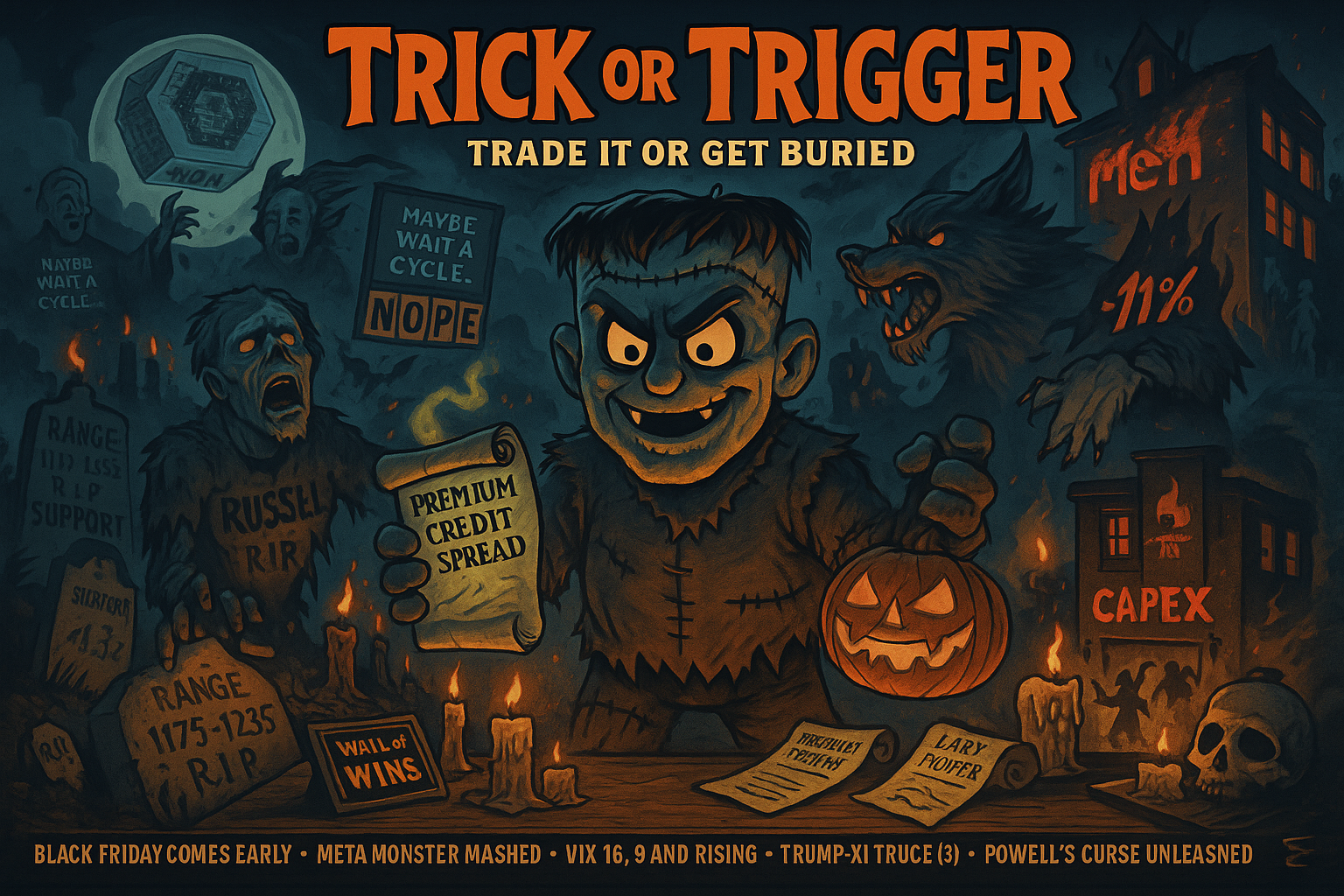

Uncle Russ In Shallow Grave Whilst Nasdaq Howls At Moon – Halloween Horror Show Complete

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

And what a Halloween horror show the markets delivered. Amazon rises from the dead. Apple conjures guidance. Meta’s ghost haunts tech. $16B crypto expiry at witching hour. Powell’s trick: “Maybe wait a cycle.”

Tech resurrection follows Meta’s Halloween massacre as energy faces oil collapse confession.

Amazon +13% premarket. Apple +3% exorcising Thursday’s AI capex selloff. ExxonMobil and Chevron confessing Q3 pain. META Monster Mashed -11% (worst drop in 3 years). Netflix starting its bear leg right before announcing a 10-to-1 stock split sending it up 3% afterhours – looks like they’re trying to bury some bad subscriber news with fresh buyer excitement.

Classic Halloween trick-or-treat for systematic traders.

Uncle Russ looks to have died and is in a shallow grave. Nasdaq howling at the moon. SPX showing new range bear breakout. RUT already bearish with new bear breakout confirmed.

2 VWAP Poppers fired. Just the 1 on both SPX and RUT. PopPop.

Anyone for Black Friday?

Keep scrolling for the tech graveyard resurrection tour…

Amazon +13% Resurrection. META -11% Massacre. Netflix Split Trick. Uncle Russ Buried.

SPX Market Briefing:

Friday Halloween arrives with tech resurrection (Amazon +13%, Apple +3%) exorcising Thursday’s Meta massacre (-11% worst drop in 3 years) whilst Uncle Russ lies in shallow grave, Nasdaq howls at moon, SPX/RUT bear breakouts activate, and $16B crypto expires at witching hour as systematic traders collect VWAP Popper treats.

Current Multi-Market Status:

- SPX: New range, bear breakout activated, ES futures +0.7% at 6870 premarket (09:25 ET)

- RUT: Already bearish range, new bear breakout confirmed, Uncle Russ in shallow grave

- ES: Question mark status, BB TnT 4hr setup developing

- NQ: Doing own thing as usual, +1.3% at 24,890 premarket, howling at moon waiting for next lightning strike

- YM/RTY: BB TnT on 4hrs pushing nicely

- CL: Bearish pinching between AVWAP, looking for break below $59.50 (Oil Bear active)

- GC: AVWAP pinching starting bull move, steady at $4027

- VIX: Eased to 16.9 from Thursday spike

- 10yr Yield: 3.93%

Tech Resurrection Following Meta’s Halloween Massacre

Thursday delivered a proper Halloween horror show. Meta got Monster Mashed -11% – its worst single-day drop in 3 years. CFO warned 2026 capex would be “notably larger” on AI infrastructure spending. Markets panicked. Tech bloodbath ensued.

Microsoft -3%. Nvidia -2%. AI infrastructure spending spooked investors across the sector. When does all this investment translate to actual revenue? Nobody knows. But the spending keeps growing.

Then Friday premarket arrived with the resurrection:

Amazon +13% after AWS revenue crushed estimates with +20% growth. Cloud strength exorcising fears about AI capex ROI. If AWS is growing 20%, maybe the infrastructure spending makes sense after all.

Apple +3% on strong December quarter guidance. The iPhone conjures revenue magic yet again. Seasonal strength ahead. Holiday buying season positioned perfectly.

Netflix +3% afterhours on 10-for-1 stock split announcement. Clever timing. Netflix was starting its bear leg on technical charts. Bad subscriber numbers brewing. Solution? Announce a stock split! Fresh buyer excitement! Bury the bad news with corporate action headlines!

This is the Halloween trick-or-treat game:

Trick: Meta warns of massive 2026 capex (-11% massacre)

Treat: Amazon AWS crushes (+13% resurrection)

Trick: AI spending spooked investors Thursday

Treat: Cloud revenue validates spending Friday

Trick: Netflix starting bear leg

Treat: 10:1 split announcement buries bad subscriber news

Systematic traders don’t predict which stocks get tricked or treated. We respond to price action with mechanical rules. VWAP Poppers don’t care about earnings narratives. They care about volatility and mechanical entry criteria.

Current Status: Amazon resurrection +13%, Apple conjures guidance +3%, Meta massacre -11%, Netflix split trick +3% burying bad news

Uncle Russ In Shallow Grave – Nasdaq Howls At Moon

Nasdaq is howling at the moon whilst Uncle Russ/Fester looks to have died and is in a shallow grave.

Perfect Halloween imagery for current market divergence.

Nasdaq (NQ): +1.3% premarket at 24,890. Doing its own thing as usual. Waiting for the next lightning strike. Tech resurrection narrative keeping the howling alive. Amazon/Apple strength offsetting Meta weakness. Still caffeinated. Still partying. Still ignoring gravity.

Russell (RUT): Already bearish range. New bear breakout confirmed. Uncle Russ is done. Buried. In a shallow grave. Small-caps leading the selloff as anticipated. The expanding triangle resolved bearishly. The journey south continues.

S&P (ES): Question mark status. +0.7% premarket at 6870. New range. Bear breakout activated. But resurrection narrative complicating the technical picture. Is this a dead cat bounce before more selling? Or genuine reversal? The question mark remains.

Dow (YM/RTY): BB TnT on 4hr timeframe pushing nicely. Boundary-to-boundary Tag ‘n Turn setups developing. These are the mechanical setups that work regardless of Halloween resurrection narratives.

The divergence tells the story: Tech (Nasdaq) still fighting. Small-caps (Russell) already dead. Large-caps (S&P/Dow) questioning which way to break.

Classic late-cycle behaviour when leadership narrows to handful of mega-cap names whilst everything else dies quietly.

Uncle Russ in the grave. Nasdaq howling. S&P confused. Systematic traders executing mechanical rules whilst others chase resurrection narratives.

Current Status: Nasdaq howling at moon +1.3%, Uncle Russ in shallow grave (bearish breakout), SPX new range questioning, divergence intensifying

$16B Crypto Expires At Witching Hour – Powell’s Trick

$16B worth of crypto options expire at witching hour today. Halloween options expiry across equity markets. End-of-month volatility cocktail mixing with tech resurrection drama and Powell’s trick from Wednesday.

Remember Powell’s line: “Maybe this is where we should at least wait a cycle.”

Translation: “Trick! We’re not cutting in December! Enjoy your treats elsewhere!”

This weakens the crypto/tech macro tailwind that’s been supporting risk assets. Markets priced in multiple cuts through year-end. Powell just said “maybe wait a cycle.” Rate-cut odds crashed 95% → 65% on Wednesday. Now crypto faces $16B expiry with weakened Fed support narrative.

Dollar eased -0.12% to 98.567 despite hawkish tone. Curve steepening paused: 2yr at 3.43%, 10yr at 3.93%. Gold steady at $4027 despite trade truce reducing safe-haven bid.

Commodity divergence tells the tale: Gold +47% year-over-year. Oil -11% year-over-year.

Trump-Xi deal removed near-term tariff terror but doesn’t solve structural issues. Credit spreads stable. Halloween options expiry creating end-of-month volatility exactly as systematic frameworks anticipate.

Tech resurrection fragile if energy confesses deep Q3 pain.

ExxonMobil and Chevron report before the bell. Expectations slashed: Exxon $1.78 (down 7.3% YoY), Chevron $1.66 (down 33.9% YoY) on weak Q3 oil. WTI averaged $65.74 in Q3 versus $81+ last year. Upstream pain dominates despite refining margin rebounds.

Energy faces Halloween horror show whilst tech gets resurrection treatment. The sector rotation continues.

Current Status: $16B crypto expiry at witching hour, Powell’s “wait a cycle” trick weakening support, Halloween options volatility mixing with month-end flows

META Monster Mashed – Netflix Split Burial Trick

META got Monster Mashed.

Thursday’s -11% drop was Meta’s worst single-day decline in 3 years. CFO’s warning about “notably larger” 2026 capex on AI infrastructure spending triggered sector-wide panic.

This wasn’t just Meta selling off. This was the market questioning the entire AI infrastructure spending thesis. If Meta’s boosting capex dramatically for 2026, when does ROI materialize? Microsoft boosting capex. Alphabet boosting capex. Nvidia selling chips for all this infrastructure.

But who’s actually generating revenue from AI to justify the spending?

AWS +20% growth suggests cloud infrastructure demand is real. But that’s infrastructure-as-a-service. What about the AI applications everyone’s supposedly building? Where’s the revenue?

Meta’s massacre exposed the question. Amazon’s resurrection provided temporary answer (at least for cloud infrastructure). But the fundamental question remains unresolved.

Meanwhile, Netflix executed the perfect Halloween trick:

Netflix was starting its bear leg on technical charts. Bad subscriber news brewing. Momentum fading. Distribution accelerating.

Solution: Announce a 10-for-1 stock split!

Result: +3% afterhours movement! Fresh buyer excitement! Split headlines bury subscriber concerns!

Classic corporate action timing. When fundamentals weaken, change the narrative with splits, buybacks, or special dividends. Create excitement that has nothing to do with underlying business performance.

Systematic traders recognize the trick. The split doesn’t change business fundamentals. It just creates short-term price action from retail buyers who think “$100 per share sounds cheaper than $1000 per share!” despite identical market cap.

The bear leg will resume. But Netflix bought time with Halloween treat headlines.

Current Status: META Monster Mashed -11%, Netflix buried bad subscriber news with split trick +3% afterhours, AI capex ROI question unresolved

SPX/RUT Bear Breakouts – 2 VWAP Poppers Fired

SPX: New range. Bear breakout activated. Technical levels clear. Mechanical rules engaged.

RUT: Already bearish range. New bear breakout confirmed. Uncle Russ leading the journey south as anticipated from expanding triangle resolution.

The systematic setups are firing:

2 VWAP Poppers executed. Just the 1 on both SPX and RUT. PopPop.

These are the mechanical volatility opportunities that work regardless of Amazon resurrections or Meta massacres. VWAP Poppers don’t care about earnings narratives. They care about anchored volume weighted average price levels, volatility expansion, and systematic entry criteria.

YM/RTY BB TnT on 4hrs pushing nicely. Boundary-to-boundary Tag ‘n Turn setups developing across multiple timeframes. These multi-day swing opportunities persist through Halloween horror shows and tech resurrection drama.

ES still has question mark on it. The technical picture remains ambiguous between new range support and bear breakout follow-through. Systematic traders wait for mechanical confirmation rather than predicting which resolves.

NQ doing its own thing as usual, waiting for next lightning strike. Nasdaq’s divergence from other indexes continues. Tech resurrection keeping the party alive whilst small-caps die quietly.

CL bearish but pinching between the AVWAP – looking for break down below $59.50 (previously $60 level noted). Oil Bear position active. Technical prediction from earlier this week playing out mechanically.

GC also AVWAP pinching but starting the bull move. Gold showing the opposite setup from crude. Same AVWAP technique. Different directional outcomes. Systematic frameworks adapt to what price action confirms rather than predicting directions.

Anyone for Black Friday? With bear breakouts activating, month-end volatility persisting, and tech resurrection fragility exposed, the setup for November retail chaos intensifies.

Current Status: SPX/RUT bear breakouts active, 2 VWAP Poppers fired, BB TnT pushing, CL breaking lower, GC breaking higher, Black Friday approaching

Energy Confesses Q3 Pain – Halloween Horror For Oil

While tech gets resurrection headlines, energy faces Halloween horror show confession.

ExxonMobil and Chevron reporting before bell today. Estimates already slashed:

- Exxon: $1.78 expected (down 7.3% year-over-year from $1.92)

- Chevron: $1.66 expected (down 33.9% year-over-year from $2.51)

Weak Q3 oil prices crushed upstream profits. WTI averaged $65.74 in Q3 versus $81+ last year. That’s -19% year-over-year on the commodity that drives their core business.

Refining margins rebounded slightly. But upstream pain dominates the narrative. When crude prices collapse, supermajors suffer regardless of operational excellence.

This creates the sector rotation dynamic:

Tech resurrection (Amazon +13%, Apple +3%) capturing headlines and momentum whilst energy confesses pain and sells off quietly. Capital rotating from old economy energy to new economy tech.

Commodity divergence tells the structural story:

- Gold: +47% year-over-year (benefiting from Fed uncertainty, geopolitical chaos)

- Oil: -11% year-over-year (suffering from demand concerns, supply abundance)

Trump-Xi trade deal removed near-term tariff terror but doesn’t solve structural oversupply issues in crude markets or long-term demand concerns from EV adoption.

CL technical setup confirms fundamental narrative: Bearish, pinching between AVWAP, looking for break below $59.50. The chart pattern validates the earnings pain energy will confess today.

Systematic traders positioned mechanically for crude weakness don’t need to predict ExxonMobil earnings. The Oil Bear setup identified technical levels. Price action confirmed direction. Now fundamentals validate what technicals already predicted.

Current Status: Energy confessing Q3 pain, Exxon/Chevron estimates slashed, crude -11% YoY, Oil Bear breaking below $59.50 as predicted, sector rotation to tech

In Other News…

“Tech Resurrection Follows Meta’s Massacre — Energy Awaits Final Confession”

Wall Street just experienced a séance.

After Meta’s –11% capex bloodbath Thursday sent traders screaming for the exits, Amazon and Apple rose from the dead Friday morning — apparently powered by AWS revenue and sheer disbelief.

It’s the financial equivalent of Frankenstein’s monster being rebooted by a lightning bolt made of cloud profits.

☠️ Thursday: The Meta Massacre

Meta’s CFO summoned market demons with one sentence:

“Capex will be notably larger in 2026.”

Translation: “We’re burning billions again — in the name of AI.”

Investors fainted faster than Percy finding the tea cupboard empty.

Microsoft shed –3%, Nvidia –2%, and Alphabet awkwardly smiled +2.5% like a kid who accidentally survived the haunted house.

By the close, tech had been ritually sacrificed to the altar of AI Capex.

Somewhere in Silicon Valley, accountants were lighting sage over their spreadsheets.

⚰️ Friday: The Resurrection Ritual

Then, before the bodies were cold — boom!

Amazon’s AWS rose +20%, Apple whispered “strong December,” and Netflix announced a 10-for-1 stock split like a priest performing last rites on investor pessimism.

The Nasdaq bounced +1.3% premarket, because apparently fear has a 24-hour expiration date.

Meta, meanwhile, sits in the corner with a dunce cap made of server racks.

️ Energy’s Turn in the Confessional

ExxonMobil and Chevron face their own Halloween horror — the Q3 Oil Confession.

Estimates slashed, margins bleeding, and WTI averaging $65.74 (down from last year’s $81+).

Their guidance reads like a ghost story:

“We promise things will improve… probably… if OPEC doesn’t trip over itself again.”

The irony? Tech spent billions on “AI energy efficiency,” while energy itself forgot how to make money selling actual energy.

Cross-Asset Chaos: Powell the Pumpkin Reaper

Powell appeared midweek to deliver his version of a horror jump-scare:

“Maybe this is where we should at least wait a cycle.”

Translation: “You’re not getting another cut, you greedy heathens.”

Crypto whimpered, gold held its nerve at $4,027, and oil collapsed — the only thing falling faster than investor faith in Powell’s guidance.

Volatility spiked, then ghosted again.

VIX at 16.9 says “boo,” markets say “meh.”

️ Hazel’s Final Thought

Meta’s ghost still haunts the data centres.

Amazon’s cloud might just be fog.

Energy’s earnings are a séance in progress.

This market isn’t bullish or bearish — it’s undead.

A walking corpse propped up by AI optimism, caffeine, and denial.

So light your pumpkin, hold your hedges, and remember:

On Wall Street, even ghosts trade after hours.

— Hazel Ledger,

FinNuts Bureau of Economic Necromancy

Rumour Has It:

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Halloween Horror Show Formation Flying Through Tech Graveyard” whilst analyzing Amazon’s resurrection and claiming they had mastered “Monster Mash Meta Massacre Advanced Cooing With 10:1 Split Trick Recognition.”

Hazel updated her crisis management protocols to include “Tech Resurrection Following Massacre Emergency Procedures” alongside contingency plans for “$16B Crypto Witching Hour Expiry Integration With Uncle Russ Shallow Grave Monitoring.”

Mac raised his Halloween whisky (in a pumpkin-shaped glass) and declared, “When Amazon rises from dead whilst META gets Monster Mashed and systematic traders collect VWAP Popper treats regardless of tricks, disciplined positioning becomes delightfully superior to narrative chasing!”

Kash attempted livestreaming about “Netflix split tricks being basically like DeFi token splits but with actual subscriber burial” but got distracted calculating Black Friday retail chaos probabilities.

Wallie grumbled that in his day, Halloween meant “proper trick-or-treating rather than this modern tech resurrection nonsense with $16B crypto expiries and Uncle Russ in shallow graves!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.