, even if the moves remain erratic. Expect sharp intraday swings, but with a bullish tilt.

On the daily chart, the real magic is happening:

-

We just broke out of a tight rising channel.

-

That channel formed part of a 123 reversal v-shape we identified last week.

-

Classic breakout pattern – and now we have confirmation.

It is not about “straight up only” action from here.

It is about higher lows, stronger rebounds, and sellers getting squeezed a little more each day.

Until proven otherwise, the bull is on.

GEX Analysis Update

- xxx

Expert Insights:

Mistake: Assuming bullish reversals will be smooth and linear.

Fix: Stay nimble. In a breakout phase like this, expect volatility within the trend. Use pullbacks to build positions, not chase highs.

Mistake: Ignoring GEX flips and volatility signals.

Fix: Track GEX daily. Net positive readings tend to support bullish stability, even during short-term whipsaws.

Mistake: Getting anchored to “it feels bearish.”

Fix: Focus on what the charts say, not emotions. Reversal setups often feel wrong – that is what makes them work.

IMAGE HERE

Rumour Has It…

Sources inside the New York Stock Exchange allegedly spotted a secret “Bull Club” forming in the cafeteria – complete with gold horns, steak lunches, and ceremonial rejection candle toasts.

Membership rule #1: You must mock anyone mentioning the word “recession” before dessert.

In other news…

-

Federal Reserve Unveils “Rate Hike Jenga” Game Night

In a stunning move toward transparency, the Fed announced that future interest rate decisions will be determined by a weekly game of Jenga. If the tower falls – emergency hike! -

Crypto Traders Launch First Blockchain-Based Hamster Derby

Investors can now bet on live hamster races recorded on the blockchain for immutable proof of furry financial victory. Early odds favour “Satoshi the Speedster.” -

IMF Rolls Out Emotional Support Unicorns for Debt-Stricken Nations

Struggling emerging markets will now be issued “Comfort Unicorns” – rainbow-clad financial mascots trained to sing soothing tunes during austerity negotiations. -

Goldman Sachs Accidentally Discovers Infinite Money Glitch on Microsoft Excel

A rogue analyst reportedly found an Excel bug allowing columns to print unlimited “bonus pools” before IT shut it down. Investigation ongoing, bonuses non-refundable. -

Tesla Announces ‘Model $’ – A Car That Mines Bitcoin While You Drive

Elon Musk’s latest innovation promises vehicles that pay for themselves by mining crypto… as long as you never brake, turn, or stop at traffic lights.

Breaking scoops courtesy of the Financial Nuts Newswire – because who needs sanity?

This is entirely made-up satire. Probably!

Fun Fact

During World War II, the New York Stock Exchange stayed open every single trading day – despite blackouts, rationing, and threats of attack.

Even when the city practised full air-raid drills, traders simply moved their operations underground and carried on.

Markets may panic fast – but history shows they are also remarkably stubborn.

Meme of the Day

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.