SPX Serves Up More of the Same While Excitement Happens Elsewhere

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

The markets are – well, they’re doing nothing. At least not on the SPX side of things. There may be some excitement happening somewhere in the financial universe, but it ain’t here.

Sometimes the best trading days are the ones where absolutely nothing happens. While other traders are scrambling around looking for action, systematic traders just sit back and watch theta decay do its beautiful, boring work.

As not a lot has changed from yesterday’s inside day drama, this week’s plan remains pretty much identical. We’re most definitely in waiting mode – which is actually good for us since we can bank that lovely theta drip without any stress or drama.

The systematic approach loves days like this. No forced trades, no FOMO, no chasing shadows. Just mechanical patience while time decay quietly transfers premium from impatient option buyers into our accounts.

Keep scrolling for the beautifully boring plan…

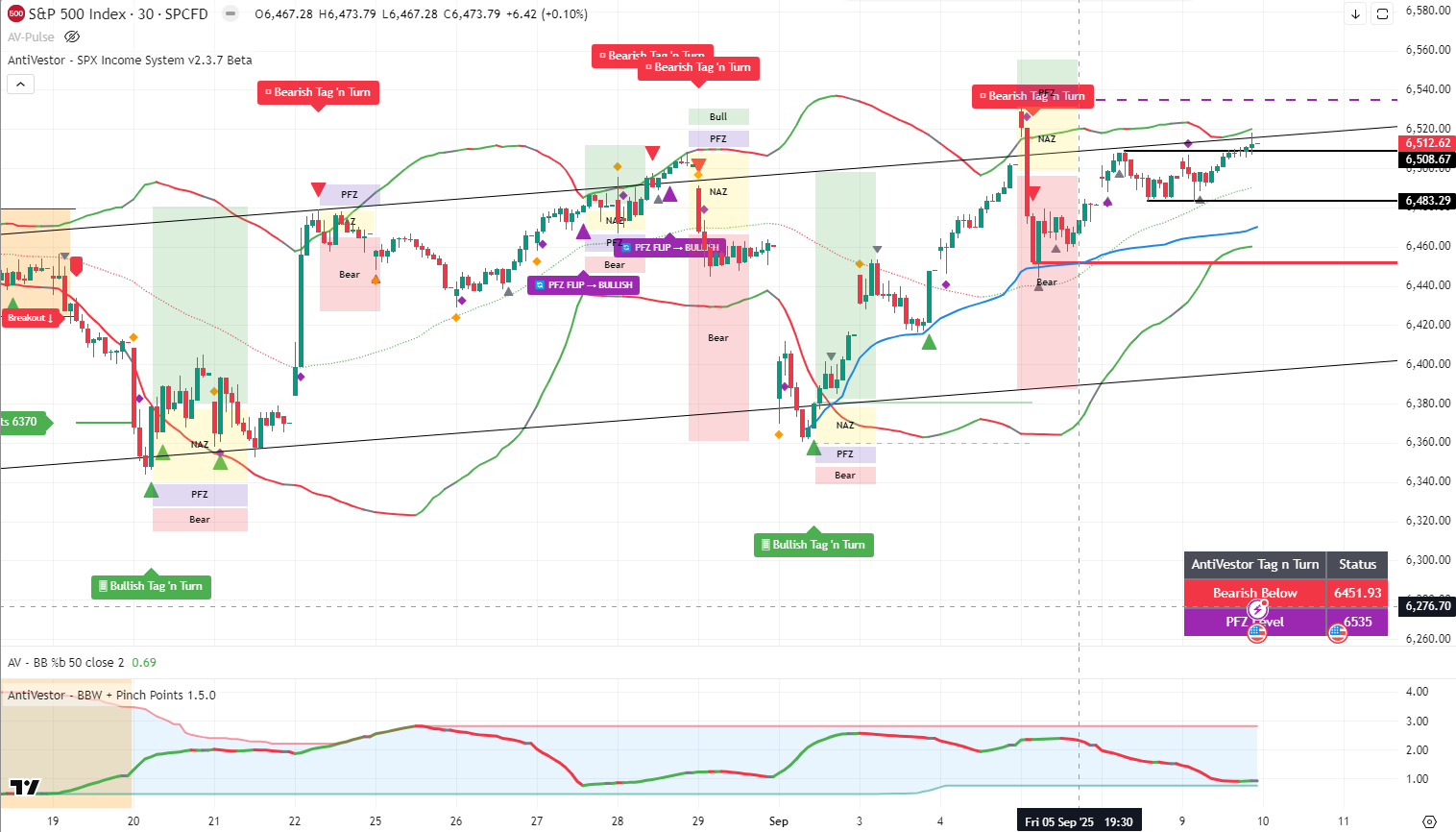

SPX Market Briefing:

When markets serve up nothing burgers, systematic traders order them with extra theta sauce.

Current System Status:

- Market Action: Absolutely nothing worth mentioning

- Systematic Plan: Unchanged from yesterday’s briefing

- Mode: Full waiting activation – patience engaged

- Theta Collection: Active and profitable

- Opening Bell: Can’t arrive soon enough for signal generation

There’s something beautifully liberating about trading days where the market refuses to cooperate with drama seekers. While momentum chasers and breakout hunters stare at flat charts wondering what went wrong, systematic traders understand that boring often equals profitable.

The Waiting Game Advantage: Professional traders know that the best setups require patience. Markets that do nothing are often building energy for the moves that matter. Meanwhile, theta decay works around the clock, quietly transferring premium from those who bought options into the accounts of those who sold them systematically.

Today’s Mechanical Deployment:

Tag ‘n Turn – Same bearish bias until proven otherwise. Still hunting that 6400 level. Market’s refusal to move doesn’t change the systematic parameters – just extends the timeline for target achievement.

Premium Popper – Waiting for opening bell to generate whatever signals emerge. Even boring markets can produce opening range action worth scalping systematically.

Lazy Popper – Perfect environment for 0-DTE theta collection. Sideways markets are theta sellers’ best friends – maximum time decay with minimal directional risk.

The beauty of having systematic approaches is that market boredom becomes profit opportunity rather than trading frustration.

In Other News…

Global flow feeds delusions of competence

Asia rose across the board like Kash discovering the office has premium coffee pods. U.S. indexes struck fresh records yesterday because apparently numbers only go up when we collectively agree they should. The global rally reflects shared confidence in central bankers eventually admitting they have no idea what they’re doing either.

Emerging markets play the trade hope game

India led gains whilst Nifty flirted with 25,000 like Percy eyeing the last biscuit in the tin. U.S.-India trade talk hopes gave momentum because nothing says “solid investment strategy” like betting on politicians having civilised conversations. Sentiment there may ripple elsewhere, proving optimism is more contagious than Mac’s caffeine addiction.

Fed cut expectations hanging by inflation’s thread

Rate-cut probability remains high whilst CPI and PPI will determine whether Powell’s next move involves champagne or tissues. Markets remaining patient like Wallie pretending to work whilst actually browsing holiday destinations. Everyone watching the data because apparently we’ve outsourced all decision-making to spreadsheets.

Waiting for the economic pin to drop

Calm persists whilst equity breadth tightens risk – markets locked in tighter than office budget approvals. Strategy involves positioning now, adjusting fast post-reports because apparently financial planning now operates on the same timeline as TikTok attention spans. Ball’s in inflation’s court, and we’re all just spectators hoping it doesn’t bounce directly into our portfolios.

-Hazel

Expert Insights:

Sideways market action often provides optimal conditions for systematic option selling strategies, as time decay accelerates while directional risk remains minimal. Professional traders view boring sessions as theta harvesting opportunities rather than trading obstacles.

Waiting mode in systematic trading represents active profit generation through time decay rather than passive market observation. The discipline to remain patient during low-volatility periods often separates profitable systematic traders from action-addicted position chasers.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered staring intently at motionless pigeons on the windowsill, claiming they were “demonstrating advanced sideways market formation patterns.”

“See how they’re not moving?” Percy announced proudly while pointing at completely stationary birds. “Classic theta decay positioning! The pigeons understand what the humans don’t – sometimes the best action is no action!”

Hazel was spotted calculating theta decay projections on seventeen different spreadsheets while muttering, “Finally, a market that makes sense. Boring equals profitable, dramatic equals disaster.”

Mac raised his morning whisky to toast “the glorious art of profitable boredom,” while Kash tried unsuccessfully to explain how sideways action was “basically like staking rewards but with actual market mechanics.”

Wallie just nodded approvingly at his broken calculator, declaring, “This is proper trading weather – predictable, sensible, and completely devoid of crypto nonsense.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

According to the CBOE, approximately 80% of all options expire worthless, making systematic option selling strategies statistically advantageous over time. The majority of profitable options trades come from theta decay rather than directional movement, particularly during low-volatility consolidation periods.

[Source: Chicago Board Options Exchange – “Options Volume and Trading Statistics”]

Meme of the Day:

When the market does absolutely nothing but your theta decay keeps working

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.