DOJ Powell Bombshell? Markets Shrug. Run On New All-Time Highs Resumes.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

And just like that, the weekend news scare is forgotten.

A run on new all-time highs again is made.

Nasdaq continues to lag but is finally starting to join the party – still a ways off from its own NATHs though.

And on a personal note – these intraday turnarounds are grinding my nutmeg.

Anyways – two small losses with the bear Tag n Turns as both SPX and RUT flip back to bullish. SPX -29.2% and RUT -6.1%.

I pre-emptively flipped on RUT as I am again away from the desk doing one of my favourite pastimes. For the sake of a tick or two prior to the final bell – I’ll take it as it saves me a headache trying to do it on my mobile tomorrow.

And if you have not gathered already, I’m writing this late Monday as I plan to be anywhere other than in front of the desk today whilst the swings keep swinging.

Both SPX and RUT are back to the bull swings. Time once again to wait and hope the chief idiot doesn’t tweet – speak – or forget to breathe.

Have fun folks.

CPI drops at 8:30. Bank earnings kick off. Phil’s elsewhere. Scroll down.

Intraday turnarounds grind nutmeg. Small losses happen. Systems adapt. That’s not failure. That’s systematic trading in action.

Market Briefing:

Tuesday brings CPI and bank earnings whilst the market pretends Sunday night never happened. DOJ subpoenas the Fed Chair? Markets don’t care. NATHs back on the menu.

Current Multi-Market Status:

- ES: 7,014.00 – at NATHs (7,016.25)

- YM: 49,797 – at NATHs (49,876)

- NQ: 25,955.75 – lagging, NATHs at 26,399

- RTY: 2,647.9 – at NATHs (2,650.3)

- GC: 4,601.8 – still elevated

- CL: 59.46

- VIX: 15.08 – dropped from yesterday’s 16.33

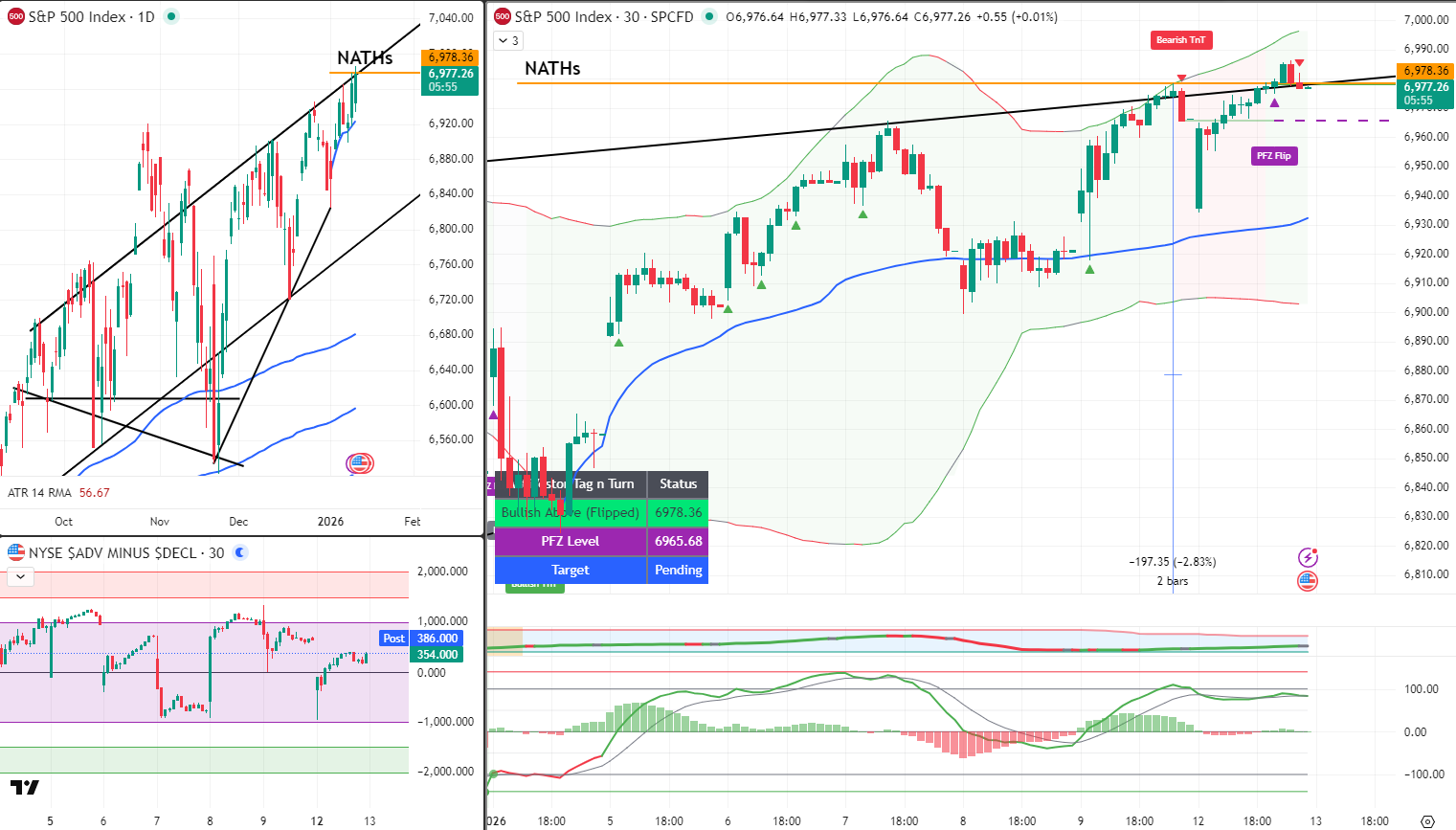

SPX – Flipped Back to Bullish

The bear TnT that triggered Friday? Done. Flipped back to bullish Monday.

| TnT Status | Level |

|---|---|

| Bullish Above (Flipped) | 6978.36 |

| PFZ Level | 6965.68 |

| Target | Pending |

| Current | ~6,977 |

Loss on bear swing: -29.2%

These intraday reversals are what they are. The system adapts. Small loss. Move on.

RUT – Pre-Emptively Flipped

I flipped RUT manually ahead of the official signal. Away from desk, doing favourite pastime, for the sake of a tick or two – I’ll take the early flip over fumbling with mobile tomorrow.

| TnT Status | Level |

|---|---|

| Direction | Bullish (manual flip) |

| Current | ~2,620 |

Loss on bear swing: -6.1%

Both indexes back to bull swings. Lockstep continues – just in the opposite direction now.

Nasdaq – Finally Joining

NQ at 25,955 with NATHs at 26,399. Still a ways off but finally showing signs of life. The laggard is starting to stir.

CPI Day

| Time (ET) | Event |

|---|---|

| 8:30am | CPI (December) |

| Various | Bank earnings begin (JPM, others) |

CPI forecast: 0.3% MoM, 2.7% YoY (headline). Core: 0.3% MoM, 2.7% YoY.

[Source: BLS, Morningstar]

The shutdown distorted October/November data. December should give a cleaner read – first proper checkpoint since the mess.

Expert Insights:

Markets have the memory of a goldfish with ADHD.

Sunday night: DOJ subpoenas Fed Chair Powell. Criminal indictment threatened. Fed independence under attack. Gold hits ATH. VIX spikes.

Monday: Completely forgotten. Run at NATHs. VIX drops from 16.33 to 15.08. Business as usual.

This is why systematic trading beats emotional reaction. The headlines scream disaster. The price action says “what disaster?” Bear TnTs flip to bullish. Small losses taken. Move on.

The chief idiot could tweet something market-moving at any moment.

Or not.

Can’t predict.

Can only position systematically and adapt when signals change.

In Other News…

Markets Recover 400-Point Drop, Declare Crisis Averted

Powell probe? Solved by Monday afternoon. Gold screaming? Background noise. JPMorgan earnings? Just dual headwinds.

S&P recovered from 400-point intraday drop Monday to close +0.65%—markets treating Fed independence crisis as temporary inconvenience resolved by closing bell. Gold hit record $4,568 whilst silver surged 4.54% screaming institutional warnings equity markets ignored because apparently precious metals only matter when supporting bullish narrative. JPMorgan reports today facing dual headwinds: Trump’s 10% credit card cap crushing Visa (-2.69%), AmEx (-4.26%), and Powell probe creating policy uncertainty analysts calling “just another earnings season challenge”.

JPMorgan’s “Dual Headwinds” (Institutional Crisis)

JPMorgan reports 7am expecting $4.97 EPS whilst navigating 10% credit card cap proposal and Apple Card takeover triggering $2.2B provision. December’s $105B expense guidance already spooked markets but apparently adding regulatory chaos and Fed independence questions counts as “manageable headwinds” not existential threats. BofA, Citi, Wells tomorrow, Goldman and Morgan Stanley Thursday all pretending monetary policy framework intact during earnings calls.

⚠️ Gold’s Record High: “Background Noise”

Gold’s Monday record $4,568 and silver’s 4.54% surge represent loudest institutional warning signal since financial crisis yet equity markets treating as decorative chart element. VIX settled 14.49 suggesting calm whilst precious metals scream fear—markets choosing which signals matter based on convenience. Safe-haven flows lifted miners proving some investors noticed warnings everyone else ignoring.

Defence Volatility Continues Being Normal Now

Defence sector extending last week’s wild swings on $1.5T military spending proposal—volatility from presidential announcements now accepted feature not bug. Energy gained on Iran supply fears adding inflation risk Tuesday’s CPI data might reveal. Walmart joined Nasdaq-100 because apparently retail belongs in tech index during Fed independence crisis.

☕ Hazel’s Take

400-point drop recovered, Powell probe dismissed, gold records ignored, JPMorgan dual headwinds. When Fed independence crisis treated as resolved by afternoon rally and precious metals screaming warnings become background noise, probably acknowledging earnings season proceeds regardless of institutional framework collapse.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: The team arrived Tuesday morning to discover markets had completely forgotten Sunday’s constitutional crisis.

“So,” Mac said, looking at the screens, “DOJ threatens to indict the Fed Chair and markets respond by… running at all-time highs?”

“Goldfish memory,” Hazel confirmed. “VIX dropped a full point overnight.”

Percy was confused. “But yesterday everyone was panicking about Fed independence and flight to safety and-“

“Yesterday was yesterday,” Wallie interrupted. “Today is CPI day. Markets moved on.”

Kash attempted to explain the disconnect between institutional stability concerns and price action but got distracted when his chart showed NATHs across three indexes simultaneously.

“Bear TnTs both flipped,” Hazel noted. “Small losses. SPX minus twenty-nine, RUT minus six.”

“Where’s Phil?” Percy asked.

“Favourite pastime. Away from desk. Wrote the briefing last night.”

Mac raised his morning whisky. “To systematic adaptation. Small losses happen. Markets forget. NATHs resume. Business as usual.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Meme of the Day:

“Sunday: ‘THE FED IS UNDER ATTACK! DEMOCRACY IS ENDING!’ Monday: ‘Anyway, here’s NATHs'”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.