New Day, Familiar Pattern? Watch For Gap And Grind Repeat Today

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

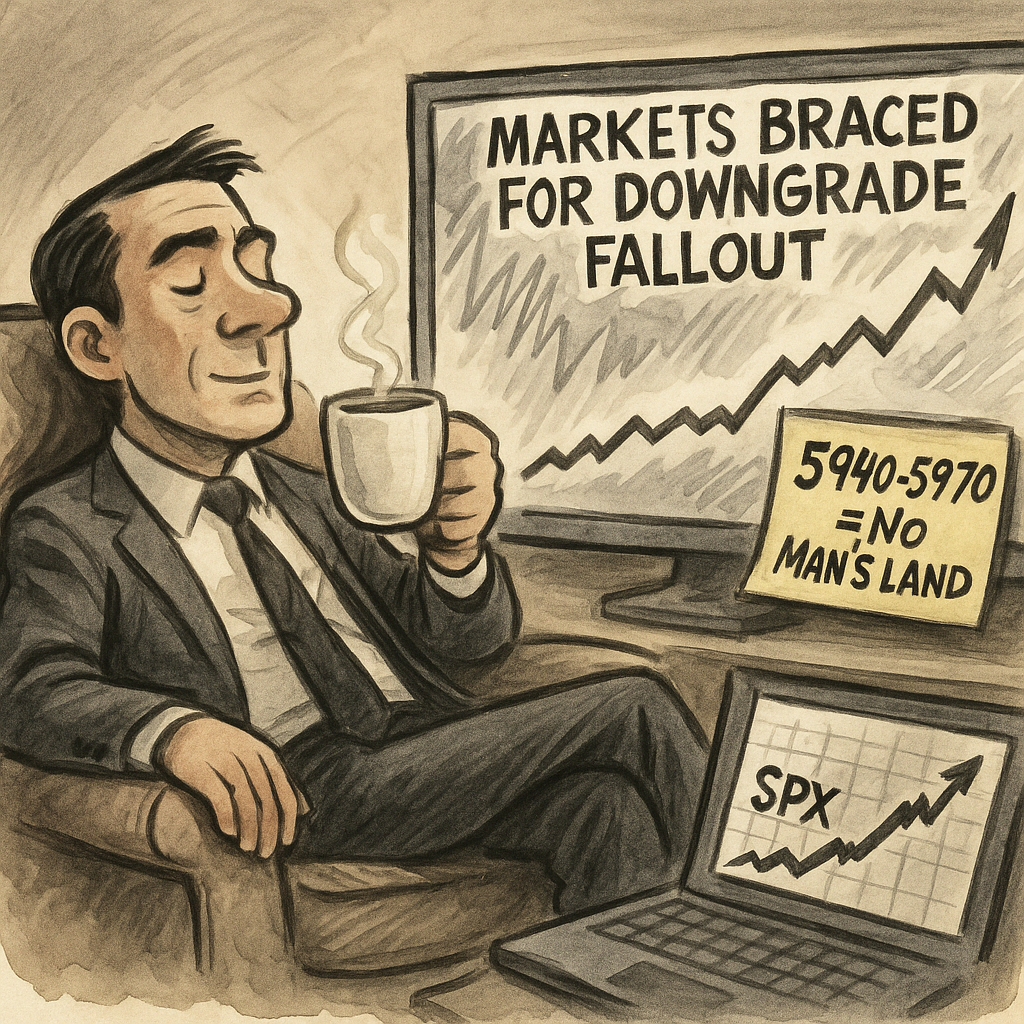

Well folks, that Moody’s downgrade? Completely shrugged off. Monday’s session powered higher like it never happened – another great reminder that headlines don’t move the market, price does.

If you followed Monday morning’s guidance to wait it out? You were rewarded with clean exits on both the BnB overnight trade and the open Friday swing – without breaking a sweat.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market Briefing

The system continues to reward patience.

Futures this morning are off about 20 points – nothing major – and that opens the door for a repeat of yesterday’s playbook: small gap down, grind higher, and another slow-motion rally back into strength.

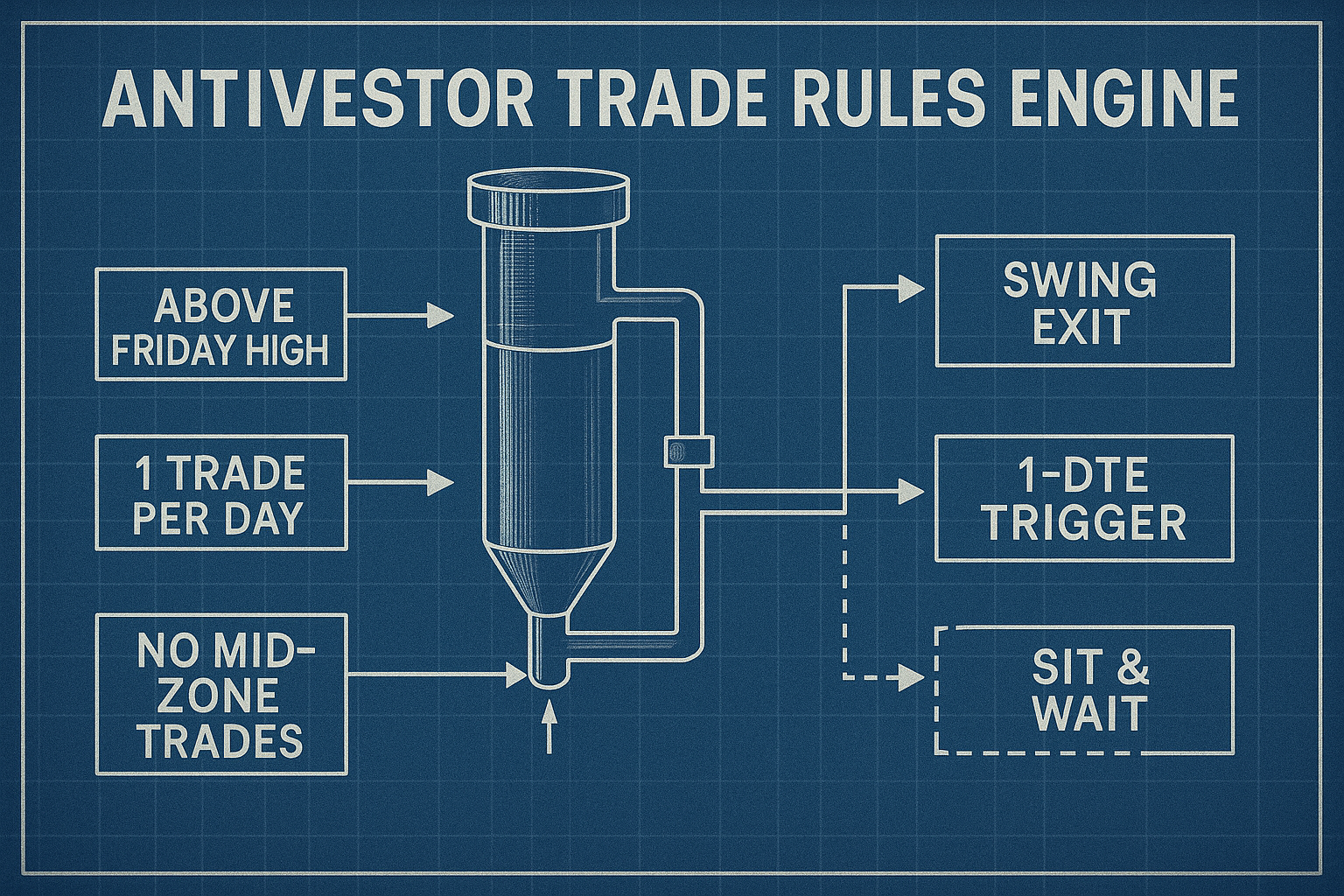

Yesterday’s TnT setup into the afternoon looked tempting, but true to form, I didn’t touch it. One trade per day is enough. That habit saved me from flipping bearish too early and getting caught flat-footed during the late-session rip higher.

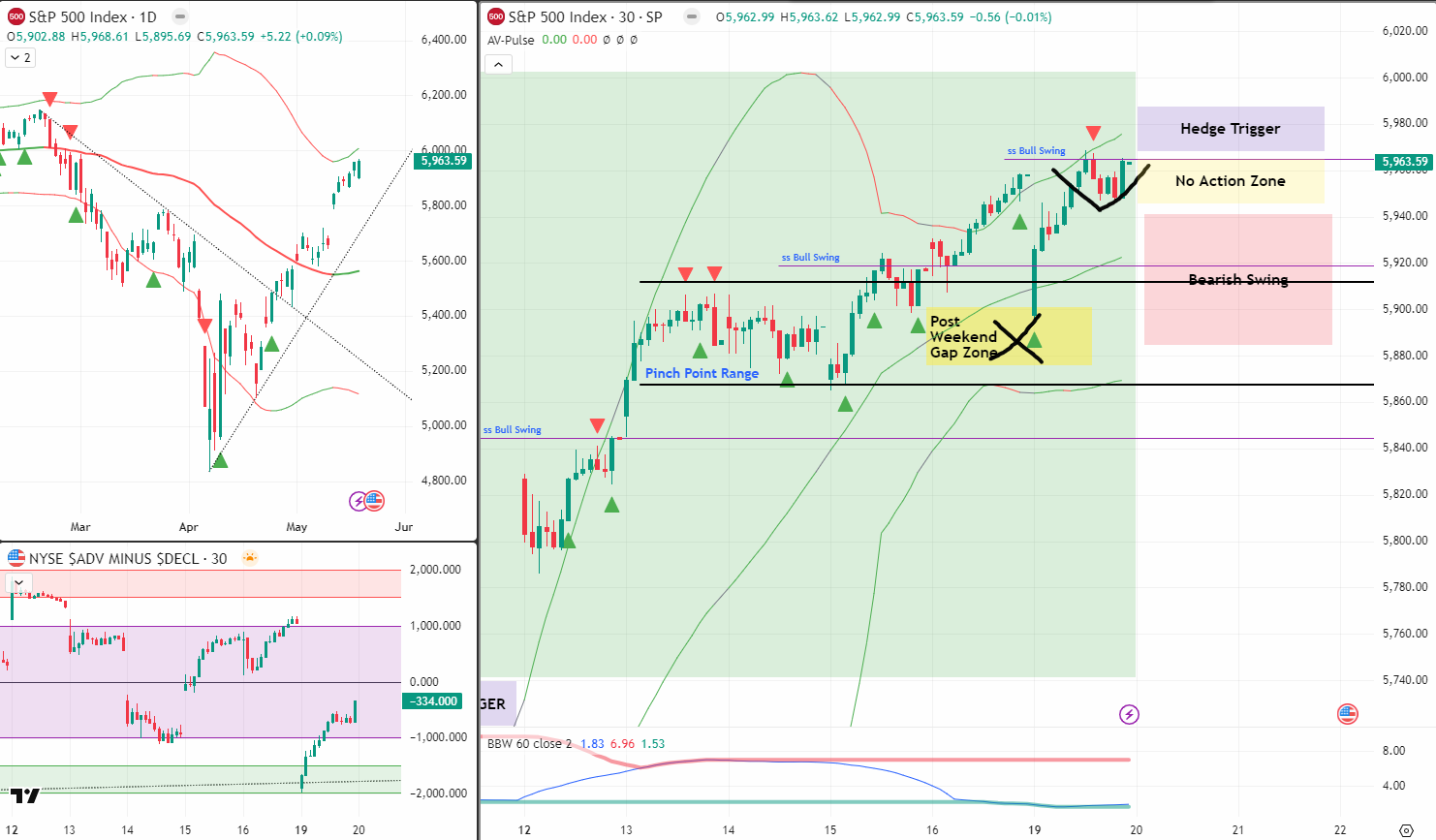

Now that we’ve got a new V-shaped reversal pattern on the books, I’m drawing fresh lines in the sand:

-

Bearish below 5940

-

Bullish above 5970

-

Do nothing between those two levels

This gives us a clear playbook for the day – wait for the break, follow the rules, and don’t chase.

Yesterday, with both my BnB and swing trades wrapped up nicely, I used the system’s new morning pulse bar signals to:

-

Enter a new bull swing trade

-

⏳ Initiate a new 1-DTE credit spread, only after price confirmed above Friday’s prior entry.

That’s how we keep compounding into profitable moves – not hoping, not guessing, just trading the rules.

Today? I’ll sit back and see how the market wants to open. If the new bulls get traction, great. If not, I’ll know exactly where to flip – no panic needed.

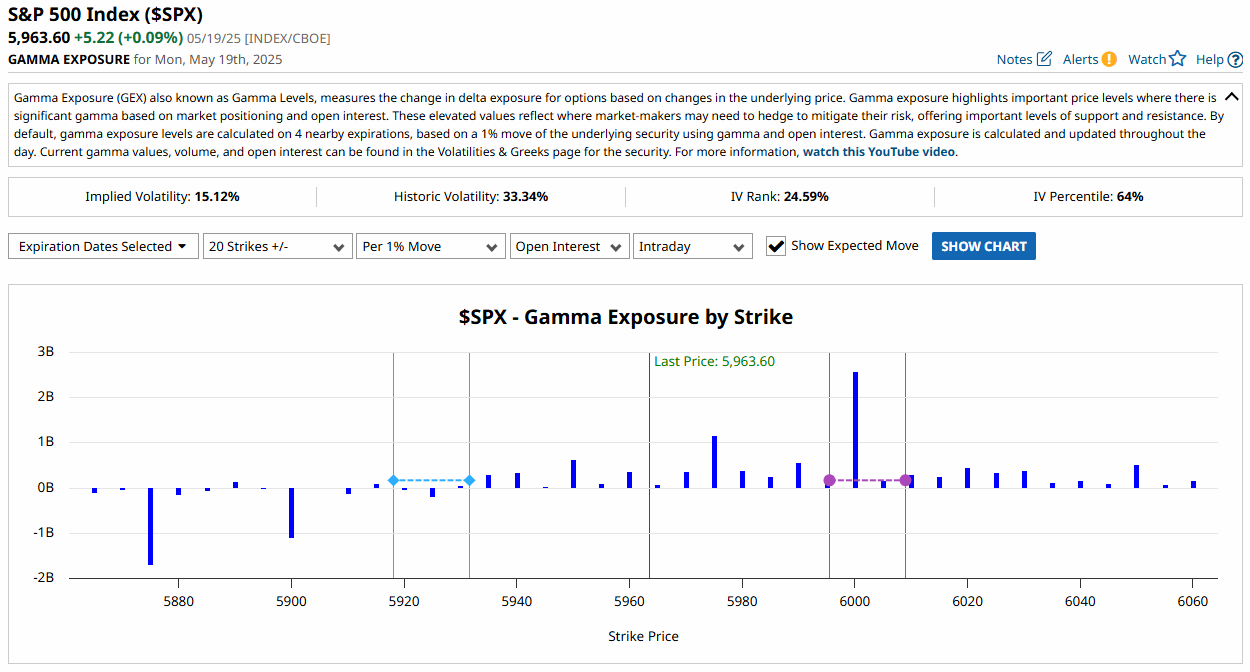

GEX Analysis Update

- 6000 the main positive gamma level

- 5925 the Flip point for the week

Expert Insights:

Mistake: Over-trading intraday setups after a morning win.

Why it hurts: Even solid setups like TnT can fail if the system already gave you a clean win.

Solution:

-

One trade per day = enough

-

Use late-day price action to mark structure, not chase new entries

-

Let clean levels like 5940 and 5970 define your next move

Rumour Has It…

FinNuts reported that “markets braced for fallout” after the downgrade. Markets responded with: “What downgrade?”

Meanwhile, over in AntiVestor land – trades got exited, new ones set up, and nobody needed a second screen.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

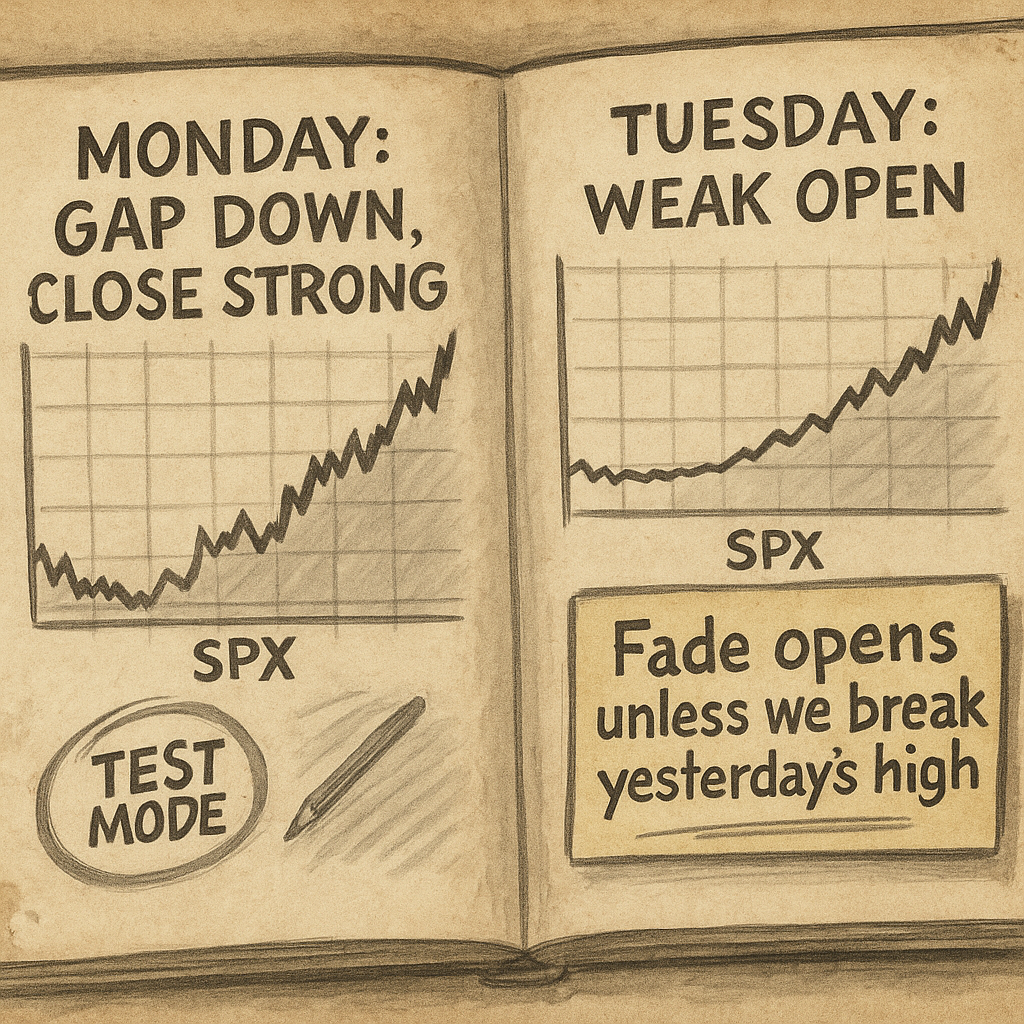

When SPX closes near session highs after a news-driven gap down, the next day’s opening gap is more likely to be faded than followed – unless it clears the prior day’s high within the first 60 minutes.

This means if today opens weak, that’s not immediately bearish. It’s more likely just digestion.

Until we’re above yesterday’s high or below your defined support zone, price is in test mode – not trend mode.

Meme of the Day

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.