Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Rolling a trade from a loss to a profit isn’t something I always do—because rolling to infinity and beyond isn’t exactly a solid trade strategy.

But when my directional bias remains intact, it can be a brilliant tool.

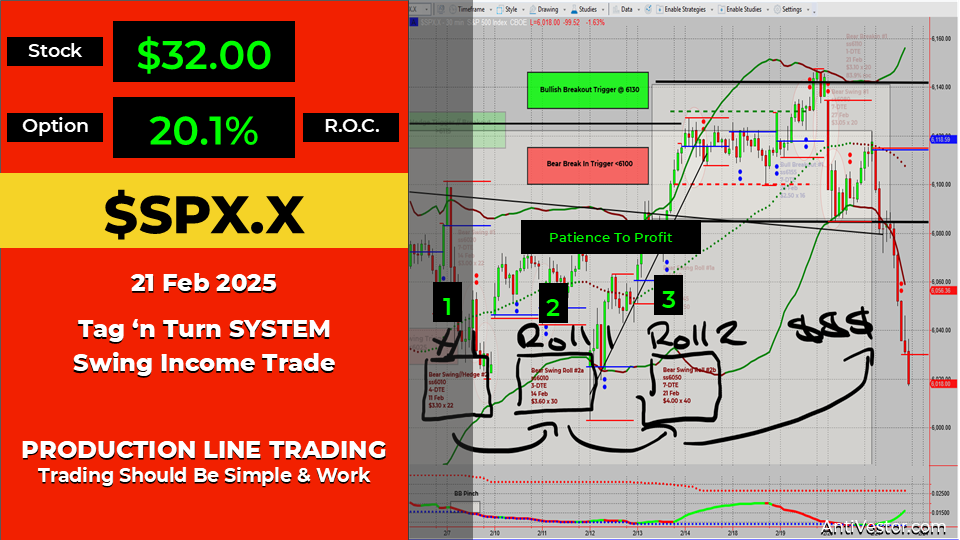

This trade started as a hedge, then morphed into a bear swing trade, and after a few well-timed rolls, it closed for a solid 20.1% return.

Here’s how it played out…

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

$500-$5,000+ Days – Even in a Market Collapse!

Important Question: What if you could turn market uncertainty into a $500-$5,000+ daily opportunity – in just minutes?

Imagine logging in, placing a simple trade, and moving on with your day – stress-free.

The SPX Income System has helped traders generate consistent, recession-proof income – WITHOUT needing years of experience.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

Rolling the Right Way – Not to Infinity

I don’t roll just for the sake of it—that’s a one-way ticket to chasing losses.

But when:

- ✅ My directional view is still valid

- ✅ The market aligns back with my bias

- ✅ There’s still time on the clock

Then rolling can turn a losing trade into a winning one.

The Evolution of This Trade

Step 1 – Hedge Becomes a Bear Swing Add-On

- Started as a hedge for my bullish trades around Feb 7

- Bullish trades closed profitably, so I converted it into a bear swing add-in

- Price rallied but stayed in range → First roll triggered

Step 2 – First Effective Roll

- Instead of a traditional roll, I let Trade #1 expire

- Opened Trade #2 with the same strikes & increased size

- Market broke out bullish—bearish thesis broken

- But still plenty of time on the clock – so wait

Step 3 – Running Out of Time, Final Roll

- The market flipped bearish again

- Chose to roll out in time & up in strikes one last time

- Friday’s sell-off sealed the win

Final Trade Breakdown

- Trade #1 – Collected $3.30 on 22 lots, expired with a -$1.70 loss

- Trade #2 – Collected $3.60 on 30 lots, expired with a -$1.40 loss

- Trade #3 – Collected $4.00 on 40 lots, closed at $0.30, producing an overall profit $3.70

- Final result? A 20.1% return on capital.

The SPX Income System Advantage

- No traditional stop-outs – Wrong direction? No problem.

- Flexibility to adjust trades – Not locked into a single outcome.

- Time as an asset – Given enough time, even a losing trade can turn profitable.

This is why I love this system—I don’t have to be right to make money.

Fun Fact

Did you know? In 2013, a Goldman Sachs trader accidentally placed a $1 billion trade, triggering massive volatility—luckily, the firm caught it just in time.

The Lesson? Even the biggest, most experienced traders make fat-finger mistakes—but having a risk-management system in place makes all the difference.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece