$2.90 to $0.10 and $3.00 to $0.30 – Premium Decay at Its Finest

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Well that’s one way to return from sick leave.

First full day back at the desk after a long weekend and some poor health over the last few days. And what greets me? Two closed trades, both winners, both delivering the kind of ROC numbers that make the migraine almost worth it.

Almost.

The bear bias I’d been banging on about in my morning briefings? Validated. The swing trade set up this time last week while price sat at the upper end of the longer-term rising channel? Crushed it. The Lazy Day Trade on today’s VWAP reclaim? Textbook.

Sometimes the best trading happens when you’re too ill to overthink it.

Keep scrolling – the numbers speak for themselves…

Two Trades. Two Wins. Zero Stress.

Post-Trade Debrief:

Trade 1: Tag ‘n Turn Swing – 96.5% ROC

The Setup:

This time last week, price was sitting at the upper end of the longer-term rising channel. The bear bias was clear. The pattern was clear. The only thing left to do was execute and wait.

So that’s exactly what I did. Swing on, then sit back.

The Execution:

- Premium Collected: $2.90

- Bought Back: $0.10

- ROC: 96.5%

- Index Move: $120

Monday’s and Tuesday’s post-tariff nonsense provided the catalyst, but the setup was there before Trump decided to play Greenland Monopoly. The systematic approach doesn’t need to predict news – it positions for the probability.

The Runway:

There’s still a fair amount of room to move towards the lower edge of the range. This swing delivered beautifully, but the larger pattern may have more to give.

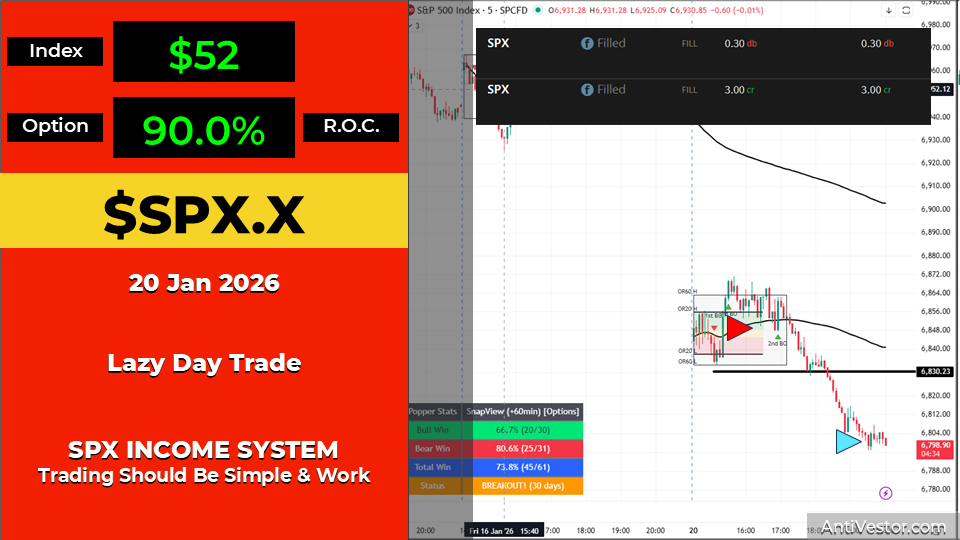

Trade 2: Lazy Day Trade – 90.0% ROC

The Setup:

Price was well below the 2-day VWAP. That gives me a bear bias – simple rule, no interpretation needed.

Then the current day’s VWAP was reclaimed. New bear trade taken.

The Execution:

- Premium Collected: $3.00

- Bought Back: $0.30

- ROC: 90.0%

- Index Move: $52

It’s called a Lazy Day Trade for a reason. Collect premium. Wait. Let theta do its job. Buy back for pennies.

The Stats (Last 30 days Visible on Chart):

- Bull Win Rate: 66.7% (20/30)

- Bear Win Rate: 80.6% (25/31)

- Total Win Rate: 73.8% (45/61)

- Status: BREAKOUT (30 days)

That bear win rate at 80.6% tells you everything about the current environment. When the system says bear, the bears are delivering.

The Bigger Picture

Two very simple trades for today.

No heroics. No predictions. No staring at screens trying to guess what Trump might tweet next.

The swing was set last week based on channel position. The day trade was taken based on VWAP rules. Both worked because the rules work – not because I’m clever, but because the system is mechanical.

First day back from illness and the desk welcomed me with nearly 190% combined ROC across two positions. If that’s not a sign that systematic beats emotional, I don’t know what is.

Trade Summary:

| Trade | Type | Collected | Bought Back | ROC | Index Move |

|---|---|---|---|---|---|

| SPX TnT | Swing | $2.90 | $0.10 | 96.5% | $120 |

| SPX Lazy DT | Day Trade | $3.00 | $0.30 | 90.0% | $52 |

Expert Insights:

The Beauty of “Set and Forget”

The Tag ‘n Turn swing was placed this time last week. For the next several days – including three spent in a dark room with a migraine – that position simply existed. No adjustments. No panic. No checking every five minutes.

The Lazy Day Trade lived up to its name. VWAP gave the bias. VWAP reclaim gave the entry. Premium decay gave the profit.

This is what mechanical trading looks like in practice. The rules don’t care about your health, your mood, or your opinions about Greenland. They just execute.

Rumour Has It…

Percy Peanut has declared today “National Bear Appreciation Day” and is wearing a small furry hat he claims represents bearish sentiment. Hazel Ledger pointed out it’s actually a dust bunny from under his desk.

Wallie Winthorpe raised his tumbler to the 96.5% ROC and muttered something about “proper trading” before returning to his newspaper. He’s circled an article about Danish real estate prices.

Kash “Krash” Cashew is confused why everyone’s celebrating bear trades when “stonks only go up.” Mac Winthorpe gently explained that premium sellers profit either way, to which Kash responded: “So it’s like a cheat code?”

Mac smiled, adjusted his fedora, and replied: “Precisely, darling. Precisely.”

The Financial Nuts consensus: “Two trades, two wins, one very relieved Phil. Coffee rations increased to celebration levels.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.