Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

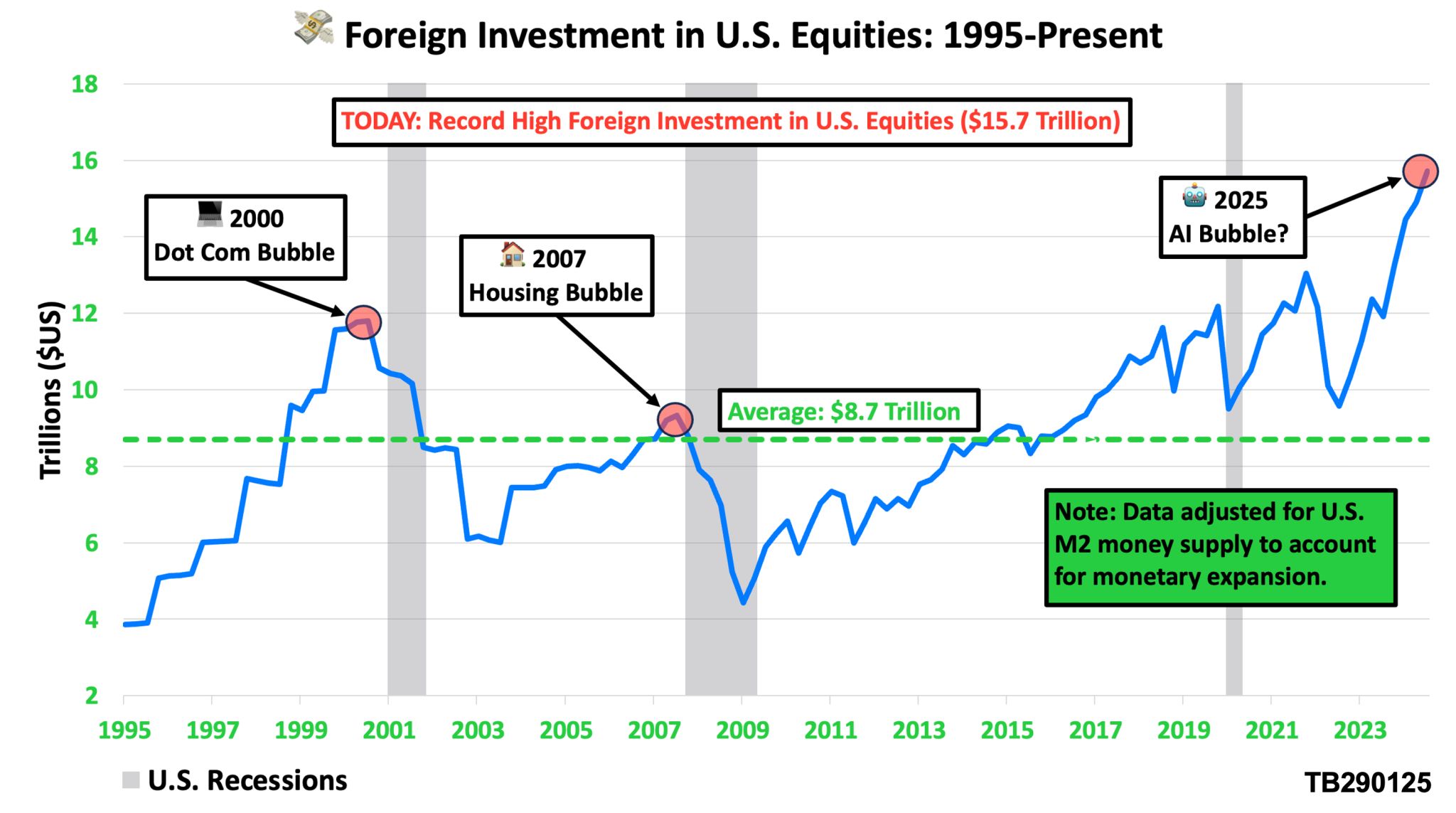

The U.S. stock market is riding an explosive wave, fuelled by foreign investment at an all-time high of $15.7 trillion.

But if history has anything to say, these record levels are red flags, not green lights.

Each time foreign capital has flooded U.S. equities—2000, 2007—the markets have crashed spectacularly. Could 2025 be next? Let’s break it down…

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

Deeper Dive Analysis:

Foreign Investment Hits Dangerous Levels

Right now, foreign capital in U.S. stocks is at $15.7 trillion, nearly double the historical average. While this cash injection has pushed markets to record highs, history tells us that when foreign money peaks, disaster follows.

The Ghosts of Market Crashes Past

Foreign investors have poured money into U.S. markets before, and each time, the script has played out the same way:

- 2000 – Dot-Com Bubble

- Foreign investment peaked at $11.8 trillion

- S&P 500 collapsed 51%, taking 17 years to fully recover

- 2007 – Housing Bubble

- Foreign investment hit $9.3 trillion

- Markets imploded by 58%, triggering a brutal global recession

- 2025 – AI Bubble?

- Foreign investment is now at a mind-blowing $15.7 trillion

- If history repeats, the fallout could be even worse

The Warning Signs Are Blinking Red

- 1️⃣ Overheated Markets – Stocks are sky-high, but is the foundation solid, or are we walking on thin ice?

- 2️⃣ Speculative Frenzy – This rally isn’t driven by real economic growth, but by leverage and hype.

- 3️⃣ Geopolitical Risks – Foreign capital is fickle—tensions, trade wars, or policy shifts could cause massive capital outflows overnight.

- 4️⃣ Economic Shockwaves – A crash doesn’t just wipe out portfolios; it rips through jobs, savings, and retirement funds.

⚠️ What Could Be the Tipping Point?

- A major earnings disappointment

- A geopolitical shock that sends investors fleeing

- A rapid credit squeeze that exposes over-leveraged traders

How to Protect Yourself

- Diversify – Spread risk across multiple assets—don’t go all-in on equities.

- Manage leverage – Markets can stay irrational longer than you can stay solvent.

- Stay nimble – Be ready to adjust as market conditions change.

Final Thought

Foreign investors have fuelled a wild rally, but markets built on speculation rarely end well. With leverage at record highs, geopolitical risks looming, and historical patterns repeating, it’s hard not to see the perfect storm forming. If history is any guide, the bubble may already be inflating past its breaking point.

Fun Fact:

Did you know? In 1989, Japan’s stock market was the largest in the world, making up 45% of global equity value. By 1992, it had lost over 60%—and it still hasn’t recovered to this day.

The Lesson? Even the biggest, strongest stock markets can collapse. Just because markets are flying high doesn’t mean they’ll stay that way.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece