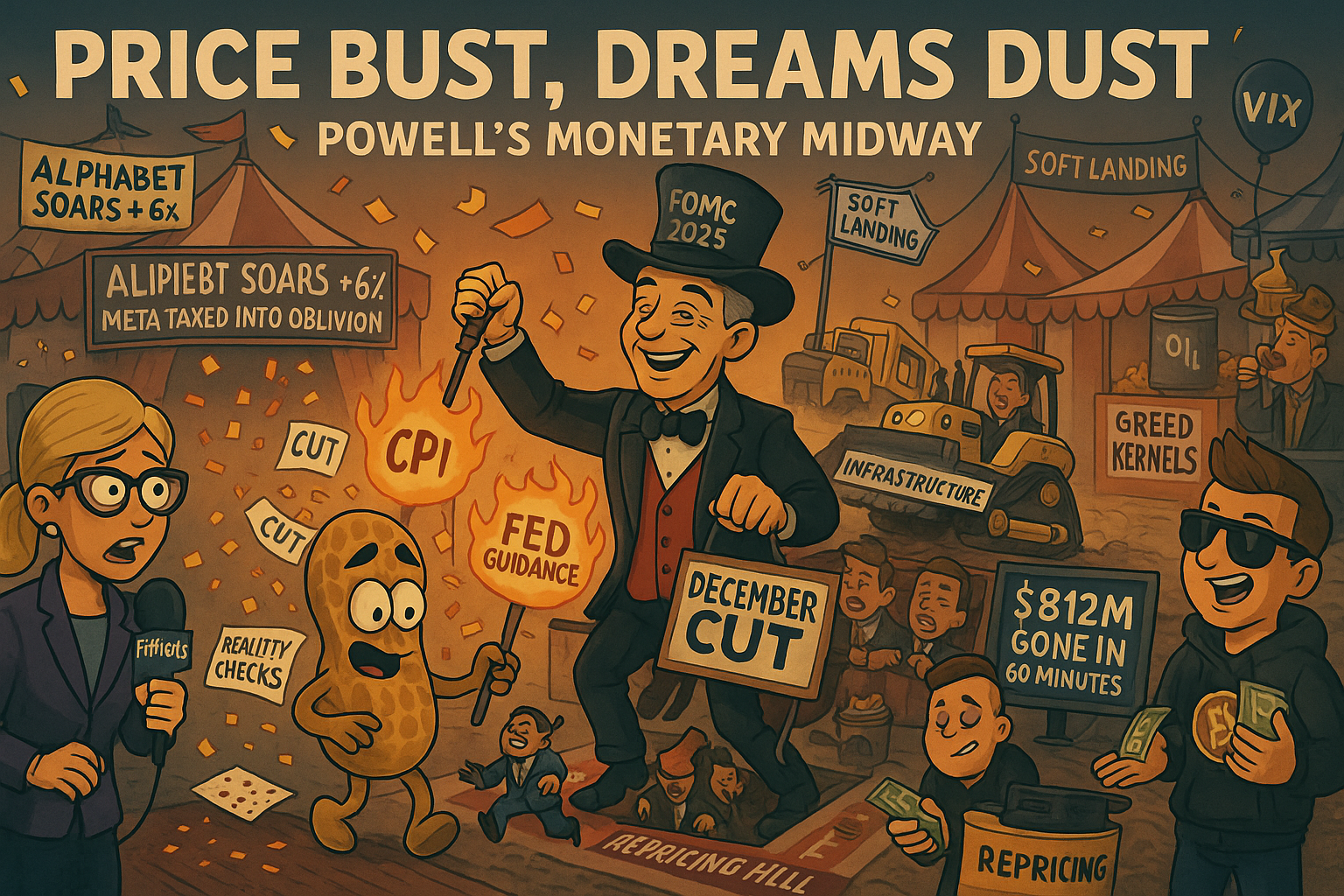

Powell: “December Cut Is Not For Sure, Far From It” – BOOM. Everything Flips.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

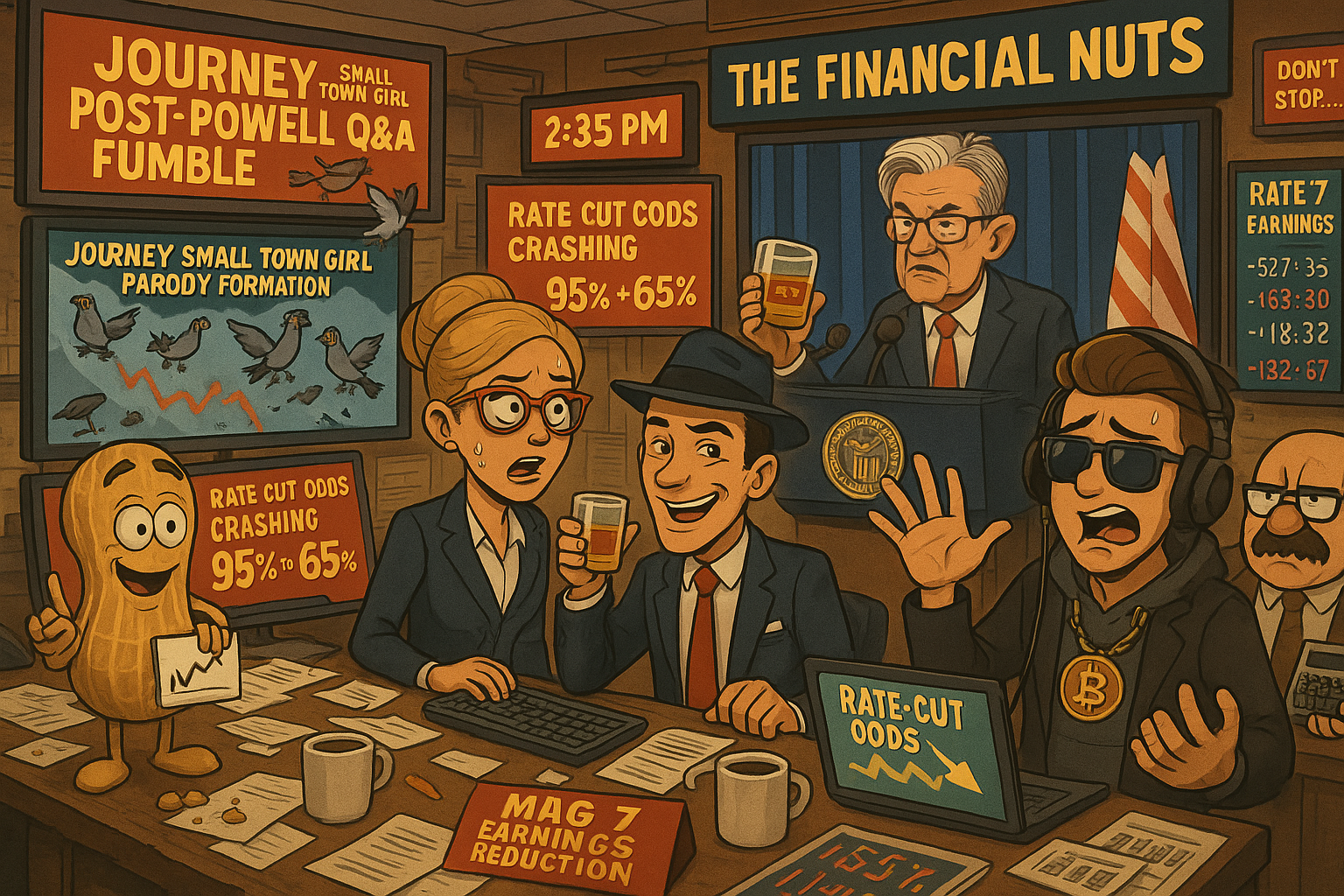

“I’m just a lonely trader, livin’ in a post-Fed world going to bear town.” (Journey’s “Small Town Girl” parody, because apparently that’s what Wednesday’s Fed Day drama deserves.)

Well, isn’t this fun? Buy the rumour, sell the news. And it looks like Uncle Powell fumbled things a little in the post-thingy Q&As.

Ah well. Looking at the daily charts again, we can hardly see a thing. Uncle Russ and Dow fell out of bed quite hard. Thankfully, they didn’t break anything. The S&P Big Boy equally sold off but rebounded. And our caffeinated crazy tech cousin Nasdaq fueled up the NOS and attempted another moon launch, closing green on the day. Just!

We’re seeing the bears slowly come back. I’ve reassessed the Dow upper boundary line using the extremes, and we can see we’re still just about clinking on to containment there too. Russell is already tipping over for the journey south.

This is a lot of mixed market viewpoints. Here’s how it happened…

Keep scrolling for Powell’s trillion-dollar fumble…

SPX Market Briefing:

Thursday post-Fed Day arrives with BTRSTN playing out perfectly as Powell’s single sentence at 2:35 PM crashes rate-cut odds from 95% to 65% in minutes whilst indexes scramble, Mag 7 earnings create chaos, and bears slowly return for the journey south.

Current Multi-Market Status:

- SPX: Bull TnT clinging on, bullish above flipped, at 6890.60 (NATHs 6939.57/6920.21)

- RUT: Bear TnT active, Range Active showing.

- ES: 6921.00, rebounded after sell-off

- NQ: 26,256.50, fuelled NOS and closed green (just!)

- CL: New Oil Bear position active

- GC: $3982.4, continuing consolidation development? We’ll see.

- VIX: 19.97, elevated post-Powell

- 2yr Bonds: 3.592%, jumped on Powell comments

The Fed Did Everything Right. Until 2:35 PM.

Here’s the timeline:

2:00 PM: Fed announces rate cut. ✅

2:00 PM: Ends QT. ✅

2:00 PM: A few dissenters noted. ✅

2:00 PM – 2:35 PM: Markets? Totally unfazed.

S&P flat. Yields steady. Commodities and crypto asleep.

Everything proceeding exactly as expected. Quarter-point cut fully priced in. No surprises. Systematic traders collecting theta whilst others chase excuses.

And then – 2:35 PM.

Powell drops one line that flips everything:

“December cut is not for sure, far from it.”

BOOM.

Rate-cut odds crash from 95% → 65% in minutes.

Stocks wobble.

Yields jump.

Traders scramble.

One sentence. Trillions moved.

This is the reality we trade in: Hours of Fed-speak mean nothing. One throwaway comment in the Q&A session moves more capital than entire policy statements.

Markets had front-run December dovishness. Everyone positioned for another cut. The quarter-point reduction wasn’t the catalyst – it was already priced. The NEXT cut was the trade.

Powell just torpedoed that trade with 7 words.

Current Status: BTRSTN executed perfectly, Powell’s 2:35 PM sentence moved trillions, December cut odds crashed 95% → 65%

Uncle Russ And Dow Fell Hard. Didn’t Break Anything.

Looking at the daily charts, we can hardly see a thing from yesterday’s drama. But the intraday action? Proper chaos.

Uncle Russell: Fell out of bed quite hard post-Powell. Already tipping over for the journey south. The expanding triangle pattern warned us this was coming. Now Russell’s leading the selloff whilst others hesitate.

Dow Jones: Equally fell hard but didn’t break anything critical. I’ve reassessed the upper boundary line using the extremes, and we can see we’re still just about clinking on to containment there too. Barely. Hanging by fingernails.

S&P 500: Big Boy sold off initially, then rebounded. Classic whipsaw behaviour during Fed announcements. Bulls defended support. Bears took profits. Systematic traders watched the chaos and executed mechanical rules.

Nasdaq: Our caffeinated crazy tech cousin fuelled up the NOS and attempted another moon launch. Closed green on the day. Just! That last caffeine hit from Tuesday is still working overtime.

We’re seeing the bears slowly come back.

Not panic selling. Not capitulation. Just methodical distribution as reality sets in: If December cut odds dropped 30 percentage points from one Powell comment, what happens when economic data actually changes?

Russell tipping over south. Dow clinging to containment. SPX rebounding but uncertain. Nasdaq still partying but running low on fuel.

This is a lot of mixed market viewpoints. Which is exactly what you’d expect when BTRSTN plays out and traders realize the rumour was better than the news.

Current Status: Uncle Russ tipping south, Dow barely contained, SPX rebounded, Nasdaq green (just!), bears returning methodically

Moral Of The Story: Boredom Never Lasts Long

In markets, boredom never lasts long. And one sentence from the Fed can move trillions.

Think about the absurdity:

- Months of economic data analysis

- Hundreds of Fed research papers

- Dozens of economist predictions

- Complex models forecasting policy paths

All rendered irrelevant by 7 words in a Q&A session at 2:35 PM on a Wednesday afternoon.

“December cut is not for sure, far from it.”

That’s it. That’s what moved trillions.

Not the actual rate cut announcement. Not the QT ending. Not the dissenting votes. Not the policy statement language carefully crafted by committee.

One throwaway line from Powell responding to a journalist’s question.

This is why systematic traders don’t predict Fed outcomes. We respond to price action with mechanical rules. Because even if you correctly predict the policy decision, you can’t predict which random Q&A comment moves markets.

The rumour was “Fed cutting rates through year-end.”

The news was “December cut not for sure.”

BTRSTN executed perfectly.

Current Status: 1 sentence at 2:35 PM moved trillions, boredom never lasts, systematic response beats prediction

SPX Clinging, RUT Bearing, Oil New Bear Active

And in other news, over on our usual playground:

SPX Bull TnT: Clinging on. Keeps bulling. Currently 6890.60, down from NATHs around 6940 but holding above critical support. The bull swing remains active until price action says otherwise. Mechanical rules. No emotions.

RUT Bear TnT: Bearish and keeps bearing. Uncle Russell showing “Range Active” status, neutral awaiting breakout, but clearly tipping over for the journey south. The daily expanding triangle resolved bearishly as anticipated.

New Oil Bear: I shall amuse myself with my new Oil Bear position and look for SPX and RUT poppers at the opening bell. Crude continuing its slide below $60 toward $56 target levels. Systematic setups developing.

Premium Poppers: Watching for volatility pops at Thursday open after Wednesday’s Fed-induced whipsaw. These are the conditions where Premium Poppers thrive – elevated VIX, uncertain direction, mechanical entry criteria.

Lazy Poppers: 0-DTE opportunities developing if volatility persists through Thursday session. Collecting premium from those chasing directional bets without systematic frameworks.

The setups are there. The mechanical rules are clear. Execute without emotion. Collect theta whilst others panic.

Current Status: SPX bull clinging on, RUT bear bearing, new Oil Bear active, popper setups developing

Mag 7 Earnings Chaos – Google Moon, META Crash

And in other OTHER news:

Google (Alphabet): Off for a moonshot! Earnings beat expectations (EPS 2.87 vs 2.267 estimate, surprise +0.603 or 26.61%). Revenue beat as well ($102.35B vs $99.94B, surprise $2.4B or 2.40%). Chart showing proper breakout energy.

Microsoft: Fell post-earnings despite beating (EPS 4.13 vs 3.67 estimate, surprise +0.46 or 12.54%). Revenue beat too ($77.67B vs $75.38B, surprise $2.29B or 3.04%). Markets wanted perfection. Got merely excellent. Sold anyway.

Meta: Fell HARD post-earnings. Massive miss on EPS (1.05 reported vs 6.723 estimate, surprise -5.673 or -84.38%!). Revenue beat slightly ($51.24B vs $49.51B, surprise $1.73B or 3.50%) but the earnings disaster overshadowed everything. Chart circled showing the damage.

This makes my speculative bear from Monday’s group call happy.

When you execute mechanical rules based on technical setups rather than earnings predictions, you occasionally catch these moves. Not because you predicted Meta would miss earnings by 84%. But because the chart setup suggested bearish positioning made systematic sense.

Sometimes systematic discipline gets rewarded spectacularly.

Current Status: Google moonshot (+26.61% earnings surprise), MSFT fell despite beat, META crashed (-84.38% earnings miss), Monday speculative bear validated

Month-End Rebalancing: What Could Possibly Go Wrong Next?

And now we look forward to the month-end rebalancing nonsense. But at least there’s little news to bugger things up.

What could possibly go wrong, next?

Famous last words from systematic traders who’ve seen enough month-end rebalancing chaos to know better than to ask that question seriously.

Month-end brings:

- Passive fund rebalancing (mechanical buying/selling regardless of fundamentals)

- Window dressing (funds adjusting positions to look good on monthly statements)

- Options expiration remnants (cleaning up positions post-October expiry)

- Quarter-end flows (this is also end of Q4 calendar for some fiscal years)

None of this has anything to do with fundamentals, Fed policy, or earnings results. It’s pure mechanical flow-driven activity.

Which means: Volatility opportunity for systematic traders with proper risk management. Chaos for those trying to apply fundamental analysis to price action driven by rebalancing algorithms.

SPX Bull TnT keeps bulling until mechanical rules say otherwise. RUT Bear TnT keeps bearing until setup invalidates. Oil Bear continues sliding. Poppers profit from volatility regardless of direction.

“I’m just a lonely trader, livin’ in a post-Fed world going to bear town.”

At least we’ve got a Journey parody to soundtrack the chaos.

Current Status: Month-end rebalancing approaching, little news scheduled, what could possibly go wrong next, systematic positioning maintained

In Other News…

“Powell Pulls the Plug: Dreams of December Cuts Meet Reality”

The Fed giveth, then Powell taketh away.

Markets threw a mini-parade Wednesday after the expected 25bp cut, only for Jerome to stroll in at the press conference, sip his metaphorical espresso, and say, “December cuts? Far from it.”

Wall Street promptly dropped its champagne and replaced it with Maalox.

The Whiplash Session

The Dow hit a record before reversing like a trader seeing his margin call email mid-celebration.

Caterpillar exploded +13%, Alphabet soared +6%, and Meta got hit with a $15.9B Trump tax, proving AI profits can’t outpace government paperwork.

Powell’s carefully engineered phrase “far from it” wiped billions in optimism, vaporising December cut bets faster than a meme stock on earnings day.

Meanwhile, the VIX collapsed to 15.92, signalling traders remain blissfully detached from reality — or fully sedated.

⚙️ Sector Rotation: The Caterpillar Paradox

Caterpillar became a meme stock for industrial dads — up 64% YTD thanks to AI data center equipment demand.

Apparently, the new bull market’s backbone is earth-moving machinery, not digital dreams.

Nvidia hit $5 trillion market cap, but Meta faceplanted 8%, proving that for every cloud empire built, another one gets rained out.

Gold rebounded, oil sulked, and energy traders looked around like “wait, did we miss something?”

Earnings: Tech’s Group Therapy Session

Alphabet: “We beat earnings and raised guidance.” ✅

Meta: “We beat too but paid a $16B tax bill.” ❌

Microsoft: “We’re fine but Azure’s tired.”

Caterpillar: “We sell power generators now — to AI.”

Tonight’s lineup — Apple, Amazon, and Coinbase — a.k.a. The Three Feelings You Regret Having on Fed Day: hope, greed, and volatility.

Cross-Asset Mood: The Hangover Arrives

Rate cut odds dropped from 98% to 52% — a rug pull so swift even crypto traders gasped.

Bond yields rose, gold clung to its $3,950 dignity, and oil pretended to care at $59.

Crypto bled $800M in liquidations because, of course, it did.

Bitcoin fell 3.5% to $113K — proving that Powell’s hawkish tone reaches the blockchain faster than a block confirmation.

☕ Hazel’s Final Thought

Wall Street wanted reassurance.

Powell gave them reality.

And somewhere between a Caterpillar all-time high and Meta’s existential tax therapy session, the market learned the true meaning of “soft landing”:

a gentle crash… followed by denial.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Journey Small Town Girl Parody Formation Flying To Bear Town” whilst analysing Powell’s 2:35 PM fumble and claiming they had mastered “Single Sentence Trillion-Dollar Move Advanced Cooing.”

Hazel updated her crisis management protocols to include “BTRSTN Validation Procedures Post-Powell Q&A Fumble” alongside emergency plans for “Rate-Cut Odds Crashing 95% To 65% Integration With Month-End Rebalancing Chaos Monitoring.”

Mac raised his post-Fed whisky and declared, “When Uncle Powell drops 1 sentence at 2:35 PM moving trillions whilst systematic traders collect theta during the chaos, disciplined positioning becomes delightfully superior!”

Kash attempted livestreaming about “rate-cut odds crashing being basically like DeFi protocol liquidation cascades but with actual Fed policy uncertainty” but got distracted calculating month-end rebalancing flow projections.

Wallie grumbled that in his day, Fed announcements caused “proper market reactions rather than this modern single-sentence fumble nonsense with Journey parody soundtracks and post-Fed Q&A chaos!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The $3 Billion Typo

In 2005, a Japanese trader tried to sell 1 share of J-Com stock for ¥640,000 ($6,400). Instead, he accidentally sold 640,000 shares for ¥1 each—turning a $6,400 sale into a $5,000 disaster involving $3 billion worth of stock!

The Tokyo Stock Exchange couldn’t cancel the trade fast enough. It’s the most expensive typo in financial history and a reminder that in trading, one wrong keystroke can change everything. Always double-check your orders! ⌨️

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.