SPX Hits Perfect Storm of Technical Levels as Non-Farm Payrolls Loom

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Here we are on NFP Friday with SPX positioned at one of those rare technical confluences that systematic traders dream about.

SPX is at range highs, near new all-time highs, sitting on a big round number, with ADD approaching bullish extremes. It’s the kind of setup where multiple technical factors converge to create genuine inflection point potential.

The beauty of this positioning is that NFP could accelerate the already upward swing or be the fuel that proves the turn and legs us into a bear move right at the start of correction season. Both outcomes offer systematic opportunities rather than creating confusion.

This is exactly why mechanical approaches work better than prediction attempts – when you’re positioned systematically, market direction becomes irrelevant to profit potential.

Keep scrolling for confluence analysis and NFP inflection planning…

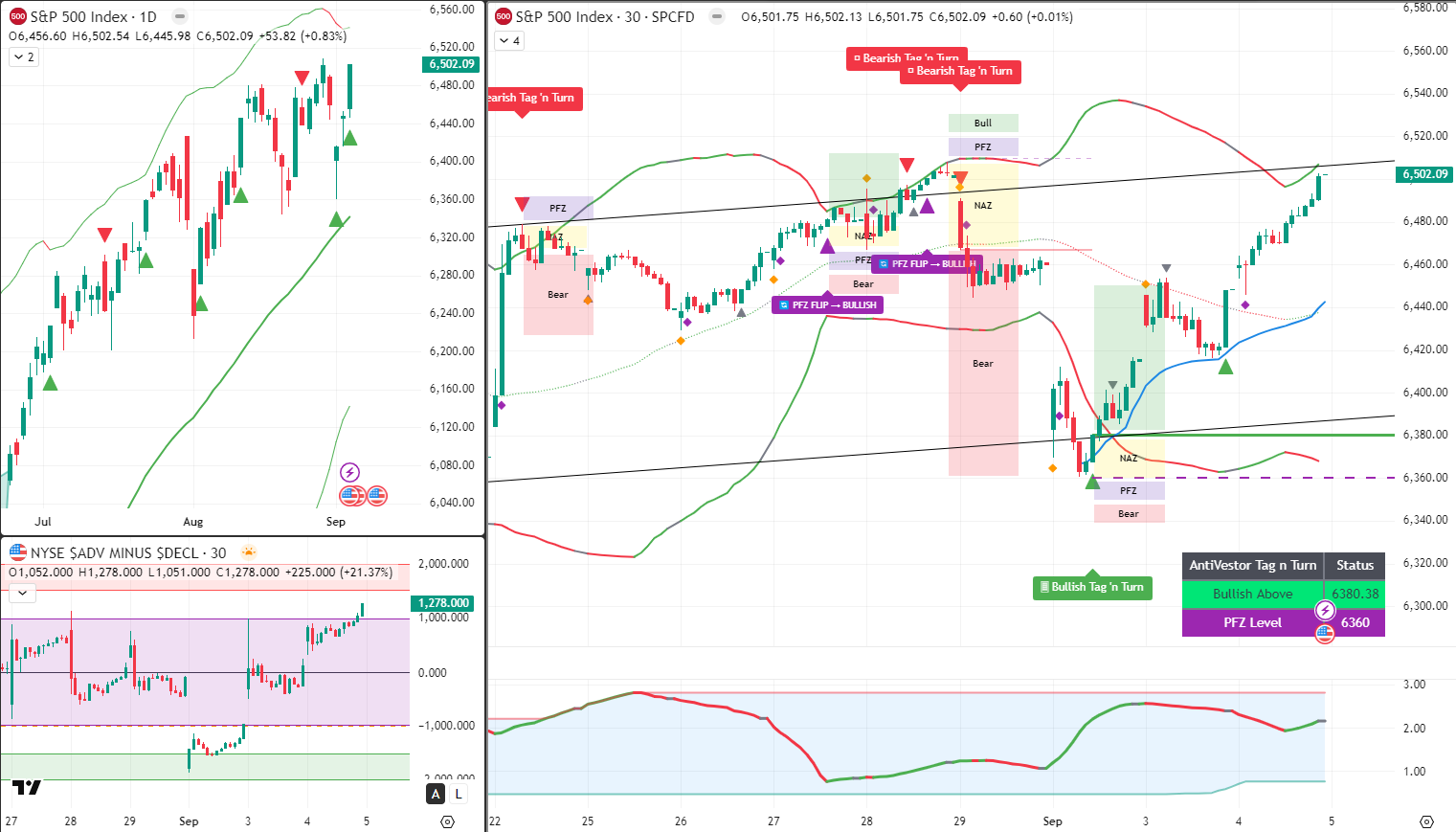

SPX Market Briefing:

The charts reveal the kind of technical confluence that creates the highest-probability systematic opportunities – multiple levels converging at exactly the right moment for mechanical decision-making.

Current Technical Confluence:

- Position: Range highs with near all-time high proximity

- Level: Big round number providing psychological significance

- Momentum: ADD near bullish extreme levels

- Timing: NFP release day with correction season context

- Systematic Status: Bullish until bearish with clear inflection potential

The NFP Inflection Point Analysis:

Today’s Non-Farm Payrolls release arrives at perfect technical timing. We have two clear systematic scenarios:

Scenario A – Acceleration: Strong NFP data could accelerate the already upward swing, pushing through range highs into new all-time high territory with momentum continuation.

Scenario B – Reversal: Weak NFP or simply profit-taking at these levels could prove the turn and leg us into a bear move right at the start of traditional correction season (September/October).

Both scenarios offer systematic profit potential when approached mechanically rather than emotionally.

The Correction Season Context:

The seasonal timing adds fascinating context without changing systematic execution. We’re positioned at technical extremes just as historically volatile months begin – creating natural inflection point potential regardless of fundamental catalysts.

Today’s Systematic Plan:

Tag ‘n Turn: Same plan – bullish until bearish. The confluence of technical levels provides clear systematic decision points rather than emotional guesswork.

Premium Popper & Lazy Popper: Awaiting the opening for algo setups. NFP Friday volatility often creates ideal conditions for mechanical opportunity recognition.

The systematic beauty is that we don’t need to predict which direction NFP pushes the market – we simply need to execute mechanically when our setups appear.

In Other News…

FinNuts Market Flash

Policy optimism saves everyone from existential dread

Markets gained support from policy optimism like Percy discovering the office biscuit tin was restocked. Global sentiment lifted by the revolutionary concept that central bankers might actually help rather than hinder economic growth for once. Revolutionary thinking in financial circles, apparently.

India leads the charge whilst others follow

Indian markets rose firmly as GST relief and Fed-cut sentiment lifted Nifty and Sensex like Kash spotting a discount on premium calculators. Gains were broad-based with Reliance and HDFC leading the parade whilst domestic flows outweighed foreign caution. Late-day profit-booking capped gains because apparently even Indian investors know when to quit whilst ahead.

Asia mirrors Wall Street like devoted pupils

Asian markets mirrored Wall Street’s strength because copying homework never goes out of style. Earnings-linked cheer and Fed trajectory drove Nikkei, Hang Seng, and Shanghai higher like Mac chasing his fourth espresso. Sentiment along the axis remaining fragile, hinging on jobs data because apparently employment numbers still matter in this brave new world.

U.S. equities discover weak data equals strong markets

American equities recovered as weak payroll data lifted S&P and Nasdaq to new highs – proving once again that bad news is brilliant news in modern finance. Bond yields fell whilst markets priced monetary easing because apparently economic weakness equals investment strength. T. Rowe’s surge highlighting renewed appetite for private fund plays because complexity sells better than simplicity.

Tension remains like Wallie’s commitment to productivity

All eyes on non-farm payrolls as markets remain vulnerable with tight positions threatening to ignite volatility faster than office gossip. Still, optimism holds with futures pointing higher tomorrow because apparently hope springs eternal in financial markets, even when logic suggests otherwise.

-Hazel

Expert Insights:

Options selling with 7DTE benefits significantly from NFP Friday volatility, as major economic releases often create the large moves needed to quickly hit profit objectives. The current technical confluence amplifies this potential by providing clear inflection levels.

Range high positioning with ADD extremes typically creates binary outcomes – either powerful breakouts or sharp reversals. Both scenarios favour systematic approaches that focus on execution rather than prediction.

Correction season context (September/October) doesn’t change systematic rules but provides valuable framework for understanding why technical confluences often resolve dramatically during these historically volatile periods.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted creating elaborate charts correlating NFP data with pigeon migration patterns, claiming “employment statistics clearly follow avian seasonal behaviour protocols.”

“The birds understand labour market dynamics better than most economists,” Percy announced while arranging his desk setup around employment data printouts. “Their nesting patterns perfectly predict non-farm payroll surprises!”

Mac immediately began planning “NFP viewing parties” at various Liverpool establishments, declaring that “proper employment data analysis requires comprehensive hospitality sector research, darling!”

Hazel started stress-testing her NFP protocols with emergency coffee supplies while muttering something about “technical confluence requiring advanced caffeine management systems during high-volatility announcements.”

Kash tried to explain how NFP releases were “basically like employment yield farming but with actual labour market NFT potential,” while Wallie just nodded approvingly at the systematic confluence approach, saying, “Finally, someone who understands that multiple technical factors matter more than single-indicator obsession.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

According to the Bureau of Labour Statistics, Non-Farm Payrolls announcements that occur when the S&P 500 is within 2% of all-time highs have historically produced average intraday moves 60% larger than typical NFP releases, due to increased sensitivity at technical extremes.

[Source: Bureau of Labour Statistics – “Market Sensitivity Analysis at Technical Extremes”]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.