Little Change In Landscape – Until Something New Happens More Of Same Expected

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Monday saw the push off the range lows noted on the daily charts.

Dow, however, decided to take a break – lagging the move or leading the next direction?

Gold is still cutting out a range. The potential rest we spoke about at the end of last month, I think it would be fair to say, is a reality.

Crude oil is coiled very tightly and there are opportunities to ping pong the range – I’ve been a little infrequent in my trading here.

Overall it looks like there has been little change in the landscape – so until something new happens more of the same can be expected.

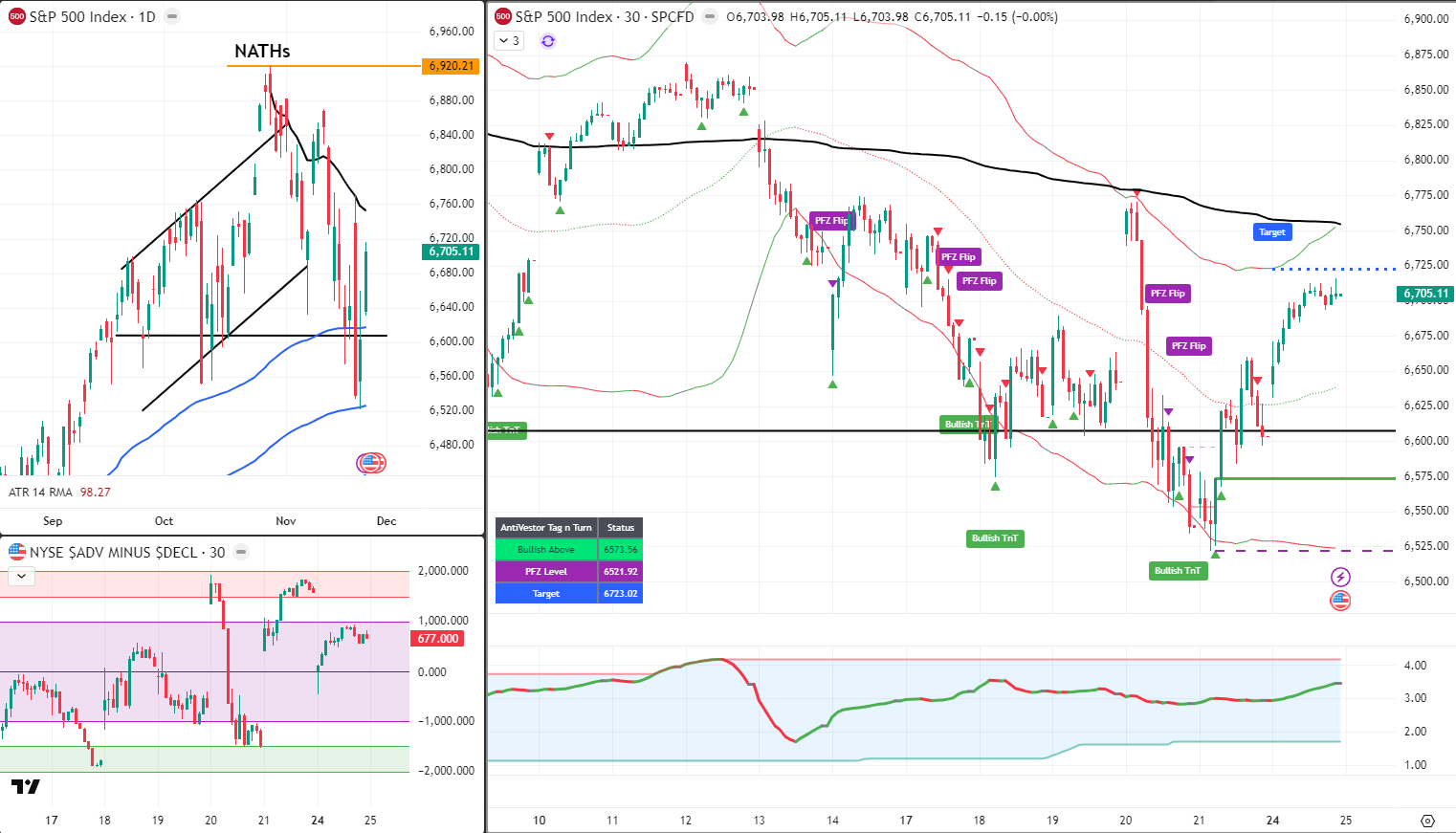

SPX TnT trades still remain bullish and nudging the upper target zone.

RUT TnT trades also remain bullish.

Uncle Russ led the bear charge – so it will be interesting to see if it leads the bull rampage from the larger range lows to highs.

For now it’s starting to ride that upper BB.

Keep scrolling for the range analysis…

Push Off Range Lows. Dow Question Mark. Little Change. Uncle Russ Bull Rampage Watch.

SPX Market Briefing:

Monday push off range lows (noted on daily charts), Dow took break creating lagging-move-or-leading-next-direction question, gold still cutting out range (potential rest from end of last month fair to say is reality), crude oil coiled very tightly (ping pong range opportunities, been infrequent trading),

overall little change in landscape (more of same expected until something new), SPX TnT bullish nudging upper target zone, RUT TnT also bullish, Uncle Russ led bear charge creating will-he-lead-bull-rampage-from-range-lows-to-highs question (starting to ride upper BB).

Current Multi-Market Status:

- ES: 6709.50, bounced off lows

- RTY: 2413.3, bounced, riding upper BB

- YM: 46,435, took a break

- NQ: 25,644, participating in bounce

- CL: $58.33, coiled tight

- GC: $4113.1, range/rest mode

- VIX: 20.64, dropping

- BTC: $87,042, recovering

Range Lows Bounced – Dow Took Break

Monday: Push off range lows on dailies. ES, NQ, RTY participating.

Dow: Took a break. Not participating. Question: Lagging the move or leading next direction?

Current Status: Bounce off lows, Dow lagging/leading question

Gold Range Rest Reality – Crude Coiled

Gold cutting out range. Potential rest mentioned end of last month = now reality. GC $4113.1 in consolidation.

Crude coiled very tightly. CL $58.33. Opportunities to ping pong the range. Been infrequent trading here.

Current Status: Gold resting, crude tight range

Little Change – More Of Same

Overall landscape: little change.

Until something new happens, more of the same expected. Range-bound action continuing.

Current Status: Status quo, more of same

SPX/RUT TnT – Uncle Russ Question

SPX TnT: Bullish above 6573.56. Target 6723.02. Currently 6705.11. Nudging upper target zone.

RUT TnT: Bullish above 2326.87. Currently 2420.80. Also bullish.

Uncle Russ question: Led the bear charge down. Will he lead the bull rampage from larger range lows to highs?

Starting to ride that upper BB. Watch for leadership signal.

Current Status: Both TnT bullish, Uncle Russ leadership watch

In Other News…

Monday’s “Powerful Rally” Lasts Until Tuesday Morning

Nasdaq’s best day since May 12 meets immediate premarket flatness. Tesla analyst discovers legacy auto “obsolete.”

Nasdaq surged 2.69% Monday—best day since May 12—before immediately going flat Tuesday premarket as markets celebrated Google TPU validation threatening Nvidia after decade of dominance. Tesla soared 7% on Melius analyst forecasting “hundreds of billions” in FSD revenue whilst declaring legacy auto “potentially obsolete”—bold call that entire automotive industry accidentally outdated. VIX plunged 11.4% to 20.52 proving volatility decreased but remained elevated because apparently being less terrified counts as optimism.

When Google’s Chips Suddenly Matter

Alphabet rocketed 6.3% on Meta chip deal validating TPU competitiveness—markets treating decade-late Google hardware strategy as Nvidia threat despite Jensen Huang selling billions quarterly. Nvidia gained 2% during session before falling 2% after hours proving competitive dynamics matter more than $65B quarterly guidance and $500B order book. Meta +3.2% because using Google chips instead of Nvidia apparently revolutionary despite both being purchased.

Tesla’s “Legacy Auto Obsolete” Thesis

Tesla surged 7% on analyst’s “hundreds of billions” FSD forecast declaring traditional automakers “potentially obsolete”—assuming regulatory approval, consumer adoption, technical reliability, and minor detail of actually working autonomously. Markets pricing FSD future whilst ignoring present where legacy auto still manufactures most vehicles humans drive.

Everything Rallies Together = Confusion

Stocks, crypto, Treasuries, gold all rallied Monday suggesting portfolio rebalancing and month-end flows rather than conviction. Cross-asset correlation breakdown means risk-on and safe-haven simultaneously bid—markets want insurance and exposure proving nobody knows anything but everyone buying.

☕ Hazel’s Take

Best day since May fades immediately, Google threatens Nvidia via Meta chip deal, Tesla analyst declares auto obsolete. When everything rallies together whilst VIX “plunges” to still-elevated 20.52, probably acknowledging month-end positioning not thesis change.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Push Off Range Lows With Dow Taking Break Flying” whilst analysing the bounce and claiming they had mastered “Lagging-Or-Leading-Next-Direction Question Recognition Advanced Cooing With Uncle-Russ-Bull-Rampage-Watch Discipline.”

Hazel updated her crisis management protocols to include “Little Change In Landscape Until Something New Happens Recognition Emergency Procedures” alongside contingency plans for “Gold-Range-Rest-Reality Integration With Crude-Coiled-Tight-Ping-Pong Analysis And Uncle-Russ-Leading-Bull-Rampage-From-Lows-To-Highs Protocols.”

Mac raised his Tuesday whisky and declared, “When range lows bounce whilst Dow takes mysterious break and Uncle Russ rides upper BB after leading bear charge, watching-for-bull-rampage-leadership becomes delightfully superior to assuming-Dow-knows-something-we-don’t!”

Kash attempted livestreaming about “Uncle Russ being basically like crypto market maker but with small cap emotions instead of liquidity pools” but got distracted calculating whether lagging means leading in reverse market psychology.

Wallie grumbled that in his day, bounces from range lows meant “conviction not this modern Dow-taking-break ambiguity with bull-rampage speculation!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.