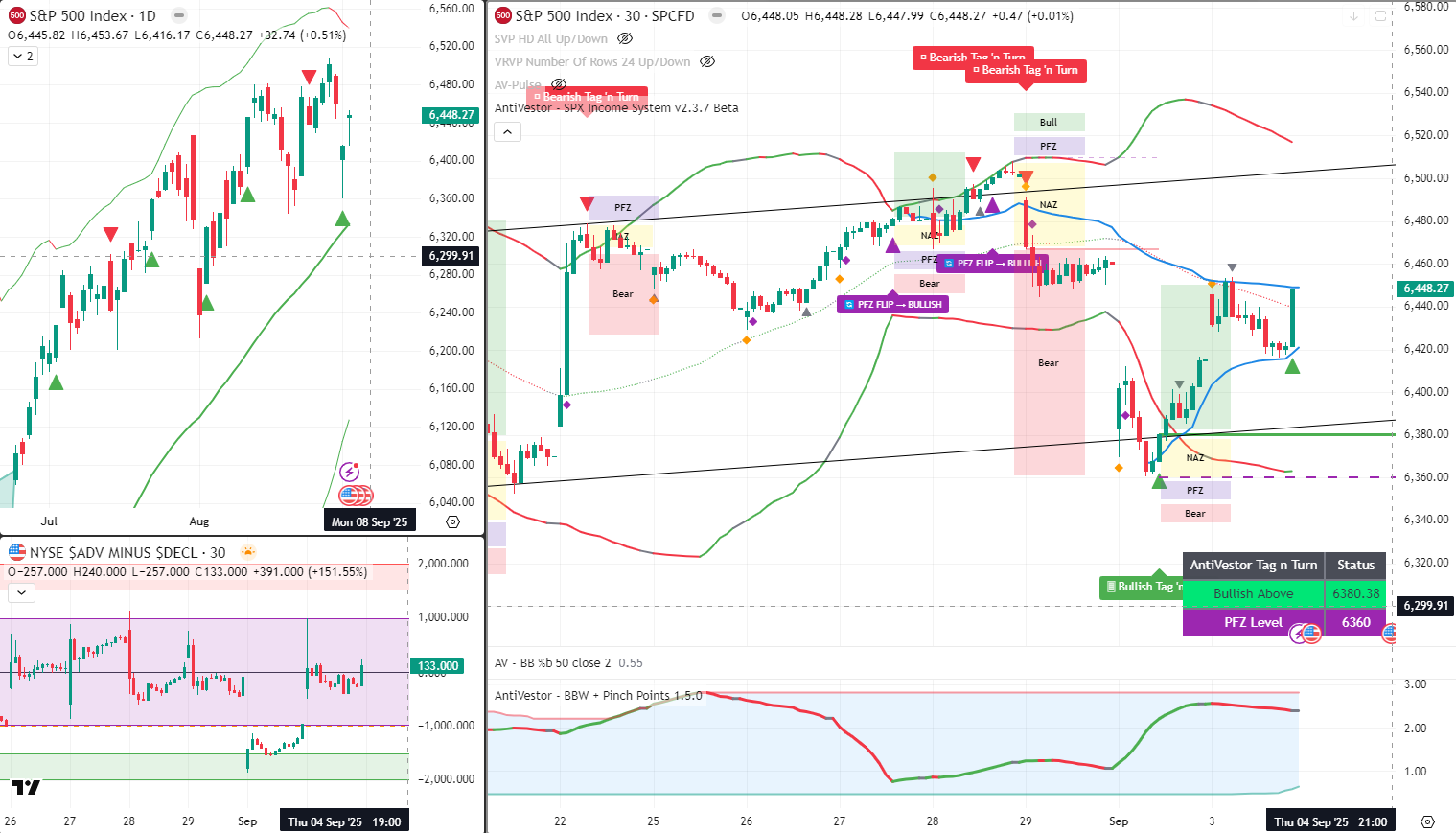

Anchored VWAP Shows Price Squeezing Between Tag ‘n Turn Points

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Morning traders – yesterday was a hard grind right up until the last 30 minutes, where we saw price go from a gap fill low to closing near the earlier highs of the day and near the second previous day’s gap down nearly being filled.

On the daily charts, we almost had a nice “island reversal,” and given that it’s a single bar, supposedly called an “abandoned baby.” I’ve never called it that or heard anyone call them that – perhaps idiots call it that. Anyway, “there we are then!”(s)

This perfectly illustrates why systematic trading beats emotional interpretation – whether you call it an “abandoned baby” or simply recognise it as a systematic reversal signal, the mechanical approach remains constant.

We’re firmly back bullish, and just for fun, I’ve popped anchored VWAP from the Tag ‘n Turn points, and we can see price has been squeezing between the anchored high and low… I continue to monitor for strategy inclusion.

Keep scrolling for 6500 target analysis and Liverpool comedy planning…

SPX Market Briefing:

The charts reveal systematic precision meeting market reality – exactly the combination that creates consistent trading opportunities regardless of pattern nomenclature preferences.

Current System Status:

- Bias: Firmly bullish targeting 6500 psychological level

- Pattern: Near-perfect island reversal/”abandoned baby” (name irrelevant)

- VWAP Analysis: Anchored from Tag ‘n Turn points showing price compression

- Range Status: High volatility boundaries clear despite no official range

- Seasonal Context: Crash/correction season (Sept/Oct) awareness active

The 6500 Target Analysis:

We’re bullish looking for a move up to 6500 level – big round psychological level and potentially the Bollinger Band highs by the time price gets there. This type of confluence targeting provides clear systematic objectives rather than wishful thinking.

Multiple “Also” Observations:

Also… Range Reality: While we don’t have an official range, we do have some clear boundary levels, so we could presume this is a high volatility range as price is swinging hard in both directions at the moment.

Also… Seasonal Awareness: As we’re in crash/correction season (Sept/Oct), this could be a clue to a potential hard and fast move down as the annual reset button gets smashed.

Also… The Columbo Comment on News: As you know, I don’t normally bother, but the first week of the month usually has some movers and shakers – NFP Friday is the big one, and today there are a few news items to be aware of during the regular session. Most of the time they’re “sput sput fizz,” but given we have that high volatility, we could be in for some “boing boing.”

Today’s Systematic Plan:

Tag ‘n Turn: Nothing to do but collect that theta and wait for the next decision point to be reached. Classic systematic patience – let time decay work while monitoring for signal changes.

Premium Popper & Lazy Poppers: Likely wait out the 10:00 news before doing anything – otherwise, it’s wait for the algo to pop up a setup. News-aware systematic timing beats reactive positioning.

Party Popper: Having some more fun tonight and visiting one of Liverpool’s many excellent comedy clubs (Crissy Rock – yes, she’s still alive!) inside one of those fancy food halls with local live music.

All in all, should be a fun day one way or the other – systematic trading enabling proper life enjoyment rather than restricting it.

In Other News…

FinNuts Market Flash

Alphabet saves the day while everyone else watches

U.S. futures gained as Alphabet’s legal victory boosted tech confidence like Kash discovering free lunch vouchers. Apple and Tesla joining the rally because apparently when one tech giant wins, they all pretend they’re related. Meanwhile, mild macro cues providing about as much excitement as Percy’s weekend hobby updates.

Asia playing regional favourites

India surging on fiscal relief like Mac after discovering the premium coffee machine works again, while China cooling under regulatory anxiety faster than Wallie’s enthusiasm for mandatory meetings. Japan softening earlier gains but stabilizing like a confused tourist checking their map twice. Traders parsing domestic catalysts versus global liquidity flows because apparently geography matters in global markets.

Bond yields achieve zen-like stability

Long-term yields softening after Japan’s auction promised execution rather than panic – revolutionary concept in government bond markets. Combined with dovish Fed chatter, the setup encouraging duration assets for now because apparently central bankers saying nice things still moves markets. Who knew monetary policy could be so soothing?

Sector rotation gets tactical

Consumer and discretionary names in India outperforming while U.S. technology led strength, proving that sometimes different countries like different things. Defensive plays like gold miners losing lustre as yields calmed because apparently precious metals need drama to stay relevant. Rotation remaining tactical, which is finance-speak for “nobody really knows what they’re doing but we’re doing it anyway.”

-Hazel

Expert Insights:

Options selling with 7DTE benefits from the current high volatility range environment where clear boundary levels provide natural profit zones. The “sput sput fizz” versus “boing boing” news distinction becomes crucial for timing entries around potential volatility spikes.

Seasonal crash awareness doesn’t change systematic execution but provides context for position sizing and risk management during historically volatile periods. September/October patterns offer educational value rather than predictive certainty.

Anchored VWAP analysis from significant turning points can provide additional confluence for systematic decision-making, particularly when price compression between levels suggests pending directional resolution.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted researching “abandoned baby” pattern terminology while claiming his pigeons have been using that exact formation for “superior nest abandonment forecasting strategies.”

“The birds clearly understand proper abandonment protocols,” Percy announced while rearranging his desk setup. “They’ve been demonstrating abandoned baby patterns for weeks – we just weren’t paying attention to their systematic wisdom!”

Mac immediately began planning “comedy club market research expeditions,” declaring that “proper Liverpool entertainment analysis requires comprehensive cultural portfolio diversification, darling!”

Hazel started calculating comedy club ticket costs as legitimate stress management business expenses while muttering something about “Crissy Rock survival rates requiring dedicated systematic verification protocols.”

Kash tried to explain how comedy clubs were “basically like entertainment yield farming but with actual laughter NFT generation potential,” while Wallie just nodded approvingly at the cultural integration approach, saying, “Finally, trading that includes proper evening entertainment rather than endless chart staring.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

According to the Bureau of Labour Statistics, the first Friday of the month Non-Farm Payrolls release consistently ranks among the highest impact economic announcements, with average S&P 500 volatility increasing by 35-50% during the hour following the 8:30 AM ET release compared to typical Friday trading sessions.

[Source: Bureau of Labour Statistics – “Economic Calendar Impact Analysis”]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.