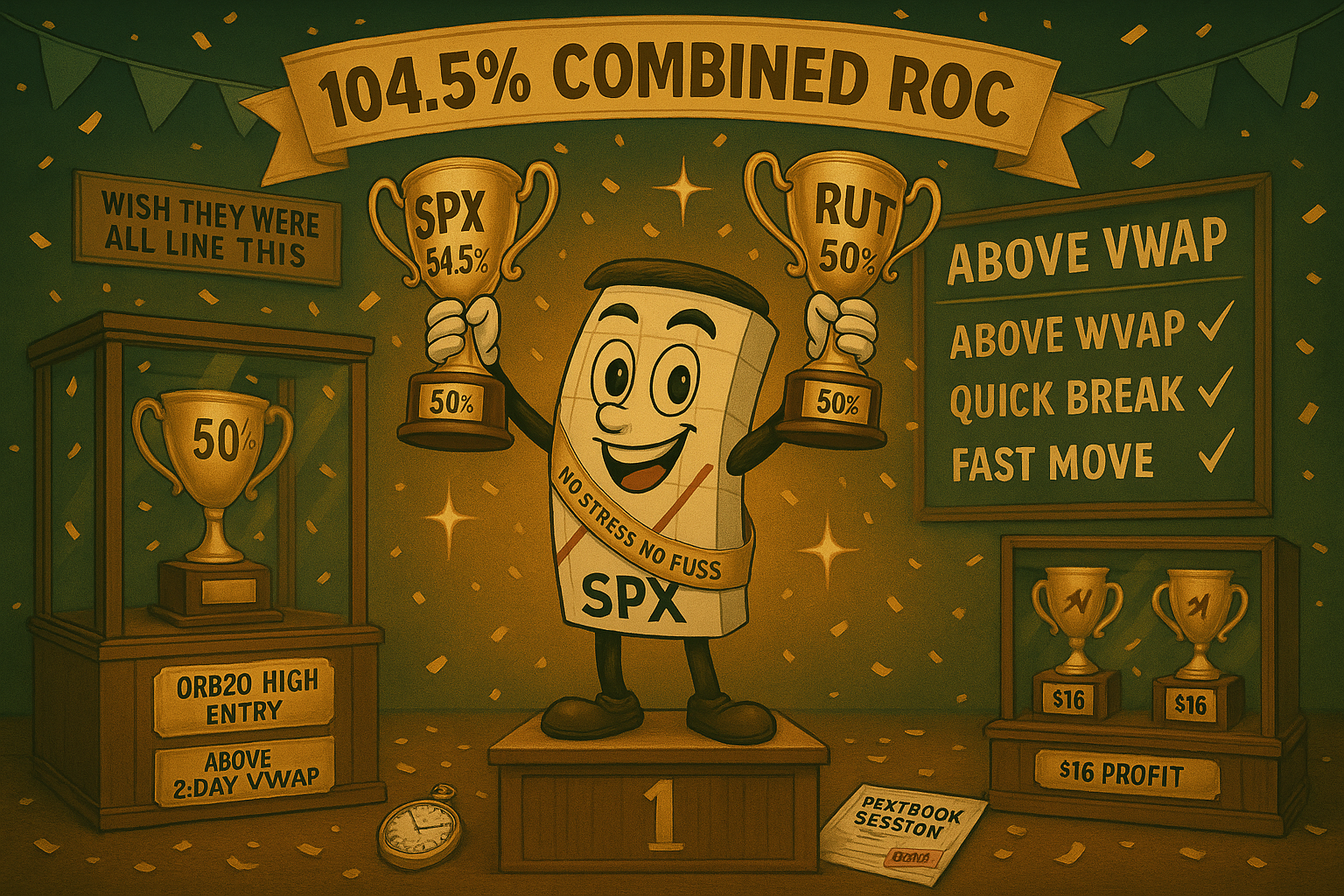

SPX 54.5% ROC – RUT 50% ROC

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Two classic ORB20 setups both above the 2 day VWAP as an added directional bias bonus.

Nice quick breaks – nice quick moves.

No stress no fuss – fast move – fast profits.

SPX 54.5% ROC. RUT 50% ROC.

Wish they were all like this.

Keep scrolling for the full breakdown…

Two Classics. Above VWAP. Quick Breaks. Quick Profits. Done.

Trade DeBriefing:

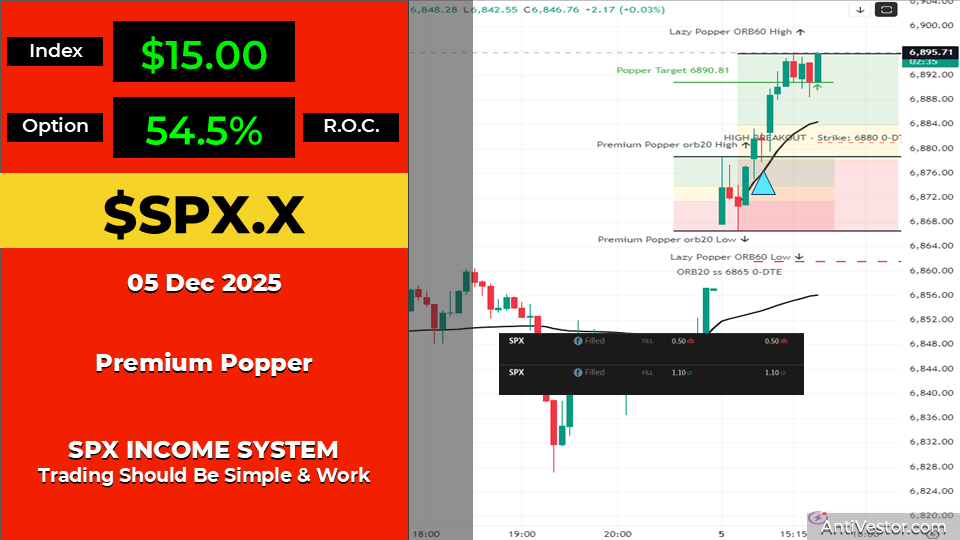

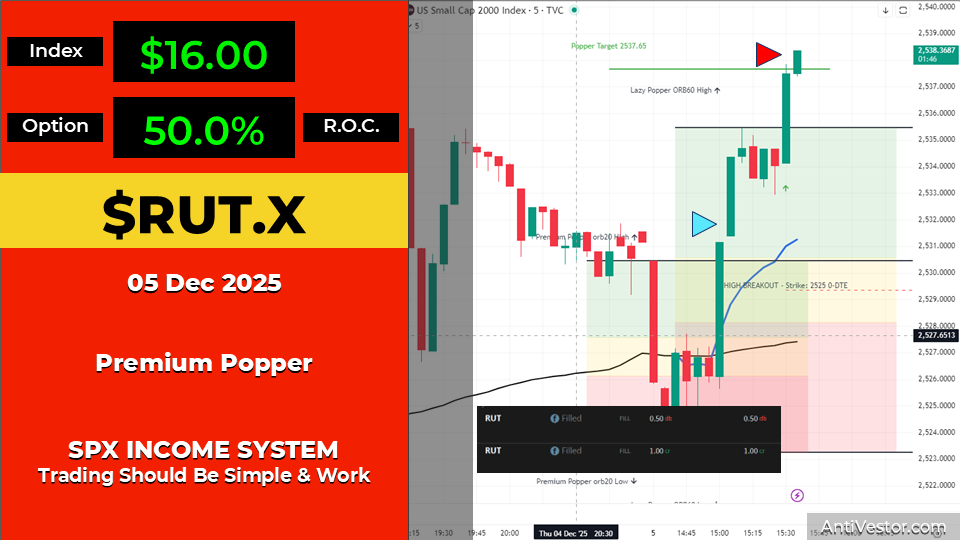

Friday December sees two classic ORB20 setups (both above 2 day VWAP as added directional bias bonus), nice quick breaks and nice quick moves, no stress no fuss fast move fast profits, SPX delivers 54.5% ROC whilst RUT delivers 50% ROC, wish they were all like this.

Two Classic ORB20 Setups

Two classic ORB20 setups both above the 2 day VWAP as an added directional bias bonus.

When you get the ORB20 setup AND price is trading above the 2 day VWAP, you’ve got directional confirmation on top of the pattern. The VWAP acts as that extra layer of bias – price above VWAP reflects bullish sentiment, and the ORB20 break gives you the entry.

Both setups had this alignment. Both setups delivered.

Current Status: Classic setups with VWAP confirmation

Nice Quick Breaks

Nice quick breaks – nice quick moves.

No hesitation. No stuttering. The breaks happened and the moves followed immediately. This is what textbook looks like – the level breaks and price commits to the direction.

SPX broke through the ORB20 High and pushed towards target 6,890.81. RUT broke through its ORB20 High and drove towards target 2,537.65.

Current Status: Clean breaks, committed moves

No Stress No Fuss

No stress no fuss – fast move – fast profits.

Compare this to yesterday’s underwater marathon where we waited hours for theta to do the work. Today? Quick in, quick out, profits banked.

Both trades executed. Both trades moved. Both trades exited profitably. Done.

Current Status: Fast execution, fast profits

Combined Results

SPX 54.5% ROC. RUT 50% ROC.

Wish They Were All Like This

Wish they were all like this.

Clean setups. VWAP confirmation. Quick breaks. Fast moves. No stress. No underwater sessions. Just execute and collect.

They’re not all like this – that’s the reality. But when they are? Appreciate it.

Current Status: Textbook day appreciated

Expert Insights

The Observation: When ORB20 setups align with price trading above multi-day VWAP, you get directional confirmation layered on top of your pattern entry. The VWAP tells you where the market sees “fair value” – trading above it reflects bullish sentiment. The ORB20 break gives you the trigger. Together, they create higher probability setups.

The Fix: Look for confluence. The ORB20 is your mechanical entry framework. The VWAP adds context and directional bias. When both align – as they did today with price above 2 day VWAP – you get the cleaner breaks and faster moves. Not every day delivers this alignment. When it does, execute and appreciate the textbook sessions.

Rumour Has It…

The Financial Nuts team reports from the newsroom…

Percy’s updating his “TEXTBOOK SESSIONS” folder. “Two classics! Both above VWAP! Quick breaks! Quick moves!” His pigeons are learning to appreciate the simple days.

Hazel’s filing today under “WISH THEY WERE ALL LIKE THIS” – a folder that doesn’t get used often enough. “No stress. No fuss. Fast profits. Filed.”

Mac’s glass today was labelled “EASY FRIDAY SPECIAL” – which he noted pairs nicely with trades that just work. “Quick in. Quick out. Weekend ready.”

Kash tallied the combined results with satisfaction: “$15 plus $16 equals $31. 54.5% plus 50% equals 104.5%. Two trades. Done.”

Wallie actually smiled: “No hours underwater? No phone call delays? Just… quick profits? This is the dream.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

IMAGE HERE

Fun Fact:

The Volume Weighted Average Price (VWAP) is considered a “benchmark” that shows where most trading activity occurred, helping traders understand whether current prices are above or below “fair value” for that session. According to Charles Schwab, “when VWAP slopes up, it indicates prices might be trending up” and traders use it as “a reference point to help make entry and exit decisions.” When price trades above VWAP, it reflects bullish sentiment – which is exactly what we saw today with both setups positioned above the 2 day VWAP before their breaks.

[Source: Charles Schwab / StockCharts – VWAP Trading Research]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.