Fully Intending Not To Do Too Much Short Term Trading – But This Was An A+ Setup

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

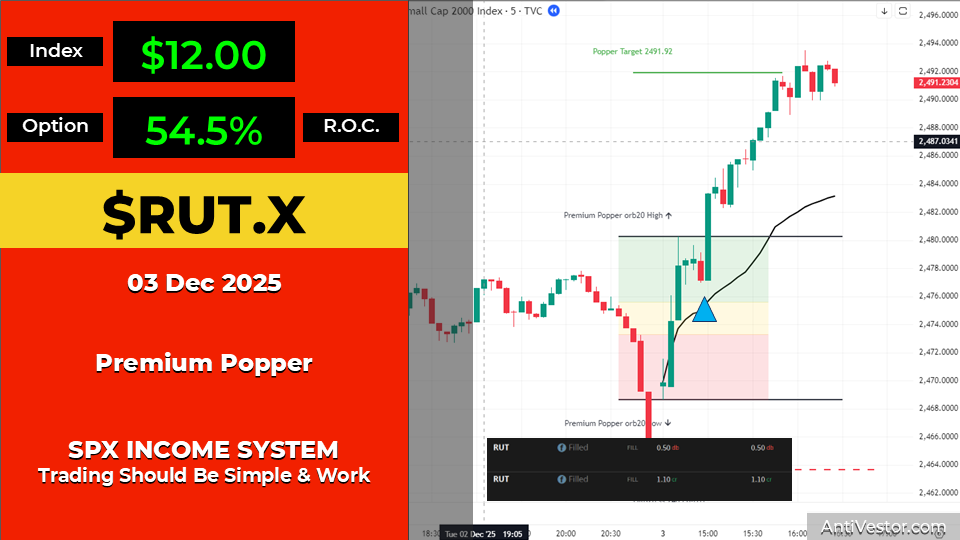

Wednesday saw another great Premium Popper setup outcome.

I was fully intending to not do too much short term trading but this setup is what I consider an A+ setup which is inside of my usual ORB20 setup.

RUT right off the opening bell showed an ideal footprint for me which was part of my usually high probability ORB20 setup.

Premium Popper options setup goes on and a fast directional move later – around $12 the exit was reached at 54.5% ROC.

I’m sometimes tempted to just wait for this setup and this setup alone.

Keep scrolling for the full breakdown…

A+ Setup. Ideal Footprint. Fast Move. Quality Over Quantity.

Market DeBriefing:

| Detail | Value |

|---|---|

| Date | Wednesday 3rd December 2025 |

| Index | RUT |

| Strategy | Premium Popper |

| Setup | A+ inside ORB20 |

| Entry | Premium Popper orb20 low |

| Target | 2,491.92 |

| Profit | $12.00 |

| ROC | 54.5% |

Post Trade Debrief:

Wednesday December sees A+ Premium Popper setup outcome on RUT (was intending not to do too much short term trading but this was too good), right off opening bell showed ideal footprint inside usual high probability ORB20 setup, Premium Popper options setup goes on then fast directional move to exit ($12 / 54.5% ROC), sometimes tempted to just wait for this setup and this setup alone.

The A+ Setup Inside ORB20

I was fully intending to not do too much short term trading but this setup is what I consider an A+ setup which is inside of my usual ORB20 setup.

Not every setup is created equal. Some are borderline. Some are acceptable. And some are A+ – the kind that makes you sit up and pay attention even when you’d planned to sit on your hands.

This was A+.

Current Status: A+ setup identified, intention to stay out overruled

Ideal Footprint Off The Bell

RUT right off the opening bell showed an ideal footprint for me which was part of my usually high probability ORB20 setup.

The opening range established. The footprint appeared. Everything aligned. When the market shows you exactly what you’re looking for – right off the bell – you don’t ignore it because you’d “planned to take it easy.”

Current Status: Ideal footprint confirmed, setup engaged

Fast Directional Move To Exit

Premium Popper options setup goes on and a fast directional move later – around $12 the exit was reached at 54.5% ROC.

Entry at the Premium Popper orb20 low. Target at 2,491.92. Fast directional move. Exit reached. Done.

No drama. No hesitation. Setup → Entry → Move → Exit → Income.

Current Status: $12 / 54.5% ROC banked

The Temptation Of Quality Over Quantity

I’m sometimes tempted to just wait for this setup and this setup alone.

When you find a setup that works this well – that shows an ideal footprint, moves fast, and delivers consistent results – there’s a temptation to simplify everything.

Why chase mediocre setups when the A+ ones exist?

Quality over quantity. Patience over activity. Waiting for excellence rather than settling for acceptable.

Current Status: Quality setup, quality outcome, quality temptation

Expert Insights

The Observation: Not every trading day requires trading. The plan was to not do too much short term trading – but when an A+ setup appears inside your high probability framework, the plan adapts. The setup doesn’t care about your intentions.

The Fix: Build a framework that recognises A+ from average. When the ideal footprint shows up right off the opening bell – that’s not the time to stick rigidly to “taking it easy.” That’s the time to execute. The discipline isn’t in avoiding trades – it’s in only taking the ones that matter. Sometimes the best trade is no trade. Sometimes the best trade is the one you almost didn’t take.

Rumour Has It…

The Financial Nuts team reports from the newsroom…

Percy’s updating his setup grading system. “A+! Right off the bell! Ideal footprint!” His pigeons are learning to distinguish between A+ and merely adequate.

Hazel’s filing the trade under “QUALITY OVER QUANTITY” protocols. “Intended to stay quiet. Setup said otherwise. Outcome: 54.5% ROC.”

Mac raised his glass in appreciation: “The man said he wasn’t going to trade much. Then the A+ showed up. Smart enough to take it.” The glass was labelled “TEMPTATION SPECIAL.”

Kash punched the numbers with satisfaction: “$12. 54.5%. One trade. Done by lunch.”

Wallie nodded slowly: “Sometimes tempted to wait for this setup alone? I’m tempted to nap. But that’s also a valid strategy.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.