Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

The week starts with a bang—Trump, tweets, and political uncertainty, and markets bouncing like a hyperactive yo-yo.

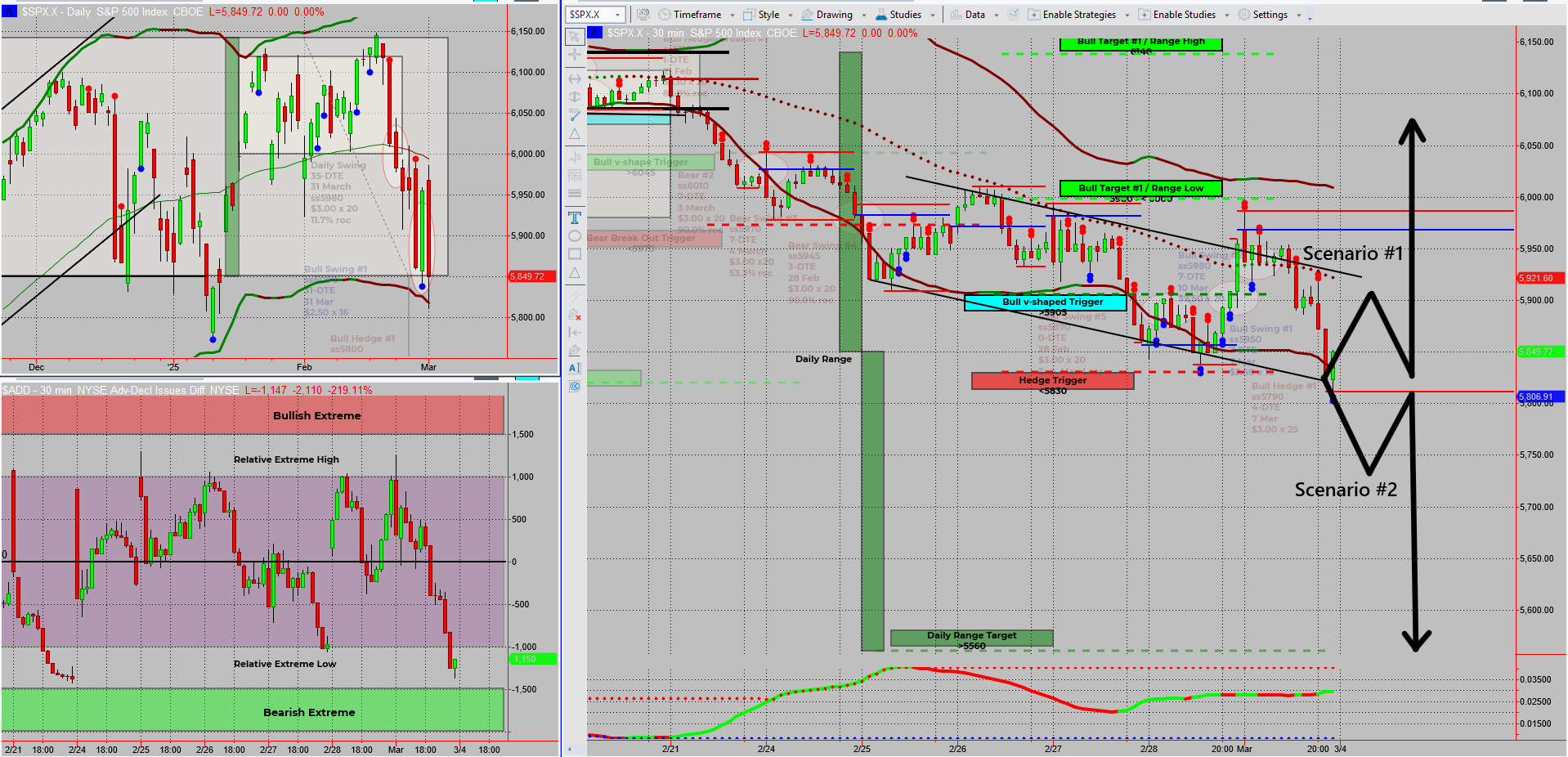

With bullish and bearish triggers already firing, we’re in a “could go either way” situation. Price is lingering at the range low on the daily chart, leaving us with two clear possibilities—a range reversal targeting the highs or a breakout move lower.

With major political talks and red flag news this week, volatility could be off the charts.

I’m hedged, prepared, and waiting. Whether the market pumps or dumps, I’m simply waiting for the next move to commit—because patience, as always, is the name of the game.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

The market opens with uncertainty at its peak—Trump’s latest comments, political negotiations, and key economic data are all on deck this week, creating wild swings.

Market Structure – A Classic “Could Go Either Way” Setup

- Bullish & Bearish triggers have fired, but price remains stuck

- The daily chart shows price hesitating at the range low

- Two possible scenarios using my 6 money-making patterns:

- Range Reversal: Price rebounds to target the range high

- Range Breakout: Price collapses and follows a measured breakout move

What’s Driving the Uncertainty?

- Political talks in focus – decisions this week could shake the markets

- Start-of-the-month red flag news – payroll reports, inflation data, and more

- General market indecision – traders waiting for a confirmed direction

How I’m Approaching It – No Need to Predict, Just React

- I’m already hedged, meaning a move in either direction is fine

- Patience is key—waiting for price to confirm its move

- Letting the market decide—no need to force trades in choppy conditions

This is one of those weeks where traders who chase moves will get whiplash, while those who stick to their system will come out ahead.

The plan? Let the market “git goin’” before committing capital.

Fun Fact

Did you know? In 2016, one of Trump’s tweets about Boeing sent the stock tumbling over 1% in minutes, wiping out $1 billion in market value—all over a comment about Air Force One being “too expensive.”

The Lesson? A single headline or tweet can move markets, but traders who follow their system instead of knee-jerk reactions are the ones who win in the long run.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece