Weekend Prep: Multi-Market Analysis Ready for Monday’s Open

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Back in Blighty after some properly relaxing time with all my adopted nieces and nephews. I’d love to report batteries are fully recharged to 100%, but somehow infinite piggyback rides have kept them hovering around the 87% mark.

Turns out being a human jungle gym is less restful than beach chairs and exotic cocktails, but considerably more entertaining.

Right now I’m back at the desk, thinking about the week gone by, and bloody hell – our traders seemed to have been doing very well with the short term swings and daily poppers whilst I was being climbed on by small humans.

That’s the beauty of systematic frameworks: They keep delivering whether you’re monitoring every tick or being used as playground equipment.

Keep scrolling for the range reversal reload…

SPX Market Briefing:

Friday brings the return from holiday, battery assessment at 87%, and catching up with where systematic positioning stands after a week of independent operation.

Current Multi-Market Status:

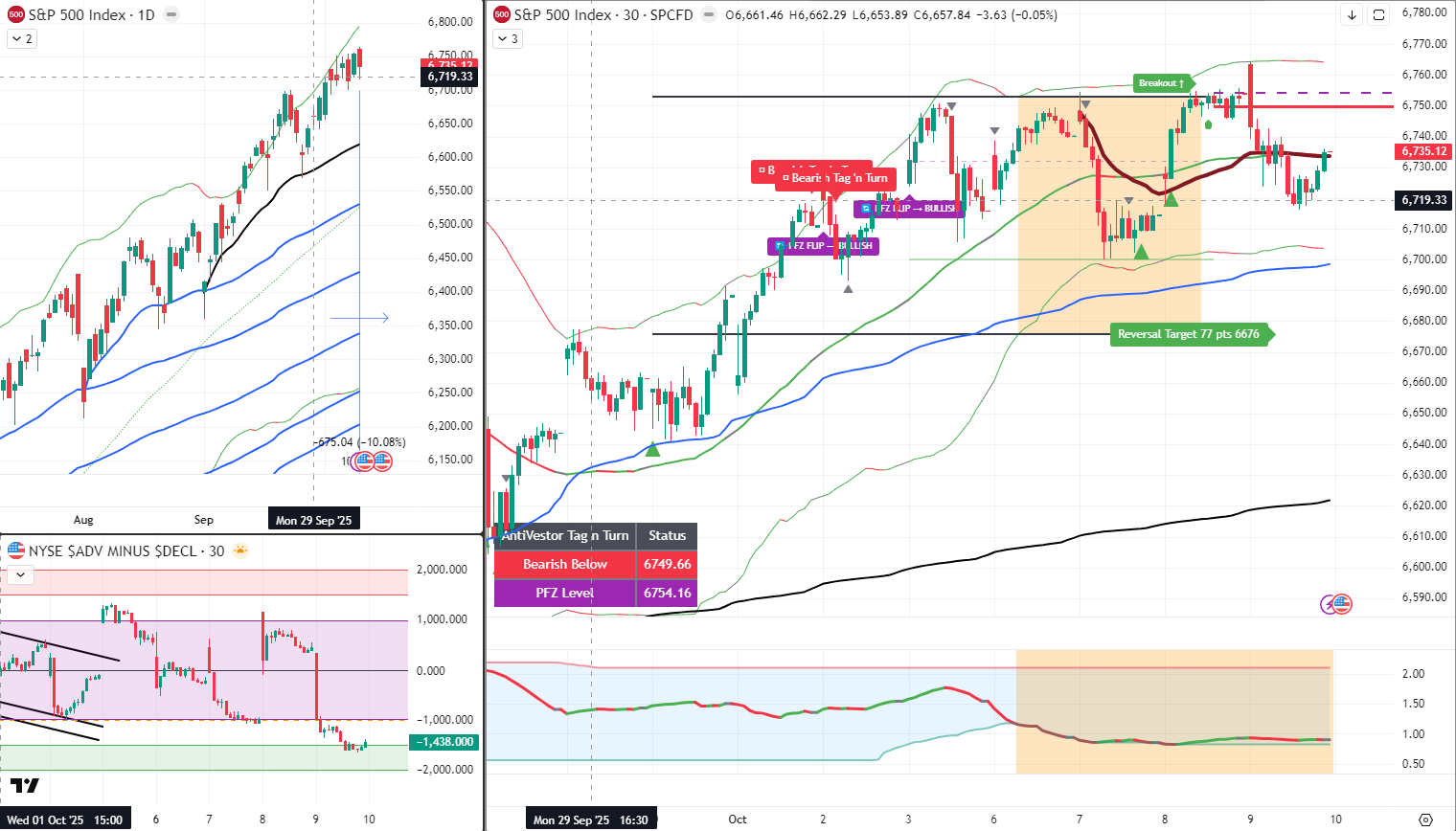

- SPX: Small range developed, bullish breakout rejected, flipped back bearish

- Trader Status: Flat, seeking bear entry near upper range boundary

- Short Term Traders: Crushing swings and daily poppers successfully

- Battery Level: 87% (piggyback ride taxation applied)

- Weekend Mission: Multi-market instrument analysis for Monday prep

The Holiday Performance Review

Catching up with the SPX Income System whilst recovering from adopted niece/nephew deployment duties. Price developed a small range over the last few days, attempted a bullish breakout, then retreated back inside the range to flip bearish.

The systematic traders weren’t waiting for permission or holiday return confirmations. Short term swings and daily poppers kept delivering profits whilst I was being used as human transportation infrastructure.

That’s what proper frameworks provide – independence from constant supervision. The rules work whether you’re watching or being climbed on by small children.

SPX Range Dynamics

Small range formation over recent sessions created classic compression before the breakout attempt. Bulls tried their luck pushing higher, but price rejected the breakout and retreated back inside range boundaries.

The flip back to bearish creates exactly the setup for returning traders seeking entry opportunities.

Current Status: Range confirmed, bearish bias active

Upper Boundary Positioning

Currently flat and looking for new entry points. Bear swing makes perfect sense given positioning near the upper range boundary. Hopping on the bear range train gets me caught up with the system exactly where systematic logic suggests entry.

Upper range boundaries provide natural resistance for bearish positioning. When price rejects breakouts and flips bias, that’s the systematic signal screaming “boarding time for bear train departures.”

Entry Strategy: Bear swing from upper range boundary resistance

Weekend Preparation Protocol

I’ll explore the other instruments over the weekend, getting everything lined up and ready for Monday’s trading. RUT, ES, GC, CL – full multi-market analysis coming to ensure systematic positioning covers all available opportunities.

Holiday return doesn’t mean jumping straight back into random trades. It means methodical review, proper preparation, and systematic entry when conditions align.

The Piggyback Battery Paradox

Holiday batteries sit at 87% thanks to infinite piggyback ride duties. Turns out small humans treat uncles like combination jungle gym, horse, and amusement park ride.

Rest is relative when you’re being climbed on by adopted armies. But the systematic positions didn’t care about battery levels – they kept working independently whilst family time happened.

That’s the lifestyle systematic trading enables: Imperfect recharging still allows proper market participation because the frameworks handle the heavy lifting.

Today’s Systematic Plan:

- SPX: Target bear swing entry near upper range boundary

- Position Status: Flat seeking systematic entry signal

- Weekend Prep: Multi-market instrument analysis across all traded vehicles

- Battery Management: 87% sufficient for systematic trade execution

- Short Term Traders: Continue crushing swings and daily poppers

In Other News…

Markets drift into weekend as shutdown strips visibility

S&P 500 futures traded near flatline at 6,735 like Percy contemplating weekend plans during office supply shortage. Nasdaq-100 futures up 0.1% near 24,940 whilst Dow futures added 48 points because apparently ten days of government dysfunction constitutes background noise. Thursday’s cash close showed retreat from Wednesday’s records proving even euphoric markets need occasional rest days. Overnight ranges compressed with S&P traveling 6,730 to 6,740 as traders awaited weekend with no economic catalysts and government shutdown entering tenth day.

Sector rotation produces selective winners

Mixed action Thursday as nineteen S&P stocks hit all-time highs including AMD benefiting from OpenAI deal momentum and Nvidia recovering after Huang comments. Johnson & Johnson, Monster Beverage, Northrop Grumman, Constellation Energy joined celebrations proving diverse sectors can achieve records simultaneously. Lowe’s extended losing streak to ninth week amid softening housing market, down 8% over period marking longest slide since 2018. Gold miners Newmont and Barrick pulled back 4% and 3% as bullion retreated from $4,000 psychological level.

Earnings season approaches during data vacuum

Calendar remains light with Q3 season kicking off next week as banks report October 14-18 providing first hard data since shutdown began October 1. FactSet expects 7.9% S&P 500 Q3 EPS growth whilst shutdown threatens October 15 CPI release if extends beyond two weeks. Levi Strauss reported Thursday beating expectations but shares dropped 8% on tariff concerns despite strong results, proving good news can’t overcome trade policy anxiety.

Cross-asset signals reveal comfortable complacency

Fed Chair Powell spoke Thursday at Community Bank Conference offering zero rate or economy commentary – markets interpreted silence as neutral-to-dovish keeping October 29 cut odds at 99%. Gold touched $3,994 early Friday hovering near $4,000 psychological level after gaining 50% year-to-date. S&P logged thirty-third straight session without 1% move, longest calm streak since January 2020’s seventy-one-day run. VIX held mid-teens suggesting complacency despite government paralysis and economic data vacuum heading into critical Fed decision.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Infinite Piggyback Ride Formation Flying” whilst claiming they had mastered “Systematic Battery Drainage Through Adopted Niece/Nephew Deployment Advanced Cooing.”

Hazel updated her crisis management protocols to include “Holiday Return Bear Entry Procedures” alongside emergency plans for “Trading at 87% Battery Capacity With Small Human Climbing Integration.”

Mac raised his Friday morning whisky and declared, “When systematic traders profit during piggyback ride duties, holiday returns become delightfully compatible with range reversal boarding opportunities!”

Kash attempted livestreaming about “SPX range flips being basically like DeFi liquidity pool reversals but with actual upper boundary rejection signals” but got distracted explaining why 87% battery capacity was sufficient for bear train boarding.

Wallie grumbled that in his day, traders didn’t take holidays because “constant market attention was required, not this systematic independence nonsense with human jungle gym family time integration!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Market Corrections: The 10% Reality Check

A “market correction” is Wall Street’s polite way of saying “shit happens”—typically defined as a 10-20% decline that reminds everyone that stocks don’t actually go up forever!

Market corrections are Wall Street’s equivalent of your parents reminding you that money doesn’t grow on trees, except the reminder comes with a 10-20% portfolio haircut that makes you question every financial decision you’ve ever made!

The term “correction” is deliciously ironic because it implies that rising stock prices were somehow wrong and needed to be fixed, like the market is a stern teacher marking errors with red ink made of investor tears.

These corrections happen roughly every year or two, serving as regular reminders that the stock market’s natural state isn’t “constantly going up” despite what everyone’s 401(k) statements during bull markets suggest.

They’re called corrections because they theoretically correct overvaluation, but they feel more like the market’s way of saying “remember me? I can go down too!” The financial media treats corrections like natural disasters, with breathless coverage about “plunging markets” and “investor panic,” when really it’s just stocks doing what they’ve always done—fluctuating in ways that make humans uncomfortable.

Professional investors know corrections are normal and healthy, like forest fires that clear out dead wood, while retail investors treat them like personal attacks on their retirement plans. The irony is that corrections often create the best buying opportunities, but most people are too busy panicking to notice!

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.