Tag ‘n Turn Flips Bearish to Bullish for 45% ROC Evening Turnaround

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Yesterday’s zoo adventure was awesome – the new area looks amazing! The fly in the ointment is that we didn’t get to spot the new snow leopard cub – apparently wasn’t out most of the day, so we’ll just have to visit again soon.

The beauty of systematic trading combined with life priorities: when trading setups work mechanically, you can focus on what really matters (like tracking elusive snow leopard cubs) without missing profitable opportunities.

Despite the leopard disappointment, I did get a little nibble on Premium Popper, as did most of my students, just after the open. Then it was straight back to the zoo for me – exactly as systematic trading should work.

Later on, in the US afternoon/UK evening, the Tag ‘n Turn did flip from bearish to bullish, so now we’re bullish until we’re bearish again. I’ve not written up my swing trade post-trade debrief yet, but it was around 45% ROC due to the fast move down and turnaround.

Keep scrolling for systematic flip analysis and zoo return planning…

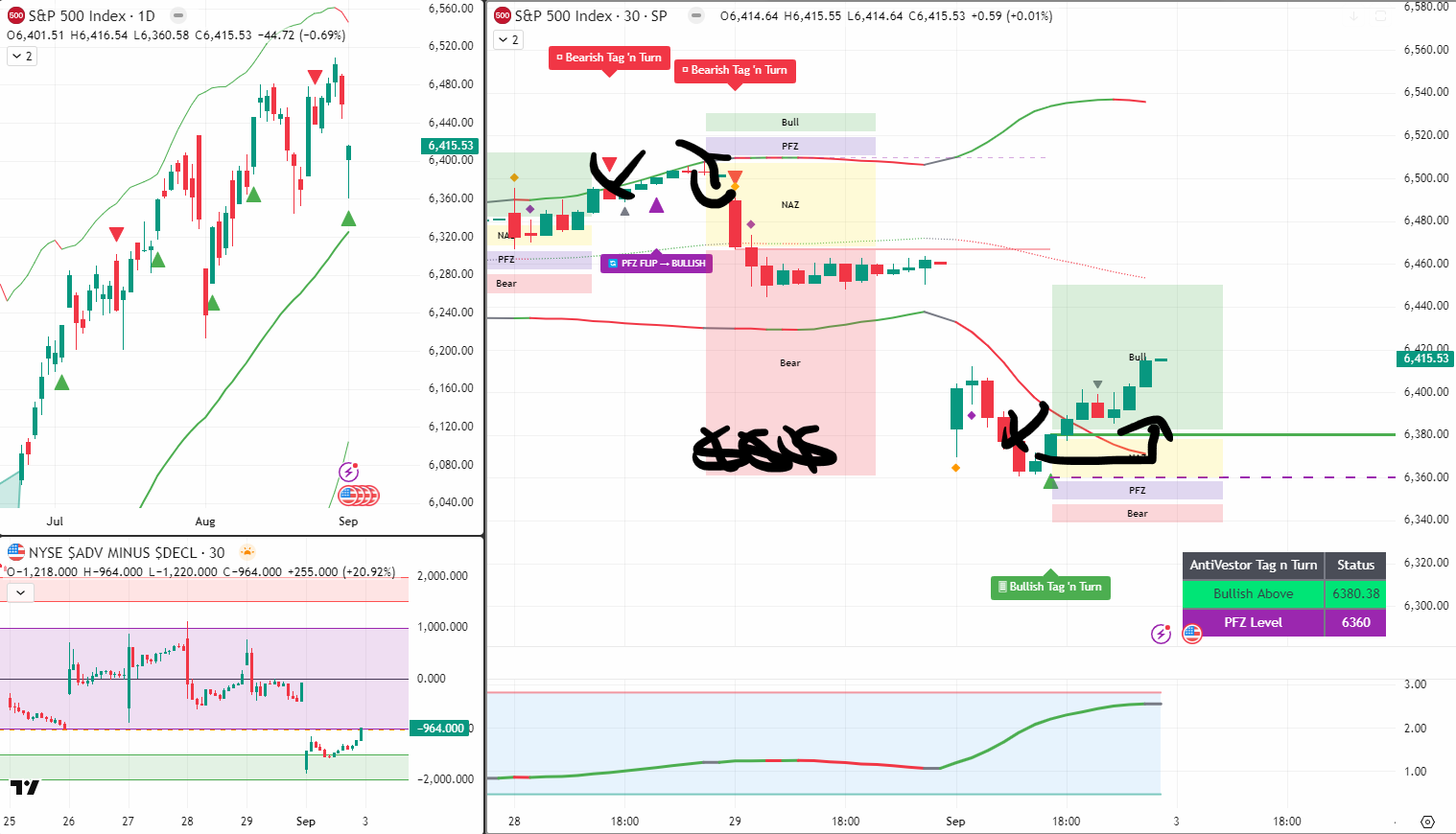

SPX Market Briefing:

The charts tell the story of systematic precision working perfectly while life adventures take priority – the ideal integration of mechanical trading with genuine experiences.

Current System Status:

- Tag ‘n Turn: Flipped bearish to bullish evening session for 45% ROC

- Current Bias: Bullish above 6380 until systematic signals change

- Premium Popper: Delivered opening nibbles for students and systematic execution

- Zoo Priority: Return visit required for proper snow leopard cub spotting

- Life Integration: Trading works around adventures, not the other way around

The Evening Flip Success Story:

The Tag ‘n Turn delivered exactly what systematic approaches promise: clear signals with measurable results. The bearish to bullish flip in the US afternoon/UK evening session produced around 45% ROC thanks to the fast move down and systematic turnaround recognition.

This type of mechanical precision happens because the system identifies market structure changes rather than trying to predict them. Fast moves create quick profits when you’re positioned systematically rather than emotionally.

Today’s Systematic Continuity:

The plan remains beautifully consistent with systematic philosophy:

Tag ‘n Turn: Bullish above 6380 until we’re bearish. Clear level, clear bias, clear systematic decision-making. No guesswork, no emotional interpretation.

Premium Popper & Lazy Popper: Await the opening bell for the algo to do its things and highlight the trades. Mechanical setup recognition without forcing opportunities.

Zoo Return Visit Planning: The snow leopard cub will eventually appear, and systematic trading approaches ensure we’ll be ready for both market opportunities and wildlife spotting when timing aligns properly.

In Other News…

FinNuts Market Flash

Futures achieving championship-level neutrality

S&P minis parked near flat by 9:25 AM like Wallie contemplating actual work – technically present but spiritually elsewhere. Nasdaq minis modestly softer while Dow little changed, collectively displaying less movement than Percy’s opinion on office temperature. Overnight ranges tighter than Kash’s grip on expense receipts after Tuesday’s tariff-shock theatrics.

Sector musical chairs gets geopolitical

Energy found its footing with Brent lurking in the high-60s like a predator waiting for weakness. Rate-sensitives getting hammered as the yield curve cheapened faster than Mac’s productivity after lunch. Semiconductors and AI hardware wobbling after tariff ruling turned export math into advanced calculus, while software strutted around on stickier revenue models like they invented recurring subscriptions.

Earnings calendar promises actual drama

Software and semiconductor earnings tilting toward week’s end, providing pivotal read on whether AI spending remains front-loaded or companies are just throwing money at shiny objects. Pre-announcements sparse as corporate executives apparently discovered the art of keeping their mouths shut. IPO chatter picking up as fall-window deals ready roadshows – soft test of whether anyone still believes in growth stories.

Cross-asset philosophy class in session

Gold’s breakout telegraphing hedge bid against fiscal worries rather than pure recession fear – apparently precious metals can read government balance sheets too. Dollar mixed while yen-watchers obsess over Bank of Japan policy tone like teenagers analyzing text messages. Oil holding firm after new Iran sanctions because geopolitics never takes holidays. Treasury term premia staying heavy, reminding everyone that supply and deficits actually matter for equity multiples.

-Hazel

Expert Insights:

Options selling with 7DTE expirations benefits most from either slow, steady movements that allow time decay to work effectively, or large fast moves that quickly hit profit objectives. Small fast moves can be challenging as they don’t provide sufficient time for theta harvest nor enough directional movement for quick profit capture.

Life priority integration works best when trading systems function independently of constant monitoring. Zoo adventures become possible when alerts handle opportunity recognition and mechanical rules govern execution decisions.

Clear level-based decision making (bullish above 6380) eliminates emotional interpretation while providing systematic frameworks that work regardless of external distractions or leisure activity priorities.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted creating detailed charts correlating snow leopard cub appearance schedules with market volatility patterns, claiming “elusive wildlife behaviour predicts systematic trading opportunities.”

“The cubs clearly understand market timing better than most traders,” Percy announced while arranging his pigeon formations around zoo maps. “Their strategic hiding patterns mirror premium collection cycles perfectly!”

Mac immediately began planning “investment research expeditions” to various zoos, declaring that “proper market analysis requires comprehensive wildlife portfolio diversification studies, darling!”

Hazel started calculating zoo membership costs as legitimate business expenses while muttering something about “snow leopard spotting requiring dedicated systematic approach protocols with proper ROI tracking.”

Kash tried to explain how zoo visits were “basically like ecosystem yield farming but with actual animal NFT potential,” while Wallie just nodded approvingly at the life-first systematic approach, saying, “Finally, trading that works around proper leisure activities rather than destroying them.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

According to Chester Zoo, snow leopard cubs typically stay in their dens for the first 2-3 months of life and only venture out when they feel completely secure. Their elusive nature makes them one of the most challenging big cats to spot in the wild, with an estimated global population of only 4,000-6,500 individuals remaining.

[Source: Chester Zoo – “Snow Leopard Conservation Programme”]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.