Upper Wicks Everywhere – Inside Day Incoming?

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

It’s Phil, and yesterday was a tale of two markets.

The Dow and Russell put in huge trending days. Uncle Russell absolutely ripped higher. Meanwhile, the S&P and Nasdaq looked at all that momentum and said “nah, we’re good” and spent the day going nowhere.

Then all of them kicked back into the close, leaving large wicks at the upper end of their daily ranges.

You know what that typically means? Narrow range day incoming. Possibly an inside day.

Which sets the tone nicely – today might be a whole lot of nothing. And that’s fine. Sometimes the best trade is no trade.

Let’s break it down.

Patience isn’t just a virtue. Sometimes it’s the entire strategy. ⏳

Market Briefing:

Multi-Market Snapshot

| Instrument | Status | Level | Notes |

|---|---|---|---|

| ES | Bullish | 6,939.50 | Near highs |

| YM | NATH | 49,115 | New all-time high |

| NQ | Bullish | 25,586 | Lagging |

| RTY | Bullish | 2,554.3 | Big trending day |

| GC (Gold) | Strong | 4,456.9 | Still bid |

| CL (Oil) | Recovering | 58.41 | Bouncing |

| VIX | Asleep | 15.16 | No fear |

| BTC | Range | 93,458 | Consolidating |

It was an interesting day yesterday on the indexes.

The Divergence

Dow and Russell put in huge trending days. I mean really trending – the kind of clean, directional moves you want to see.

Meanwhile, SPX and Nasdaq stuttered and never really got going at all. They gapped higher at the open and then just… sat there. Meandering. Chopping. Going nowhere with purpose.

The Upper Wicks

Here’s the interesting bit: all of the indexes kicked back into the close, creating larger than normal wicks at the upper end of their daily ranges.

Typically when I see this, I anticipate a narrow ranging day – possibly an inside day. Which may set the tone for today.

The Bigger Picture

Despite Dow making new all-time highs, prices are still contained. Nothing new is really developing. The consolidations that have been present since October last year are still in effect.

As usual, until something new happens, the same thing is likely to continue.

Range bound. Chop. Patience required.

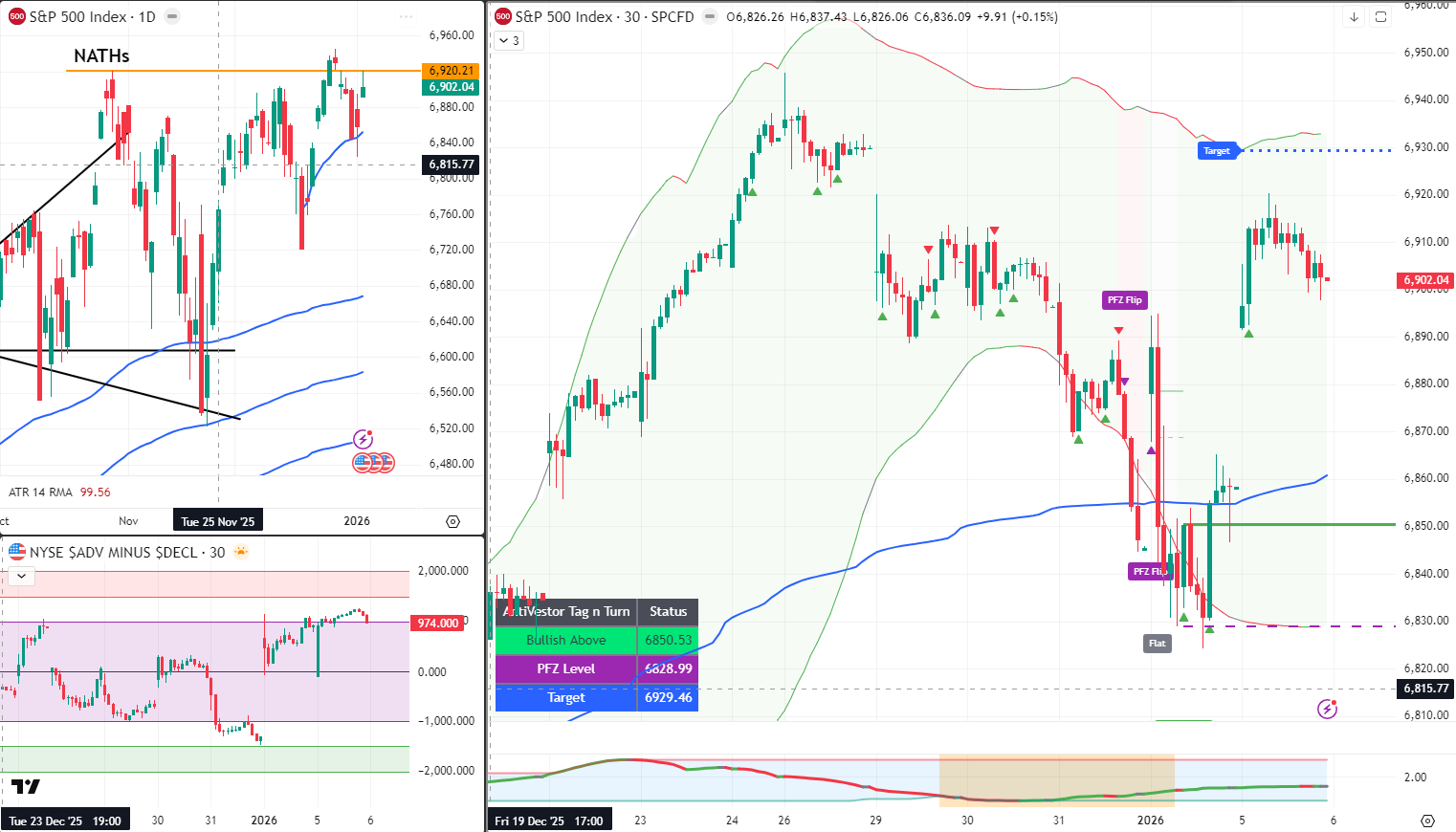

SPX Analysis

The Tag n Turn that developed last Friday continues to work.

Currently bullish above 6850.53, targeting 6929.46. PFZ level sits at 6828.99.

But here’s the thing – price is just meandering sideways after the gap higher at the open. As just mentioned, I’d expect prices to continue to meander.

And with price not near the upper or lower Bollinger Bands, there’s likely nothing to do in the short term from a swing perspective.

| TnT Status | Level |

|---|---|

| Direction | Bullish |

| Bullish Above | 6850.53 |

| PFZ Level | 6828.99 |

| Target | 6929.46 |

| Current | ~6,902 |

The setup is working. It’s just not exciting. And that’s fine.

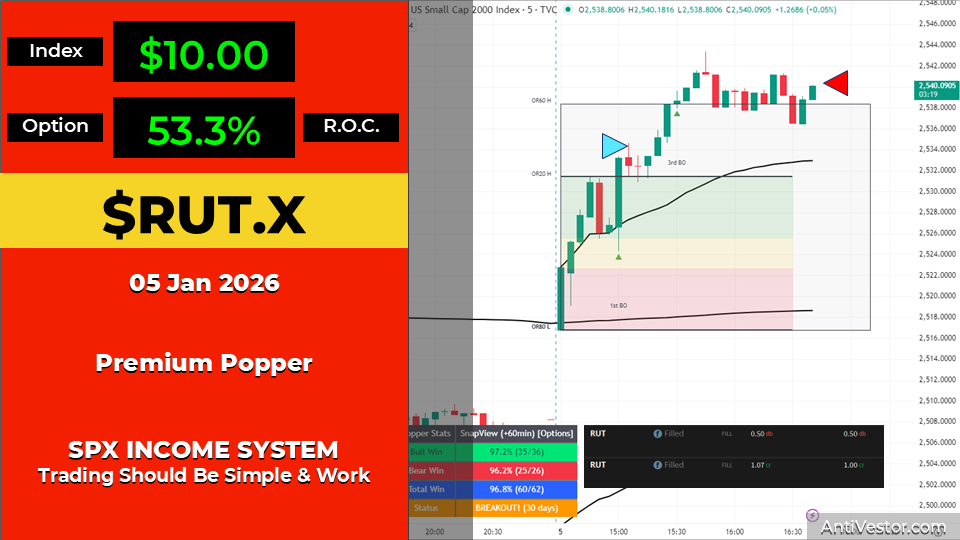

RUT Analysis

Uncle Russell made a power move higher yesterday.

The Tag n Turn flipped bullish above 2518.6, with PFZ at 2515.68. Target pending.

Now here’s my confession: I’ve not been able to get on board with this Tag n Turn. And this is one of those times where not being in a rush to do anything kicks me in the shins.

The move happened. I wasn’t in it. Such is life.

| TnT Status | Level |

|---|---|

| Direction | Bullish (Flipped) |

| Bullish Above | 2518.6 |

| PFZ Level | 2515.68 |

| Target | Pending |

| Current | ~2,548 |

That said, the Premium Popper continues to scalp the open beautifully.

Yesterday’s Poppers:

- Trade 1: 61.5% ROC ✅

- Trade 2: 53.3% ROC ✅

- Combined: 114.8% ROC

- Setup Grade: A+ (both)

Two A+ setups right at the open. Mechanical execution. Premium collected.

The system doesn’t care that I missed the swing. The system just keeps paying.

What I’m Watching Today

Inside Day Potential – Those upper wicks suggest today could be narrow and contained. If we get an inside day, it sets up potential for a larger move tomorrow.

Premium Popper Setups – As always, watching the open for A+ setups. The system keeps delivering.

The Do Nothing Zone – SPX is mid-range on the Bollingers with no clear edge. Sometimes the best trade is patience.

Looking Ahead

The Dow made new highs. Russell trending hard. SPX and Nasdaq can’t be bothered.

Upper wicks suggest today might be narrow and quiet. An inside day setup is in play.

The October consolidation refuses to die. And that’s fine. Until it breaks, we trade the range.

SPX TnT working but meandering. RUT TnT left without me. Premium Popper keeps scalping regardless.

Sometimes patience is the strategy. Sometimes patience kicks you in the shins. The system doesn’t care either way.

PopPop.

In Other News…

Dow Records 48,977 Celebrating Geopolitical Chaos

Chevron surges as “only US major in Venezuela.” Banks hit all-time highs. Infrastructure rebuild thesis before stabilization.

Dow hit record 48,977 Monday (+595 points) as markets “digested” Venezuela military strike by immediately calculating profit opportunities. Chevron surged 5.1% as “only US major in Venezuela”—positioning advantage from political instability. Energy posted best session since April: Halliburton +8%, Exxon +4.2%, SLB +6% on “infrastructure rebuild thesis” despite zero stabilization. Goldman +4%, JPM +3%, BAC +2% to all-time highs proving banks profit from everything including coups.

️ When “Only US Major” Becomes Competitive Advantage

Chevron led rally as only US oil major positioned in Venezuela—competitive moat built on geopolitical chaos. Halliburton +8%, SLB +6% on infrastructure rebuild thesis proving markets plan reconstruction before rubble settles. Oil stayed near $58 WTI because analysts note 1M bpd output “too small to move markets” despite earlier treating every Venezuelan barrel as critical.

Banks Hit All-Time Highs on Instability

Financials posted best session since April with Goldman +4%, JPM +3%, BAC +2% reaching all-time highs celebrating military strike. Markets discovering banks profit from: rate cuts, rate hikes, stability, instability, peace, war, and apparently regime changes in OPEC members. Q4 earnings expectations high despite—or because of—geopolitical chaos as bank CEOs report January 13-15.

Gold Rallies Alongside Risk-On: Everything’s Haven Now

Gold +2% to $4,450 on “safe-haven flows” whilst risk-on equities surged creating “unusual divergence” where both safety and risk simultaneously bid. VIX dropped to 14.90 suggesting calm whilst gold treating situation as threatening. Markets declaring stocks, gold, crypto, dollars all havens proving definition expanded to include whatever’s rising.

☕ Hazel’s Take

Dow records on chaos, Chevron benefits from “only major” positioning, banks hit highs, infrastructure rebuild planned. When military strike becomes energy bull thesis and financial sector celebration whilst gold rallies alongside, probably acknowledging markets optimize profits not stability.

—Hazel, FinNuts

Expert Insights:

The Upper Wick Tell

Here’s a pattern worth noting: when you see large upper wicks across multiple indexes after a trending day, it often signals exhaustion at those levels.

Buyers pushed price higher, but sellers showed up into the close and pushed it back down. The resulting wick tells you there’s supply overhead.

What typically follows? One of two things:

- Inside day / consolidation – Market digests the move, coils up, then breaks

- Continuation lower – The rejection was the start of a pullback

Given we’re still in the October consolidation range and nothing has really broken out, option 1 feels more likely. Expect chop, expect narrow range, expect boredom.

Which is fine. Boredom pays well when you’re selling premium.

Rumour Has It…

The FinNuts team learns about patience (again)…

“I missed it.”

The words hung in the air like a fart in a lift. Nobody wanted to acknowledge them, but everyone could smell the regret.

Mac looked up from his newspaper. “Missed what?”

“The RUT move.” Phil – wait, not Phil, this is the FinNuts universe – Wallie stared at his screen mournfully. “I was waiting for confirmation. Being patient. Not rushing. All the things I’m supposed to do.”

“And?”

“And it ripped 40 points without me.”

Percy wandered over with a cup of tea, biscuit crumbs on his chin. “Is that bad?”

“It’s not ideal, Percy.”

“But didn’t you say patience is a virtue? That not being in a rush is the key to systematic success? That—”

“Yes, thank you Percy, I’m aware of the irony.”

Mac folded his newspaper with a knowing smirk. “You know what the real lesson is here?”

Wallie looked up hopefully. “That the market’s random and sometimes you just miss moves?”

“No. The lesson is that the Premium Popper paid anyway.” Mac tapped his screen. “61.5%. 53.3%. Right there at the open. Whilst you were crying about missing the swing, the scalps were banking.”

“But—”

“The system doesn’t care about your feelings, Wallie. It just keeps paying.”

Hazel didn’t look up from her triple monitors. “He’s right. I took both Poppers. 115% combined ROC. Done by 10am.”

Wallie’s eye twitched.

Percy offered him a biscuit. “There, there. At least you’ve got your health.”

“Do I though, Percy? Do I really?”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.