Premium Poppers Crushing It. Swings Still Swinging. System Still Paying.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

and yesterday’s expected quiet day turned out to be a complete dud.

Just goes to show – opinions are like a*holes. Everyone’s got one and they’re usually full of shit.

Seriously though, I’ve seen this large wick phenomenon turn out to be true more times than it’s wrong. I’m curious now – especially since I have fast access to coding scripts and greater research capabilities than I previously had. I may run a study to look at the probabilities of “wick today, narrow range tomorrow” likelihood.

Anyway, that’s a tomorrow thing. Another item on my always-growing research list.

Let’s think about making money.

Your predictions don’t pay the bills. Your setups do. Scroll down.

Market Briefing:

Multi-Market Snapshot

| Instrument | Status | Level | Notes |

|---|---|---|---|

| ES | Bullish | 6,978.50 | Pushing higher |

| YM | NATH | 49,747 | New all-time highs |

| NQ | Bullish | 25,750 | Following |

| RTY | NATH setup | 2,596.4 | Hugging upper BB |

| GC (Gold) | Strong | 4,472.3 | Still bid |

| CL (Oil) | Weak | 56.42 | Downtrend continues |

| VIX | Asleep | 15.12 | Complacent |

The swings are swinging. Still bullish.

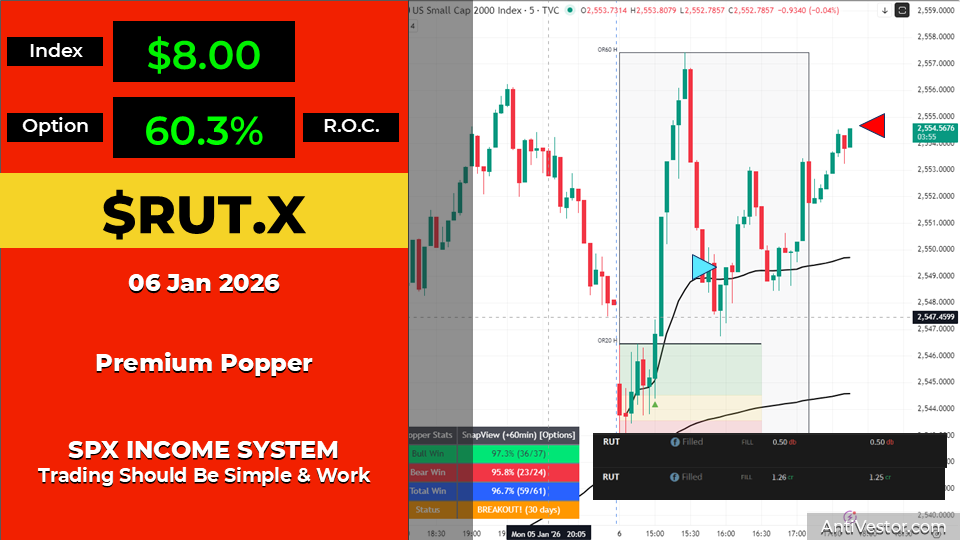

RUT – The Straight Line Higher

Uncle Russell moved in a straight line yesterday.

No hesitation.

No pullback.

Just up.

And now it’s hugging the upper Bollinger Band with band expansion visible on the band width indicator.

You know what that typically means? Trend continuation.

A run to new all-time highs could well be on the cards.

| TnT Status | Level |

|---|---|

| Direction | Bullish (Flipped) |

| Bullish Above | 2518.6 |

| PFZ Level | 2515.68 |

| Target | Pending |

| Current | ~2,596 |

The TnT swing is working.

The band expansion is confirming.

NATHs are within reach.

SPX – Following Along

SPX is bullish above 6850.53 with target at 6934.63. Currently sitting at 6948.69 – which means we’re pushing through target territory and into new all-time high territory.

| TnT Status | Level |

|---|---|

| Direction | Bullish |

| Bullish Above | 6850.53 |

| PFZ Level | 6828.99 |

| Target | 6934.63 |

| Current | ~6,948 (NATHs) |

Dow – First to Pop

The Dow was first to pop its “new year new me” cherry. New all-time highs already printed. Leading the charge.

Premium Poppers – Crushing It

The Premium Poppers are absolutely crushing it at the open.

Again!

Yesterday was no exception.

The system keeps delivering regardless of what I think the market will do.

That’s the entire point.

The Tag n Turn swings are just waiting for the next action point. The Premium Poppers are just waiting for the markets to open.

PopPop.

News I’m NOT Watching Today!

- ADP Employment at 8:15am – Forecast 47K. This sets the tone for Friday’s NFP.

- ISM Services PMI at 10:00am – Forecast 52.3. Services sector health check.

- JOLTS Job Openings at 10:00am – Forecast 7.65M. Labour market demand.

Data-heavy day. Could create volatility. Could create setups.

News I’m NOT Watching This Week!

| Day | Event | Time (ET) |

|---|---|---|

| Wed 7 | ADP Employment | 8:15am |

| Wed 7 | ISM Services PMI | 10:00am |

| Wed 7 | JOLTS Job Openings | 10:00am |

| Thu 8 | Unemployment Claims | 8:30am |

| Fri 9 | Non-Farm Payrolls | 8:30am |

| Fri 9 | Unemployment Rate | 8:30am |

| Fri 9 | UoM Consumer Sentiment | 10:00am |

Wednesday and Friday are the heavy days. Today’s triple data drop could move markets.

Looking Ahead

Yesterday I expected nothing and got 119% ROC.

Today I’m expecting… well, I’ve learned my lesson about expectations.

The swings are bullish. RUT is hugging the upper band with expansion. Dow’s already at NATHs. SPX is pushing through targets.

The Premium Poppers will fire at the open regardless of what I think.

That’s the system. That’s the point.

PopPop.

In Other News…

Dow “Touches” 49,000, S&P “Flirts” With 7,000: Milestone Romance

Record run faces “first test” hours later. Venezuela flip from profit to problem. Gold signals fear during equity celebration.

Dow touched 49,000 intraday Tuesday—brief contact counting as achievement—whilst S&P “flirts” with 7,000 proving markets now celebrate proximity romance with round numbers. Records immediately face “first test” Wednesday with ADP, JOLTS, ISM dropping same day because apparently milestone celebration requires instant validation. Gold at $4,468 and silver at $79 signal safe-haven demand whilst equities hit records creating contradiction where fear and euphoria coexist.

Venezuela Narrative: Profit to Problem in 48 Hours

Energy stocks retreated as Venezuela supply concerns emerged—Chevron paring earlier 10% pop proving Monday’s profit opportunity became Wednesday’s supply threat. Oil dropped WTI to $56.54 (-1%) as Venezuela deal adds supply, complete reversal from infrastructure rebuild thesis celebrating regime change. Markets discovering same event bullish then bearish depending on which day asked.

CES AI Battle: Huang vs Su Compete for Dominance

Nvidia rose following Vera Rubin “physical AI” announcement whilst AMD’s Lisa Su unveiled yottaflop ambitions—CES becoming AI arms race. Analysts split on Nvidia valuation suggesting perfect execution insufficient for consensus. Technology led gains despite mixed reception proving markets reward participation over evaluation during milestone celebrations.

Safe-Haven Surge During Record Euphoria

Gold $4,468, silver $79 signal safe-haven demand whilst Dow crosses 49,000 and S&P approaches 7,000 creating paradox where fear and celebration simultaneous. VIX at 14.2 shows “complacency, not fear” meaning markets unconcerned about being unconcerned whilst buying both risk and safety. Credit spreads tight despite contradictory signals suggesting everything fine except safe-havens screaming otherwise.

☕ Hazel’s Take

Dow touches 49K, S&P flirts 7K, immediate data test, Venezuela flip, gold signals fear during records. When milestone proximity equals achievement and same event bullish then bearish within 48 hours, probably acknowledging Wednesday’s “first test” determines if celebration justified or delusional.

—Hazel, FinNuts

Rumour Has It…

The FinNuts team reflects on yesterday’s prediction disaster…

“So about that inside day,” Mac said, not looking up from his newspaper.

Wallie stared at his screens. The charts were green. Very green. Embarrassingly green given yesterday’s forecast.

“We don’t talk about the inside day,” Wallie muttered.

“I’ve got it on the whiteboard,” Percy announced cheerfully, pointing to where he’d written “INSIDE DAY PREDICTION” with a big red X through it. “For posterity.”

“Thank you, Percy.”

“You’re welcome! I also drew a little crying face next to it.”

Hazel was already three coffees deep and running numbers. “RUT moved in a straight line. No pullback. Just… up. Band expansion visible. NATHs incoming.”

“So the opposite of sideways,” Kash observed.

“The exact opposite of sideways, yes.”

Mac finally looked up. “You know what the lesson is here?”

“That predictions are worthless?” Wallie offered hopefully.

“That predictions are worthless,” Mac confirmed. “But the Premium Poppers paid anyway. The swings are working. The system doesn’t care what you think will happen.”

“Opinions are like—” Percy started.

“Yes, thank you Percy, we know the rest.”

“I was going to say opinions are like weather forecasts. Occasionally accurate but mostly just background noise.”

Everyone stared at Percy.

“That was… surprisingly insightful,” Hazel admitted.

Percy beamed. “I’ve been practicing.”

Mac returned to his newspaper. “Dow made new highs. RUT’s next. SPX is pushing through targets. The only thing that matters is whether you took the setups.”

“Did we take the setups?” Percy asked.

“We always take the setups.”

“PopPop?”

“PopPop.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The “Walk the Bands” Phenomenon

During strong trends, price doesn’t just touch the Bollinger Bands – it hugs them. This is called “walking the bands” and it’s one of the most reliable trend continuation signals.

According to John Bollinger himself, when price consistently closes in the upper half of the bands during an uptrend, it’s a sign of underlying strength, not overextension. The bands are designed to contain approximately 95% of price action – when price persistently pushes against one side, it indicates directional conviction.

The common mistake? Assuming a touch of the upper band means “overbought.” In trending markets, it often means “strong and getting stronger.”

RUT is walking the bands right now. History suggests it continues until something breaks the pattern.

[Source: Bollinger on Bollinger Bands – John Bollinger]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.