Oil Slumps on Middle East Tensions – What It Means for SP

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Thursday’s market was technically closed…

But the futures market clearly didn’t get the memo.

Globex dropped off 55 points during what was supposed to be a quiet holiday session.

Meanwhile, oil slipped on news of escalating conflict in the Middle East.

It’s rare for so much drama to unfold while the official US markets are on pause.

And that might make Friday’s session more interesting than usual.

Let’s zoom in on the chaos that happened… when nothing was supposed to happen.

Most Trade SPX Blind. You’ll Trade It Like You Designed It.

Pulse bars flip the lights on. You see it. Trade it. Bank it.

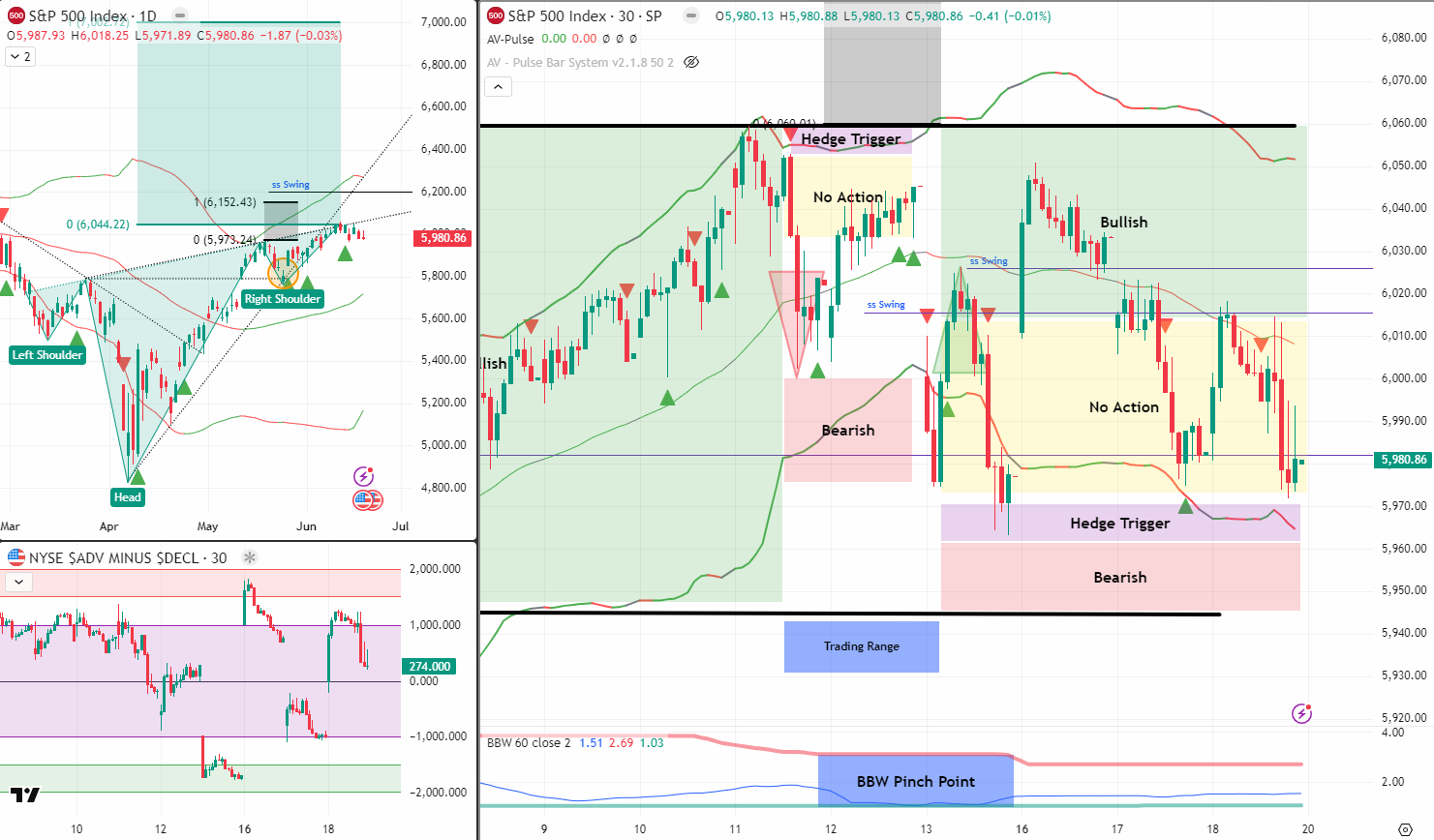

SPX Market Briefing

So here’s what we’ve got:

Thursday was Juneteenth – closed for trading.

Despite that, SPX futures dropped 55 points intraday.

️ Oil dropped too, on renewed military and political drama in the Middle East.

What should have been a market pause…

turned into a stealth volatility event.

Add that to what we’ve already seen this month –

and you’ve got a market coiling tighter than a late-cycle gamma squeeze.

SPX has been compressing most of this week and last.

Volume is light, range is narrow, and pulse bars are scarce.

So where are we now?

Still waiting.

Bullish or Hedge?

Honestly?

I think I’ll take another long weekend.

The weather here in the UK is blistering.

Mrs. Newton has suggested a stroll through a retail outlet…

[harder eye roll].

While I’m sweating through department stores,

let’s see if the market decides to finally break this range.

In Other News…

Oil Pops, Powell Pops Hope

Flat index masks furious rotation

First move – energy surge:

Brent’s early spike drove XLE +2.2 % at the open, offsetting a 0.9 % drop in consumer discretionary. Index futures printed a muted 12-point band as traders digested Gulf headlines and a tougher Fed.

Tech churn – Nvidia clipped:

Malaysia’s H-series probe shaved 1.1 % off Nvidia, while data-center REITs caught a defensive bid. Semis split: AI-linked names held firm, but handset and export-tied names slipped on Taiwan’s lowered GDP forecast.

Curve talk – flattest in months:

Powell’s tariff nod compressed 2s/10s to 6 bp, spooking banks and lifting utilities. Gold miners slumped after Citi questioned $3,000 bullion targets, easing metals heat just as oil surged.

Setup ahead – witching watch:

Triple-witching hits tomorrow with 45 % of S&P gamma expiring. 5,560 is the gravity line. A ceasefire could yank oil and juice growth; more missiles keep the tape defensive. (≈ 390 w)

Expert Insights:

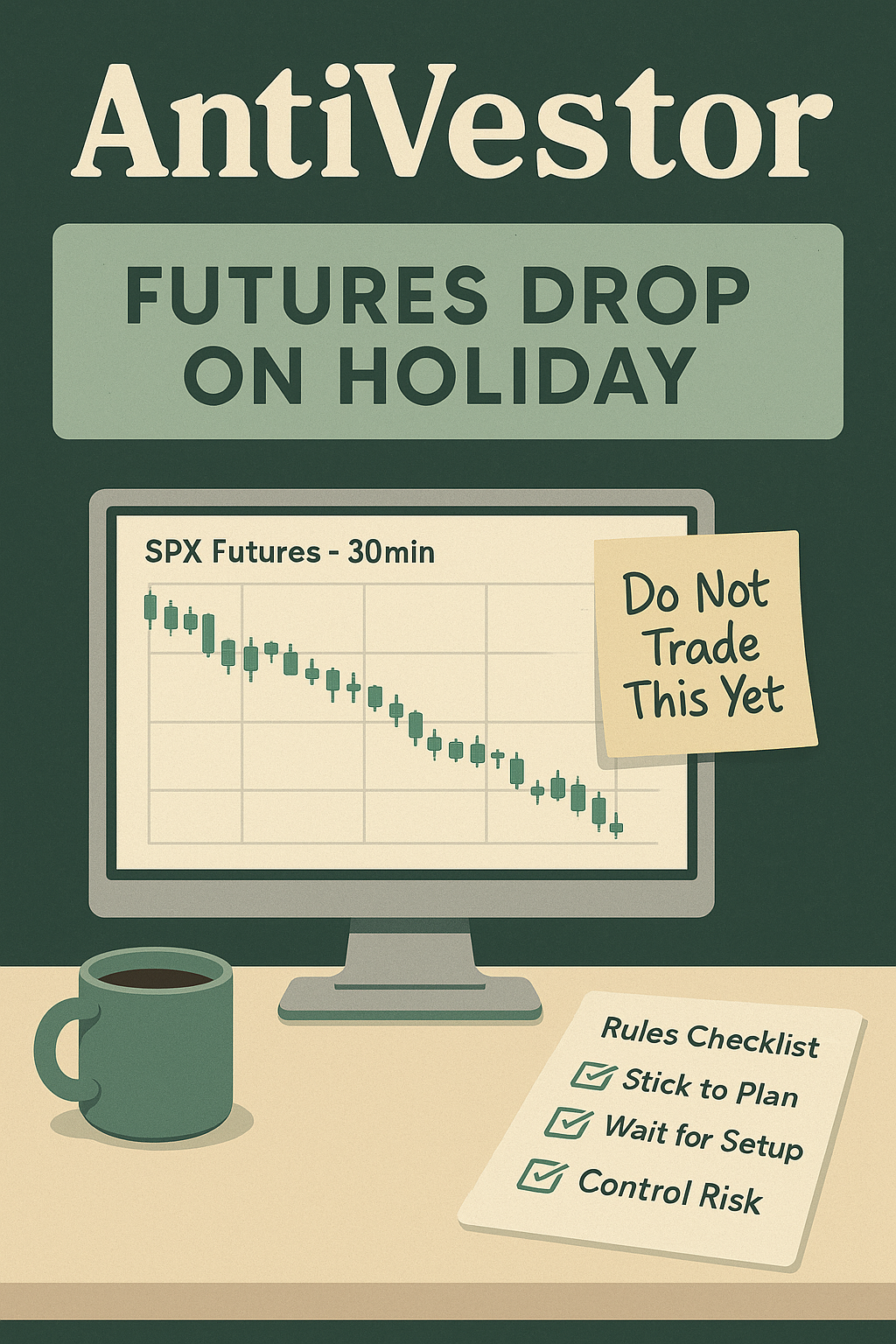

Common Trading Mistake:

Overreacting to futures movement during a holiday or illiquid session.

Why It Happens:

-

Traders see a surprise move and feel behind

-

They enter emotionally before the “real” market confirms it

-

Thin volume amplifies fake signals

✅ What To Do Instead:

-

Acknowledge the move, but don’t anchor to it

-

Wait for a breakout from your actual setup zone

-

Let the pulse bar or opening range confirm direction

Rumour Has It…

“SPX Futures Now Trade on Emotion, Not Volume”

After Tuesday’s 55-point futures drop on a closed market, anonymous insiders revealed the real trading engine behind the scenes:

GPT-9 powered by Reddit threads

Volume decisions made by memes

Hedge triggers now determined by emoji count

One trader summed it up:

“Nothing was open. But everything broke anyway.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

IMAGE HERE

Fun Fact

The tighter the coil, the louder the pop.

But knowing when that pop happens? That’s where setups matter.

We don’t front-run volatility. We let it walk into our trap.

Meme of the Day

“Me: Planning a Chill Holiday.

Market: Drops 55pts Anyway.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.