CL Bullish Range Reversal Delivered 129.4% Return, Assessing Next Setup

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

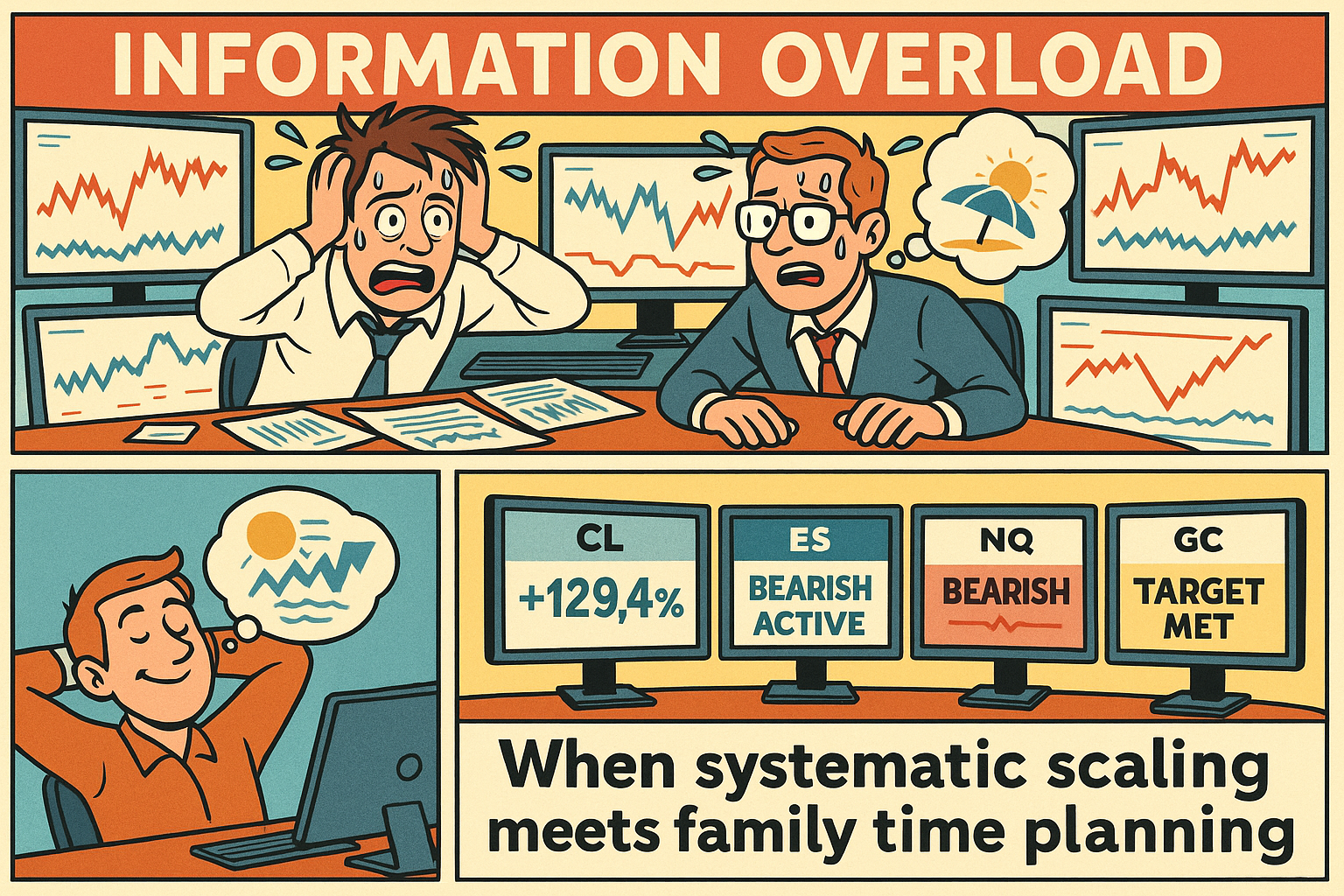

Righty then, we have a lot of ground to cover today as I’ve opened up what I typically trade a little wider. Tag ‘n Turn all the way across multiple markets and timeframes – systematic approach scaling beautifully.

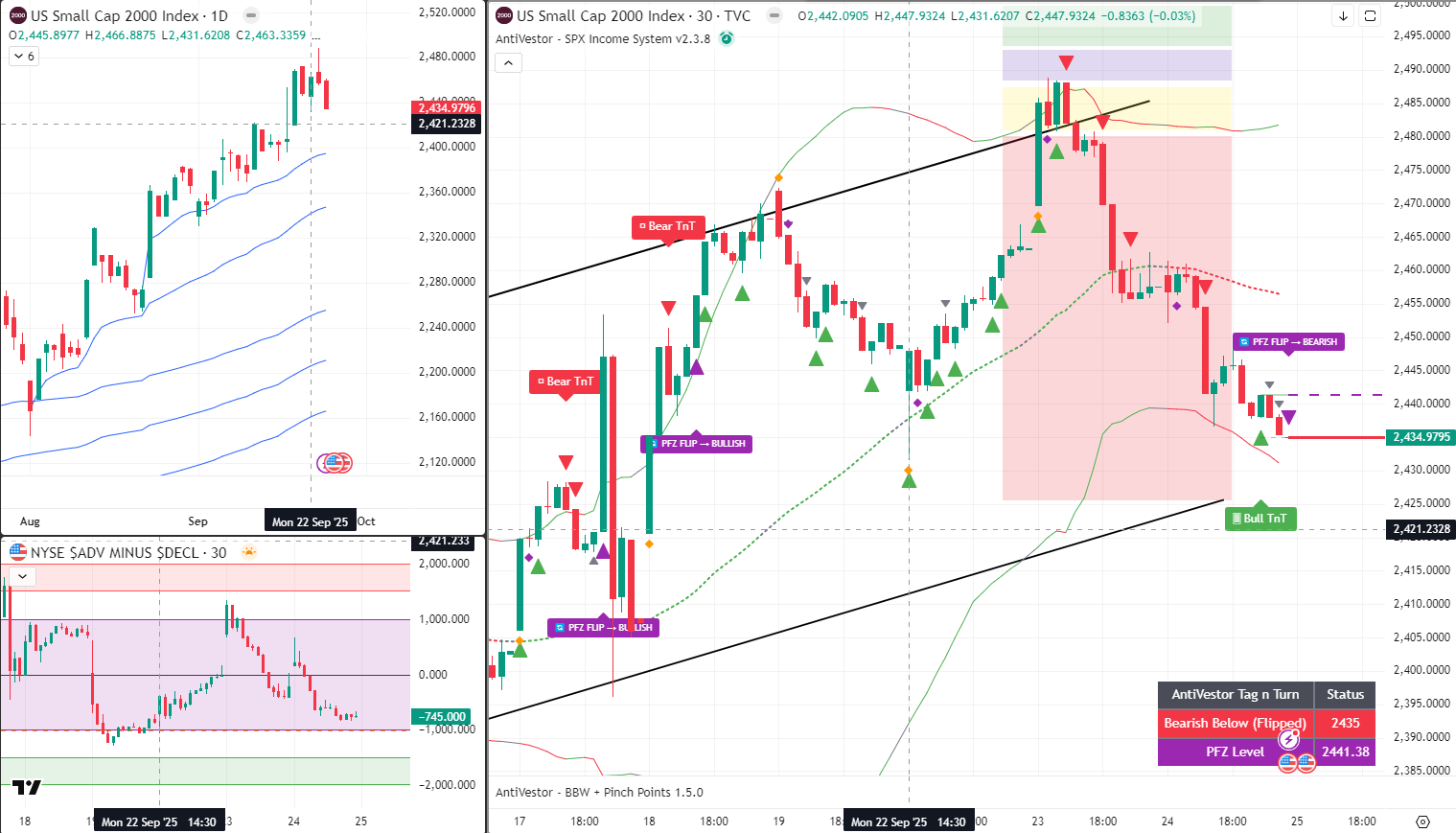

Cash markets (SPX, RUT) running 30-minute Tag ‘n Turns collecting premiums on shorter-term swings using options as the profit vehicle. Futures markets (ES, GC, CL) using the slightly bigger picture on 4-hour charts with the more conservative price action entries we sometimes deploy when wanting to delay entries slightly.

With the groundwork laid, let’s dive into what’s developing across this expanded systematic universe.

Keep scrolling for the multi-market Tag ‘n Turn breakdown…

SPX Market Briefing:

Today showcases the beautiful scalability of systematic approaches across multiple markets and timeframes simultaneously.

Current Multi-Market Status:

- SPX/RUT Cash: Both bearish now, 30-min Tag ‘n Turn premium collection active

- ES Futures: Bearish V-shaped entry targeting crash window directional move

- CL Futures: 129.4% return delivered, assessing breakout vs reversal setup

- GC Futures: Bearish from recent breakout target achievement

Cash Markets Alignment:

Both SPX and RUT are now bearish. RUT made it official on Tuesday, whilst SPX arrived late to the party yesterday. I’m still working on getting the software to handle transitions from breakout target met to Tag ‘n Turn setup properly, ensuring correct entries display now and in future iterations.

The 30-minute timeframe on cash markets provides excellent premium collection opportunities for those shorter-term swings using options as the vehicle to profit from mechanical precision.

ES Futures Strategy:

ES trade is also bearish using Tag ‘n Turn entry with V-shaped entries. I’m looking for a larger directional move here as we come into the crash/correction window proper, and I want to take advantage of it.

Additional motivation for the larger timeframe futures approach: I’ll be taking a few days away from the 6th-10th, so having bigger picture exposure makes sense and allows me to relax more fully with the family whilst positions work mechanically.

Crude Oil Success Story:

CL crude oil’s bullish range reversal (AKA Tag ‘n Turn) pushed a fast move higher targeting the range highs for a cracking 129.4% return on risk. Systematic precision delivering exactly what the setup promised.

Now assessing again for breakout or reversal setup as per the 6 Money Making Patterns. I’m leaning towards bearish here as prior Bollinger band breakouts have been exceptionally short-lived before turning lower. A break back into the range will develop the setup perfectly.

Gold Positioning:

GC gold is also bearish for the moment, looking for some short-term bearish movement from the recent breakout target level being met. Another systematic transition playing out mechanically.

Today’s Systematic Plan:

- Cash Markets: Continue 30-min Tag ‘n Turn premium collection on SPX/RUT

- ES: Monitor bearish V-shaped development for crash window positioning

- CL: Assess breakout vs reversal setup following 129% return success

- GC: Execute bearish positioning from target achievement level

- Premium/Lazy Poppers: Keep popping at opening bell for faster action

Other than the additional market assessments, the plan is and remains systematically consistent.

SPX – S&P 500 Cash

Tag ‘n Turn all the way

RUT – Russel 200 Cash

Tag ‘n Turn all the way

/CL – Crude Oil Futures

CL crude oil’s bullish range reversal (AKA Tag ‘n Turn) pushed a fast move higher targeting the range highs for a cracking 129.4% return on risk. Systematic precision delivering exactly what the setup promised.

Now assessing again for breakout or reversal setup as per the 6 Money Making Patterns. I’m leaning towards bearish here as prior Bollinger band breakouts have been exceptionally short-lived before turning lower. A break back into the range will develop the setup perfectly.

/GC – Gold Futures

GC gold is also bearish for the moment, looking for some short-term bearish movement from the recent breakout target level being met. Another systematic transition playing out mechanically.

/ES – S&P 500 Futures

ES trade is also bearish using Tag ‘n Turn entry with V-shaped entries. I’m looking for a larger directional move here as we come into the crash/correction window proper, and I want to take advantage of it.

Additional motivation for the larger timeframe futures approach: I’ll be taking a few days away from the 6th-10th, so having bigger picture exposure makes sense and allows me to relax more fully with the family whilst positions work mechanically.

/CL – Crude Oil Result

In Other News…

FinNuts Market Flash

Costco earnings prove warehouse shopping conquers all

ES climbed +0.4% to 6,715 by market open like Kash discovering Costco sells bulk energy drinks. Overnight range 6,700-6,720 tighter than Mac’s rationing of the office whisky supply. NQ managed +0.2% whilst RTY sat flat because apparently small companies are having existential crises again. VIX at 13.1 suggests fear levels somewhere between “mild concern about queue lengths” and “forgot Costco membership card at home.”

Homebuilders celebrate mortgage rate relief

Homebuilders rallying 4-6% as thirty-year mortgage rates dropped to 6.2% from 6.8% peaks, proving that slightly less expensive borrowing equals celebration in housing markets. KB Home and Toll Brothers leading gains whilst regional banks up 2.1% on steepening curves because apparently making money off interest rate differentials never gets old. REITs advancing on reduced refinancing pressure like property investors discovering financial relief.

Consumer bifurcation reaches philosophical heights

AutoZone falling 6% whilst cutting full-year guidance on lower-income consumer weakness because apparently car maintenance becomes optional during economic stress. Costco membership model proves resilient with 5.8% comparable sales growth, demonstrating that bulk shopping transcends economic uncertainty. Restaurant chains mixed with fast-casual outperforming sit-down formats because eating quickly costs less than dining leisurely.

Gold miners discover eternal optimism

Gold miners surging 8% following metal’s $2,691 record high – the 37th record of 2025 because apparently precious metals are having their best year since discovery. Tech mixed with semiconductors under pressure whilst cloud names hold strength, proving not all technology stocks share the same emotional baggage. European funds posting $420M inflows on export optimism because apparently continental investors still believe in international trade.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered arranging his desk pigeons in “Multi-Market Formation” whilst claiming they had “predicted the exact Tag ‘n Turn scaling across five simultaneous markets through coordinated flight pattern diversification.”

Hazel was spotted updating her “Family Time Trading Protocols” whilst simultaneously preparing “Multi-Timeframe Management Procedures” for when systematic approaches need to work independently during holidays.

Mac raised his morning whisky and declared, “My dear chaps, when one system works beautifully, why not deploy it across every bloody market available!”

Kash was livestreaming about “Tag ‘n Turn being basically like DeFi yield farming but across multiple asset classes with actual systematic scalability,” whilst Wallie just grumbled, “In my day, we traded one market properly rather than spreading ourselves across five different timeframes!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Limit vs Market Orders: The Tortoise and the Hare

Market orders are like the impatient hare-they execute instantly but might get terrible prices during volatile moments, while limit orders are the patient tortoise that waits for the right price and often wins the race!

This is the most important trading lesson that nobody teaches beginners until after they’ve already blown up their account! Market orders are the “I want it now!” button of trading-you click buy or sell and your broker immediately executes at whatever price is currently available, even if that price sucks.

It’s like rushing into a store and yelling;

“I’ll pay whatever!” during a Black Friday stampede.

Limit orders are the opposite: you specify the exact price you’re willing to pay (or accept when selling) and your order sits patiently until the market comes to you, like a chess master waiting for the perfect move.

During normal market conditions, the difference might be pennies, but during volatile periods, market orders can get absolutely destroyed by sudden price gaps while limit orders protect you from panic pricing!

The rookie mistake is always using market orders because they’re faster, but experienced traders know that paying a few cents more (or receiving a few cents less) adds up to serious money over time. It’s the classic tortoise and hare story: the flashy, fast option often loses to the patient, strategic approach. Sometimes the best trade is the one you don’t rush into! ⚡

Meme of the Day:

When you scale Tag ‘n Turn across five markets and CL delivers 129.4% whilst you plan family time

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.