Mag7 Swings Fabulously: META 1200% ROI, NVDA Triple Digit, AMZN 285% – Cherry On Top Of SPX Income System

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

We exited Friday with another rally into the weekend making this 3 for 3 on the observation.

Little to no weekend news noise to bugger things up at the Sunday night open on futures. Everything remains mostly where things closed on Friday.

We are now near the lower end of the range that I’ve been banging on about for weeks.

Critical level. Decision point. Pop lower = breakout territory, more red ink needed. Or push higher from the range lows – as per my 6 money making patterns.

TnT setup: entered Friday getting back bullish on both SPX and RUT, stayed that way all day into the close.

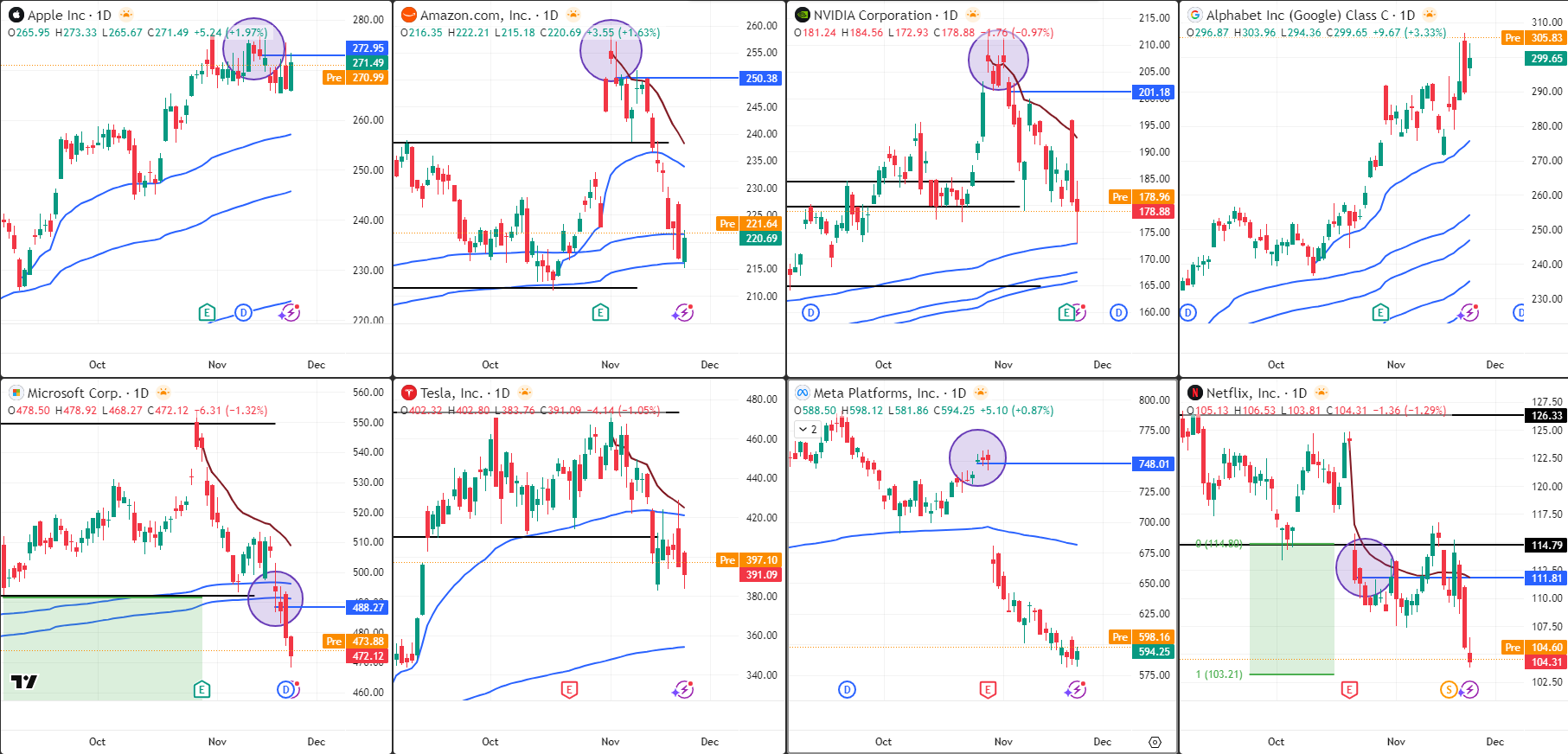

Taking a look at the Mag7 which we’ve not done for a wee while – my swings are doing fabulously well:

- META: Blow out winner, over 1200% ROI

- NVDA: Bear just reaching triple digit ROI, breaking back into prior range

- AMZN: 285% ROI, closing in on range low target

- MSFT: Bear breakout just got going

- NFLX: Not Mag7 obvs – but making bank, reaching breakout target

Nice little cherry on top of the SPX Income system – just using the 6 money making patterns.

As for poppers – not had much time last few weeks with one thing and another. Emergencies aside – should have a good crack at them this week to scalp that opening bell.

Keep scrolling for the range decision analysis…

3 For 3 Friday Rally. Critical Range Lows. Mag7 Swings Banking. Poppers Return This Week.

SPX Market Briefing:

Friday rally 3-for-3 confirmed, quiet weekend (no news noise to bugger things up), near lower end of range (critical decision point – breakout or bounce per 6 patterns), TnT bullish SPX and RUT from Friday into close, Mag7 swings fabulous (META 1200%, NVDA triple digit, AMZN 285%, MSFT starting, NFLX banking) – cherry on top of SPX Income, poppers returning this week.

Current Multi-Market Status:

- ES: 6641.25, near range lows

- RTY: 2380.5, -10.36% from highs

- YM: 46,335, -10.05%

- NQ: 24,435.25, -10.46%

- CL: $57.57, slumping

- GC: $4071.7, recovering

- VIX: 23.31, elevated stable

- BTC: $86,060, -36% from highs

Friday 3 For 3 + Range Decision

Friday rally pattern: 3 for 3 confirmed. Quiet weekend. Stable open.

Now near range lows I’ve been banging on about. Critical decision point:

- Pop lower = breakout territory, more red ink

- Push higher = range low bounce, 6 patterns playbook

Current Status: Decision point, breakout or bounce

TnT Bullish Both

SPX: Bullish above 6573.56, target 6727.09.

RUT: Bullish above 2326.87 (flipped), target pending.

Both held bullish Friday into close.

Current Status: TnT bullish, swing trades active

Mag7 Swings – Fabulous

| Stock | Status | ROI |

|---|---|---|

| META | Blow out winner | 1200%+ |

| NVDA | Bear swing, back in range | 98% |

| AMZN | Closing on target | 285% |

| MSFT | Bear breakout starting | Early 20% |

| NFLX | Making bank | Near target |

Cherry on top of SPX Income. 6 patterns working.

Current Status: Mag7 fabulous, cherry on top

Poppers Return

Not had much time last few weeks. One thing and another.

Emergencies aside – good crack at opening bell scalps this week.

Current Status: Poppers back in action

In Other News…

Williams Says Dovish Thing, Markets Forget Entire Week

$800B Mag Seven vaporised in November. Thiel sold pre-earnings. “Off the charts” means -3.2%.

Futures rallied on Williams’ dovish pivot reviving December cut hopes as markets practiced selective amnesia about four-day massacre. VIX retreated 11% to 23.43 from 27.8 peak whilst S&P sits 4% below highs and Magnificent Seven shed $800B+ in November. Nvidia CEO Huang declared “Blackwell sales off the charts”—stock responded by falling 3.2% because apparently chart-topping sales warrant punishment.

When $800 Billion Disappears Nobody Notices

Mag Seven carnage: Microsoft -7% weekly, Amazon -6%, Oracle -11%, AMD -16%, Micron -16%—November destroying tech portfolios whilst Nvidia’s perfect beat changed precisely nothing. Peter Thiel’s fund sold entire $100M Nvidia stake pre-earnings proving smart money’s timing remains impeccable. Alphabet bucked trend +8% on Gemini 3 launch because only AI product announcement beating AI infrastructure reality.

Growth-to-Value Rotation Finally Happens

Old economy outperformed as growth-to-value rotation accelerates—analysts predicting this since 2022 finally correct through patience rather than insight. Tech bleeding despite earnings beats whilst boring companies with actual profits attract capital. Revolutionary discovery: companies trading at reasonable multiples occasionally outperform speculation.

☕ Hazel’s Take

Williams says dovish thing, markets rally, everyone forgets $800B November carnage. When “off the charts” sales produce -3.2% and October CPI canceled leaves Fed data-blind at December decision, probably acknowledging words now matter more than numbers.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Friday Rally 3 For 3 Observation Pattern Recognition Flying” whilst analysing the weekend quiet open and claiming they had mastered “Critical Range Decision Point Advanced Cooing With META-1200-Percent-ROI Appreciation Discipline.”

Hazel updated her crisis management protocols to include “Little To No Weekend News Noise Not Buggering Things Up Recognition Emergency Procedures” alongside contingency plans for “Pop-Lower-Breakout-Territory Integration With Push-Higher-From-Range-Lows-6-Patterns Analysis And Popper-Strategies-Return Protocols.”

Mac raised his Monday whisky and declared, “When Friday rally makes it three for three and Mag7 swings deliver quadruple digit returns whilst critical range decision approaches, nice-little-cherry-on-top-of-SPX-Income becomes delightfully superior to missing-the-patterns-entirely!”

Kash attempted livestreaming about “META 1200% ROI being basically like NFT moon shot energy but with actual profitable exit strategy” but got distracted calculating whether Friday pattern #4 would be too good to be true.

Wallie grumbled that in his day, 1200% returns meant “suspicious not this modern cherry-on-top celebration with breakout target terminology!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.