Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Sometimes, doing nothing is the best trade you’ll ever make.

While I was off enjoying my long weekend, SPX’s bullish move got slapped back into the range. Had I jumped in long, I’d probably be hedging or cursing my screen right now.

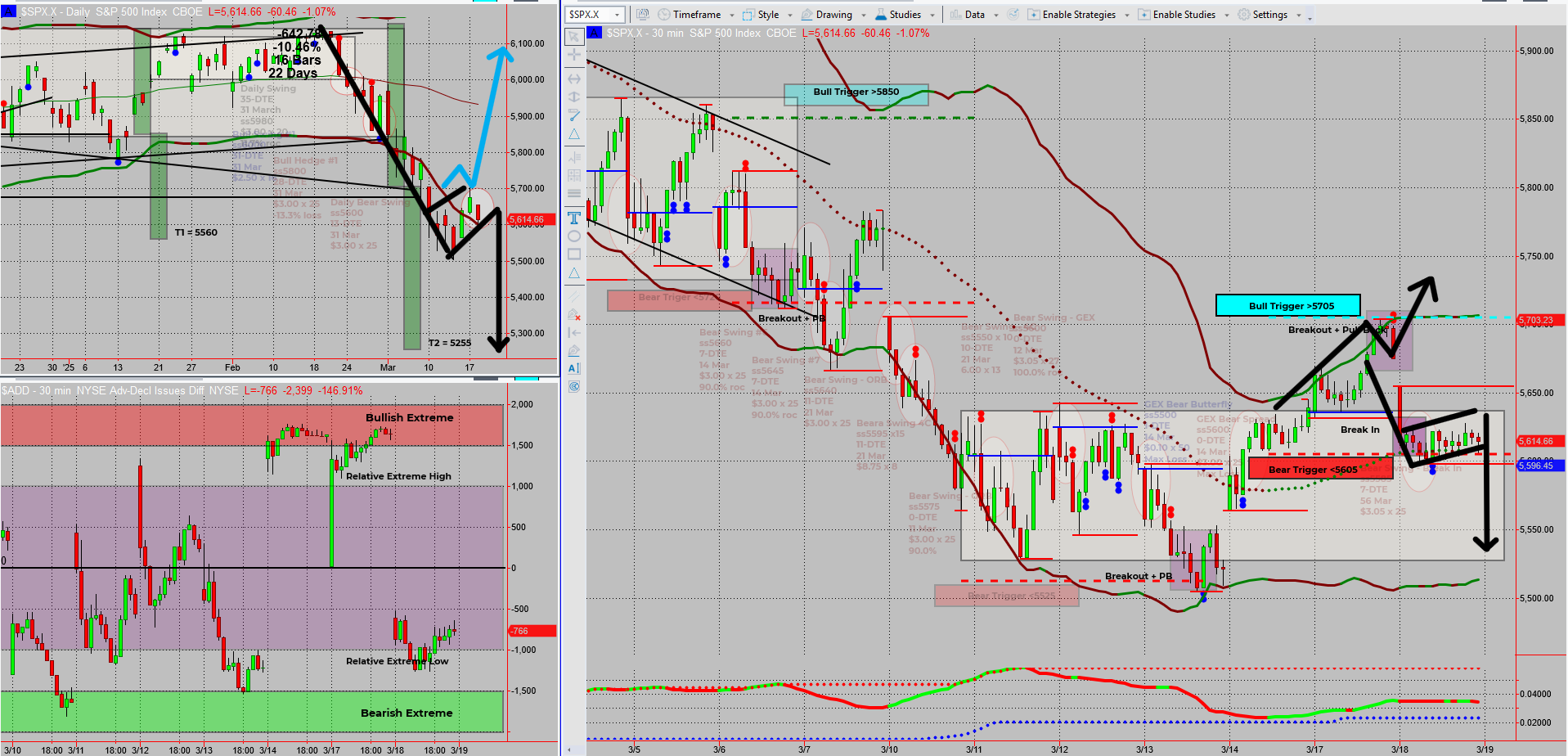

Now, price is coiling into a bear flag, and with the FOMC circus rolling into town at 2PM, I’m expecting things to stay tight until the fireworks start.

- Bullish above 5705.

- Bearish below 5605.

- Until then, I sit back and let the market make the first move.

Because in this game, you don’t force trades—you wait for the perfect shot.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

Some days, doing nothing is the right trade.

That’s exactly what I did over my long weekend, and it ended up saving me from stepping into a bullish trap. SPX’s move up was short-lived, and now we’re right back in the range—but this time, it’s setting up in an interesting way.

The Setup – Bear Flag + FOMC = Volatility Incoming

SPX has:

- Fallen back into the previous range—bulls are losing control.

- Coiled into a tight bear flag formation—hinting at a breakdown.

- FOMC later today, which could be the match that lights the next move.

The Trade Plan – Let the Market Show Its Hand

Right now, I have no interest in guessing. Instead, I’m letting the market come to me.

- Bullish above 5705? I’ll consider a long setup.

- Bearish below 5605? I’ll ride the downside momentum.

- Until then, I sit tight.

Bigger Picture – The Waiting Game

FOMC is always a game of patience. Traders try to guess what’s coming, but most end up whipsawed to oblivion.

I won’t be one of them.

- If the market confirms my bias, I strike.

- If it fakes out, I wait for a better setup.

- No stress, no panic—just disciplined execution.

Bottom Line – The Best Trade Is Sometimes No Trade

For now, I’m watching, waiting, and keeping my capital intact.

Because when the market finally makes its real move, I’ll be there, ready to take full advantage.

Fun Fact

Did you know? The longest FOMC meeting in history lasted five days—in 1932, during the Great Depression. Traders were left in limbo, staring at their tickers, waiting for an answer that took 120 hours to arrive.

The Lesson? Waiting for clarity isn’t new—it’s just that today, we get our pain in hours, not days.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece