Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

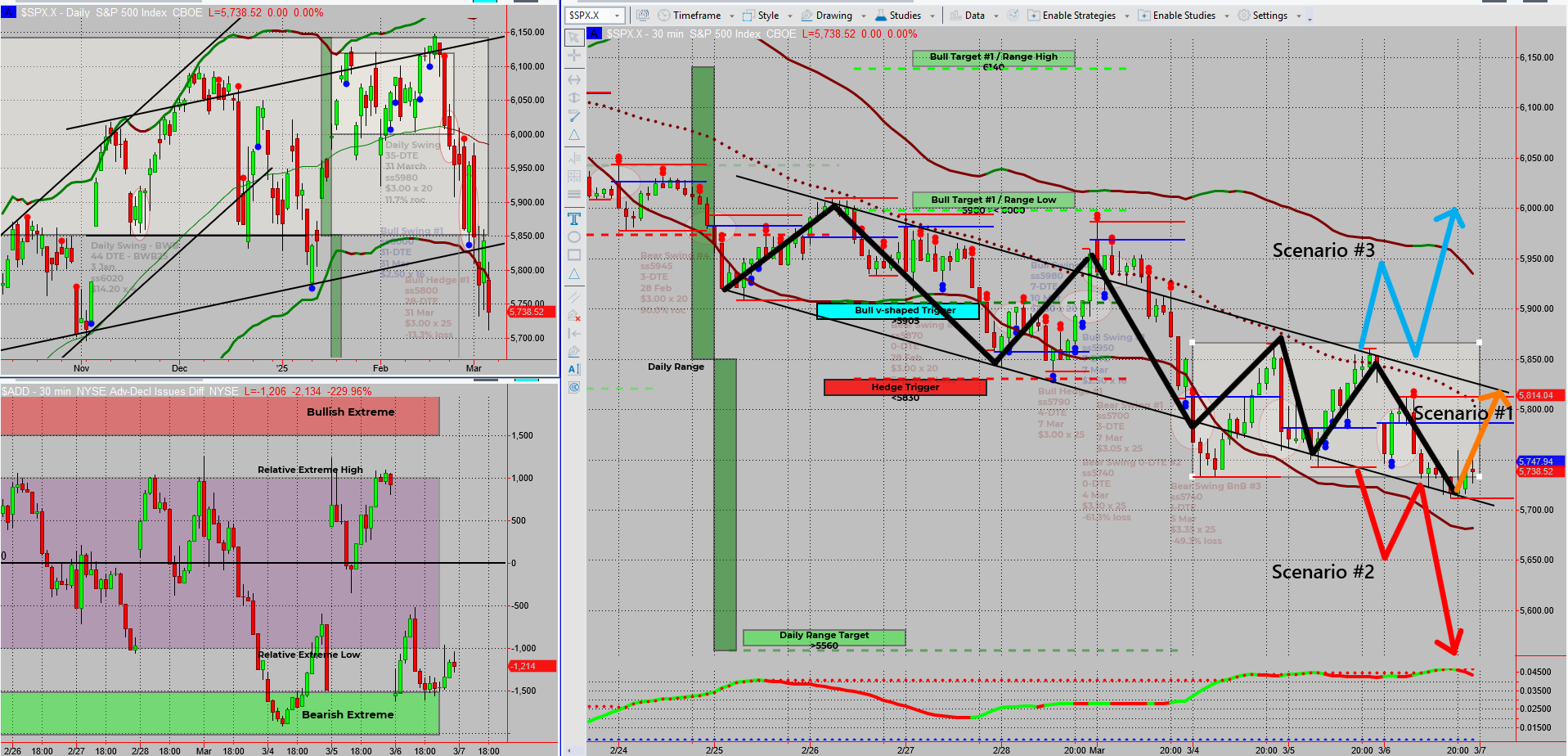

The market is acting like a drunk sailor, stumbling between a sideways range and a downsloping channel, leaving traders scratching their heads and redrawing trendlines daily.

If this feels frustrating, welcome to the real evolution of price action—the part nobody talks about.

Traders love to show off the perfect trade after it happens, but the real challenge is navigating price movement as it unfolds. One day, it’s a range, the next, it’s a channel, and by the time you’ve figured it out, the market’s already moved on.

For now, I remain hedged and in a no-lose position, watching how this range resolves.With Trump pulling a 2018-style tariff play, and NFP looming, we could be in for a big move soon—or just more of the same slow churn.

Either way, I’ll be ready when the market finally decides to commit.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

Price action is in full “make up its mind later” mode, bouncing between a short-term range and what could evolve into a downsloping channel.

The only certainty? Traders who force trades in this mess will get chewed up.

The problem with trendlines and pattern analysis is that they’re constantly evolving. One day, it looks like a clean range, the next, it’s a slanted consolidation, and suddenly, what looked like a breakout yesterday is just noise today.

This is why I never rely on one rigid framework—instead, I follow my six money-making patterns that adapt as price action develops.

At the moment, I see three scenarios playing out.

- If price respects the range, we get a bounce toward the highs.

- If it breaks the range, we could see a sharp downside continuation.

- And if we keep drifting in no-man’s land, then it’s just more of the same.

Forcing trades when the market hasn’t committed is a recipe for frustration.

Thankfully, I don’t need to guess.

My hedge is holding firm, keeping me in a no-lose position while the market sorts itself out. I’m not eagerly adding trades or picking a direction yet—I’m waiting for the market to show its hand first.

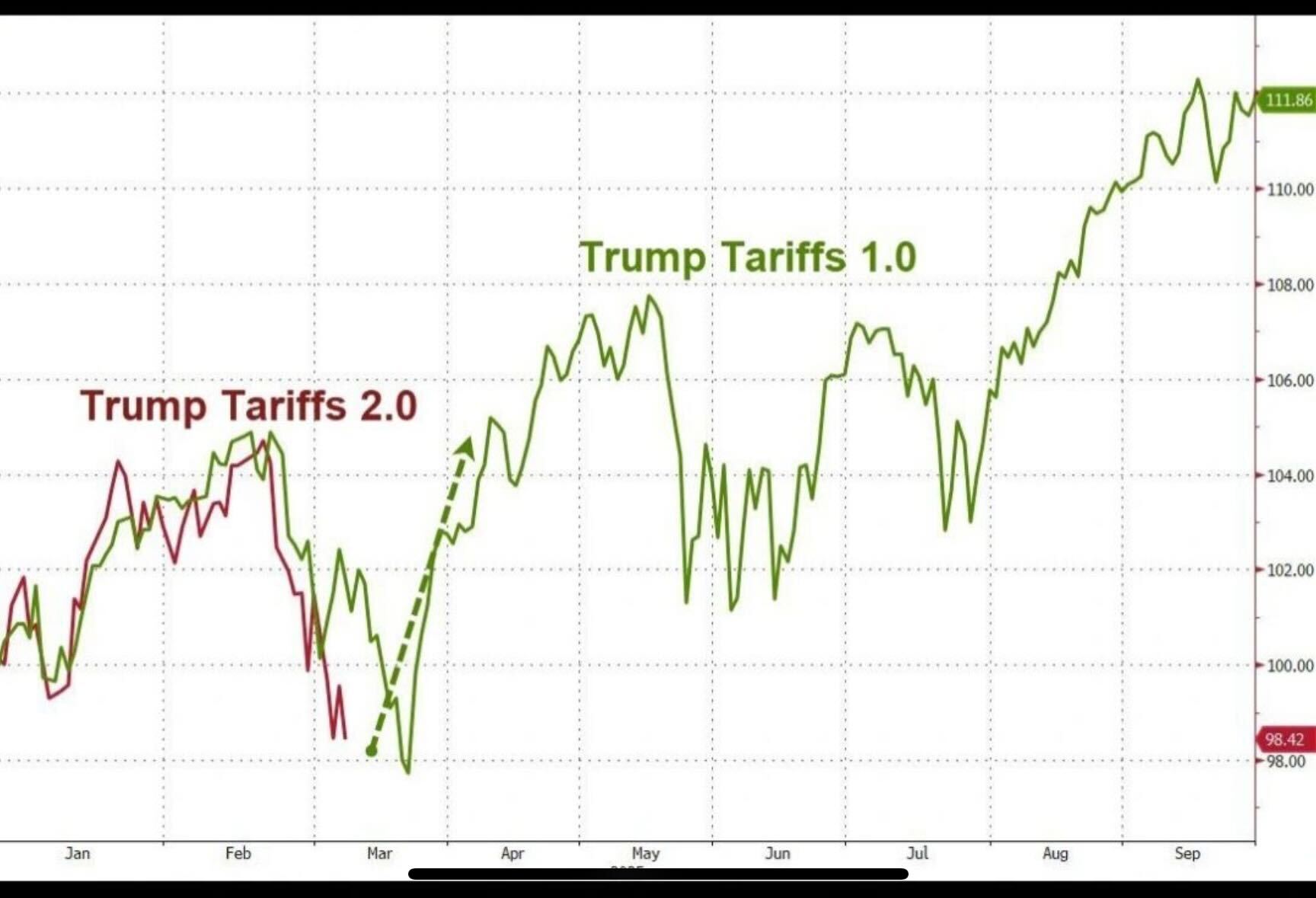

Meanwhile, in tariff news, Trump just announced a temporary removal of tariffs under the USMCA agreement until April 2nd.

If this feels like déjà vu, that’s because it is.

The market is mirroring the 2018-19 trade war, where even in a declining market, we saw strong rallies. No two market cycles are ever exactly the same, but they do tend to rhyme.

- So, will NFP be the trigger that finally kicks this market into gear?

- Or will we be stuck with another day of watching paint dry on the charts?

Either way, I’ll stay patient, stay hedged, and be ready for when the next real move arrives.

Fun Fact

Did you know? In 1987, a trader at Salomon Brothers coined the phrase “Dead Cat Bounce” to describe a brief market rally during a larger downturn. The idea? Even a dead cat will bounce if dropped from high enough.

The Lesson? Short-term rallies don’t always mean the trend has changed—a bounce isn’t the same as a recovery.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece