From Fakeout to Full Send – SPX Flips Bullish

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

You could almost hear the financial media pop champagne today.

“Markets Surge Amid Easing Trade Tensions” they yelled.

“Global confidence returns!” they assured.

And sure, that’s a cute story.

But for us, Wednesday’s bear push now looks like a feint. A setup. A spring.

By Friday, the bull had not only taken the ball – it ran with it.

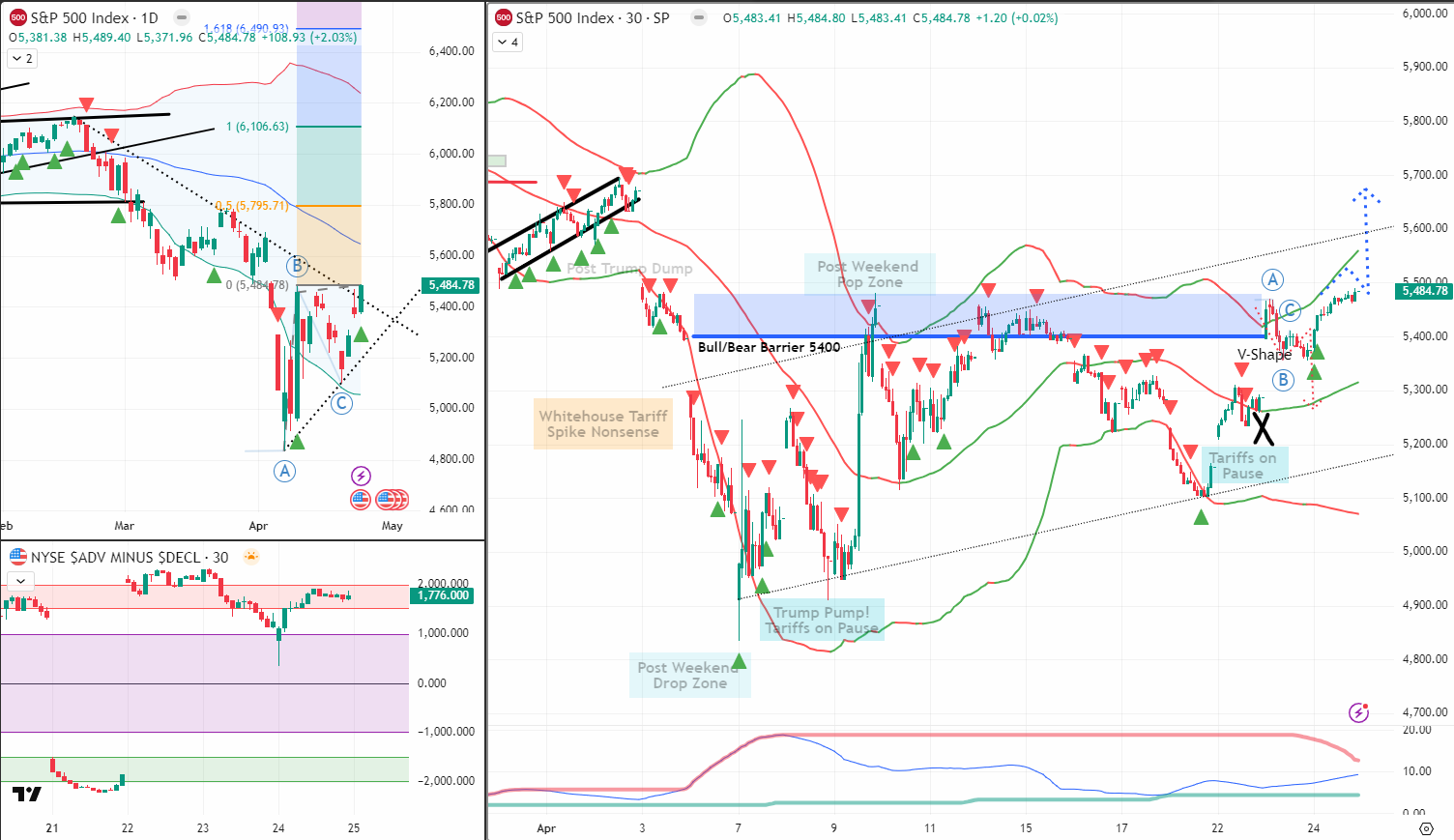

That V-shaped reversal pattern on the daily chart? It’s live. And it’s loud.

Technically, it’s now pointing to a projected upside of 6106.

That’s not just some random number. That’s the prior range high zone coming back into focus.

And in case you needed a reminder…

The bear is dead. Long live the bull. (until it isn’t)

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

SPX Market View – Bullish Flip Confirmed

Wednesday gave us a classic tease.

Bearish energy. A flicker of downside. But it fizzled fast.

Then came Thursday – and with it, a clean sweep into Friday.

The V-shaped daily reversal triggered.

-

Price pushes off the lows

-

Sentiment flipped

-

And a new upside target emerged at 6106

It’s not just technical fluff. This level marks a structural return to the previous range highs – a natural magnet for bullish continuation.

Meanwhile, I’ve done a bit of chart housekeeping myself.

After two months of letting bias sneak in and lines and notes multiply like rabbits, I’ve hit the reset button.

Clean charts. Clean mind. Just the essentials.

The direction has changed – and I’m treating it with fresh eyes.

One line I am keeping?

5400. It’s been the pivot point for weeks. A battle-tested zone. It now serves as the bull’s first major checkpoint.

If price respects that level on any dip, it’s game on.

And if we breach it? That’s when the doubt returns.

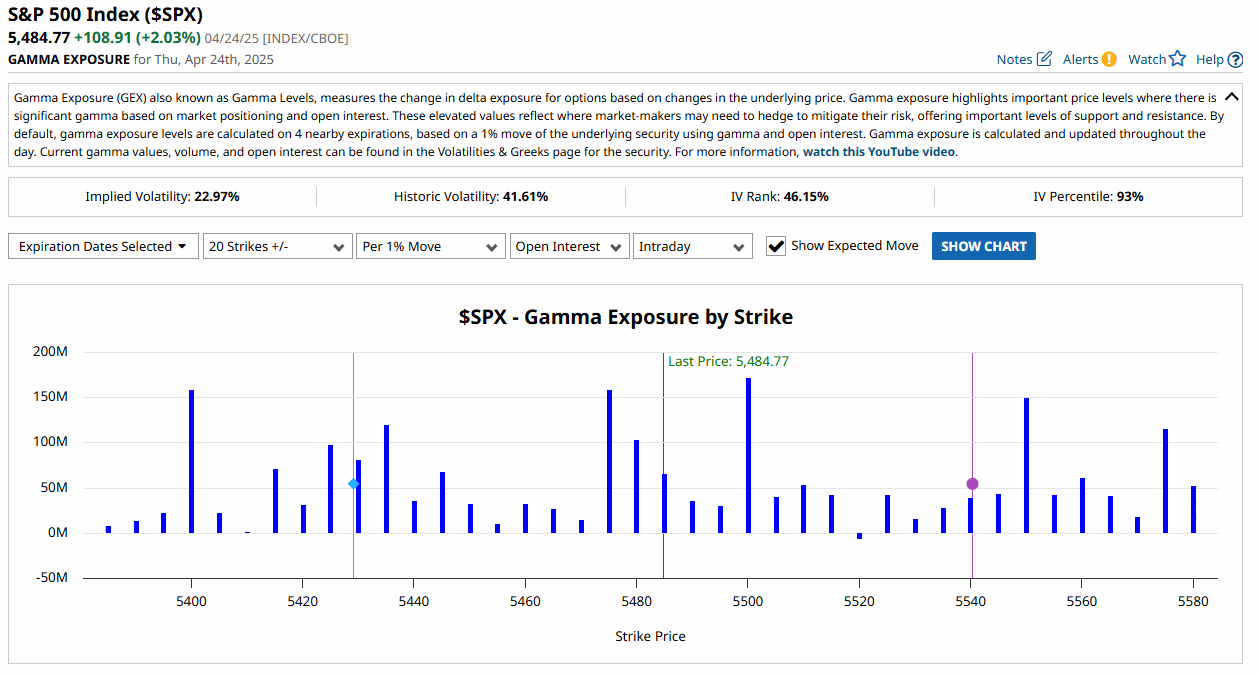

GEX Analysis Update

Expert Insights: Common Trading Mistakes & How to Avoid Them

MISTAKE: Letting cluttered charts and old bias cloud current decisions.

FIX:

-

Regularly clean your charts — strip them down to what matters.

-

Use setups that speak for themselves (like the V-shape).

-

Don’t bring yesterday’s opinion into today’s trade.

A new direction demands a new perspective. And as price shifts, so must your lens.

️Rumour Has It…

BREAKING:

Powell Declares Bull Market, Blames Moon Phase for Midweek Bear Tease

Financial news outlets were caught scrambling when the SPX reversed higher through thursday despite Wednesday’s doom-and-gloom.

“Clearly the moon was in retrograde,” Powell reportedly muttered, while clutching a Fibonacci ruler.

In other news, China’s trade delegation released a statement saying, “We’re not sure what’s happening either.”

(This section is entirely made-up satire. Probably.)

Fun Fact – The Original “Clean Chart” Addict Was… Jesse Livermore

Before indicators, algos, and triple-screen madness, Jesse Livermore – the OG speculator – was famous for trading from price and price alone.

In fact, he refused to use charts with clutter.

He would manually draw his price levels, log his trades by hand, and sometimes go days without placing a trade – waiting for the market to tip its hand.

His trading edge?

-

Patience.

-

Price action.

-

And a clean, unobstructed read.

One of his favourite tricks?

He’d mentally mark key inflection levels (like your 5400) and wait until price either exploded past or rejected hard before acting.

So next time you reset your chart – you’re not just decluttering…

You’re channelling Livermore.

Meme of the Day

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.