Bollinger Band Pinch Missed by Cat’s Whisker Creates Automation Dilemma

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

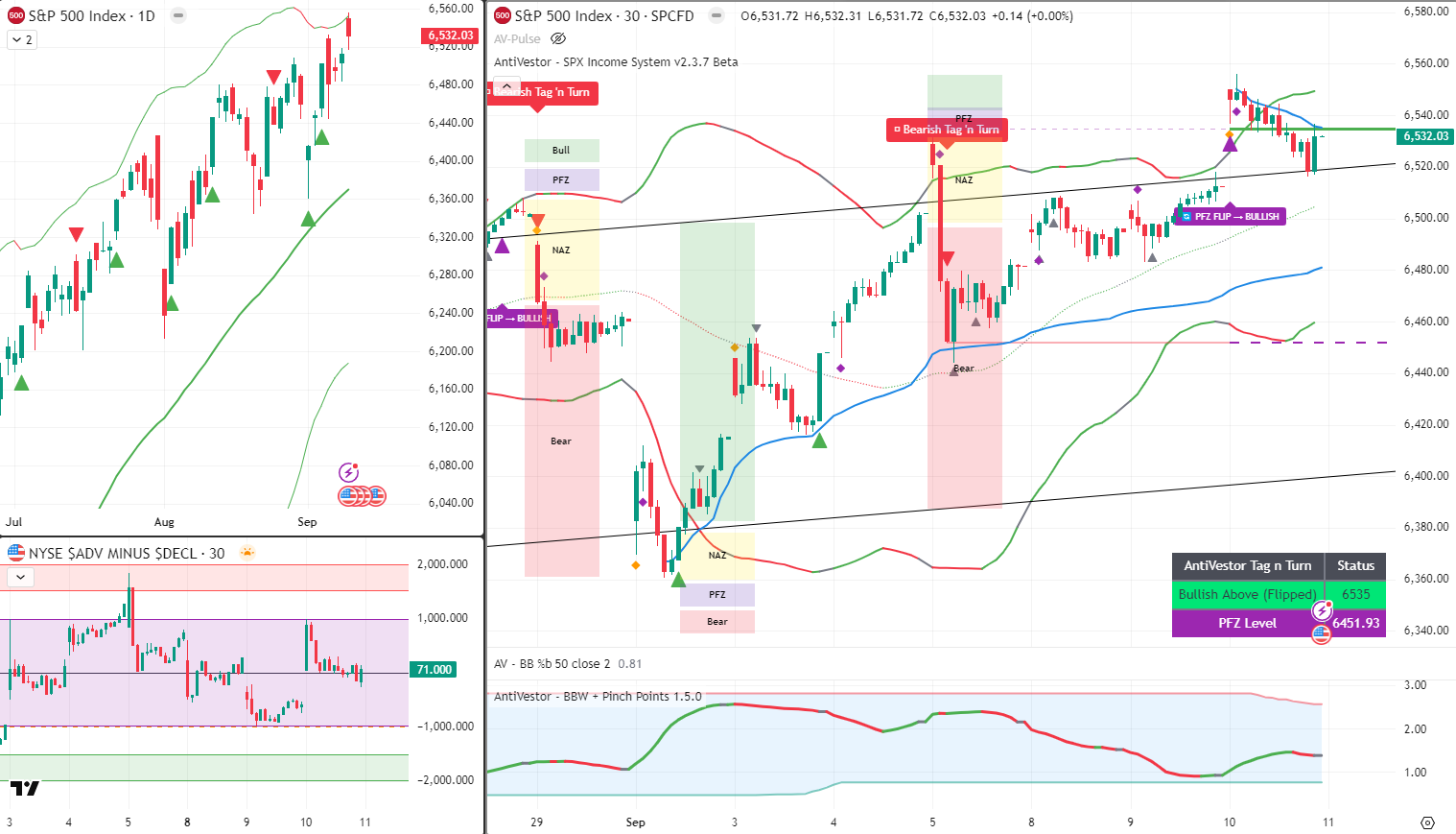

Well, this is one of those mornings where the systematic approach meets the messy reality of market edge cases. The system officially flipped to bullish yesterday, but we’ve got a couple of wrinkles that need ironing out.

Sometimes automated analysis breaks down ever so slightly when rare scenarios pop up. We’ve got two things happening simultaneously that don’t play nicely together, and it’s exactly why human oversight still matters in systematic trading.

First wrinkle: we had a wide no-action zone from the bear swing that flipped to bullish yesterday, which means we now have a wide bear PFZ level. That’s definitely a fly in the ointment that needs some thinking.

Second wrinkle: we missed out on an official Bollinger Band pinch by a cat’s whisker. We’d already spotted the containment area and marked it off, but officially from the software’s point of view, it’s not official. Another rare occasion requiring manual finesse.

Keep scrolling for the manual override plan…

SPX Market Briefing:

When systematic meets manual, experience trumps automation every time.

Current System Status:

- Official Position: Bullish (software confirmed)

- Reality Check: Range treatment with manual override

- Key Levels: 6556 pullback high (bullish completion), 6515 range re-entry (bearish reset)

- Gap Higher: Standard range breakout treatment required

- Software Lag: Expected during edge case scenarios

For me, and as we’ve been commenting on, I see this as a range marked off by the black sloping lines already on the chart. Yesterday’s gap higher is part of standard range breakout treatment – we need to push above the pullback high at 6556 to complete the breakout and go properly bullish.

The Range Reality: A price move back inside the range has already started, so a push below 6515 will break back into the range and put the system back bearish – although the software won’t be there yet. This is exactly why manual oversight remains crucial during edge cases.

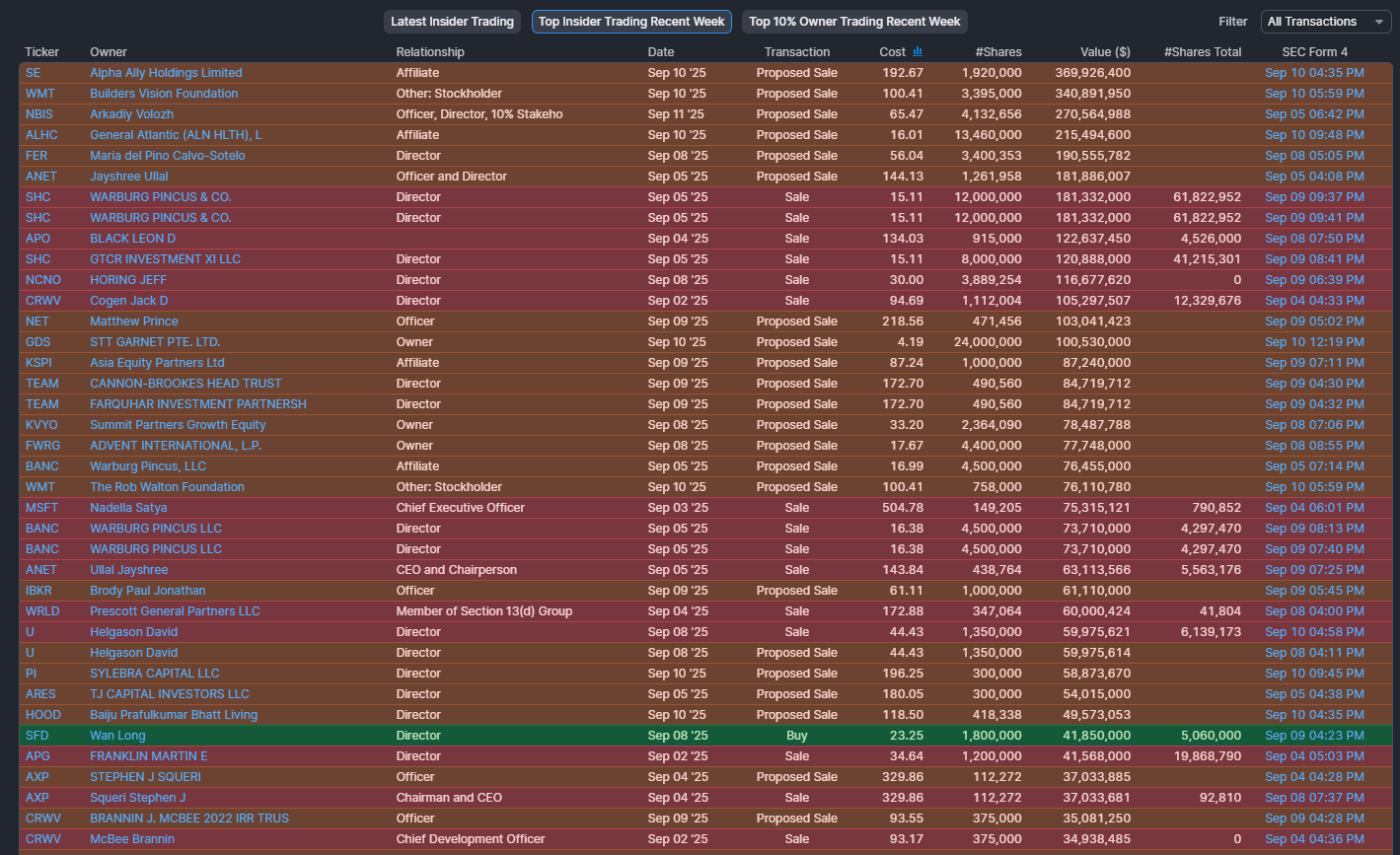

The Insider Apocalypse: Speaking of edge cases, we’ve got some seriously concerning data. Over the last week, 198 of the top 200 insider trades were sells. In two weeks, it was 398 of 400! The last time insider dumping hit this scale was the late 1920s, right before the Great Depression.

Today’s Systematic Deployment:

Tag ‘n Turn – Manual override engaged. Treating as range until 6556 breaks (bullish completion) or 6515 breaks (back to bearish). Software will catch up eventually.

Premium Popper – Range breakout environments often provide excellent opening volatility. Waiting for mechanical signals regardless of software wrinkles.

Lazy Popper – Perfect setup for 0-DTE collection during transitional periods. Manual range boundaries create clear risk parameters.

In Other News…

FinNuts Market Flash

Leadership swings to AI whilst inflation takes a coffee break

S&P futures crawled to +0.3% by 9:25 AM like Kash discovering Oracle’s quarterly numbers actually made sense. Nasdaq modestly higher whilst Dow sat flatter than Percy’s enthusiasm for new technology. Bond yields slipped and dollar ticked lower because apparently everyone’s having a lovely morning pretending AI will solve everything including inflation.

Sector rotation discovers shiny new objects

Oracle and cloud infrastructure leaders surged like Mac after discovering the office has gigabit internet. Semiconductors rallied across the board because chips are apparently the new oil, except shinier and more expensive. Legacy tech lagged behind like Wallie trying to keep up with artificial intelligence trends whilst still using Internet Explorer.

Earnings confessional gets religious about AI

Oracle’s forecast and contract pipeline stole the show like a proper West End production, proving that enterprise software can still make grown analysts weep with joy. Other companies remained cautious because apparently not everyone’s discovered the magic of adding “AI-powered” to their product descriptions. Synopsys missed guidance and remains under pressure, proving that even chip design software has feelings.

Cross-asset circus embraces the AI revolution

Inflation tailwinds helped both equities and crypto because apparently lower prices equal higher asset values in this brave new world. Dollar weakness supported risk assets whilst gold hovered stable like a confused precious metal wondering why everyone’s obsessing over computer chips instead. Credit spreads compressed slightly whilst global markets leaned positive, proving optimism travels faster than common sense.

-Hazel

Expert Insights:

Edge cases in systematic trading require human judgment to override automated signals when market reality diverges from programmed parameters. The ability to recognize and manually handle rare scenarios separates robust systematic approaches from rigid algorithmic failures.

Range breakout treatment follows established mechanical rules regardless of software classification delays. When human pattern recognition identifies clear boundaries before automation catches up, manual override becomes the systematic choice.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered trying to feed his desk pigeons “Bollinger Band Pinch Points” made from tiny breadcrumbs arranged in squeeze formations.

“The pigeons understand market compression better than the software!” Percy announced while arranging increasingly complex bread patterns. “Look how they peck around the edges – classic range behaviour!”

Hazel was spotted frantically updating her “Manual Override Emergency Protocols” while muttering, “Software wrinkles, insider apocalypse, and we’re still supposed to hit quarterly targets? I need stronger coffee and weaker shareholders.”

Mac raised his morning whisky to toast “the glorious art of human intuition defeating robotic rigidity,” while Kash tried to explain how range breakouts were “basically like liquidity farming but with actual technical levels.”

Wallie just nodded grimly at his broken calculator, declaring, “This is why I trust mechanical pencils over digital analysis – at least when they break, you know they’re broken.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

According to Finviz data, insider selling ratios exceeding 95% of total insider transactions have historically preceded major market corrections. The current 398 of 400 insider sells (99.5% ratio) matches concentration levels last seen in late 1929, when similar executive selling patterns preceded the Great Depression market collapse.

[Source: Finviz.com – “Insider Trading Data and Historical Market Analysis”]

Meme of the Day:

When your software says bullish but your chart says range and insiders are dumping everything

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.