Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

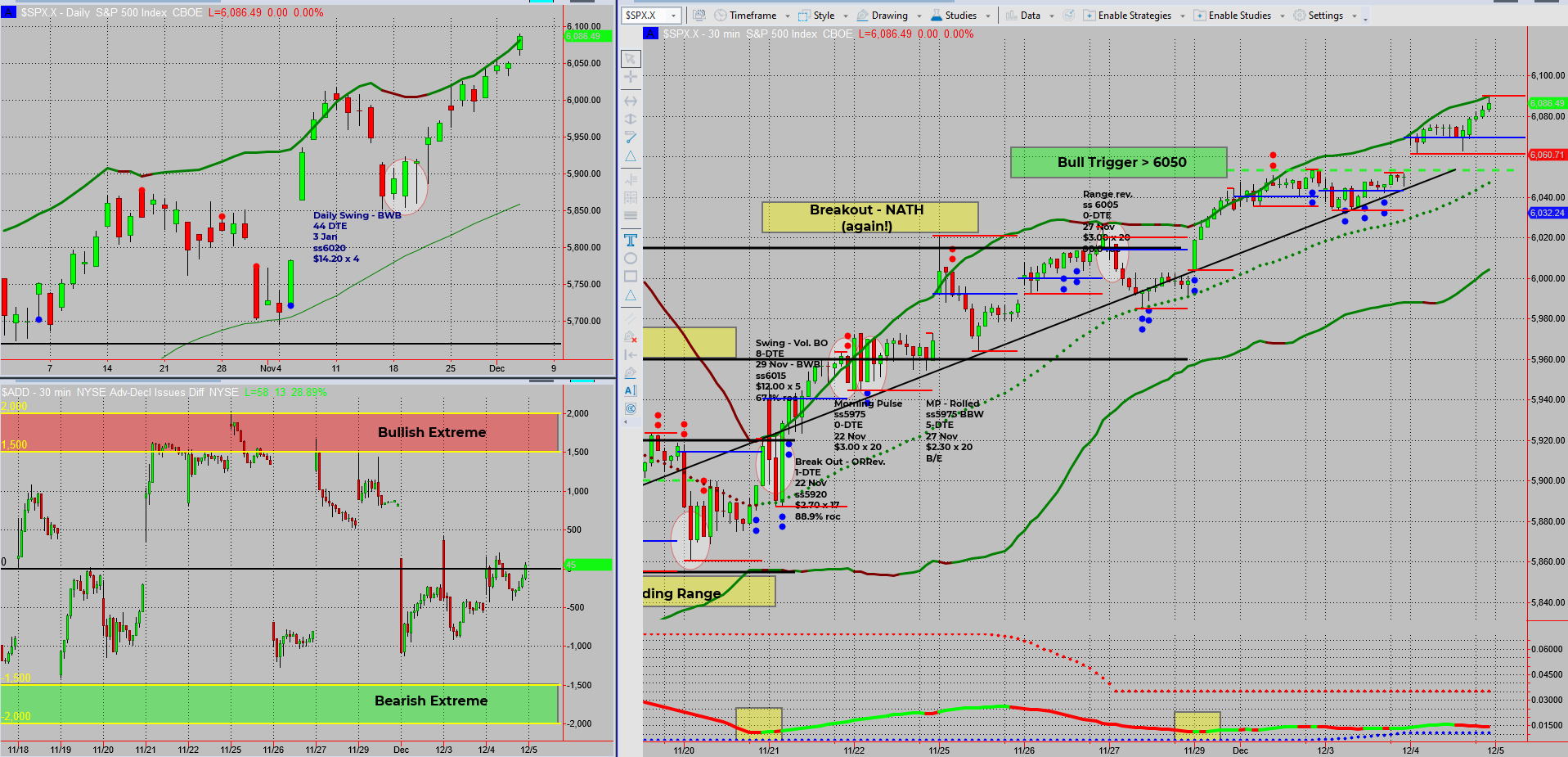

It’s good to be back after a short break! The market didn’t take a break, though, delivering solid returns on my income swing trades—98.4% and 67.1% gains to be precise. Let’s dive into the setups and what’s next on the horizon.

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

After stepping away for a few days to recover, I returned to find the markets behaving beautifully. Here’s a quick rundown:

- Two short-term income swing trades concluded successfully:

- Trade 1: 98.4% return.

- Trade 2: 67.1% return.

- A third swing trade with January expiration is steadily on track.

Despite some sideways action recently, my bullish end-of-year bias remains firm. Here’s why:

- The market shows little appetite for bear swings—a great sign for continued upward momentum.

- Current setups lean bullish, but I’ll still evaluate short-term trades in either direction.

What’s next?

- I’m keeping an eye on new income swing setups.

- Patience is key as I wait for the perfect entry points to emerge.

For now, it’s back to watching, waiting, and pouncing on the right opportunities. Onward!

Fun Fact:

The stock market is often more predictable than you think—Mondays have historically been the worst-performing day of the week for the S&P 500, while Wednesdays and Fridays tend to be the strongest.

This trend, often called the “Monday Effect,” suggests traders might be influenced by pessimism over the weekend or bearish news digestion. Fridays, on the other hand, often reflect pre-weekend optimism or position adjustments. While not a hard-and-fast rule, it’s a quirky tidbit that highlights the subtle behavioural patterns of traders and investors.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece