Rest of Week’s News Cancelled For Big Brother “Government Shutdown” Edition

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Today’s the day – Fed Day. The rest of the week’s news has unsurprisingly been cancelled again because of what’s turning out to be another weird episode of Big Brother “Government Shutdown” edition!

All four indexes are starting to diverge from each other in spectacular fashion. Russell has already stalled. Dow is showing signs of exhaustion. S&P is experiencing slowing momentum. And Nasdaq’s last caffeine hit has just kicked in and is ready to carry on partying like it’s 1999 all over again.

Apart from that, everything is just fine!

Crude oil is slipping past the $60 level previously noted. Gold is reacting nicely off its recent AVWAP line – will this be the push back to NATHs or the start of the grind sideways noted in yesterday’s letter? Time will tell.

On my usual trading timeframes with SPX and RUT, the bull is bulling and the bear is bearing. Nothing really to do for the moment but collect that theta whilst the world sorts itself out.

I’ll most likely take the day to myself given the news and the wild reactions we’re seeing as a result of whatever reports, economic releases, or suggestions get released to Wall Street. Any excuse is being used to jump-start the next big move. This week, Mag 7 earnings and rate cuts are going to be used as excuses for something. LOL.

For the moment, I shall remain cautious and wait for my moments to pounce.

Keep scrolling for the caffeine-fuelled divergence drama…

Russell Stalled. Dow Exhausted. SPX Slowing. Nasdaq Partying. Theta Collection Intensifies.

SPX Market Briefing:

Fed Day Wednesday arrives with indexes diverging in four different directions whilst government shutdown chaos cancels the rest of the week’s news and systematic traders collect theta waiting for clarity.

Current Multi-Market Status:

- SPX: Bear TnT, bullish above flipped, at NATHs (6911.30/6900.88), slowing momentum

- RUT: Bear TnT, neutral awaiting fresh setup, “Range Active 7” showing, already stalled

- ES: 6936.00, continuing grind

- NQ: 26,297.75, last caffeine hit activated, ready to party

- YM: 47,760, showing exhaustion signs

- CL: $59.96, slipped past $60 level as predicted

- GC: $4037.70, reacting off July AVWAP line (~$3995), decision point

- VIX: 16.34, remarkably calm for Fed Day

- DXY: 98.799, contained

Big Brother: Government Shutdown Edition

The rest of the week’s news has been cancelled. Again. Because apparently we’re filming another episode of Big Brother “Government Shutdown” edition, and nobody told the markets they were supposed to care.

This is becoming a recurring sitcom at this point. Markets barely blink anymore when government dysfunction headlines arrive. “Oh, another shutdown extension? Cool. Anyway, back to front-running the Fed…”

The desensitisation is complete. Government chaos? Background noise. Extended shutdowns? Meh. Fed rate decision and Mag 7 earnings? NOW WE’RE TALKING.

This is the reality we trade in: actual governance dysfunction gets treated like elevator music whilst quarter-point rate cuts and tech earnings drive trillion-dollar market moves.

Apart from that, everything is just fine!

Current Status: Government shutdown episode filming, markets ignoring dysfunction, Fed Day taking precedence

Four-Way Index Divergence – Reality TV Caffeine Edition

Here’s where things get properly entertaining: All four indexes are starting to diverge from each other like reality TV contestants on wildly different caffeine schedules.

Uncle Russell: Already stalled. The expanding triangle pattern continues holding. “Range Active 7” showing on charts. Momentum gone. Energy depleted. Uncle Russ is sitting this one out.

Dow Jones: Showing signs of exhaustion. YM around 47,760, grinding higher but lacking conviction. The old-school industrials are tired. They’ve seen this movie before. They’re not buying the hype.

S&P 500: Slowing momentum. SPX at NATHs around 6911, still grinding but the pace is decelerating. Not stalled like Russell. Not exhausted like Dow. Just… slowing. Hesitant. Waiting.

Nasdaq: Last caffeine hit just kicked in! NQ at 26,297, ready to carry on partying like it’s 1999 all over again! Tech megacaps front-running earnings! Mag 7 optimism! Innovation narrative! TO THE MOON!

Four indexes. Four completely different energy levels. Four diverging paths.

This is classic late-cycle behaviour when leadership narrows dramatically. When only the caffeinated tech stocks can maintain upward momentum whilst everything else stalls, exhausts, or slows.

Divergence doesn’t persist indefinitely. Something breaks. Either Nasdaq pulls everyone higher, or reality pulls Nasdaq lower.

Current Status: Four-way divergence developing, Russell stalled, Dow exhausted, SPX slowing, Nasdaq caffeinated

Fed Day – Excuses For Something

Today’s the day. FOMC announcement at 2:00pm. Powell press conference at 2:30pm. Quarter-point rate cut fully priced in.

But here’s the thing: I’ll most likely take the day to myself given the news and the wild reactions we’re seeing as a result of whatever reports, economic releases, or suggestions get released to Wall Street.

Any excuse is being used to jump-start the next big move.

This week, Mag 7 earnings and rate cuts are going to be used as excuses for something. LOL.

Think about it:

- Apple reporting? Excuse to move.

- Amazon earnings? Excuse to move.

- Alphabet results? Excuse to move.

- Meta numbers? Excuse to move.

- Microsoft guidance? Excuse to move.

- Fed cuts rates? Excuse to move.

- Powell says anything? Excuse to move.

- Taco Tweet – you got it 😉

Markets are searching desperately for catalysts to justify the next leg – either continuation higher or reversal lower. Every data point becomes ammunition. Every headline becomes validation.

The excuse doesn’t matter. The direction was already decided. The news just provides permission.

Current Status: Fed Day catalyst hunting, Mag 7 earnings as excuse generator, wild reactions anticipated

Crude Past $60 – Prediction Validated

Crude oil is slipping past the $60 level previously noted. Currently around $59.96, the technical prediction from recent briefings plays out perfectly.

Remember the setup: YTD VWAP resistance held. Prior swing highs swept in stop-running behaviour. $60 support testing anticipated. Break below opens $56 revisit.

Prediction: Validated. Technical analysis: Working. Systematic approach: Delivering.

The $60 level wasn’t some arbitrary number. It was a clear technical support level derived from proper chart analysis and price action understanding. When systematic frameworks identify levels that actually matter, price respects them.

Now we watch whether $60 holds on retests or if the slide continues toward $56. Either outcome provides tradable setups for those following mechanical rules rather than guessing directions.

Current Status: CL past $60 as predicted, $56 revisit possible, systematic analysis validated

Gold At AVWAP Decision Point

Gold is reacting nicely off its recent AVWAP line from the July lows. Currently around $4037, testing that critical support level established yesterday.

Here’s the question: Will this be the push back to NATHs, or the start of the grind sideways noted in yesterday’s letter?

Time will tell.

Two possible paths:

- Bounce to NATHs: Support holds, buyers step in, gold rallies back toward $4100+ psychological resistance

- April Redux: Sideways consolidation for extended period, base-building, range-bound behaviour

Both scenarios are valid. Both follow recent historical patterns. Both provide systematic trading opportunities depending on which develops.

What we don’t do: Predict which outcome occurs and position before confirmation. What we do: Wait for price action to clarify direction, then execute mechanical rules when criteria meet.

Gold bugs remain excited. But excitement doesn’t create automatic setups. Patience and proper criteria do.

Current Status: Gold bouncing off July AVWAP (~$3995), decision point between NATH push or sideways grind

Bull Bulling, Bear Bearing, Theta Collecting

On my usual trading timeframes with SPX and RUT, the bull is bulling and the bear is bearing.

SPX Bull TnT flipped and active. RUT Bear TnT holding pattern. Both behaving exactly as systematic frameworks predict they should.

Nothing really to do for the moment but collect that theta.

This is proper systematic trading during high-volatility catalyst events: Positions established. Rules followed. Greeks managed. Theta collected. Patience maintained.

No FOMO chasing Fed announcements. No emotional reactions to Powell’s facial expressions. No panic adjustments based on headline algorithms.

Just systematic execution. Mechanical patience. Theta collection whilst chaos erupts around the trading floor.

For the moment, I shall remain cautious and wait for my moments to pounce.

This isn’t inaction. This is disciplined positioning. When setups meet criteria – pounce. When chaos reigns without clear signals – collect theta and spectate.

Current Status: Bull bulling, bear bearing, theta collecting, cautious pouncing positioning maintained

Wild Reactions And Excuse Generation

The wild reactions we’re seeing as a result of whatever reports, economic releases, or suggestions get released to Wall Street tell the real story.

Markets aren’t responding to fundamentals. They’re responding to narrative permission.

Every data point gets interpreted through the lens of “does this justify our next move?” Every Fed word gets analysed for “can we use this as an excuse?”

This week: Mag 7 earnings plus rate cuts equal excuses for something. LOL.

The laugh is necessary because the absurdity deserves acknowledgement. Markets have decided they want to move. Direction uncertain. But movement certain. Now we just need official permission in the form of Fed decisions and tech earnings.

Whatever those catalysts deliver – good, bad, mixed – they’ll be used to justify whatever direction was already queued up.

Any excuse will do. The excuse is irrelevant. The predetermined direction is everything.

Systematic traders recognise this game and refuse to play. We don’t predict direction. We respond to confirmation. We execute mechanical rules. We collect theta whilst others chase excuses.

Current Status: Wild excuse-driven reactions anticipated, systematic patience maintained, predetermined direction awaiting official permission

I’ll forgo my usual chart dump in favour of my Snap shot Chart

In Other News…

“Markets Hit Record Highs, Ignore Reality (and Amazon’s HR Department)”

Wall Street’s in full denial mode again — the Dow, S&P, and Nasdaq all hit record highs Tuesday while Amazon fired 14,000 people and investors applauded like it was a productivity hack.

S&P futures +0.2%, Nasdaq +0.3%, Dow flat, because who cares about layoffs when there’s a rate cut party coming and Nvidia’s still levitating?

VIX 16.32, aka “we’ve stopped feeling feelings.”

Apparently, it’s impossible for stocks to fall when tech stocks have become an emotional support animal for the entire economy.

Tech Euphoria: Now a Full-Blown Religion

Nvidia +4.98%, Microsoft +0.8% premarket, Apple, Broadcom, Palantir, Micron, CrowdStrike — all hitting new highs.

The Magnificent Seven are now up 41% YTD, dragging the rest of the market along like exhausted sled dogs tied to a rocket.

Meanwhile, the “real economy” is flatlining — Industrials, Energy, and Consumer Staples collectively gasping for oxygen while tech chants “AI will fix it.”

If this keeps up, next quarter’s GDP report will just be Nvidia’s earnings transcript printed on Treasury letterhead.

Earnings Week: Welcome to the $8 Trillion Therapy Session

This week is basically Tech Church Confession Hour.

-

Microsoft: expects $74.96B revenue (+14.3% YoY) — Powell might start quoting Azure growth in his next speech.

-

Alphabet: flirts with $100B quarter because “searching things” is now an economic indicator.

-

Meta: praying AI ads can fund Zuckerberg’s VR midlife crisis.

-

Apple & Amazon: reporting Thursday, trying to look busy while the market ignores fundamentals entirely.

Together, these five giants represent $8 TRILLION in market cap.

That’s not diversification — that’s a religion with five gods and one prophet named Powell.

Cross-Asset Denial: Everything’s Fine, Probably

10-year 4.01%, 2-year 3.47%.

Everyone pretending this means “soft landing” when it really means “please cut rates before our optimism expires.”

Gold $4,000, because rich people still hedge.

Oil $60, because apparently demand is optional now.

VIX 16.3, the same level as before every major market faceplant since 2007.

Powell speaks 2:30 PM — investors praying for dovishness, pretending to listen to the words, and only hearing “free liquidity.”

☕ Hazel’s Final Thought

Markets are partying like it’s 1999, Nvidia’s a national religion, and the Fed’s expected to bless the rally without mentioning inflation.

Amazon just laid off 14,000 people — but don’t worry, tech stocks are hiring new believers.

If this is the soft landing, it’s happening mid-air.

— Hazel Ledger,

FinNuts Bureau of Euphoric Denial and Unpaid Severance

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Four-Way Caffeine-Schedule Divergence Formation Flying” whilst filming Big Brother “Government Shutdown” edition and claiming they had mastered “Fed Day Excuse Generation Advanced Cooing.”

Hazel updated her crisis management protocols to include “Reality TV Index Divergence Management Procedures” alongside emergency plans for “Theta Collection During Wild Excuse-Driven Reaction Integration With Mag 7 Earnings Permission Seeking.”

Mac raised his Fed Day whisky and declared, “When Russell stalls, Dow exhausts, SPX slows, and Nasdaq’s last caffeine hit kicks in whilst collecting theta, systematic discipline becomes delightfully superior to excuse-chasing chaos!”

Kash attempted livestreaming about “four-way index divergence being basically like DeFi protocol participants on different energy schedules but with actual reality TV government shutdown entertainment” but got distracted calculating excuse-generation probabilities.

Wallie grumbled that in his day, Fed announcements caused “proper market reactions rather than this modern excuse-seeking nonsense with caffeinated Nasdaq partying and government shutdown background noise!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

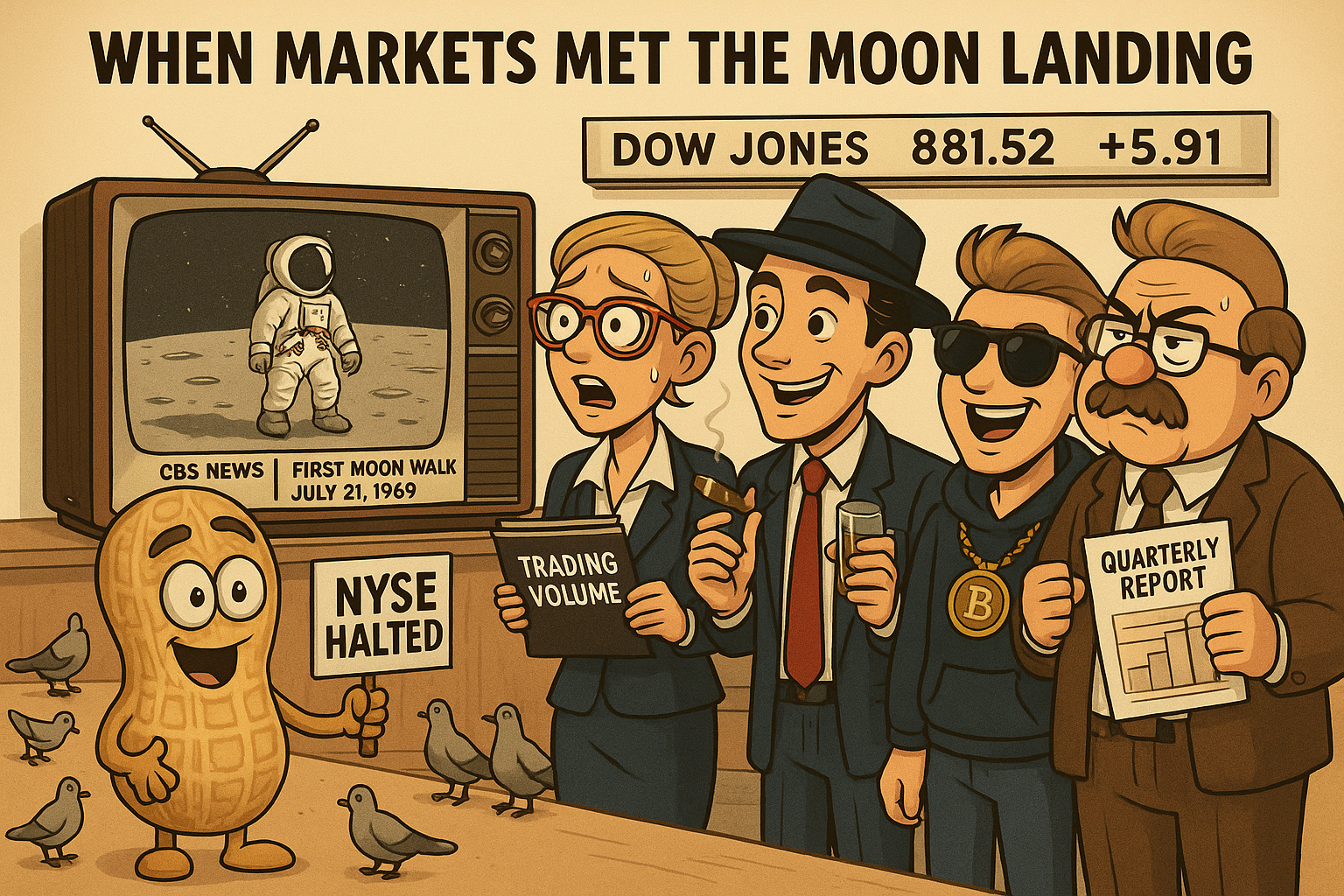

When Markets Met the Moon Landing July 21, 1969: NYSE floor traders stopped for Armstrong’s first steps

On July 21, 1969, the New York Stock Exchange halted trading at 12:43 PM ET as Neil Armstrong stepped onto the moon. Floor traders gathered around television sets to witness history. When trading resumed, the Dow closed up 5.91 points at 881.52. The “moon landing bounce” proved short-lived as markets worried about Vietnam War costs and inflation – the Dow wouldn’t break 1,000 until November 1972. Proving that even lunar achievements can’t fix fiscal policy.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.