Premium Poppers Fire Multiple Wins While RUT AVWAP Filter Keeps Small Caps Sidelined

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

We’re flipping.

We’re flopping.

And if you blinked yesterday, you might have missed two directional changes before your coffee went cold.

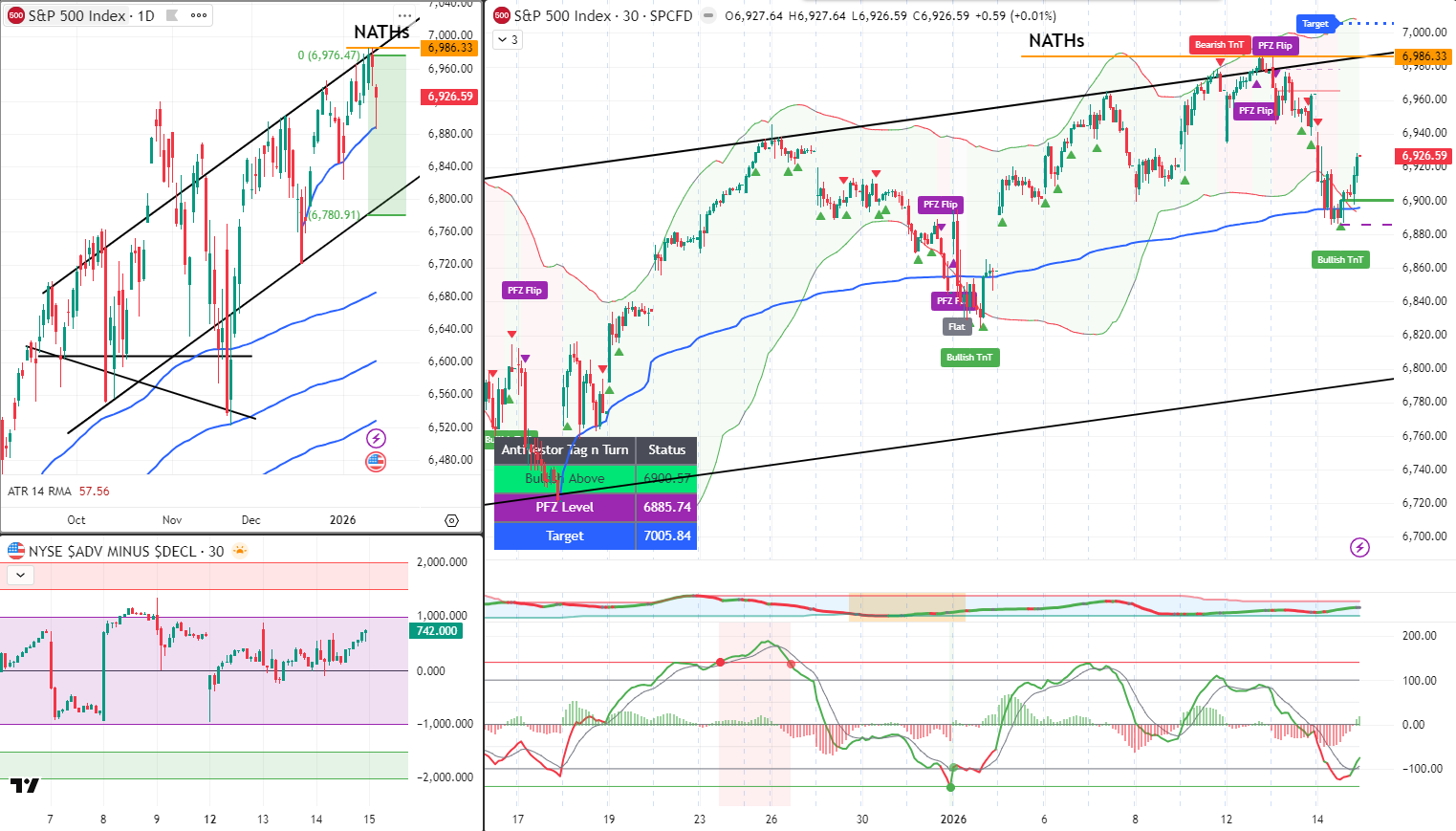

SPX has done what SPX loves to do – wandered down to kiss the lower Bollinger Band and tap that longer-term VWAP anchored from mid-December. You know the one. The “range lows” level I’ve been banging on about since Monday’s group call with the updated trendline channels.

The question now is beautifully simple: Is this yet another flip-flop setup where we bounce back towards highs? Or does the bull finally wrestle control and make a proper run at those tantalising new all-time highs?

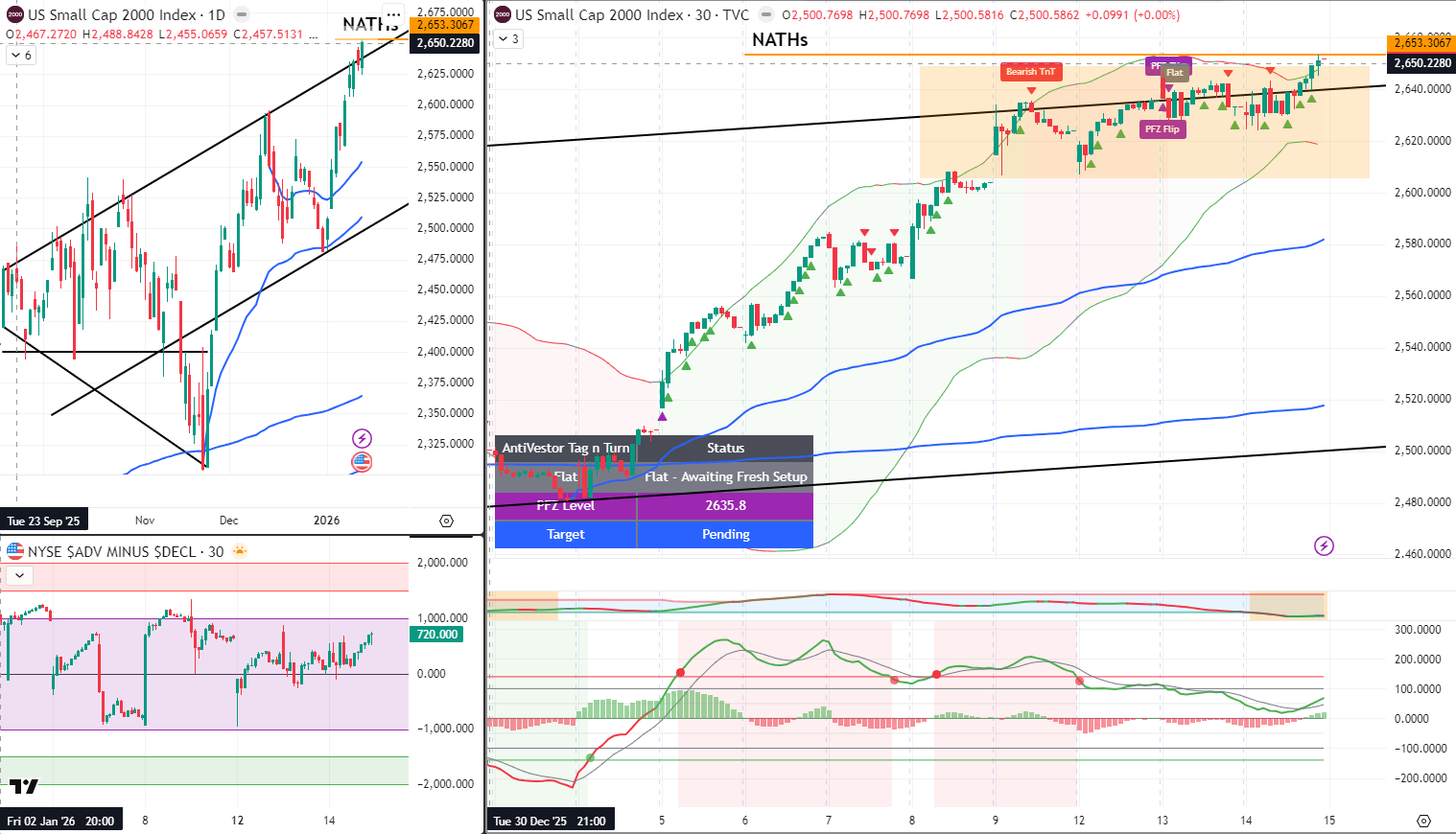

Meanwhile, Uncle Russell decided he’d had enough of that Bollinger Band pinch and promptly launched a bull breakout move. The little fella is now knocking on NATH’s door – again. Just waiting for that pullback to give us the continuation setup we want.

Keep scrolling – less risky than catching a falling knife…

Market Briefing:

The Flip-Flop Chronicles Continue

If you’ve been following along this week, you’ll know we’ve seen more directional changes than a confused GPS in central London.

Yesterday’s action brought us right back to where the bulls need to make a decision. SPX hit the lower Bollinger Band and tested that longer-term VWAP anchored from mid-December – what I’m now officially calling the “range lows” based on the updated trendline channels we covered in Monday’s group call.

This is exactly the kind of setup where systematic traders thrive. No emotional guessing about whether we bounce or break. Just levels, rules, and mechanical response.

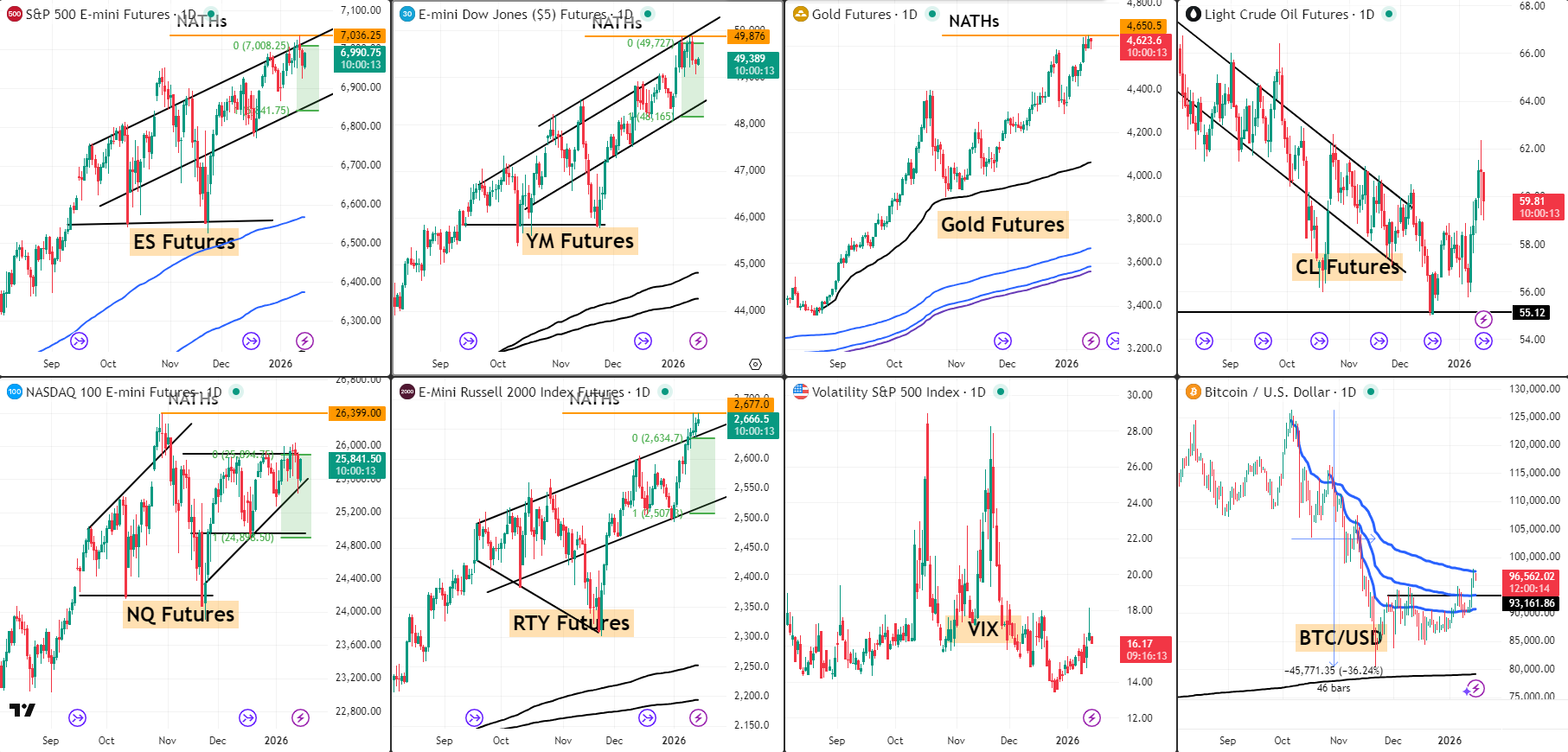

Current Multi-Market Status:

- SPX: TnT Bullish Above – PFZ 6885.74 – Target 7005.84

- RUT: TnT Flat – Awaiting Fresh Setup – PFZ 2635.8 – Target Pending

- ES: 7,036.25 – Testing upper range near NATHs

- RTY: 2,666.5-2,677.0 – At NATHs

- YM: 49,876 – At NATHs

- NQ: 26,399.00 – At NATHs

- GC: 4,650.5 – Continuing strength at NATHs

- CL: 59.81 – Downtrend channel continues

- VIX: 16.17 – Elevated but stable

- NYSE Breadth: +742,000 (positive)

RUT Breakout Alert

While SPX plays the range dance, small caps have made their move.

RUT was officially in a range with a textbook Bollinger Band pinch. And just as quick as you can say “squeeze breakout,” the bull move launched with another NATH challenge underway.

Current price sitting at 2,650.22 with the NATH at 2,653.31. That’s kissing distance.

The TnT is showing flat – awaiting fresh setup – which means we’re looking for that pullback to give us the continuation entry. Patience here. The breakout happened. Now we wait for the proper setup to join the party.

Premium Poppers Delivered Again

Yesterday’s action on SPX was Premium Popper paradise. Multiple setup opportunities presented themselves at the opening bell, and those who followed the mechanical rules walked away with nice scalps.

RUT? The AVWAP filter did its job and kept us on the sidelines. No setups meeting criteria means no trades. That’s not failure – that’s discipline.

The system doesn’t care about FOMO. It cares about high-probability setups with defined risk.

What Today Brings

The game plan is beautifully simple:

Tag ‘n Turn: SPX bullish setup remains active with that 7005.84 target. RUT waiting for fresh setup after the breakout move.

Premium Popper: Eyes on the opening range. Let the bell ring, let the volatility pop, and let the mechanical rules tell us what to do.

Lazy Popper: After the opening seesaw settles, we look for those sweet premium collection opportunities into the close.

Same plan. Different day. Mechanical execution continues.

Expert Insights:

The Art of the Flip-Flop

Range environments are where systematic traders separate themselves from the emotional crowd. While everyone else panics at each directional shift, we simply follow the playbook.

When price reaches the lower end of a defined range with supporting confluence – lower BB, VWAP anchor, updated trendline channels – we’re not guessing what happens next. We’re positioning for the mechanical setup.

The flip-flop becomes our friend because we know ranges tend to contain price until they don’t. And when they break? We have setups for that too. Either the bounce continues our range plays, or the break activates our breakout patterns.

Either is good with me. That’s the beauty of mechanical rules over emotional prediction.

In Other News…

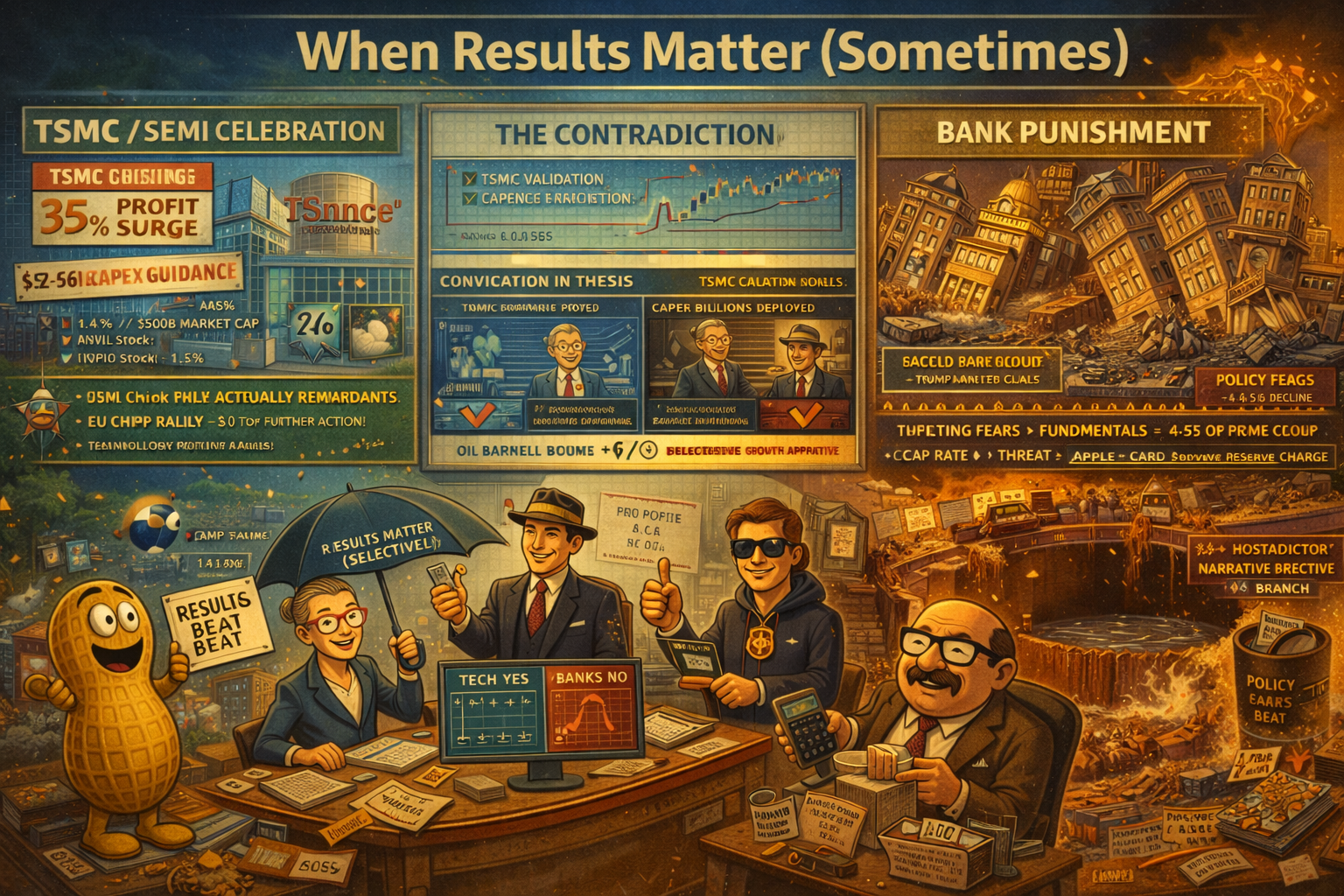

TSMC Validates AI Whilst Banks Punished for Executive Branch

35% profit surge lifts semis. Solid bank earnings fall 4-5% on policy fears. Oil crashes 3% on presidential comment.

TSMC’s 35% profit surge and $52-56B capex guidance validated AI spending thesis—semiconductors rallying as ASML crossed $500B market cap whilst financials cratered 4-5% despite solid earnings because apparently policy fears trump actual results. BofA, Wells, Citi beat estimates then fell because Powell DOJ probe and Trump rate cap threats matter more than income statements proving business models work. Oil crashed 3% erasing Iran risk premium on Trump’s de-escalation comments proving geopolitical threats evaporate via presidential pronouncement.

When 35% Profit Growth Actually Matters

TSMC’s record quarter sparked EU chip rally with ASML +4%, Nvidia +1.5%—finally an earnings beat markets reward rather than dismiss. $52-56B capex guidance demonstrates conviction in AI infrastructure spending proving sector willing to deploy billions on thesis. Small caps outperformed Wednesday (+0.7%) as rotation from megacaps continues suggesting size becoming liability not advantage during policy uncertainty.

Solid Bank Results = 4-5% Decline

Goldman reports expecting $14.2B revenue, Morgan Stanley $17.7B, BlackRock after record $342B Q4 inflows pushed AUM to $14 trillion—sector demonstrating strength whilst being punished for external factors. JPMorgan beat Tuesday, BofA/Wells/Citi delivered Wednesday, all fell 4-5% because Powell probe and rate cap create policy headwinds fundamentals cannot overcome. Markets treating sector as hostage to executive branch decisions not business performance.

️ Oil’s 3% Crash: Iran Premium Gone

Oil plunged 3% on Trump’s Iran de-escalation comments—entire geopolitical risk premium evaporating via single statement. Markets spent days pricing Iran tensions then reversed completely proving presidential tweets more powerful than actual military developments. Energy sector whipsawing on pronouncements rather than supply/demand fundamentals.

Markets “Choosing Both Narratives”

TSMC’s AI validation provides growth story whilst Fed crisis creates uncertainty—markets simultaneously embracing optimism and fear depending on sector. Treasury curve steepening, dollar weakness supporting commodities, gold consolidating at $4,620 whilst VIX easing to 16.2 suggests selective risk appetite where technology bullish, institutions bearish. Options flow shows hedging not panic proving measured concern about contradictory signals.

☕ Hazel’s Take

TSMC validates spending, banks fall 4-5% on solid results, oil crashes on tweet. When 35% profit growth rewarded whilst policy fears override fundamentals and geopolitical premiums evaporate via pronouncement, probably acknowledging earnings matter selectively and presidential comments move markets more than balance sheets.

—Hazel, FinNuts

Rumour Has It…

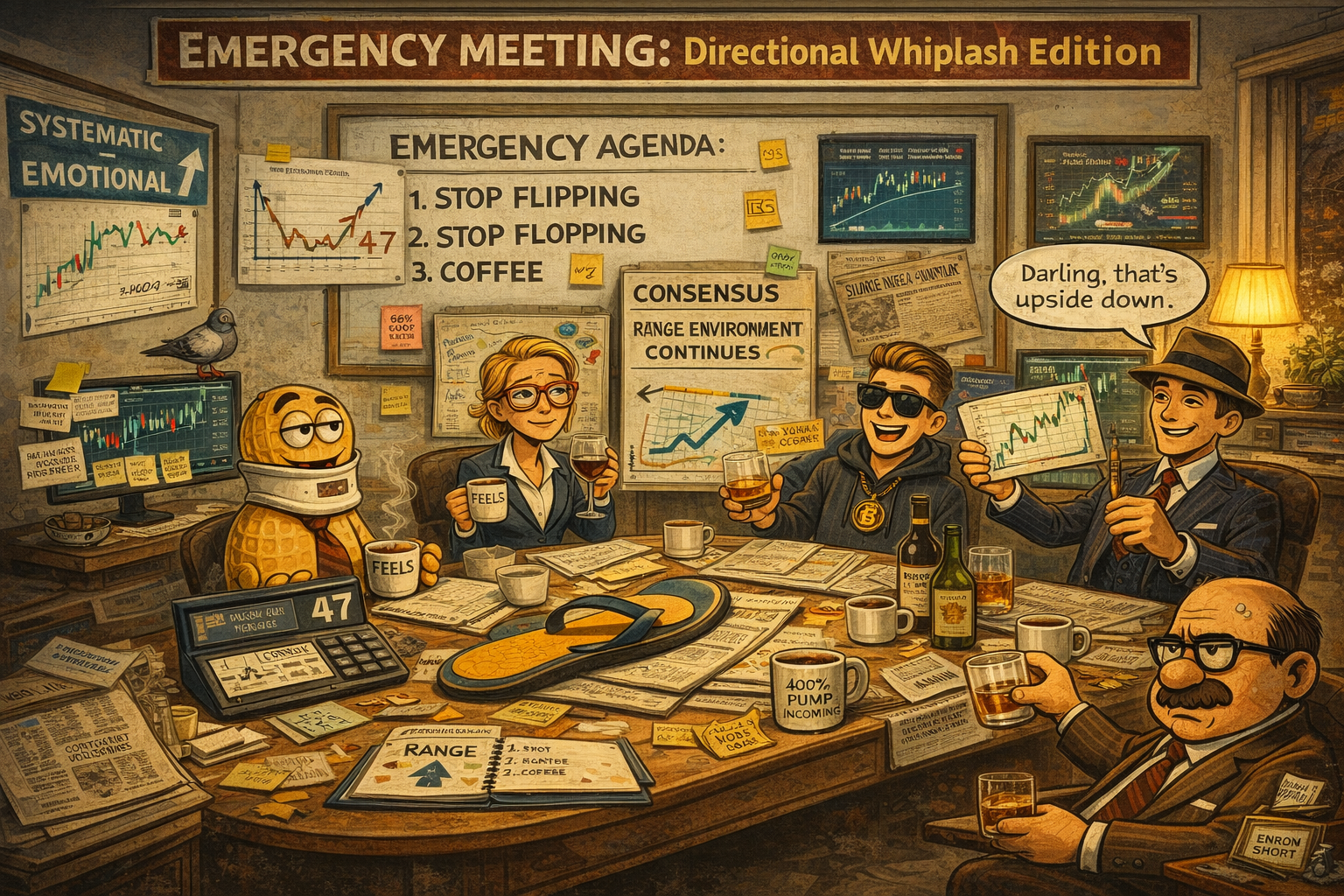

Percy Peanut has installed a flip-flop counter on his desk after yesterday’s market action.

He’s currently at 47 flips since Monday and has requested hazard pay for emotional whiplash.

Hazel Ledger pointed out that his chart was upside down again, which would explain why he thought we were rallying when we were actually declining. Percy insists the chart orientation is “bullish thinking.”

Wallie Winthorpe, sipping something brown from his favourite tumbler, muttered that “in my day, we just called this a sideways market and got on with it.” He then complained about the youth and their obsession with counting every wiggle.

Meanwhile, Kash “Krash” Cashew is convinced the flip-flopping is a bullish pattern for his meme coin portfolio. “Looks just like the flag formation that preceded the last 400% pump,” he announced to no one in particular. Mac Winthorpe gently suggested he might be holding the chart the wrong way too.

The Financial Nuts consensus? “Flip-flop environment remains intact. Coffee consumption rising accordingly.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The “January Barometer” – where January’s performance predicts the full year – has an 86% accuracy rate since WWII. When the S&P 500 finishes January in positive territory, stocks have averaged a 16.2% gain for the full year. No crystal ball required – just calendar patterns doing their thing.

[Source: Fidelity – “January Barometer 2025” – https://www.fidelity.com/viewpoints/active-investor/january-barometer]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.