2 Trades. 2 Wins. 1 Distracted Trader

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

You ever feel smug about spotting a perfect setup –

only to realise you read the wrong candle?

That was me Thursday morning: high on system rules, low on attention span.

Turns out, the 15-min Premium Popper bar closed dead-centre.

No trade.

But wait 5 mins?

The 20-min bar closes bottom 40% and gives the green light.

$1.20 in → $0.60 out.

Boom. 50% ROC.

Later in the day, Lazy Popper shows up, slaps down $5 in premium, and quietly exits for 10 cents after 2pm.

98% ROC.

You can read the Full Trade DeBriefing here

And I wasn’t the only one – My AntiVestor Crew is smashing the Wall of Wins

The week now sits at 9 of 10 wins across the system –

Even without the swing, this thing is printing.

Now, let’s look at what Friday might bring…

Keep reading for trade anatomy.

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

SPX Market Briefing:

The Head & Shoulders pattern that’s been quietly forming all week is looking more believable now.

A rough right shoulder may be developing – as flagged in Monday’s Briefing and in the Fast Forward calls.

But here’s the important part: each time we gap up, we close lower.

The pattern is consistent – and Thursday did it again.

The following day’s behaviour?

A drop. A gap. A breakdown. Sometimes all three.

Enter Friday – we’ve now got:

-

A new bearish Tag ‘n Turn on the 30-min

-

A wide No Action Zone

-

A PFZ looming way above 6390

-

And a contracting BBW, which suggests we’re inching toward another range environment.

The big wildcard? Breadth.

The ADD is holding in no-man’s land – meaning either direction could erupt at the open.

If it bursts higher – we could visit the PFZ.

If it flushes – this right shoulder could drop hard.

Either way, we’ve seen this setup before.

Let the system lead.

I’m watching for:

-

A Premium Popper at the open

-

A possible Lazy Popper into the close

-

And a patient eye for what the next real swing might look like.

In Other News…

☕ Markets, hold my latte: we’re rallying on boredom

1) Tape @ 03:05 ET — the “is this thing on?” rally

S&P 6,378 +0.07%. NDX +0.11%. Dow +0.06%. Overnight ranges tighter than a CFO’s expense report (<0.3%). Thursday finished meh; pre‑market says “fine, have a relief bid then.”

2) Rotation — oil face‑plants, transports order dessert

Energy is the class dunce as crude heads for a 4–5% weekly drop. Cheaper fuel = happier trucks, planes, and any stock that cries when Brent sneezes—provided the dollar keeps sulking. Japan’s pop keeps tech perky; the rest of Asia said “you first,” and hid behind selective positioning.

3) Earnings & events — Goodyear at 08:30, bring your tariff swear jar

Headliners: Goodyear’s call plus a gaggle of small caps. What to listen for: tariffs, freight, and “how much FX pain did the softer dollar actually cancel?” Expect creative accounting meets creative vocabulary.

4) Cross‑asset spice — rate‑cut cosplay, gold gets a passport stamp

Miran’s nomination + Waller chatter juiced cut odds; JPM is out with four starting September. Softer dollar props metals; gold gets a policy glow‑up as tariff drama kisses Swiss bars. Translation: backdrop stays friendly into September—unless incoming data flips the script and throws the projector.

TL;DR

Tiny bid. Cheaper oil. Dollar on the back foot. Cuts narrative humming. Trade it like it’s fragile optimism wrapped in bubble wrap—and keep one finger on the eject.

Expert Insights:

BBW Contraction ≠ Range Just Yet

Bollinger Band Width is narrowing, yes – but we haven’t hit the pinch point yet.

Until we do, treat the setup as post-trend drift, not consolidation.

→ What to Do: Use BBW to guide setup selection – go to Range mode only when the system says so.

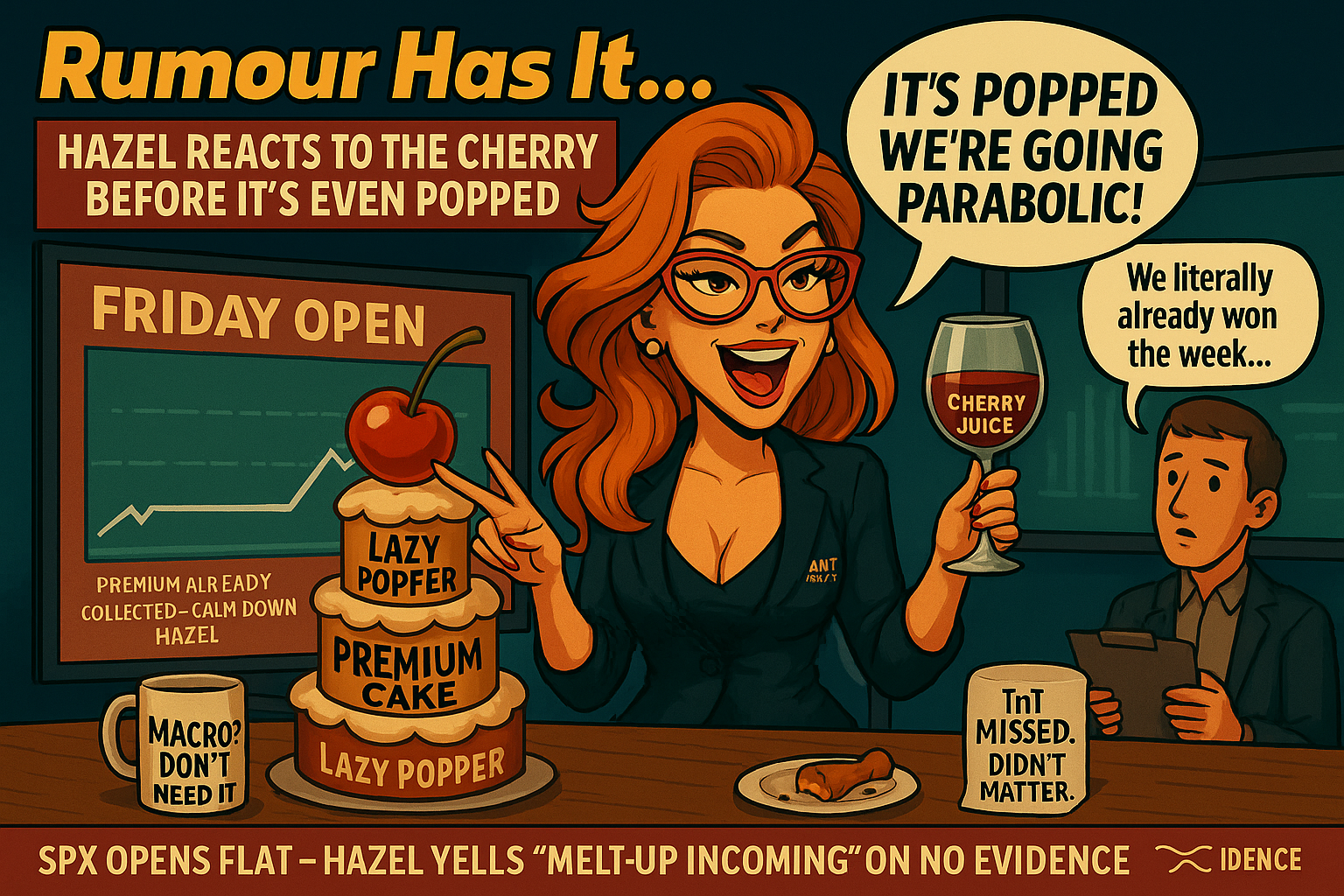

Rumour Has It…

Friday’s Cherry Popper Setup May Be Literal

Sources inside the AntiVestor trading bunker claim someone brought in an actual cherry pie to celebrate the Lazy Popper’s 98% ROC.

“Was it gluten free?” asked one confused intern.

“Does it matter?” said the trader while closing his $5 to $0.10 buyback.

Tune in for Monday’s post-pie diagnostics.

Disclaimer: Some traders were harmed by excessive pastry.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The term “pinch point” isn’t just a trading thing – in engineering, it’s a critical failure zone in structural stress.

In trading, we use it for the same reason: something’s about to give.

[Source: Engineering Toolbox – “Pinch Points and Pressure Zones”]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.