Tech Earnings, Trump-Xi Meeting, Quarter-Point Cut – Markets Front-Run Everything Simultaneously

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

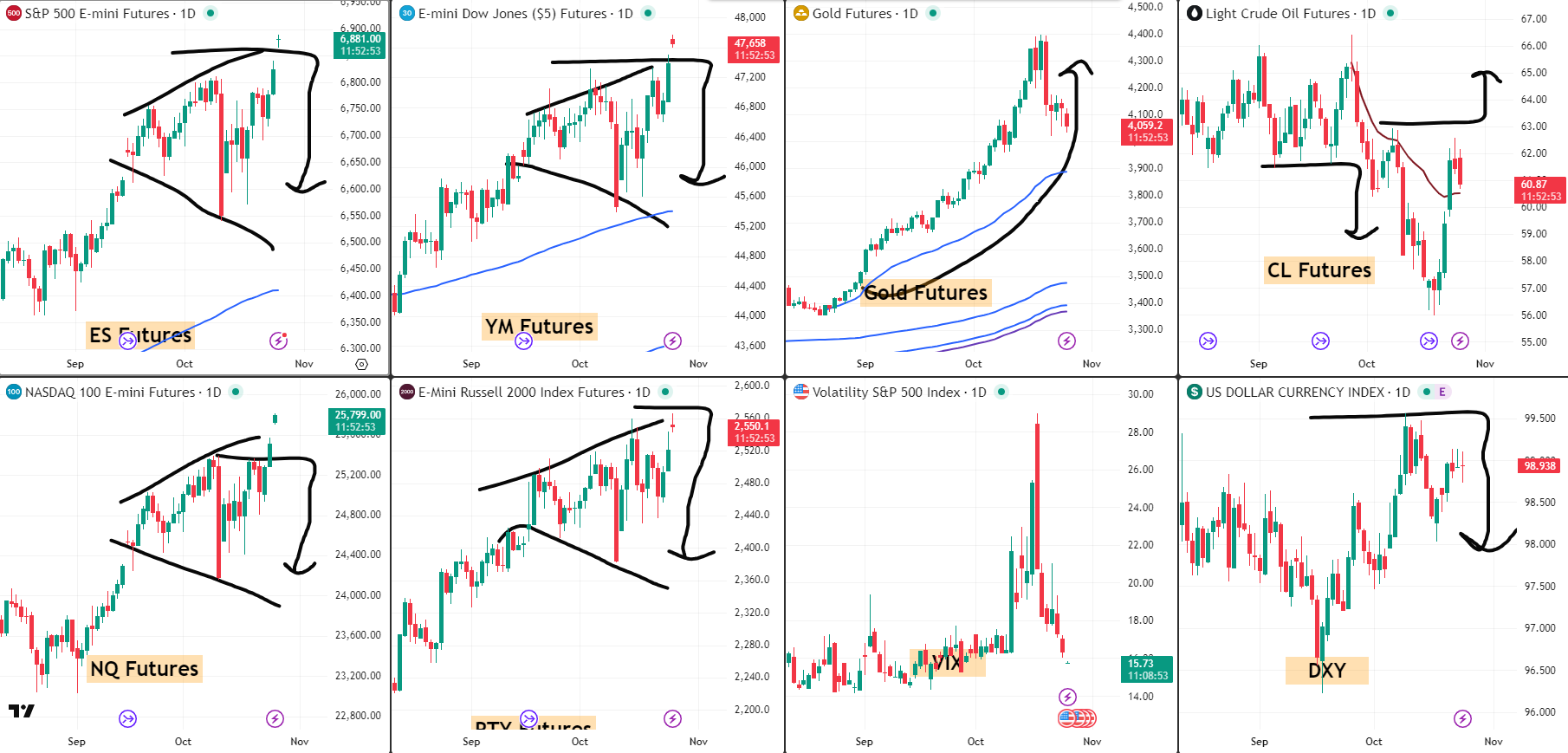

The week starts with a proper bang. US stock futures advanced overnight as investors gear up for what might be the most pivotal week of the quarter – expected Federal Reserve interest rate cut, major tech earnings from Apple, Amazon, Alphabet, Meta, and Microsoft, plus a high-stakes meeting between President Donald Trump and Chinese President Xi Jinping.

Markets have nearly fully priced in a quarter-point rate reduction after Friday’s cooler-than-expected inflation data. Traders are simultaneously front-running tech earnings, trade deal hopes, and Fed dovishness all at once.

Is this a clear case of buy the rumour sell the news?

Guess we’ll find out soon enough.

Overnight futures popped higher on the back of the on-again-off-again trade deal news and that fully priced-in rate cut. Will these run-away gaps continue to defy gravity, or are we finally due for some gravitational reality?

The gold bugs still look excitable, but that $50 overnight drop may be suggesting the dip isn’t yet over. The only thing that looks remotely normal is crude oil – which reacted off YTD VWAP and just swept the prior swing high before the breakout move.

“Lower oil” has been promised. Will the King Taco Deliveroo it?

Keep scrolling for the patient positioning strategy…

Friday Patience Proved Perfect. Monday Gets Same Treatment. Hindsight Validates Standing Aside.

SPX Market Briefing:

Monday arrives with overnight futures gapping higher on trade optimism and Fed certainty, kicking off the most event-dense week of the quarter whilst systematic traders assess whether to participate or spectate.

Current Multi-Market Status:

- SPX: Bear TnT, bullish above flipped (6801.21), at NATHs (6808.58), patient stance maintained

- RUT: Bear TnT, bearish below 2518.66, watching for setup clarity

- ES/YM/NQ/RTY: Upper range at NATHs territory, overnight gap higher

- CL: Around $60.98, looks “normal” – reacted off YTD VWAP, swept prior swing high, stop running behaviour

- GC: $4100 area with $80+ overnight drop despite excited bugs

- VIX: 19.73, relatively calm despite pivotal week setup

- DXY: 98.938, contained

The Week That Could Move Everything

This isn’t just another week. This is THE week where multiple major catalysts converge simultaneously:

Wednesday 29 October:

- Federal Funds Rate decision (4.00% forecast vs 4.25% current)

- FOMC Statement

- FOMC Press Conference (2:30pm)

Markets have fully priced in the quarter-point cut. No surprise expected. But Powell’s commentary? That could move things.

Tech Earnings Parade:

- Apple

- Amazon

- Alphabet

- Meta

- Microsoft

Five of the largest market-cap companies reporting simultaneously. Combined market influence is staggering. Any earnings misses or forward guidance disappointments could crater the entire complex.

Trump-Xi High-Stakes Meeting:

- Trade deal on-again-off-again drama

- Markets front-running positive outcome

- Overnight gap higher on optimism

Classic setup for “buy the rumour, sell the news” scenario.

Thursday 30 October:

- Advance GDP q/q (3.0% forecast vs 3.8% previous)

Friday 31 October:

- Core PCE Price Index m/m (0.2% forecast)

- Employment Cost Index q/q (0.9% forecast)

Everything that could move markets is happening this week. Simultaneously. and more so because of the government shut down and a very dry reports month.

Current Status: Pivotal week setup, multiple catalysts, markets front-running outcomes

Friday’s Patient Stance – Validated By Hindsight

Given the surprise pop higher to start the week, I may take the same stance as last Friday’s gap higher and be patient, standing aside.

That Friday advice? Absolutely perfect with benefit of hindsight.

Markets gapped up Friday morning. Patient systematic traders stood aside. Watched. Assessed. Refused to chase. And avoided the whipsaw that followed.

Sometimes the best trade is no trade. Sometimes discipline means spectating whilst others chase gaps.

I’ll have to take the same viewpoint and assess things as markets open, but once again I’m expecting to be inactive on swings and the popper strategies.

Patience validated. Strategy reinforced. Standing aside remains brilliant.

Current Status: Patient positioning, assessing at open, expecting inactivity on swings/poppers

Run-Away Gaps Defying Gravity

Overnight futures have popped higher. Again. ES gapping up. NQ following. YM along for the ride.

These run-away gaps just keep happening. Each time, markets front-run the next catalyst. Trade deal hopes? Gap up. Fed cut priced in? Gap up. Tech earnings optimism? Gap up.

Eventually, physics demands a correction. Eventually, gravitational reality asserts itself. Eventually, the gap-chasers get burned.

But when? That’s the question systematic traders refuse to guess about.

We don’t predict tops. We respond to price action with mechanical rules.

Current Status: Run-away gaps continuing, gravity still suspended, patience maintained

Gold Bugs Excited But Reality Dropping $50

The gold bugs remain excitable around $4100, but that $50 overnight drop may be suggesting the dip isn’t yet over.

Psychological level testing continues. $4000 held. Rally attempted. $4100 area reached. Then… $50 drop overnight.

Classic behaviour when markets front-run outcomes before confirmation. Gold rallied on inflation concerns and Fed dovishness expectations. Now that quarter-point cut is fully priced? Some profit-taking appears.

Current Status: Gold bugs still excited, $50 drop suggests dip continuing, psychological levels testing

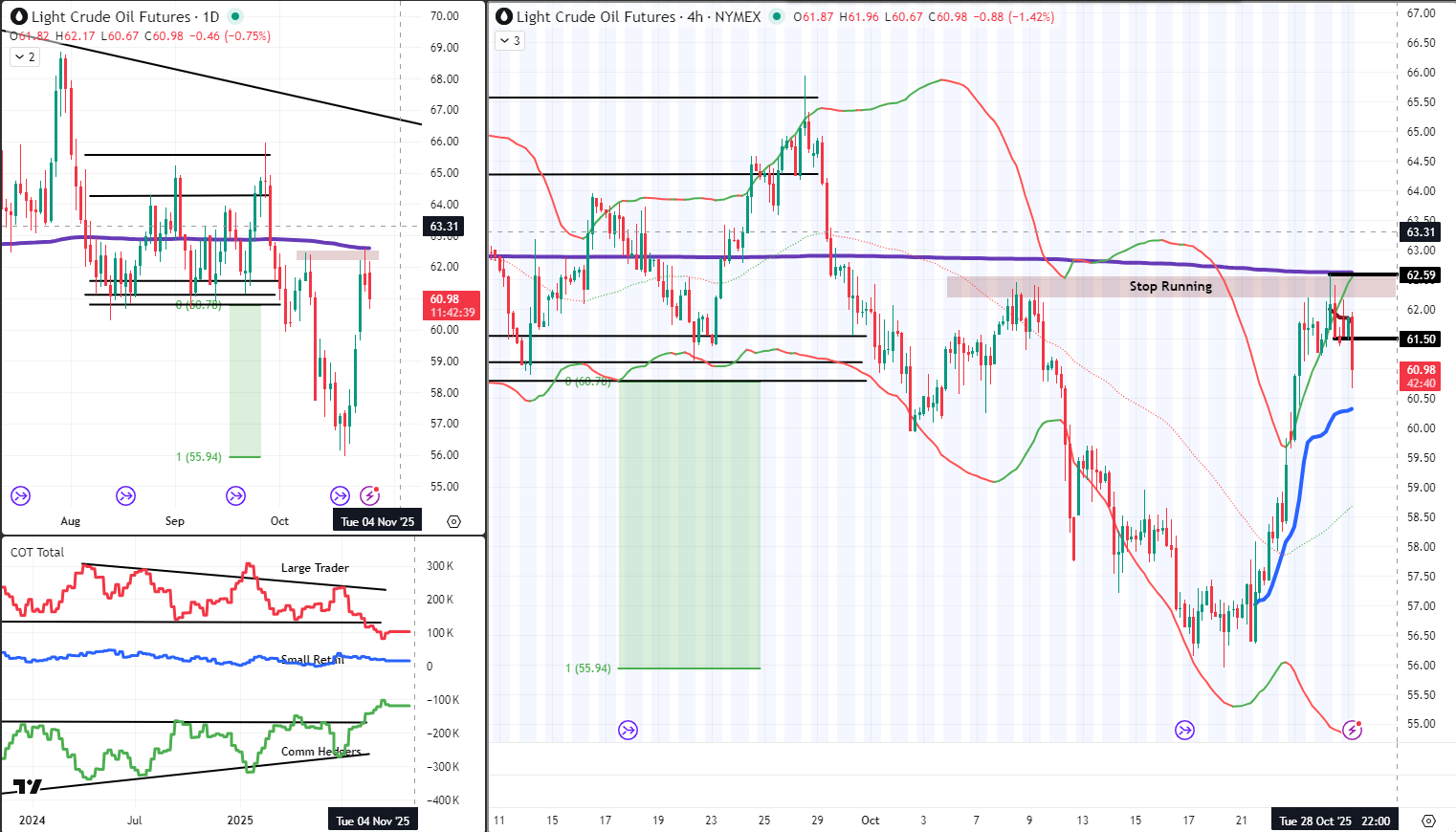

Crude Oil – The Only Normal-Looking Market

Here’s what’s properly fascinating: The only thing that looks remotely normal is crude oil.

CL reacted off YTD VWAP. Swept the prior swing high before the breakout move. Classic stop-running behaviour. Textbook technical action.

Everything else is gapping, front-running, defying gravity. But crude? Just doing normal market things with logical technical levels and systematic behaviour.

“Lower oil” has been promised by the powers that be. Will King Taco Deliveroo it, or just tease?

I may take a peek at oil futures as the slide looks like it’s about to get even more slippery. For now, my swing from Friday is just fine, and a little fun on the shorter timeframes using popper tactics may be what we need.

Current Status: CL showing normal behaviour, stop running complete, swing from Friday holding, shorter timeframe poppers possible

The Patient Positioning Philosophy

Given everything – the overnight gap, the pivotal week setup, the fully priced catalysts, the run-away behaviour – systematic discipline suggests:

Stand aside on swings. Be selective on poppers. Assess at open.

This isn’t fear. This isn’t bearishness. This is mechanical risk management when markets front-run multiple catalysts simultaneously before any confirmations arrive.

Friday’s patient stance proved perfect. Monday gets the same treatment. If opportunities develop that meet systematic criteria? Execute. If not? Spectate without regret.

My swing from Friday remains fine. Shorter timeframe popper tactics on specific setups may provide opportunities. But chasing overnight gaps into a week this loaded with catalysts?

That’s not systematic trading. That’s hope disguised as strategy.

Current Status: Patient positioning maintained, selective participation only, no regret spectating

In Other News…

Records Friday. Rally Monday. Reckoning Imminent.

Wall Street’s walking on air, probably because it’s forgotten about gravity.

S&P futures +0.7% to 6,880. Nasdaq +1.0%. Dow +265 points.

Friday’s record close — Dow 47,207 — has traders declaring victory before earnings even start.

VIX 15.74, lowest since August, meaning fear’s now roughly equivalent to losing your charger before a flight.

Apparently, the market’s collective IQ drops 10 points every time Powell says “soft landing.”

️ Rotation: Everyone’s Invited to the Optimism Party

Friday’s rally was so broad even utilities felt cool for a day.

Cooler CPI cemented the Fed’s “we’re cutting soon, probably” narrative, and optimism spread like caffeine at Percy’s desk.

Tech led ahead of Magnificent 7 earnings.

Healthcare jumped after Novartis splurged $12B on Avidity — the decade’s biggest pharma M&A, or as Wallie calls it, “finally finishing a project.”

Copper ripped higher on global growth bets, industrials bid on trade hopes, and energy slipped, proving even optimism occasionally runs out of fuel.

Earnings Week: The Confession Marathon Begins

This week:

-

Alphabet Tuesday

-

Microsoft & Meta Wednesday

-

Apple & Amazon Thursday

Basically, one continuous therapy session for Big Tech.

Together they’ve racked up $56B in quarterly capex, up 52% YoY, and now investors want proof that all those data centres print money instead of just memes.

Meta +66.5% YTD — market darling.

Apple +25.8% YTD — respectable, but apparently not enough to buy new excitement.

Earnings growth +19% sounds heroic until you remember it’s the slowest in six quarters — like Hazel calling it an “early night” at 2AM.

⚖️ Cross-Asset Vibes: The Optimism Olympics

Yield curve steepened — 2Y 3.47%, 10Y 4.01% — signalling confidence in two more cuts this year.

Gold steady $4,083 (+48.7% YoY), oil $61.98 (-17% YoY), proving commodities are having their own identity crisis.

Copper surging bets on Chinese stimulus and trade peace simultaneously — because why pick one fantasy when you can believe both?

Options traders are back in full FOMO mode, loading up on tech calls like it’s 2021 and risk management’s still optional.

VIX curve flattened, the market equivalent of shouting “YOLO” in an earnings week.

☕ Hazel’s Final Thought

Markets are euphoric. Tech’s on trial.

And the Dow’s acting like it just discovered caffeine and forgiveness in the same morning.

The rally’s real — for now.

But earnings week always starts with cheers and ends with accountants quietly reaching for the whisky.

— Hazel Ledger,

FinNuts Bureau of Euphoric Denial and Scheduled Reality Checks

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Buy Rumour Sell News Formation Flying” whilst claiming they had mastered “Systematic Patience During Fed Week Front-Running With Multiple Catalyst Gap-Up Advanced Cooing.”

Hazel updated her crisis management protocols to include “Pivotal Week Positioning Procedures” alongside emergency plans for “Patient Stance Validation Through Friday Hindsight Integration With King Taco Oil Deliveroo Monitoring.”

Mac raised his Monday morning whisky and declared, “When markets front-run Fed cuts, tech earnings, and Trump-Xi meetings simultaneously whilst gapping higher, the proper response is obviously patient spectating!”

Kash attempted livestreaming about “run-away gaps being basically like DeFi protocol parabolic pumps but with actual gravitational reality eventually” but got distracted wondering if King Taco would actually deliveroo lower oil.

Wallie grumbled that in his day, markets fell “with proper conviction rather than this modern gravity-defying nonsense with fully-priced catalysts and overnight gap-up frustration!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

️ NYSE Seats Cost $4 Million for Non-Existent Chairs

A “seat” on the New York Stock Exchange sold for over $4 million in 2005—despite there being no actual chairs involved, just trading privileges!

The most expensive furniture in financial history was completely imaginary! NYSE “seats” were trading memberships that gave you the right to trade on the exchange floor, but despite the name, no actual seating was provided.

These invisible chairs cost more than most people’s lifetime earnings, reaching a peak price of $4 million in 2005 before the exchange went public. The irony was perfect: you paid millions for a “seat” and then had to stand all day in a chaotic trading pit, screaming at other people while waving pieces of paper.

It was like paying country club membership fees to work in a factory! The trading floor was so hectic that actual chairs would have been trampled, ignored, or weaponized during busy market days. When the NYSE finally went public in 2006, these million-dollar memberships became regular stock shares, instantly making the transition from exclusive club to public company.

Today’s electronic trading happens from comfortable office chairs that cost about $500, proving that sometimes progress means trading imaginary expensive seats for real affordable ones!

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.