6400 Target Active with 6540 PFZ Flip Providing Wiggle Room Buffer

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Morning team – we ended last week with a bear Tag ‘n Turn after an initial jump higher on NFP. The markets eventually saw the light and reality and reacted accordingly.

This perfectly demonstrates why systematic approaches beat emotional reactions to news events. The initial NFP pop looked bullish to emotional traders, but the systematic rejection at key technical levels told the real story.

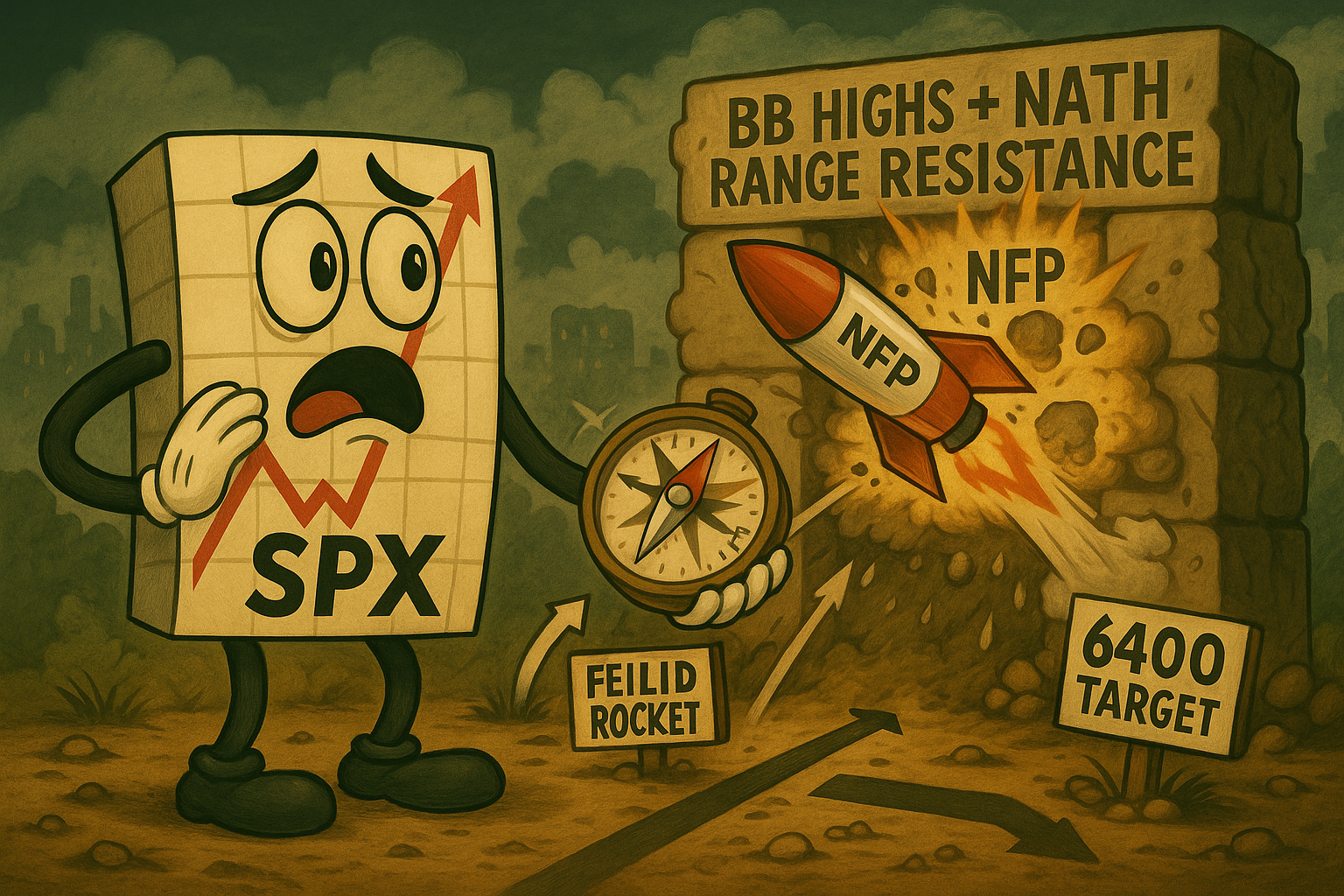

SPX gapped higher and traded lower – interestingly right at the Bollinger Band highs (and NATHs) and coincidentally the slightly angled range highs. No matter which way we look at it, we have Tag ‘n Turn and now looking for a push to the lower Bollinger Band/range at around 6400 level.

The “back to bullish” PFZ flip level is nearly 6540, so we have a fair amount of wiggle room between decision levels. This type of systematic clarity eliminates guesswork while providing clear mechanical guidelines.

Keep scrolling for systematic bear analysis and wiggle room planning…

SPX Market Briefing:

The charts tell the story of systematic precision triumphing over news-driven emotional reactions – exactly how mechanical trading should function during major economic releases.

Current System Status:

- Tag ‘n Turn: Bearish after NFP reality check rejection

- Target: 6400 level (lower Bollinger Band/range confluence)

- Flip Level: 6540 PFZ providing systematic reversal signal

- Buffer Zone: Fair wiggle room between decision levels

- News Response: Initial gap higher rejected at multiple technical confluences

The NFP Reality Check Analysis:

Friday’s action delivered a textbook example of why technical levels matter more than initial news reactions. The gap higher took SPX directly into the confluence of Bollinger Band highs, new all-time high levels, and angled range resistance.

The systematic rejection at these levels triggered the bear Tag ‘n Turn signal, proving that markets eventually respect technical reality regardless of initial emotional responses to economic data.

The 6400 Target Framework:

We’re now looking for a push to the lower Bollinger Band/range at around 6400 level. This target provides clear systematic objectives rather than wishful directional thinking.

The beauty of having the PFZ flip level at 6540 means we have fair wiggle room between current positioning and reversal signals. This eliminates the stress of tight trade management while maintaining systematic discipline.

Systematic Decision Levels:

- Current Bias: Bearish until bullish

- Target: 6400 (lower BB/range confluence)

- Flip Level: 6540 (PFZ back to bullish)

- Buffer: 140 points of systematic wiggle room

Today’s Mechanical Plan:

Tag ‘n Turn: Bearish until bullish on the swing approach. Clear directional bias with defined reversal levels removes emotional interpretation.

Premium and Lazy Poppers: Just awaiting the opening bell again as usual to start collecting some premium. Monday morning volatility often provides ideal conditions for mechanical setup recognition.

The systematic approach remains beautifully consistent regardless of weekend news analysis or market predictions.

In Other News…

FinNuts Market Flash

Weak data becomes the new strong data

Markets traded on weak data and cautious optimism like Kash discovering that terrible performance reviews somehow lead to promotions. Revolutionary concept that economic weakness equals market strength continues to baffle anyone with functioning brain cells, yet here we are celebrating job losses like they’re Christmas bonuses.

India parties whilst America panics about employment

GST relief announcement sparked buying frenzy in India as Nifty50 surpassed 24,800 whilst Sensex climbed sharply like Mac after discovering unlimited coffee privileges. Meanwhile, America’s pathetic August jobs report created just 22,000 jobs, undermining labour strength faster than Wallie’s work ethic. Standard Chartered now forecasting possible 50-basis-point Fed cut because apparently economic failure equals monetary success.

Global risk appetite improves despite obvious problems

Risk appetite improved as equities rose, gold stayed elevated, and yields dropped because apparently investors have discovered the art of ignoring reality completely. Political strains in Japan and Europe moderating enthusiasm like Percy discovering the office heating bill, whilst yen weakened notably on uncertainty about leadership and policy direction.

Markets await inflation reality check

CPI data looming as the key driver because apparently inflation numbers still matter in this upside-down world where bad news equals good markets. Markets anticipating large Fed cuts whilst positioning remaining defensive – financial equivalent of wanting cake whilst dieting. Investors favouring rate-sensitive sectors whilst awaiting clarity because apparently gambling on central bank decisions passes for investment strategy nowadays.

-Hazel

Expert Insights:

Options selling with 7DTE benefits from the current bearish bias toward 6400, as directional moves toward clear technical targets often provide the steady progression needed for optimal theta collection combined with directional profit capture.

The 140-point buffer between 6400 target and 6540 flip level creates ideal systematic trading conditions, allowing sufficient room for normal market noise while maintaining clear decision frameworks.

NFP reactions that initially gap against technical resistance often reverse more decisively than gradual trend changes, as the failed breakout creates additional selling pressure from disappointed bulls and technical traders recognising rejection signals.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted creating elaborate charts showing “pigeon flight pattern correlations with NFP gap-and-fade behaviour,” claiming his birds predicted the Friday reversal three days in advance.

“The pigeons clearly understood that Bollinger Band highs don’t appreciate being disrespected,” Percy announced while rearranging his desk formation around technical analysis printouts. “Their formation flying perfectly demonstrated the gap-higher-then-fade protocol!”

Mac immediately began planning “systematic rejection celebration parties,” declaring that “proper technical level respect requires comprehensive hospitality industry appreciation, darling!”

Hazel started calculating buffer zone management costs while muttering something about “140-point wiggle room requiring advanced systematic protocols with proper risk management coffee allocation.”

Kash tried to explain how technical rejections were “basically like resistance farming but with actual level-flip NFT potential,” while Wallie just nodded approvingly at the systematic approach, saying, “Finally, markets that respect proper technical boundaries rather than ignoring fundamental mathematical principles.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.