Weekly Wrap – 9 to 13 June 2025

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

This past week delivered everything a trader could ask for – geopolitical panic, fake WW3 headlines, breakout rallies, and textbook swing entries. We began the week bullish following a clean Tag ‘n Turn and finished it with SPX bouncing 80+ points into Monday, confirming the power of both patience and pulse bars.

The market gave us opportunities – not just in price movement, but in proving how powerful “doing less” can be when your system is built right. Most trades executed were built from the daily setups discussed in the pre-market reviews posted each morning, with special focus on:

-

Monday’s bounce setup from prior range

-

Mid-week pulse bar entries confirmed by cash vs futures divergence

-

Friday’s late-day panic reversal that proved bullish swing bias right again

Now let’s spotlight the traders who didn’t just follow the playbook – they executed it like pros.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Pulse Bars Don’t Lie. They Just Pay.

Top 5% candles = predictable edge. Learn it. Use it. Profit.

Student Wins of the Week

KJP

Scored their first profitable paper trade after previous struggles. Took the lesson, followed the structure, closed the laptop, and returned to a bigger balance. That’s system confidence in action.

Part-Time Praxeologist

Used the “Just Breakfast” strategy midweek, faded geopolitical fear, and pulled a 43% return off a simple contract flip. Smart move. Even smarter exit.

Rodger Van Loenen

Tried his first-ever Broken Wing Butterfly swing – and smashed a 98.17% return. “Let’s do it again,” he says. Yes. Yes, you should.

Duncan Gillies

Closed a 4-day and 5-day BWB for 95% gain. Followed with two more 2-day swings at 70% and 80%. Highlight? He’s using V-entry confirmation plus pulse bars to avoid whipsaws. Execution meets refinement.

James Davis

Played the XSP pulse bar for a quick winner. No overthinking. Just rule, trigger, trade.

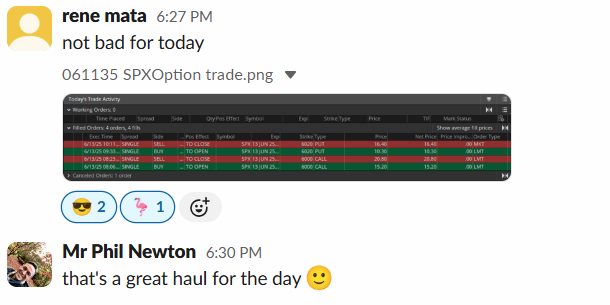

Rene Mata

Scalped into Friday with confidence and locked in a strong finish. The screenshot says it all – clean fills, great exits.

Hana Azmi

Finished 3 out of 5 wins, up 10% on the week. Self-reviewed losses, identified consolidation missteps, and planned to review the broken butterfly strategy over the weekend. This is what trader development looks like.

What Ties It All Together?

Every single win above was executed off the Tag ‘n Turn bias + Pulse Bar triggers discussed throughout the week. These weren’t lucky guesses – they were:

✅ Rule-based

✅ Time-tested

✅ Emotionless

✅ Repeatable

And most importantly – they didn’t require market direction to make money.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.