Happy New Month – Too Soon For “Christmas Soon” But Never Too Soon To Ban Mariah Carey

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

If we normally say “White Rabbits” at the start of a new month, can we say “Red Zombies” for November?

Happy new month! Is it too soon to start saying “Christmas soon” and “Looks like a cold one”? Whatever day of the year it is, it’s always too soon for Mariah Carey!

Anyway. Anyway. Moving on…

The markets continue to do SFA. Uncle Russ is the only index pushing lower off the range highs. The rest are just standing around the metaphoric campfire kicking stones and shootin’ the shit.

VIX is attempting to nudge higher, which could simply be a nervous tic. Oil looks to be developing a lower high, and if we can get below $60 (yes, still), I’ll be a happier person. Gold is definitely stalling, and perhaps that sideways range we speculated on last week will develop and start to unfold.

On the usual stomping ground, SPX and RUT are doing their things. I’m waiting for the usual Tag ‘n Turn setups, although we’ve had some bearish breakouts on both of those, so just waiting for those targets to be reached or for the range to continue.

Scalping the open looks like it may be the play again for some quick action and poppop some premium.

There’s a lot of potential news scheduled for this week if the government lockdown can get its act together. Otherwise, it’s gonna be scrubbed again.

Watch this space.

Keep scrolling for the campfire stone-kicking analysis…

Markets Do SFA Whilst Uncle Russ Leads Lower. VIX Shows Nervous Tic.

SPX Market Briefing:

Monday November opens with “Red Zombies” replacing White Rabbits as markets do SFA standing around metaphoric campfire kicking stones whilst Uncle Russ leads lower off range highs, VIX shows nervous tic nudging higher, oil develops lower high targeting $60 break, and economic calendar faces government shutdown scrubbing risk.

Current Multi-Market Status:

- SPX: Bearish breakout waiting for targets or range continuation

- RUT: Leading lower off range highs, bearish breakout active (Uncle Russ doing the work)

- ES: 6899.50, standing around doing SFA

- NQ: 26,145.75, kicking stones at the campfire

- YM: 47,808, shootin’ the shit with others

- CL: $60.88, developing lower high, targeting break below $60

- GC: $4156.3, stalling, sideways range speculation developing

- VIX: 17.75, nudging higher (nervous tic?)

- 2yr Bonds: 3.578%

Red Zombies For November – Too Soon For Mariah

Red Zombies for November. Because if we say “White Rabbits” at the start of every month for luck, surely November deserves something more… Halloween-adjacent? Red Zombies it is.

Happy new month!

Now the important question: Is it too soon to start saying “Christmas soon” and “Looks like a cold one”?

Answer: Whatever day of the year it is, it’s always too soon for Mariah Carey.

Every year, the same pattern. November arrives. Someone, somewhere, starts playing “All I Want For Christmas Is You.” Retail stores dust off their festive playlists. The debate begins: “Is it too early for Christmas music?”

The answer is always yes. It’s always too early for Mariah in November.

December 1st? Fine. Perhaps acceptable. November 1st? Absolutely not. Thanksgiving hasn’t happened yet. Remembrance Day hasn’t happened yet. Guy Fawkes Night within spitting distance. We’ve literally just finished Halloween.

Let the Red Zombies have their moment before the sleigh bells arrive.

But here’s the trading reality: Markets don’t care about Mariah Carey timing debates. They care about systematic setups, mechanical rules, and whether Uncle Russ continues leading the journey lower whilst everyone else stands around doing SFA.

Current Status: Red Zombies November kickoff, too soon for Christmas songs, always too soon for Mariah, markets ignoring seasonal debates

Markets Standing Around Campfire Kicking Stones

The markets continue to do SFA.

Sweet. F***. All.

Friday’s Halloween tech resurrection created some excitement. Amazon +13%. META -11%. Uncle Russ in shallow grave. Proper action.

Monday November? Everyone’s just standing around the metaphoric campfire kicking stones and shootin’ the shit.

ES Futures: 6899.50. Not going anywhere. Just… standing there. Kicking stones.

YM Futures: 47,808. Also standing around. Occasionally picking up a stone. Examining it. Throwing it back down. Shootin’ the shit with the others.

NQ Futures: 26,145.75. Nasdaq at least had the decency to party hard last week. Now? Hangover. Standing around. Contemplating whether to howl at the moon again or just kick stones like everyone else.

The only index actually doing something:

Uncle Russ (RTY): 2495.7. Leading lower off range highs. The only one with direction. Everyone else paralyzed by indecision whilst Russell methodically pushes south.

This is classic late-cycle behaviour. Small-caps leading directional moves whilst large-caps hesitate. Russell showing the path. SPX/Dow/Nasdaq wondering whether to follow or stay by the warm campfire a bit longer.

VIX: 17.75. Attempting to nudge higher. Is this genuine fear creeping in? Or just a nervous tic from traders watching Uncle Russ break lower whilst everything else does nothing?

Probably nervous tic. Markets hate uncertainty more than they hate selling. Right now, we’ve got uncertainty: Will SPX/Nasdaq follow Russell lower? Or will Russell bounce back up to join the campfire?

Watch this space.

Current Status: Markets doing SFA campfire stone-kicking, Uncle Russ only index leading lower, VIX showing nervous tic at 17.75

Oil Lower High Development – Still Targeting $60 Break

Oil (CL): $60.88. Developing a lower high pattern.

If we can get below $60 (yes, still), I’ll be a happier person.

This has been the target for weeks. Halloween Friday almost cracked it. Crude touched lows around $59.50 area. Then bounced. Classic lower high development.

The AVWAP pinching I mentioned last week played out. Crude broke down as anticipated. But the follow-through didn’t materialize yet. Instead, we got bounce back above $60.

Lower high development setup:

Previous high around $62-63 area earlier in October. Failed to sustain. Sold off hard. Bounced to current $60.88. If this becomes a lower high (failing to reclaim previous highs), the next leg down targets $56-58 range.

The $60 level matters psychologically and technically. Round numbers always matter in commodities. Breaking and holding below $60 would confirm the bear trend continuation. Bouncing above and reclaiming would question the entire Oil Bear thesis.

Current price action: Developing the lower high. Testing $60 as support/resistance battleground. Systematic Oil Bear position still active. Waiting for mechanical confirmation of breakdown.

Energy earnings last week confirmed fundamental weakness: ExxonMobil and Chevron confessed Q3 pain as predicted. Weak oil prices crushing upstream profits. The chart predicted what fundamentals confirmed.

Now we need price action to follow through. Break $60. Hold below. Continue the journey to $56-58 targets.

Current Status: Oil at $60.88 developing lower high, targeting break below $60, AVWAP pinch played out, Energy Bear active

Gold Stalling – Sideways Range Speculation

Gold (GC): $4156.3. Definitely stalling.

Perhaps that sideways range we speculated on last week will develop and start to unfold.

Gold had a monster run: +47% year-over-year through October. From ~$2800 levels at the start of 2024 to touching $4300+ in recent weeks. That’s the kind of move that demands consolidation.

The question isn’t IF gold consolidates. The question is HOW.

Option 1: Pullback consolidation (sells off 5-10% then resumes uptrend)

Option 2: Sideways consolidation (trades range-bound for weeks/months digesting gains)

Option 3: Parabolic blowoff (one final spike then collapses)

Current price action suggests Option 2: Sideways consolidation.

Gold stalling at these levels. Not selling off aggressively. Not spiking higher. Just… stalling. The AVWAP pinching I mentioned last week showed potential bull move starting. That played out with brief spike. Now stalling again.

Classic range development signs:

Higher lows forming. Lower highs forming. Volatility compressing. Traders unsure whether to buy dips or sell rallies. Resolution pending.

The fundamental drivers remain bullish (Fed uncertainty, geopolitical chaos, currency debasement concerns). But after +47% year-over-year, traders need time to decide if $4100-4300 is fair value or just a pit stop on the way higher.

Systematic traders don’t predict which way gold breaks from consolidation. We wait for mechanical confirmation. Range boundaries will reveal themselves. Then we trade boundary-to-boundary until breakout occurs.

Current Status: Gold stalling at $4156.3, sideways range speculation developing, AVWAP bull move stalled, consolidation likely

SPX/RUT Bearish Breakouts – Waiting For Targets

On the usual stomping ground, SPX and RUT are doing their things.

Both showing bearish breakouts last week. Now the waiting game begins.

SPX: Bearish breakout from recent range. Targets pending. Will price continue lower to hit those targets? Or will the range reassert itself with bounce back to prior highs?

RUT: Already bearish with new breakout confirmed. Uncle Russ leading the way lower off range highs. This is the index showing conviction whilst others hesitate.

I’m waiting for the usual Tag ‘n Turn setups. Although we’ve had some bearish breakouts on both SPX and RUT, so just waiting for those targets to be reached or for the range to continue.

This is the systematic patience game:

Bearish breakout occurs → Price moves toward targets → Systematic traders don’t chase → Wait for either: (a) targets hit triggering profit-taking zones, or (b) breakout fails and range resumes triggering reversal setups.

Tag ‘n Turn (TnT) setups on deck:

These multi-day swing opportunities develop when breakouts reach exhaustion or ranges reassert boundaries. The mechanical rules don’t predict which scenario plays out. They respond to what price action confirms.

Right now, we’re in the “waiting for confirmation” phase. Bearish breakouts active. Targets ahead. Tag ‘n Turn setups will trigger when price reaches decision points.

Scalping the open looks like it may be the play again for some quick action and poppop some premium.

When multi-day swings are in waiting mode, 0-DTE opportunities fill the gap. Markets doing SFA during the day? Perfect for Premium Poppers at the open. Collect theta whilst others stand around campfire kicking stones.

Current Status: SPX/RUT bearish breakouts waiting for targets, Tag ‘n Turn setups on deck, scalping the open for quick premium collection

Economic Calendar Packed – IF Government Doesn’t Scrub It

There’s a lot of potential news scheduled for this week if the government lockdown can get its act together. Otherwise, it’s gonna be scrubbed again.

Here’s what’s theoretically scheduled:

- Monday Nov 3 (Today): ISM Manufacturing PMI at 10:00am (49.4 actual vs 49.1 forecast – slightly better than expected, still contractionary below 50)

- Tuesday Nov 4: JOLTS Job Openings tentative (7.21M forecast vs 7.23M previous)

- Wednesday Nov 5: ADP Non-Farm Employment Change (28K vs -32K previous – big reversal if accurate), ISM Services PMI (50.8 forecast vs 50.0 previous)

- Thursday Nov 6: Unemployment Claims tentative

- Friday Nov 7: Average Hourly Earnings, Core PCE Price Index, Non-Farm Employment Change, Unemployment Rate – ALL TENTATIVE

The warning at the bottom of the economic calendar:

“U.S. government data may be impacted by the shutdown. ‘Tentative’ events are subject to delay, revision, or cancellation.”

Translation: Don’t get too excited about Friday’s Non-Farm Payrolls. They might not happen (again!). Government shutdown episode #6 (or whatever number we’re on) means employment data may get scrubbed.

This creates the perfect excuse-driven trading environment:

- Data comes out → Markets react violently → Systematic traders collect volatility premium

- Data gets cancelled → Markets react violently to uncertainty → Systematic traders collect volatility premium

Either way, the setup favours mechanical positioning over narrative prediction.

ISM Manufacturing PMI already released at 49.4 (slightly better than 49.1 forecast but still contractionary). Markets yawned. Everyone waiting for Friday’s jobs data. Which may or may not happen.

Watch this space.

Current Status: Economic calendar packed but “tentative” due to shutdown, ISM Manufacturing 49.4 released, Friday NFP may get scrubbed, excuse-driven volatility incoming

In Other News…

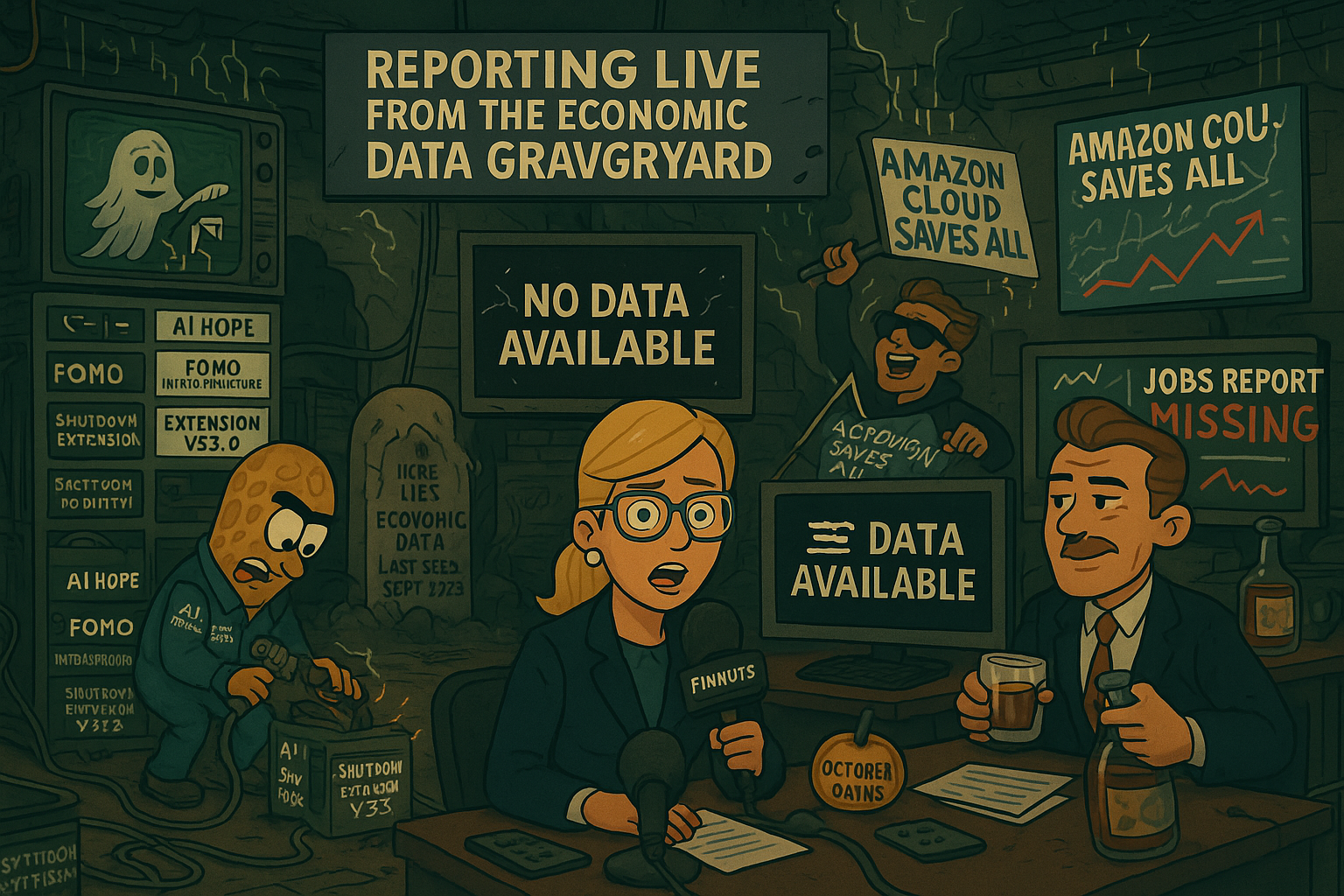

“Markets hit new highs. The economy hit pause. Nobody noticed.”

Apparently, Wall Street has decided that economic data is optional.

Jobs report? Gone. SNAP benefits? Cut. GDP updates? Missing.

But hey — Amazon’s cloud is growing, so who needs the actual economy anyway?

AI Saves Everything (Again)

Friday’s rally was powered by Amazon’s AWS posting 20% growth, its best pace since 2022.

CEO Andy Jassy proudly raised capex to $125 billion, effectively announcing:

“We’re going to spend our way to AI enlightenment.”

Alphabet joined the joyride, up +2.5%, because apparently every spreadsheet with “AI” in it now qualifies as infrastructure.

Meanwhile, Meta dropped 11%, Microsoft –3%, and somewhere in Silicon Valley, a CFO whispered:

“Maybe… AI isn’t free?”

️ The Old Economy’s Undead Comeback

GM +14.9%, AT&T beat earnings, Southwest made a profit — yes, airlines, the same companies that charge you for seatbelts now, are suddenly financial heroes.

This October rally feels less like a recovery and more like a séance where forgotten companies are being resurrected for one last encore.

Shutdown? What Shutdown?

The US government has been “temporarily unavailable” for 33 days, but the stock market is too polite to notice.

41 million Americans are losing SNAP benefits on November 1.

Jobs report? Not coming.

CPI? Delayed.

But traders have found the perfect hedge: just ignore it.

Hazel summed it up best during Friday’s newsroom chaos:

“If you don’t have data, you can’t have bad data.”

Global Sanity Briefly Appears

Trump and Xi called a truce on October 30 — which, in Wall Street terms, means they agreed to “pause arguing until after the rally.”

Fentanyl tariffs halved. Rare earth controls paused.

Everyone cheered, except economists, who now have to model optimism without evidence.

⚙️ Cross-Asset Chaos: The Calm Before the Lag

Gold collapsed below $4,000 after China axed its gold purchase incentive — clearly Beijing decided traders had too much joy.

Oil’s struggling near $58, down 11% year-on-year, as if even crude is tired.

The yield curve steepened again — a classic sign that investors think “soft landing” is just a marketing slogan.

Still, 98% of futures traders expect another Fed cut by December, ignoring Powell’s October warning:

“This may be the last one.”

Which, knowing Powell, translates to: “I dare you to bet against me.”

☕ Hazel’s Final Thought

Wall Street’s thriving on missing information, frozen bureaucracy, and AI optimism so overcaffeinated it could power a small city.

If this rally were a movie, it’d be titled:

“Mission: Data Impossible – The Algorithm Awakens.”

— Hazel Ledger, FinNuts Bureau of Blind Confidence and Synthetic Optimism

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Red Zombies November Formation Flying Around Metaphoric Campfire” whilst analysing markets doing SFA and claiming they had mastered “Stone-Kicking Shootin’ The Shit Advanced Cooing With Mariah Carey Ban Enforcement.”

Hazel updated her crisis management protocols to include “Markets Doing SFA Campfire Monitoring Procedures” alongside emergency plans for “Government Shutdown Economic Data Scrubbing Integration With Uncle Russ Leading Lower Whilst Others Hesitate Tracking.”

Mac raised his Monday whisky and declared, “When markets stand around campfire kicking stones whilst Uncle Russ leads lower and systematic traders scalp the open collecting premium, disciplined positioning becomes delightfully superior to narrative chasing!”

Kash attempted livestreaming about “economic calendar tentative events being basically like DeFi governance proposal delays but with actual government shutdown implications” but got distracted calculating which Mariah Carey song is most annoying.

Wallie grumbled that in his day, November meant “proper Red Zombies respect rather than this modern too-soon-for-Christmas nonsense with government data scrubbing and campfire stone-kicking markets!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.