Looking For Pullback Part Of Continuation Setup – SPX Target 6882 RUT Target 2542

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

The bull just keeps wanting to bull.

Despite the dailies being near the upper boundary of the range – it’s looking like there’s still a little more bull juice to squeeze and we are now seeing prices push towards new all time highs again.

SPX and RUT remained bullish as we moved into the range discussed yesterday and popped out of it just as quick.

We now have the breakouts – just looking for the pullback part of the continuation setup.

Should those develop, SPX has a breakout target of 6882 and RUT has a target of 2542.

Bear bias is OFF and short term bull bias is ON.

Popper setups are back to being each way and whatever sets up with no filters.

We have news out today – unemployment claims – could rock the boat. All eyes still looking towards Friday’s big headline numbers NFP.

Gonna be a fun end to the week and start of the month.

Keep scrolling for the breakout targets breakdown…

Breakouts Confirmed. Targets Set. Bull Juice Flowing. Pullback Hunting.

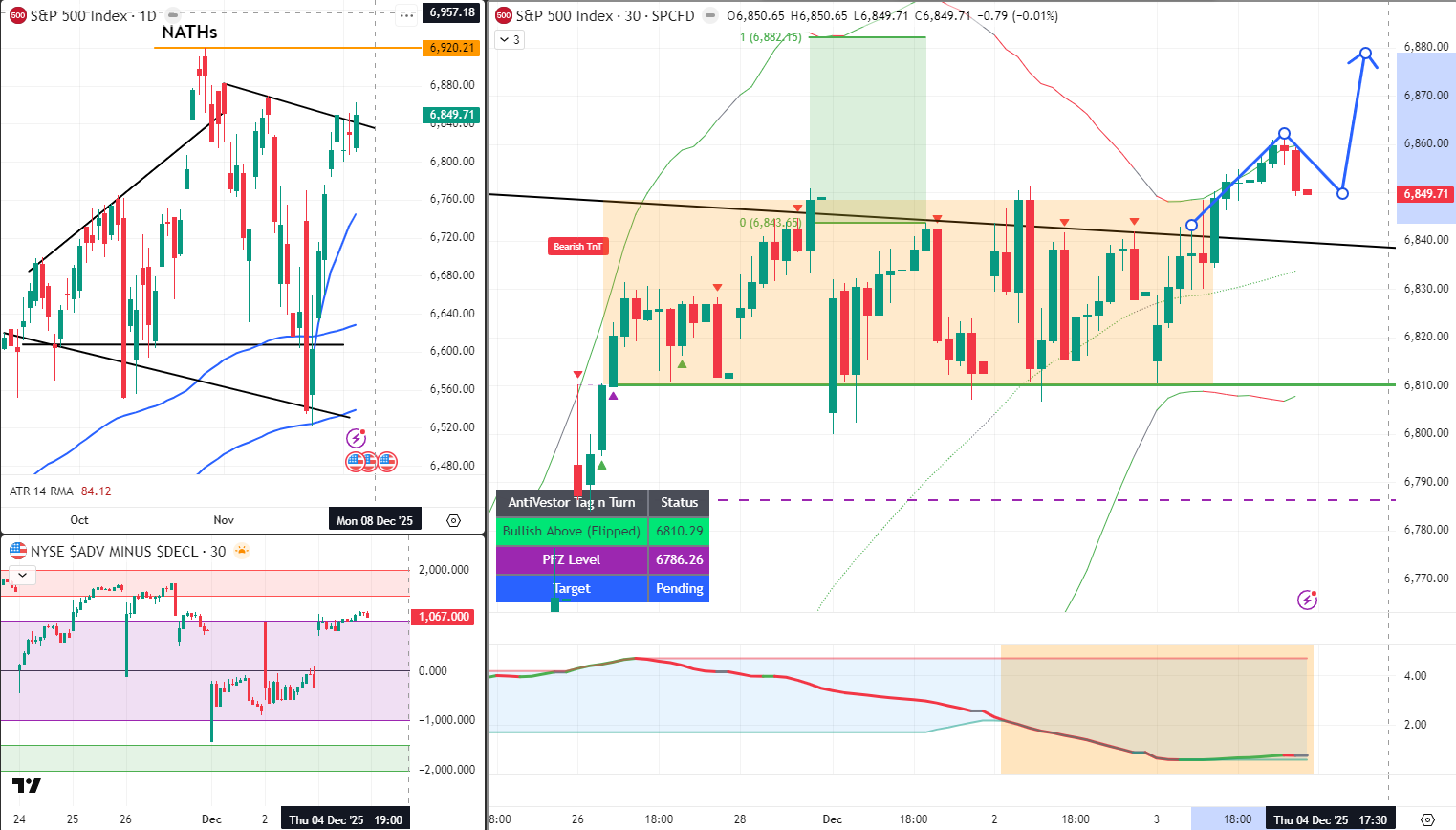

SPX Market Briefing:

Thursday December sees the bull wanting to bull (despite dailies near upper boundary – still more bull juice to squeeze – pushing towards new ATHs),

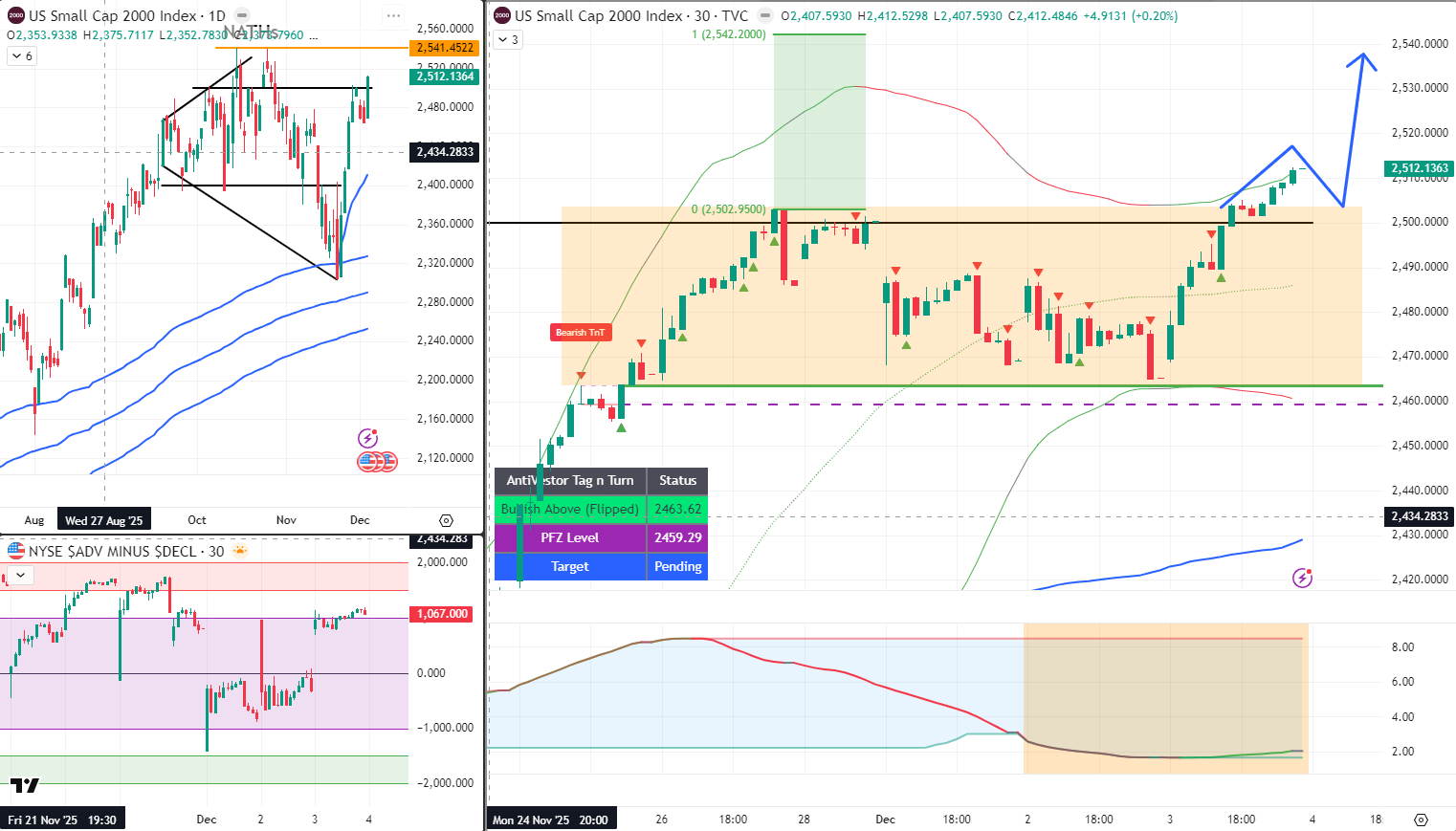

SPX and RUT remained bullish and moved into range discussed yesterday then popped out just as quick (breakouts confirmed), now looking for pullback part of continuation setup (SPX target 6882, RUT target 2542),

bear bias OFF short term bull bias ON, popper setups back to each way no filters, unemployment claims today could rock boat, all eyes on Friday NFP – fun end to week and start of month.

Current Multi-Market Status:

- SPX: Bullish Above (still) 6810.29, BO target 6,882

- RUT: Bullish Above (still) 2463.62, BO target 2,542

- ES: 6,868.75 – breakout mode

- YM: 48,017 – pushing highs

- NQ: 25,683.50 – ATH territory

- VIX: 16.12 – subdued

- GC: 4,226.30 – consolidating

- CL: 59.25 – upper channel

- BTC: 93,486 – holding gains

Bull Juice Still Flowing

The bull just keeps wanting to bull.

Despite the dailies being near the upper boundary of the range – it’s looking like there’s still a little more bull juice to squeeze and we are now seeing prices push towards new all time highs again.

Current Status: Bull bias confirmed, pushing ATHs

Breakouts Confirmed

SPX and RUT remained bullish as we moved into the range discussed yesterday and popped out of it just as quick.

We now have the breakouts. The consolidation that had been building is now resolved to the upside. Both indexes have confirmed their breakout status.

Current Status: Breakouts confirmed on both SPX and RUT

Continuation Setup – Targets Set

We now have the breakouts – just looking for the pullback part of the continuation setup.

Should those develop:

- SPX breakout target: 6882

- RUT breakout target: 2542

The continuation setup requires a pullback to test the breakout level before resuming higher. Standard stuff.

Current Status: Waiting for pullback, targets set

Bias Flip – Bear Off Bull On

Bear bias is OFF and short term bull bias is ON.

Popper setups are back to being each way and whatever sets up with no filters. The directional filter that served us well through the range phase is now lifted.

Current Status: Bear filter removed, each way poppers

News Watch – Unemployment Claims And NFP

We have news out today – unemployment claims – could rock the boat.

All eyes still looking towards Friday’s big headline numbers NFP. Gonna be a fun end to the week and start of the month.

Current Status: Unemployment claims today, NFP Friday

Expert Insights

The Observation: The range phase ended faster than expected. Yesterday we were discussing waiting for breakouts – today we have them. Markets don’t wait for permission.

The Fix: When breakouts confirm, the setup shifts to continuation. Look for the pullback for the continuation – that’s your for the breakout swing.

Targets are set: 6882 SPX, 2542 RUT.

Bear filter comes off.

Trade what the market gives you.

In Other News…

Dow Celebrates Third-Highest Close on 32,000 Jobs Lost

ADP shows -32K vs +40K expected. Markets rocket because bad = good when Fed involved.

Dow hit third-highest close Wednesday rocketing 408 points as ADP revealed 32,000 jobs lost versus 40,000 expected gains—markets celebrating 72,000-job miss because weak employment guarantees Fed cuts. Salesforce crushed estimates by 26% ($3.25 vs $2.58 EPS) whilst Microsoft fell 2% on reports of cut AI sales quotas—apparently reducing growth targets more concerning than massive beats. Rate futures now price 89% December cut odds proving job losses become bullish catalyst when central bank pivots.

When Missing by 72,000 Jobs = Rally Fuel

ADP’s catastrophic miss shifted Fed calculus as Treasury curve steepened and dollar weakened celebrating economic weakness. Markets treating -32K jobs as Christmas gift because Fed now forced to cut. Natural gas hit 3-year highs near $5/MMBtu on cold weather whilst Delta warned shutdown could cost $200M—airline somehow rising 3.6% on expense warnings because apparently guidance doesn’t matter when macro narrative fits.

Earnings Split: Beat Big or Crash Hard

Salesforce and Marvell (acquiring Celestial AI for up to $5.5B) soared whilst Pure Storage crashed 27% on weak outlook, GitLab fell 13% on quarterly loss—proving markets now binary between massive beats rewarded and anything less punished violently. Apple hit $289 record on China iPhone demand because one bright spot validates everything.

Microsoft’s AI Quota Cuts Ignored Completely

Microsoft cutting AI sales quotas—signal that hypergrowth narrative moderating—fell 2% then promptly forgotten as markets focused on Salesforce beat instead. When major AI player reduces targets but gets ignored whilst cloud software company beating estimates becomes entire narrative, probably acknowledging selective attention drives positioning.

☕ Hazel’s Take

Dow celebrates third-highest on 32,000 jobs lost, Salesforce beats 26%, Microsoft cuts AI quotas ignored. When 72,000-job miss becomes bullish catalyst, probably acknowledging bad news only good when Fed says so.

—Hazel, FinNuts

Rumour Has It…

The Financial Nuts team reports from the newsroom…

Percy’s frantically updating his range diagrams. “They popped out! Just like that! Breakouts confirmed!” His pigeons are learning to recognise continuation patterns.

Hazel’s flipping the bias switch from BEAR to BULL whilst updating protocols. “Bear filter: OFF. Each way poppers: ON. Targets: SET.”

Mac’s glass is now labelled “BULL JUICE SPECIAL” whilst Kash calculated the breakout targets. “6882 and 2542. Write it down. Or don’t. Up to you.”

Wallie actually looked mildly interested: “Breakouts confirmed? Targets set? Finally something to do besides wait for Friday.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Studies on breakout behaviour show that “throwbacks” (pullbacks after upward breakouts) occur about 55% of the time. Price typically rises for an average of 5 days after a breakout before the pullback begins, with gains of 6-9% being most common before the retracement. The pullback itself takes about 10 days to complete before the trend resumes – so patience is required during the continuation setup phase.

[Source: ThePatternSite / Thomas Bulkowski – Chart Pattern Research]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.