Crude Slips Lower Targeting $60 – Break Opens $56 Low Revisit

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

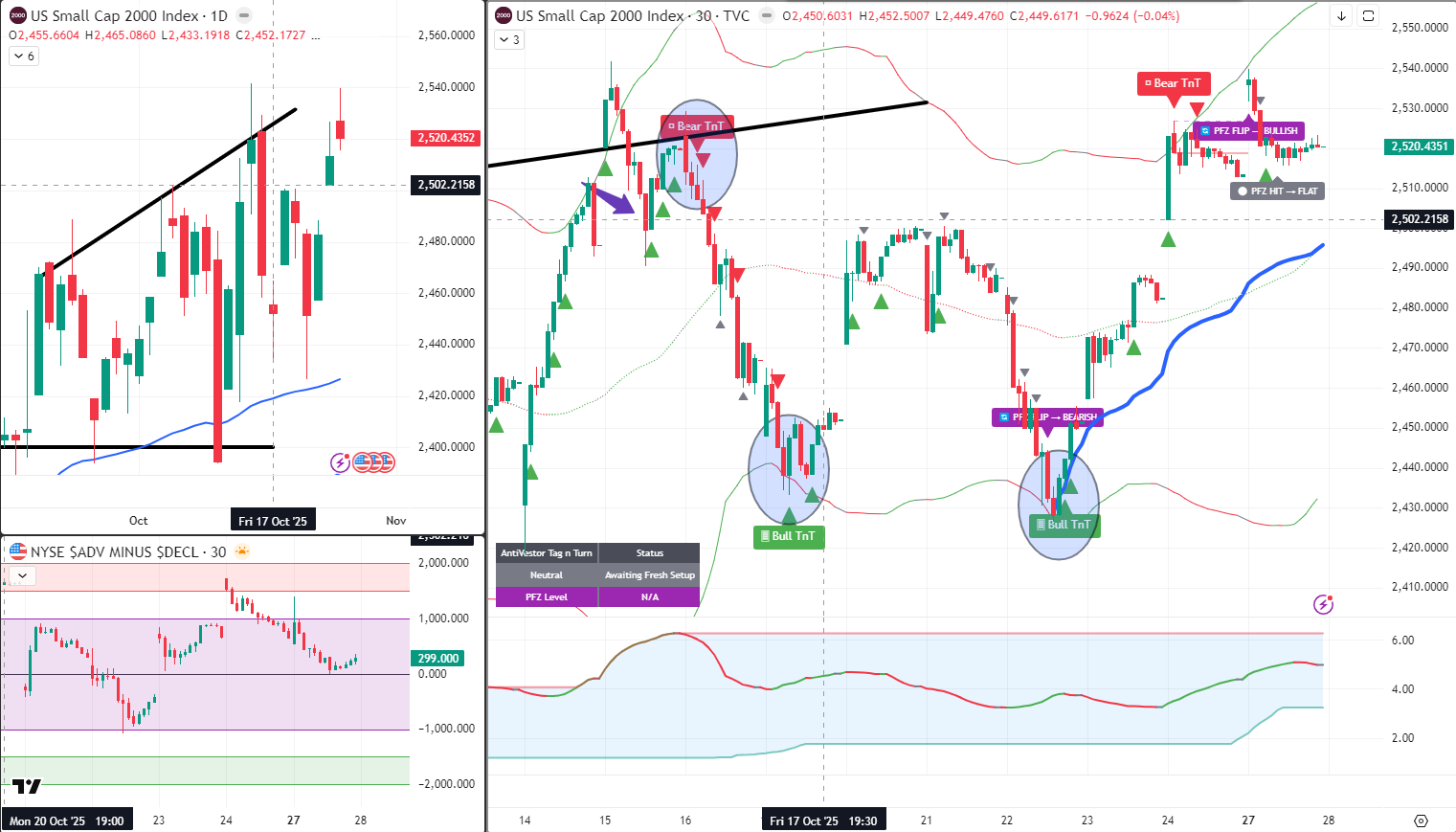

A new day and the NATHs are holding – for the moment. Uncle Russell’s expanding triangle pattern is holding fast, which could well be the precursor for the other main indexes to eventually follow suit. I suspect a more news-driven reaction from this week’s varied items will no doubt trigger the next moves.

I’m still of a mind that this is a Buy The Rumour Sell The News type of event. BTRSTN for short, because apparently everything needs an acronym these days.

Regarding the usual setups on my Tag n Turn swings on SPX and RTY, my decision to sit and wait was both right and wrong. Wrong on SPX as prices flipped and ripped (which could still be short-lived). Over on RUT, that decision to wait worked out fine.

In both cases, saving myself the frustration of flipping bear to bull to bear and bull is avoided. A little patience and common sense is winning the day for me – even if it means missing some moves.

The Premium Poppers worked out just fine with SPX pushing higher and RUT pushing lower. This divergence is affirming the BTRSTN possibility.

Keep scrolling for the expanding triangle drama…

Patience Validated On RUT. SPX Flip Missed. Premium Popper Divergence Affirms BTRSTN.

Market Briefing:

Tuesday continues Fed week build-up with NATHs holding temporarily whilst Uncle Russell’s expanding triangle pattern suggests potential trouble ahead for all indexes if news-driven catalysts don’t deliver.

Current Multi-Market Status:

- SPX: Bear TnT, bullish above flipped (6901.21), at NATHs (6877.28/6875.15), FFZ Level 6790.33

- RUT: Bear TnT, FFZ FLIP = FLAT, neutral awaiting fresh setup, patient stance validated

- ES: 6906.50, continuing upward grind

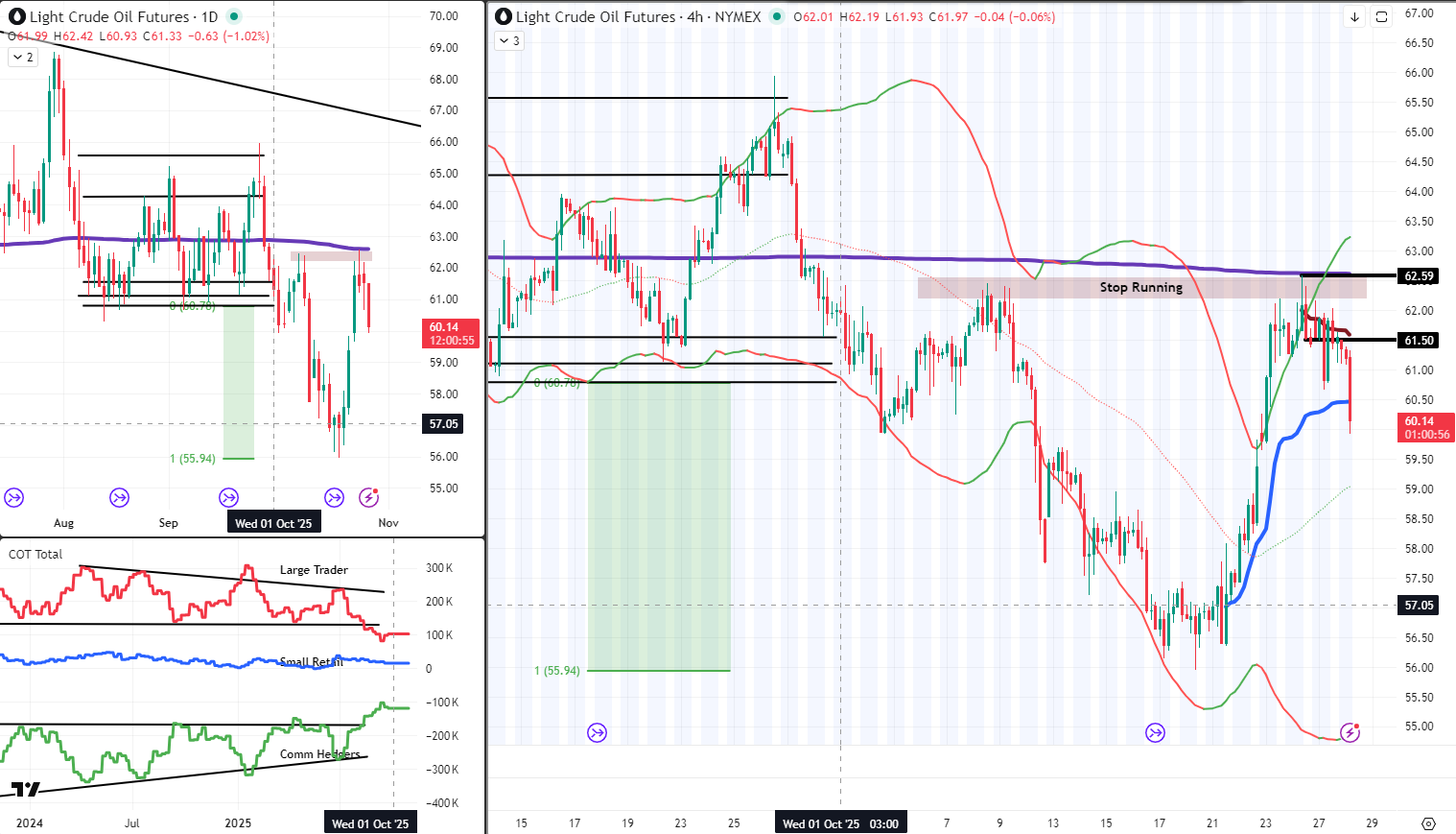

- CL: Around $60.14, slipping lower, targeting $60 break for $56 revisit

- GC: Flushed to July AVWAP support (~$3923), likely rest period incoming

- VIX: 15.87, remarkably calm for Fed week

- DXY: 98.099, contained range

Uncle Russ’s Expanding Triangle – Precursor Warning

Here’s what’s properly fascinating: Uncle Russell’s expanding triangle pattern is holding fast. This technical formation often acts as a precursor for other main indexes to eventually follow suit.

Expanding triangles typically signal indecision and volatility building beneath the surface. Price action widens with each swing, creating larger ranges as neither bulls nor bears establish clear control.

When one major index develops this pattern whilst others continue grinding higher? That’s divergence. And divergence eventually resolves – usually not in favour of the grinders.

RUT showing this behaviour whilst SPX and NQ push to new highs? Classic setup for either RUT to suddenly catch up (bullish resolution) or the other indexes to roll over and join RUT’s uncertainty (bearish resolution).

Given this week’s news-heavy calendar, I suspect a more news-driven reaction from the varied items will trigger the next moves. The expanding triangle is coiling. The catalysts are approaching. Something will break the pattern.

Current Status: Uncle Russ expanding triangle holding, potential precursor for other indexes, news-driven triggers approaching

Patient RUT Stance Validated, SPX Flip Missed

Regarding the usual setups on my Tag n Turn swings on SPX and RTY, my decision to sit and wait was both right and wrong:

Wrong on SPX: Prices flipped and ripped higher. The Bear TnT flipped bullish above 6901.21. Markets pushed to fresh NATHs. Standing aside meant missing the move.

But here’s the thing – that move could still be short-lived. We’re grinding into Fed announcement territory with everyone front-running the quarter-point cut. If BTRSTN plays out, this rip becomes a trap.

Right on RUT: That decision to wait worked out fine. Uncle Russell’s expanding triangle continues developing. No clean setup emerged. Patient stance prevented getting chopped around in widening ranges.

In both cases, saving myself the frustration of flipping bear to bull to bear and bull is avoided. A little patience and common sense is winning the day for me – even if it means missing some moves.

This is systematic trading’s beautiful reality: You won’t catch every move. But you’ll avoid emotional whipsaws, preserve capital during uncertainty, and maintain discipline when setups don’t meet criteria.

I’d rather miss a move with patience than catch a move with frustration.

Current Status: RUT patience validated, SPX flip missed but frustration avoided, common sense approach maintained

Premium Popper Divergence – BTRSTN Confirmation

Here’s where things get properly interesting: The Premium Poppers worked out just fine with SPX pushing higher and RUT pushing lower.

This divergence is affirming the BTRSTN possibility.

Think about it: SPX grinding to new highs on Fed optimism and trade deal hopes. RUT showing expanding triangle weakness and lower price action. Classic internal divergence suggesting the rally lacks broad participation.

When large caps push higher whilst small caps struggle, that’s selective strength – not market-wide conviction. When Premium Poppers profit from both directions simultaneously, that’s confirmation of divergent behaviour.

If this truly is a Buy The Rumour Sell The News setup, we’d expect exactly this pattern: Front-running optimism pushing majors higher whilst underlying weakness appears in breadth indicators and smaller indexes.

Wednesday’s Fed announcement could be the catalyst that resolves this divergence. Either RUT catches up (bullish), or SPX rolls over (bearish). But divergence doesn’t persist indefinitely.

Current Status: Premium Popper divergence working both directions, BTRSTN setup affirmed, resolution approaching

Gold Flushed to July AVWAP – April Redux Incoming?

Gold continues to be flushed down the sluice right to its most recent AVWAP line from the July lows and the start of the last move higher.

Currently around $3923, testing that critical support level. If this holds, I don’t necessarily see an automatic buy opportunity emerging.

I do think we’ll see prices rest in much the same way we saw back in April this year.

April’s behaviour: Gold consolidated sideways for weeks after testing support. No immediate rally. No capitulation breakdown. Just patient base-building and range-bound consolidation whilst markets absorbed information.

Same setup appears to be developing now. AVWAP support from July provides technical foundation. But rather than bouncing immediately, expect prolonged consolidation as gold digests the recent flush and establishes new equilibrium.

The gold bugs remain excitable, but excitement doesn’t create automatic buying opportunities. Patience and proper setup criteria do.

Current Status: Gold at July AVWAP support (~$3923), April-style consolidation likely, no automatic buy signal

Crude Slips Lower – $60 Break Opens $56 Door

Crude oil is slipping lower and pushing away from the prior resistance levels previously noted. Currently around $60.14, approaching critical decision territory.

If we can see the $60 level firmly taken, a revisit of $56 lows seems likely.

The technical setup supports further downside: YTD VWAP resistance held. Prior swing highs got swept in classic stop-running behaviour. Now price is testing the next significant support level.

Break below $60 with conviction opens the door to $56 – roughly a 6-7% additional decline from current levels. That’s meaningful movement in crude, creating opportunities for systematic traders with proper risk management.

King Taco’s “lower oil” promises may actually deliveroo this time. The chart certainly suggests downside continuation if $60 fails to hold.

My swing from Friday remains in play. Watching for $60 break to potentially add exposure or adjust positioning depending on how price action develops.

Current Status: CL slipping toward $60, break opens $56 revisit, swing from Friday holding, systematic approach maintained

BTRSTN Event Probability Rising

Let’s connect the threads:

Buy The Rumour: Markets front-running Fed cut (fully priced), tech earnings optimism (five megacaps reporting), Trump-Xi trade deal hopes (on-again status).

Sell The News: Wednesday’s actual Fed announcement, Thursday’s GDP data, Friday’s employment costs – what if outcomes disappoint or forward guidance underwhelms?

Supporting Evidence:

- Uncle Russ expanding triangle (underlying weakness)

- Premium Popper divergence (SPX higher, RUT lower)

- Gold consolidating rather than rallying (lack of safe-haven demand)

- Crude breaking lower (deflationary pressure building)

- VIX remaining calm despite catalyst density (complacency)

This week’s news-driven reactions will trigger the next major moves. Either the rumours get validated and markets extend higher with conviction, or the news disappoints and BTRSTN plays out with sharp reversals.

Systematic traders don’t predict which outcome occurs. We position patiently, execute mechanically when criteria meet, and avoid emotional attachment to directional bias.

Patience on RUT validated. SPX flip missed but frustration avoided. Premium Poppers profiting from divergence. That’s the systematic edge.

Current Status: BTRSTN probability rising, news-driven week building, patient positioning maintained, systematic execution ready

In Other News…

“The Calm Before the Macro Storm”

Wall Street’s been hitting record highs like it’s on performance-enhancing optimism.

The Dow just had its first 47K close, the S&P flirted with 6,900, and the Nasdaq’s acting like rate cuts are free refills at the dopamine bar.

Apparently, mild inflation, a government shutdown, and a tariff deadline are bullish now.

Fear’s vanished. The VIX collapsed to 16.37 — that’s the market’s way of saying, “We’ve stopped caring, and it feels incredible.”

Zen and the Art of Financial Delusion

Investors meditated their way through Monday’s rally.

Tech and Communication Services led the charge — because nothing says “macro stability” like buying AI stocks ahead of a Fed meeting and a trade summit hosted by two men who treat Twitter like foreign policy.

JPMorgan blessed Bitcoin as loan collateral, instantly converting crypto bros into LinkedIn thought leaders.

Healthcare joined the enlightenment circle with Novartis dropping $12 billion for Avidity, because if you can’t innovate, just buy the people who can.

Meanwhile, 34 S&P names hit new highs — most of them because traders ran out of reasons to be bearish.

Pharma Buys Gains, Intel Buys Time

Novartis paid a 46 % premium to buy relevance. CFOs everywhere are now Googling “cheap RNA startups before the Fed ruins everything.”

Intel’s earnings beat got buried under another round of AI existential crisis — apparently, even robots can’t tell what Intel does anymore.

Kroger raised guidance, proving the last safe trade is still “people need snacks.”

Cross-Asset Yoga

The bond market is doing downward-facing yield curves again — 2-year at 3.42 %, 10-year near 4.6 %. Translation: everyone’s pretending this is a soft landing while quietly stretching for impact.

Gold chilled after its 5 % tantrum, oil took a nap, and the dollar decided to stay out of the drama.

Wall Street’s new mantra: “We manifest lower inflation and higher bonuses.”

☕ Hazel’s Final Thought

Markets are floating on caffeine, hope, and algorithmic faith.

The Fed meets Wednesday, Trump and Xi shake hands Thursday, and by Friday, traders will either be rich or explaining their “long-term conviction” in therapy.

For now, enjoy the serenity — it’s the kind you only get right before a spectacular mess.

— Hazel Ledger,

FinNuts Bureau of Zen-Flation and Denial Management

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Expanding Triangle Formation Flying With BTRSTN Event Preparation” whilst claiming they had mastered “Uncle Russell Divergence Pattern Recognition Advanced Cooing.”

Hazel updated her crisis management protocols to include “Patient Stance Validation Procedures Despite Missing Flip-and-Rip Moves” alongside emergency plans for “Premium Popper Divergence Confirmation During BTRSTN Setup Integration.”

Mac raised his Tuesday morning whisky and declared, “When saving yourself bear/bull/bear/bull flipping frustration matters more than catching every single move, systematic discipline becomes delightfully superior!”

Kash attempted livestreaming about “expanding triangles being basically like DeFi protocol consolidation patterns but with actual precursor warning signals” but got distracted calculating BTRSTN probability percentages.

Wallie grumbled that in his day, markets fell “with proper expanding triangle follow-through rather than this modern NATHs-holding nonsense with divergent Premium Poppers!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

When Bears and Bulls Actually Fought

The terms “bull market” and “bear market” might come from actual bull vs. bear fights in 1800s California!

These brutal spectacles were Sunday entertainment after church. Bears would swipe downward defensively while bulls charged upward aggressively. The financial metaphor stuck: bulls drive markets up, bears drive them down. Thankfully, we’ve moved from literal animal fights to metaphorical market battles!

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.