Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

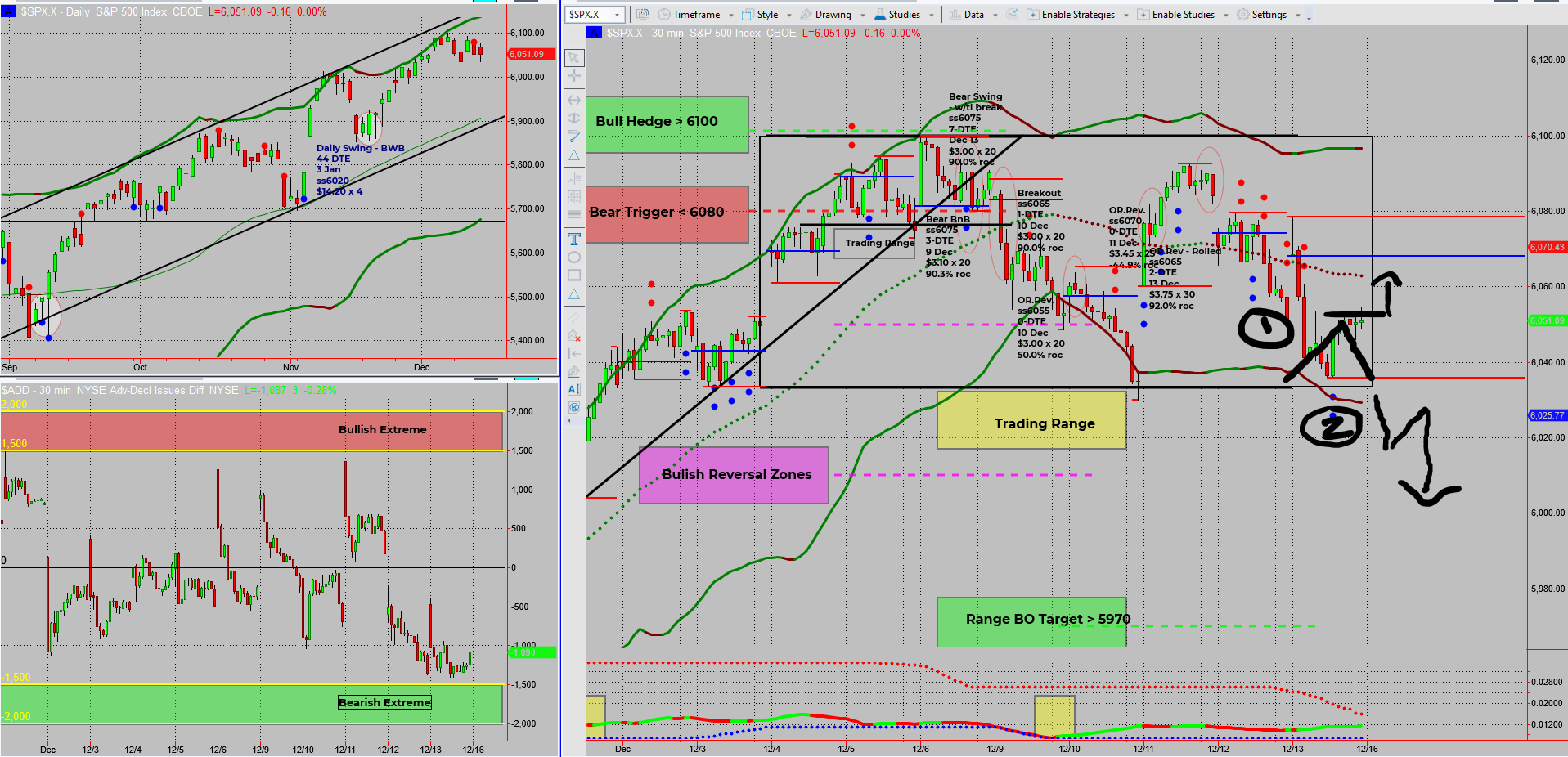

Last week’s SPX Income trades delivered the goods, even without directional movement. That’s the beauty of this system—it works in all conditions! As we dive into next week’s opportunities, a clearly defined range opens the door for some lucrative setups. Let’s chart the course!

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX has set the stage for a straightforward yet exciting trading week ahead.

With a well-defined sideways range in play, it’s time to focus on the opportunities this creates. Sideways ranges unlock four of the six money-making patterns in the SPX Income System, giving us multiple paths to profits.

Whether it’s reversals at range lows, breakouts of range highs, or even hybrid setups, the plan is clear: follow the signals and let the system do its magic.

Here’s what’s on the radar this week:

- The Four Patterns in Play:

- Pattern 3: Buy at range lows for bullish reversals.

- Pattern 4: Sell at range highs for bearish reversals.

- Pattern 5: Buy breakouts of range highs for bullish continuation.

- Pattern 6: Sell breakouts of range lows for bearish continuation.

- Where We’re Focused:

- Friday’s close puts SPX right at the range low, making Pattern 3 (bullish reversals) and Pattern 6 (bearish breakouts) the immediate setups to watch.

- Keep an eye on pulse bars—the trusty signals that confirm timing and direction.

- The Hybrid Option:

- If price dips out of the range but fails to reach its breakout target, a “break-in” setup can capture the move back into the range. Adaptability is key!

- The Big Picture:

- As always, stick to the rules. With clear boundaries and reliable signals, this week’s range offers precision, profitability, and, most importantly, simplicity. Let’s keep the momentum going!

Fun Fact:

The last week of December has been dubbed the “Santa Claus Rally” by traders since 1950. Historically, SPX gains an average of 1.3% during this time.

This end-of-year rally isn’t just a festive phenomenon—it’s tied to lower institutional trading volumes, tax-loss harvesting, and a general optimistic sentiment. While it doesn’t happen every year, it’s something to keep in mind as we approach the holidays. Could Santa visit again this year? Only time (and the market) will tell!

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece