Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

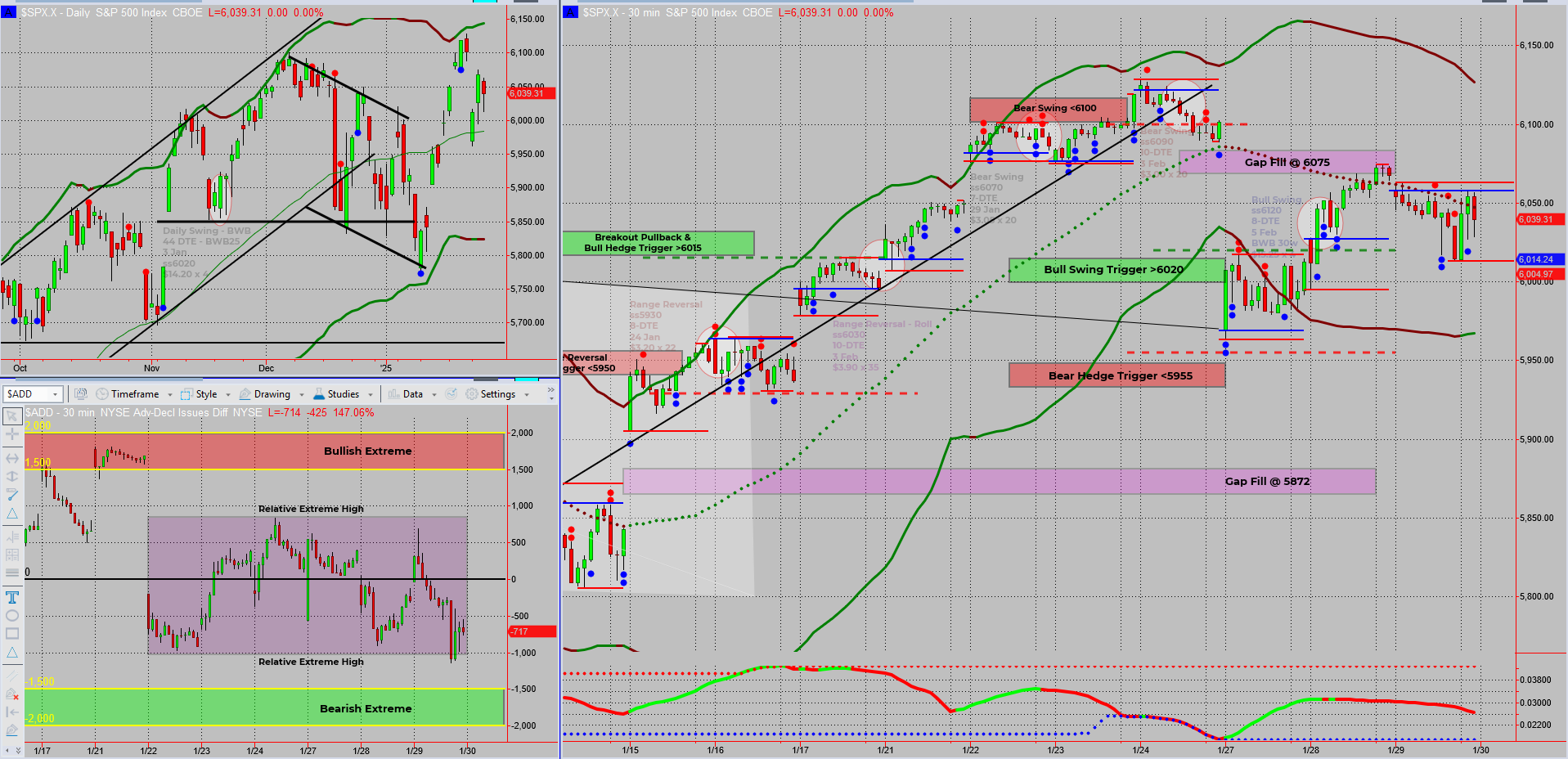

SPX is setting up for another inside bar battle—yesterday’s price action played out like a scripted drama, with a push higher before fading into the FOMC event. Now, we’re seeing a similar setup unfolding, making today’s session a potential repeat performance.

The big question: Will we get another pop higher before rolling over, or is this the setup for a proper breakout? Futures are slightly up, suggesting a gap higher at the open, but as always, I’ll be waiting for clear confirmation before making any big moves.

Let’s dive into the setups, what I’m watching, and how I’m positioning for whatever unfolds next.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

⏳ The Market’s Tug of War: Which Way Will It Break?

Wednesday Review:

- SPX followed expectations – a challenge of the inside bar high, followed by a sell-off into the FOMC decision.

- The inside bar setup remains in play today, meaning we could see a similar push-and-fade before any clear direction emerges.

Current Market Setup:

- Short-term bearish bias, but longer-term bullish structure remains intact.

- $ADD levels at relative extremes – currently at a low, suggesting a pop higher before a potential fade.

- Futures are slightly up overnight, so a gap higher at the open could fulfill the expected move.

Trade Plan for Today:

- Bullish income swing trade is open and tracking with the SPX Tag ‘n Turn setup.

- Bear hedge remains intact in case the market rolls over.

- Watching for a break above the inside bar high, followed by potential weakness later in the session.

That’s the playbook for today, Trader! Stay sharp, keep the setups in mind, and let’s see if this inside bar pattern plays out as expected.

Fun Fact: The FOMC’s Sneaky Pattern

Did you know that in over 60% of FOMC meeting days, the initial market reaction is reversed within 48 hours? It’s like a financial bait-and-switch, where the market fakes one direction only to flip the script the next day.

Why does this happen?

Traders react emotionally to Jerome Powell’s comments, algo traders pile in, and short-term liquidity spikes. But once the dust settles, the market recalibrates based on actual economic data rather than knee-jerk reactions.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece