Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

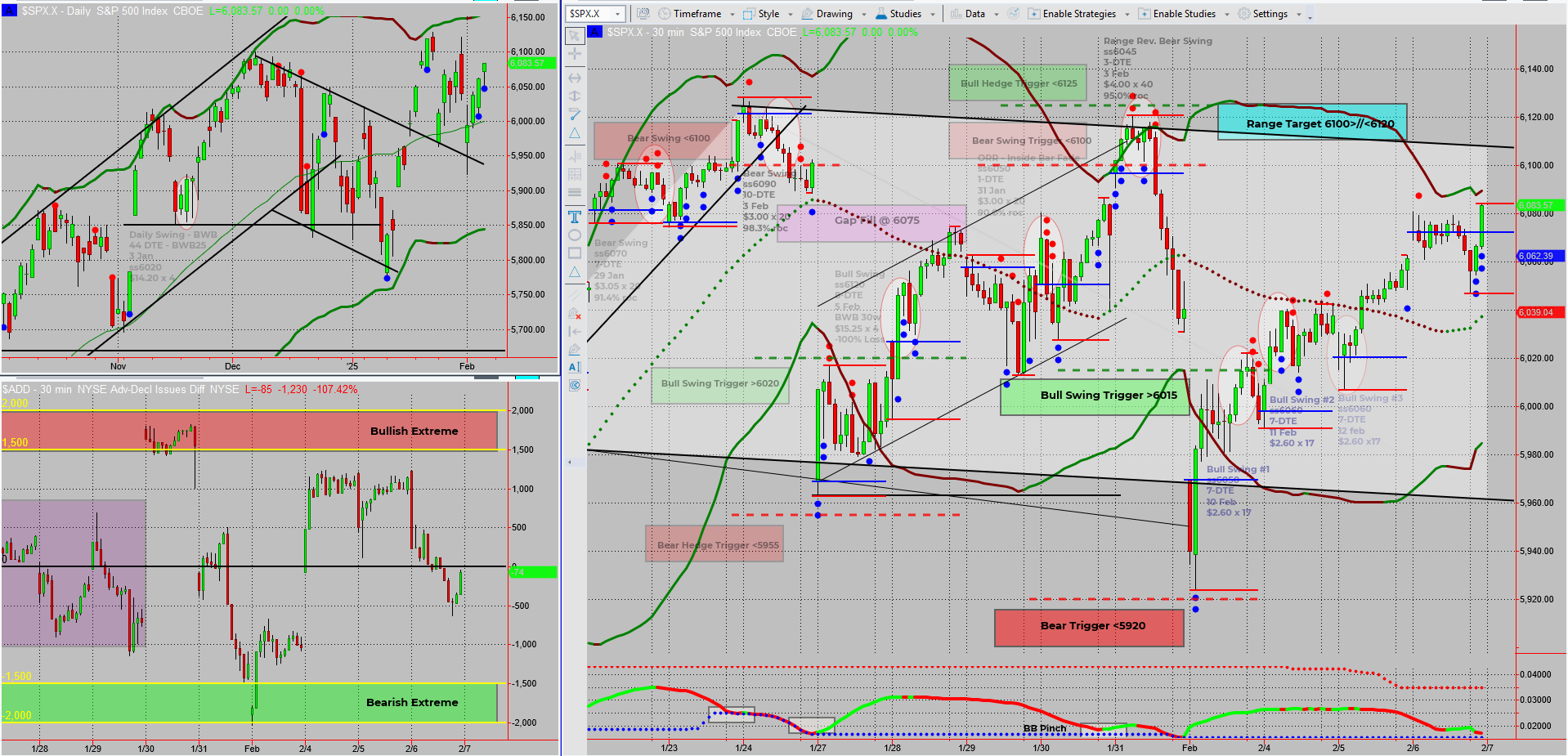

The bulls keep charging as SPX edges closer to 6100. But with the NFP report dropping pre-market, things could get lively.

Will we blast through resistance or bounce back down? Expect some whipsaw chaos before the market settles – but with a bullish trend already in play, we should at least get one more push toward target exits before the dust settles.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

Bullish Move On Track

SPX has ridden the momentum train all the way from the range lows to the range highs. Now, we’re staring at 6100, the key level where decisions will be made.

NFP Report – A Market Mover

Today’s Non-Farm Payroll (NFP) data drops just before the opening bell. This is one of the bigger monthly catalysts, meaning we could see:

- A breakout past 6100 if the market likes the numbers.

- A sharp rejection back into the range if traders get spooked.

- A whipsaw shakeout, with wild swings before settling.

Short-Term Expectation? A Push Higher

Even if volatility kicks in, the existing bullish momentum should at least give us a final nudge up toward target exits. Whether we smash through 6100 or stall out, we’re in prime position to lock in profits.

⏳ The Good Kind of Waiting

Once again, we’re in a holding pattern, waiting for the market to tip its hand. But this is strategic patience – the kind where we’ve done the hard work and now simply let the market do its thing. The setups are in place – now, we sit back and watch the magic unfold.

Fun Fact:

Did you know? In 2010, a trader accidentally caused a $1 trillion stock market crash in just 36 minutes – all because of a fat-finger trade.

The Lesson? One typo, one misclick, or one overleveraged position can cause chaos. Always double-check your trades, because even the pros have hit the wrong button before.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece