Will We See Friday Turnaround #3 Or Will Corrective Move Finally Become Reality? Popcorn Ready

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

When you’re wrong about something, you are often wrong fast and potentially multiple times.

When you’re right (eventually in this case) you become right fast.

Although in this case being right involved being temporarily right before the wrong part took this fecking expanding triangle on the dailies to another new high.

So kinda right, briefly. Then wrong. Then kinda right (again). Then wrong.

Then it’s Al Pacino time again: “Whoohaar” with a chorus coming straight from the top of Nakamoto tower: “Yippie Ki-Yay, mother fucker.”

Funny thing as an accompaniment to this was the growing pressure to have a few mindset chats around trading through.

As we don’t know when the good times come for any strategy – we do know they do come with a proven data backed strategy.

The SPX Bulls bull’ed – tagged turned again and bear swing bear’ed.

NVDA was briefly the one stock to rule them all before being cast into the fires of Mordor.

And with headlines like this adding fuel to those fires:

“Markets Reject Nvidia’s $500 Billion Reality, Embrace AI Bubble Narrative. 119K jobs kill December cut hope; Walmart soars as tech collapses; Bitcoin crashes below $87K”

It’s not surprising that we finally see the holders dreams melt – at least briefly, while the next long term dip buying opportunity sets up.

RTY futures are already down 10% and have confidently led the bear charge.

NQ futures are a close second and could possibly reach >10% before the week closes.

ES and YM are just nudging past the 5% down from recent highs.

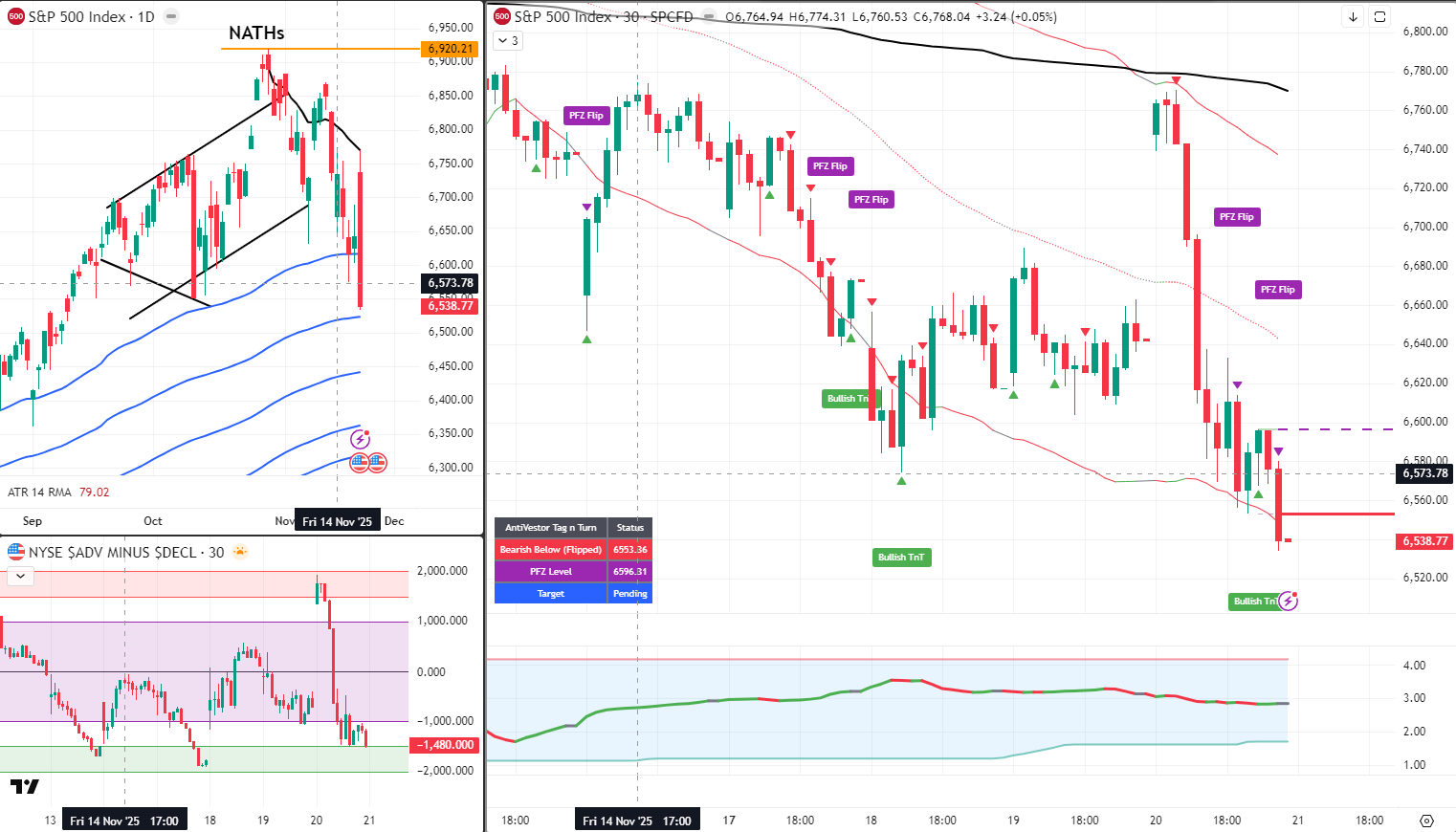

It’s now a question of will we see another Friday turnaround making it a 3rd in a row – or will the corrective move finally become a reality?

Stay tuned, eyes peeled – popcorn at the ready.

Keep scrolling for the Mordor analysis…

Wrong Fast Multiple Times. Whoohaar & Yippie Ki-Yay. NVDA Into Mordor. RTY Leading 10% Down.

SPX Market Briefing:

Wrong-fast-multiple-times reality (kinda right briefly, then wrong, then kinda right again, then wrong before expanding triangle new high then explosion),

Al Pacino whoohaar meets Nakamoto tower Yippie-Ki-Yay-mother-fucker Die Hard chorus, growing pressure for mindset chats around trading-through (don’t know when good times come but proven data-backed strategy delivers),

SPX Bulls bull’ed tagged turned bear’ed whilst NVDA briefly one-stock-to-rule-them-all before cast into fires of Mordor (headlines rejecting $500B reality embracing AI bubble narrative with 119K jobs killing December cut hope, Walmart soaring tech collapsing, Bitcoin crashing below $87K creating holders dreams melting whilst dip buying opportunity sets up),

RTY futures already 10% down confidently leading bear charge with NQ close second (could reach >10% before week closes), ES and YM nudging past 5% down, question whether Friday turnaround #3 or corrective move finally reality (stay tuned eyes peeled popcorn ready).

Current Multi-Market Status:

- ES: 6533.25, -700 pts (-10.07%), past 5% down

- RTY: 2302.9, -260 pts (-10.13%), leading 10% down

- YM: 45,888, -4,875 pts (-10.05%), past 5% down

- NQ: 23,934.25, -2,761 pts (-10.46%), approaching >10%

- CL: $58.88, continuing slump

- GC: $4042.1, Mordor fires

- VIX: 27.54, elevated volatility spike

- DXY: 100.214, dollar strength

Wrong Fast Multiple Times – Then Right Fast

When you’re wrong about something, you are often wrong fast and potentially multiple times.

Whipsaw reality. Wrong. Wrong again. Wrong third time. Fast.

When you’re right (eventually in this case) you become right fast.

Eventually correct direction confirms. Then moves fast in your favour.

Although in this case being right involved being only temporarily right before the wrong part took another look at this fecking expanding triangle on the dailies to another new high.

Expanding triangle = price making higher highs and lower lows creating widening pattern. Broke to new high before finally breaking down.

So kinda right, briefly. Then wrong. Then kinda right (again). Then wrong.

Sequence: Right → Wrong → Right → Wrong → Then explosion.

Current Status: Wrong fast multiple times before eventually right fast

Yippie Ki-Yay From Nakamoto Tower

Then it’s Al Pacino time again: “Whoohaar” with a chorus coming straight from the top of Nakamoto tower: “Yippie Ki-Yay, mother fucker.”

Pacino’s “whoohaar” meets Die Hard’s “Yippie Ki-Yay” from Nakamoto Plaza (Nakatomi Plaza crypto edition).

Bitcoin crashes below $87K. Markets explode. Die Hard Christmas movie timing appropriate.

Current Status: Pacino whoohaar meets Die Hard Nakamoto tower explosion

Mindset Chats – Trading Through Required

Funny thing as an accompaniment to this is the growing pressure to have a few mindset chats around trading through.

Devil cursed conditions creating demand for mindset support. Trading through choppy phases requires mental fortitude.

As we don’t know when the good times come for any strategy – we do know they do come with a proven data backed strategy.

Can’t predict when conditions improve. But proven strategies eventually deliver.

Current Status: Growing pressure for mindset chats, trading through proven strategies deliver

NVDA Cast Into Mordor’s Fires – Headlines Fuel Fires

The SPX Bulls bull’ed – tagged turned again and bear swing bear’ed.

Bull setup triggered. Tagged target. Turned. Bear setup triggered.

NVDA was briefly the one stock to rule them all before being cast into the fires of Mordor.

“Markets Reject Nvidia’s $500 Billion Reality, Embrace AI Bubble Narrative. 119K jobs kill December cut hope; Walmart soars as tech collapses; Bitcoin crashes below $87K”

Real headline. $500B market cap rejected. Jobs data killing rate cut hopes. Retail (Walmart) up, tech down. Bitcoin collapsing.

It’s not surprising that we finally see the holders dreams melt – at least briefly, while the next long term dip buying opportunity sets up.

Holders capitulating. Dreams melting. Creating dip buying setup for long-term buyers.

Current Status: NVDA into Mordor, holders dreams melting, dip opportunity forming

RTY Leading 10% Down – NQ Close Second

RTY futures are already down 10% and have confidently led the bear charge.

RTY: 2302.9, -10.13% from highs. Leading correction. Uncle Russell bear general.

NQ futures are a close second and could possibly reach >10% before the week closes.

NQ: 23,934.25, -10.46%. Already past 10%. Tech getting destroyed.

ES and YM are just nudging past the 5% down from recent highs.

ES: -10.07%. YM: -10.05%. All indexes past 5%, approaching official correction territory.

Current Status: RTY 10% down leading, NQ >10%, ES/YM past 5%

Friday Turnaround #3 Or Real Correction?

It’s now a question of will we see another Friday turnaround making it a 3rd in a row – or will the corrective move finally become a reality?

Pattern: Last two Fridays = big sell off, bigger turnaround.

This Friday: Will pattern repeat (#3) or break (real correction)?

Stay tuned, eyes peeled – popcorn at the ready.

Current Status: Friday turnaround #3 or real correction unknown, popcorn ready

SPX didn’t quite get to the upper Bolly – it did flip at the lower Bolly 60 min lazy poppers would have got your paid in the short term – and a very slight discretionary bear entry

RUT bulled up to the upper Bolly and gave a clear TnT for the bear – flipped and flopped briefly near the end of the session – which most people would have avoided manually or been in and out and ended the day back bearish.

The 1 decision per day – unofficial rule for manual trading would have helped here

In Other News…

Nvidia Beats Perfectly, Markets Punish Immediately

Only third reversal of this magnitude in 3.5 years. September jobs data kills December hopes. Peak logic.

Markets erased entire +2.5% Nasdaq rally Wednesday in dramatic reversal—only third of this magnitude in 3.5 years—as Nvidia opened +5% on perfect beat then closed -3.2% because apparently crushing expectations by 10% warrants punishment. September jobs report (two months stale) killed December rate cut odds from 70% to 40% proving economy’s August condition controls December monetary policy. VIX spiked to 27.36 as tech premium valuations questioned whilst Walmart surged 6.5% demonstrating old-economy resilience.

When Perfect Becomes Insufficient

Nvidia delivered $1.30 EPS beating $1.25, $57B revenue crushing $54.9B, Q4 guidance $65B destroying $61.7B estimate with $500B order book visibility—then closed -3.2% at $180.64. Micron -9%, Western Digital -9%, Lam -5% as semiconductor complex discovered beating estimates by unprecedented margins insufficient for maintaining gains. Decliners beat advancers 2,157 to 621 proving democracy works in selloffs.

Walmart’s Wealthy Customer “Resilience”

Walmart beat expectations with 75% of gains from $100K+ households—old economy “resilience” meaning wealthy people still shopping during crisis. Gap +5% on comp beat, Home Depot -5% missing expectations as consumer bifurcation accelerates. Markets pricing growth scare whilst celebrating retailers whose strength derives from upper-income spending.

☕ Hazel’s Take

Perfect Nvidia beat punished, September data kills December policy, Walmart’s wealthy customers prove resilience. When third-rarest reversal in 3.5 years occurs because two-month-old jobs report matters more than $500B order book, probably acknowledging sentiment divorced reality.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Wrong Fast Multiple Times Then Right Fast Eventually Flying” whilst analysing the whipsaw sequence and claiming they had mastered “Al Pacino Whoohaar Meets Die Hard Yippie-Ki-Yay Advanced Cooing With NVDA-Cast-Into-Mordor Recognition Discipline.”

Hazel updated her crisis management protocols to include “Expanding Triangle To New High Before Explosion Recognition Emergency Procedures” alongside contingency plans for “Growing-Pressure-For-Mindset-Chats Integration With RTY-10-Percent-Down-Leading Analysis And Friday-Turnaround-Number-Three-Versus-Real-Correction Protocols.”

Mac raised his Friday whisky and declared, “When wrong fast multiple times before eventually right fast whilst NVDA gets cast into Mordor fires and RTY leads ten percent down, staying-tuned-with-popcorn-ready becomes delightfully superior to predicting-Friday-pattern-continuation!”

Kash attempted livestreaming about “Nakamoto tower being basically like Nakatomi Plaza but with Bitcoin instead of bearer bonds” but got distracted calculating whether Friday turnaround pattern #3 counts as reliable or recency bias.

Wallie grumbled that in his day, 10% corrections meant “panic not this modern popcorn-ready behaviour with Lord-of-Rings references!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.