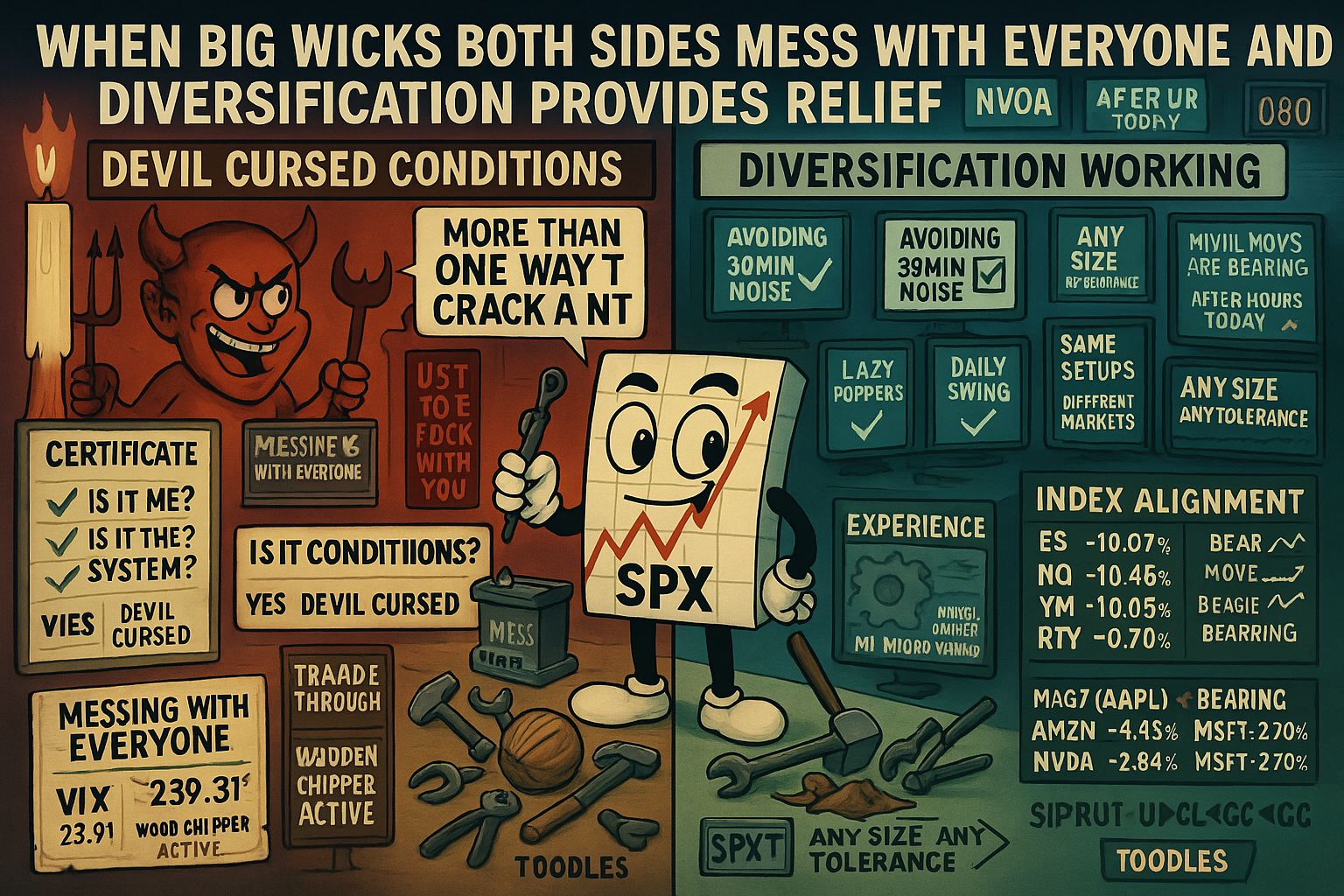

Three Questions: Is It Me? Is It The System? Is It The Market Conditions?

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

We are seeing huge wicks again on both the lower and upper portions of the day’s high low range – which if I’m honest – is winding me up and getting under my skin just as much as you keep telling me.

Such is the way of things.

There are going to be times when it’s easy – every decision is another in a long string of great decisions. Then there will be times when you need to quickly flip and change your viewpoints with new information.

And lastly, there are times like now where it seems like someone has made a deal with the devil just to fuck with you.

In short there are 3 things you can do to guide you:

- Is it me?

- Is it the system?

- Is it the market conditions?

As long as you are following your system it’s likely not going to be 1 or 2 which leaves those devil cursed market conditions to contend with – which means – it’s likely that messing with everyone at the moment regardless of your system.

How do I deal with it? I trade through. I’ve seen this a lot of times.

Other things I’ve been doing over the last few months is adding some other markets – which you’ve seen me talk about from time to time either here or during our fast forward group calls.

The same setups on 4hr futures charts are working just fine and avoiding much of the noise on 30min charts.

Scalping the opening with my Premium Poppers. Getting the daily swing with the Lazy Popper. Fancy a little sip on crude oil? Want to hoard some gold? The system works there too and allows for a little diversification on timeframes and markets.

These days there are mini micro contracts on many of the main futures & options – so it’s easy enough to have some exposure to suit any position size or risk tolerance.

My point is there is always more than one way to crack a nut.

Start small – start with 1 market and 1 system – THEN you can expand – assuming you want to.

Keep scrolling for the chart analysis…

Devil Cursed Conditions. Trade Through. Diversify. NVDA Earnings Watch.

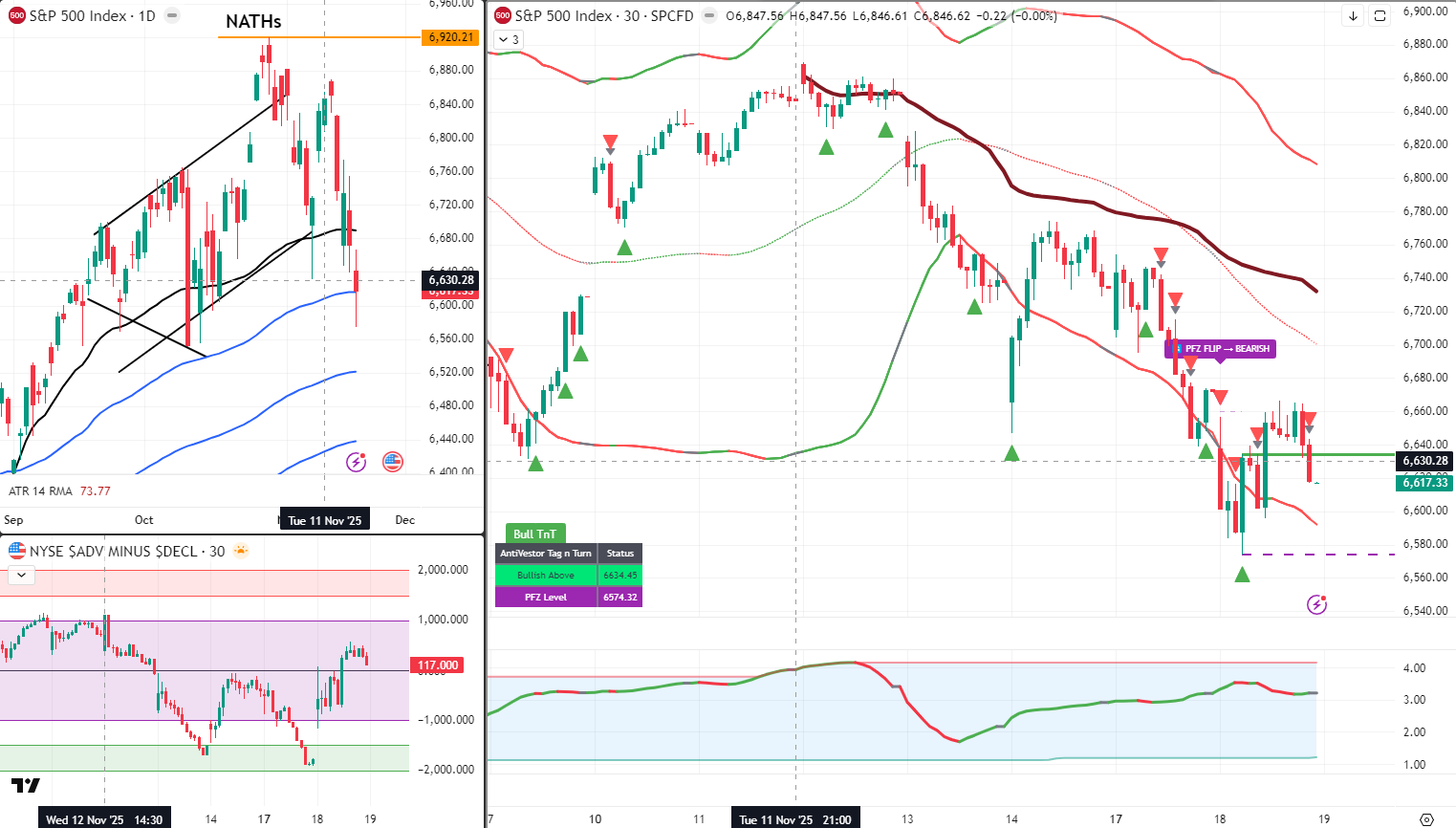

SPX Market Briefing:

Wednesday reviews Tuesdays BIG Wick Action – both sides (winding up systematic traders confirming devil-cursed market conditions messing with everyone),

three-question framework (is it me/system/conditions – if following system it’s likely conditions), trade-through approach (seen this before, diversify markets/timeframes),

4hr futures avoiding 30min noise whilst Premium/Lazy Poppers plus crude/gold working (more than one way to crack nut, start with 1 then expand),

indexes finally moving together bearishly (VIX high not out of wood chipper yet),

Mag7 tipping bearish with NVDA earnings after hours (AI bubble burst or sput sput fizz).

Current Multi-Market Status:

- ES: 6660.00, -700 pts from highs (-10.07%)

- RTY: 2364.8, -260 pts from highs (-10.13%)

- YM: 46,245, -4,879 pts from highs (-10.05%)

- NQ: 24,684.25, -2,761 pts from highs (-10.46%)

- CL: $60.24, dead duck

- GC: $4115.6, ready for another push

- VIX: 23.91, still elevated

- DXY: 99.596, dollar strength continuing

Big Wicks Both Sides – Devil Cursed

We are seeing huge wicks again on both the lower and upper portions of the day’s high low range.

Upper wicks. Lower wicks. Both sides getting tested. Neither holding. Choppy mess.

Which if I’m honest – is winding me up and getting under my skin just as much as you keep telling me.

Not just you. Me too. These conditions frustrating everyone.

And lastly, there are times like now where it seems like someone has made a deal with the devil just to fuck with you.

Devil cursed market conditions. Technical term.

Current Status: Big wicks both sides, devil cursed conditions confirmed

Three Questions Framework

In short there are 3 things you can do to guide you:

- Is it me?

- Is it the system?

- Is it the market conditions?

As long as you are following your system it’s likely not going to be 1 or 2.

Following rules? Check. System data backed? Check. Then it’s not you or the system.

Which leaves those devil cursed market conditions to contend with – which means – it’s likely messing with everyone at the moment regardless of your system.

Everyone getting chopped. All systems struggling. Conditions the culprit.

Current Status: Not you, not system, devil cursed conditions confirmed

Trade Through – Diversify

How do I deal with it? I trade through. I’ve seen this a lot of times.

Experience counts. These phases happen. Trade through them.

The same setups on 4hr futures charts are working just fine and avoiding much of the noise on 30min charts.

Higher timeframe = less noise. 4hr smoothing out 30min chop.

Scalping the opening with my Premium Poppers. Getting the daily swing with the Lazy Popper. Fancy a little sip on crude oil? Want to hoard some gold?

System works across markets. Crude oil. Gold. Same setups. Different instruments.

My point is there is always more than one way to crack a nut.

Start small – 1 market, 1 system – THEN expand.

Current Status: Trade through, diversify timeframes/markets, crack nut differently

Chart Overview – Indexes Finally Together

The main 4 indexes are finally all moving kind of together – the bear moves are bearing.

ES: -10.07% from highs. NQ: -10.46%. YM: -10.05%. RTY: -10.13%.

All in correction territory together. Bearish alignment.

Gold looks like it’s ready to try for another push to highs.

GC: $4115.6. Pulling back but setup forming for next push.

Crude oil is a dead duck at the moment.

CL: $60.24. Flat. No momentum either direction.

VIX remains high so we are not yet out of the wood chipper.

VIX: 23.91. Elevated volatility. Chop continues until this drops.

Current Status: Indexes aligned bearish, gold preparing, oil dead, VIX wood chipper active

Mag7 + NVDA Earnings

Mag7 exposure started out as hate on META has turned into a little occasional stock exposure with most of the moves now tipping over to bearish.

AAPL: 267.44, topped. AMZN: 222.55 (-4.43%). NVDA: 181.36 (-2.84%). GOOGL: 284.96. MSFT: 493.79 (-2.70%). TSLA: 401.25 (-1.88%). META: 597.69.

Most rolling over. Bearish structure forming across Mag7.

With NVDA earnings out after hours today – the collective corner of the financial world is waiting to see if the AI bubble will burst or if we will see just another earning go sput sput fizz and we can all get on with whatever we were doing before.

NVDA earnings = AI narrative verdict. Burst or fizz? Market waiting.

We will see what we see when we see it at the moment it’s supposed to be seen.

Toodles.

Current Status: Mag7 tipping bearish, NVDA earnings today, AI bubble verdict pending

In Other News…

Four-Day Streak: Froth Discovers Gravity

BofA flashes sell signal. Managers most overweight since February. Nvidia faces $320B verdict tonight.

Markets attempted stabilisation Wednesday after Tuesday’s rout extended losing streak to four days—Dow shedding 498 points as VIX spiked 10% to 24.67. BofA survey flashed “sell signal” with managers holding 3.7% cash and most overweight equities since February, proving Wall Street remains bullish precisely when being bullish becomes dangerous. Nvidia reports tonight needing to beat $55B revenue and guide Q4 above $61.5B or face $320B market cap reckoning.

When Froth Meets Reality

BofA warns “froth will correct without Fed December cut”—rate cut odds collapsed from 90% to levels making December easing unlikely. Home Depot plunged 6% after cutting guidance proving consumer confidence evaporating from kitchen renovations. Target reports expecting revenue -1%, EPS -5% as retail sector prepares to confirm what Home Depot already admitted.

Defensive Rotation Achieves All-Time Highs

Eli Lilly and Medtronic hit records as investors discover revolutionary strategy: buy companies making actual products for sick people instead of speculative AI infrastructure. Tech led losses with Nvidia -3%, Amazon and Microsoft pressured whilst markets rotate from 2025 winners into perceived safety. Consumer discretionary down 2% week-to-date as spending reality meets enthusiasm.

☕ Hazel’s Take

Four-day streak, VIX at 24.67, managers most overweight since February, Nvidia facing $320B tonight. When BofA flashes sell signal and froth correction requires Fed cut that isn’t coming, probably acknowledging positioning created its own headwind.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Big Wicks Both Sides Devil Cursed Conditions Recognition Flying” whilst analysing the choppy mess and claiming they had mastered “Three Question Framework Is-It-Me-System-Or-Conditions Advanced Cooing With Trade-Through-And-Diversify Discipline.”

Hazel updated her crisis management protocols to include “Someone Made Deal With Devil Just To Fuck With You Recognition Emergency Procedures” alongside contingency plans for “4hr-Futures-Avoiding-30min-Noise Integration With Crude-Oil-Dead-Duck-And-Gold-Ready-Push Analysis And NVDA-Earnings-AI-Bubble-Verdict Protocols.”

Mac raised his Wednesday whisky and declared, “When big wicks both sides confirm devil cursed conditions messing with everyone regardless of system, trading-through-with-timeframe-diversification becomes delightfully superior to abandoning systematic approach!”

Kash attempted livestreaming about “devil cursed conditions being basically like DeFi rug pull energy but spread across all markets equally” but got distracted calculating whether NVDA earnings count as bubble burst or sput sput fizz.

Wallie grumbled that in his day, choppy markets meant “sitting on hands rather than this modern trade-through-and-diversify behaviour with mini micro contracts!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The Longest Shutdown’s Statistical Casualty 43 days of darkness leaves permanent data gaps

The October 2025 jobs report may become the first missing monthly employment data since the Bureau of Labour Statistics began the Current Population Survey in 1948 – a streak of over 900 consecutive months broken by the longest government shutdown in U.S. history.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.