Having An Opinion Comes With A Price – Sometimes Right, Sometimes Wrong, Sometimes “Mostly Wrong”

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Having an opinion comes with a price sometimes. Sometimes you’re right. Sometimes you’re wrong. Sometimes you’re only “mostly wrong,” as Miracle Max might have said.

This time, I was only mostly wrong for a short while.

The bear quadrangle are all finally moving in lockstep. Prices are moving inside the established patterns, and a move from the range highs to the range lows is on the way. There will potentially be a huge gap at the opening bell should these >1% moves hold from the overnight sessions.

VIX clue from yesterday that the excitement was elevated was indeed justified. Gold is continuing to stall whilst oil is making a run for $60 and its next leg down.

Sooooo we were kinda right. And as usual, we never know when we were right.

It reminds me of a gold bug guru back in the 90s who was sending out newsletters or those magalogue things for their services. Now, this was at a time when gold was $250-ish. Gordon Brown, the then UK Chancellor, had just kneecapped the UK by selling the lion’s share of the gold reserves.

OK, so that sets the scene: This gold bug was for several years touting gold at $1000 from $250-ish at a time when nobody was interested in gold. However, with around 12 years of hindsight later, turns out he was right.

Sometimes you can be both right on your view and wrong on the time. And people only remember that it wasn’t right now.

I can at least stop banging my big bear drum and celebrate. If not a Black Monday, perhaps I’ll be allowed an off white Tuesday.

Keep scrolling for the bear vindication timing lesson…

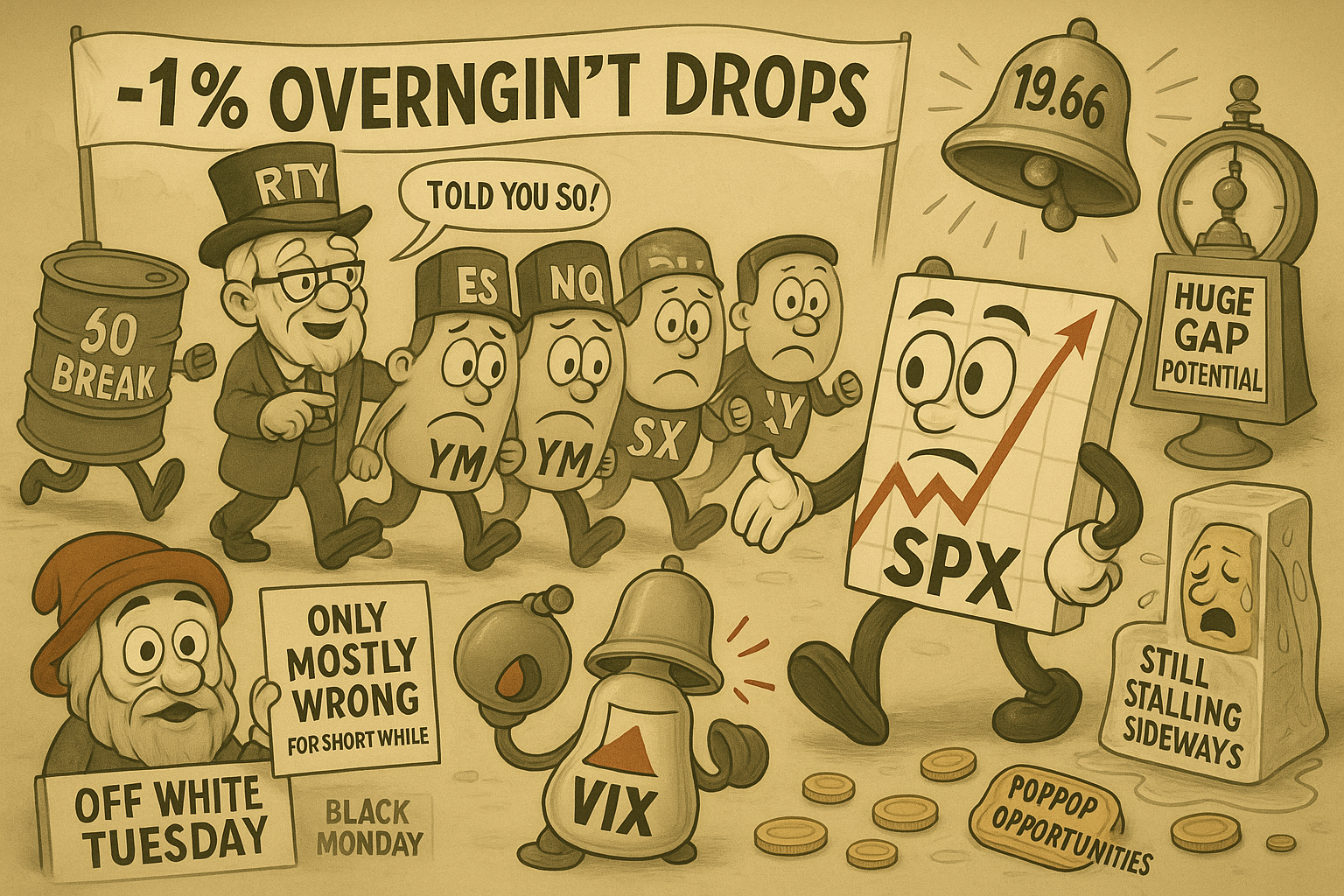

4 Indexes Move In Lockstep. >1% Drops. VIX Justified. Bear Was Right.

SPX Market Briefing:

Tuesday November delivers bear quadrangle vindication as ES/YM/NQ/RTY finally move in lockstep with >1% overnight drops, VIX elevated clue justified at 19.66, huge gap potential at opening bell, whilst oil runs for $60 target and gold stalls sideways proving “kinda right but never knowing when” – celebrating off white Tuesday instead of Black Monday.

Current Multi-Market Status:

- SPX (ES): 6805.50, down >1% overnight, bear quadrangle moving in lockstep

- RUT (RTY): 2441.2, continuing lower as anticipated

- YM: 47,200, down >1% overnight, finally following Russell south

- NQ: 25,722.25, down >1% overnight, joining the bear party

- CL: $60.14, making run for $60 break and next leg down

- GC: $4087.1, continuing to stall sideways

- VIX: 19.66, elevated excitement from yesterday justified

- 2yr Bonds: 3.576%

Only Mostly Wrong For A Short While

“He’s only mostly dead.” – Miracle Max, The Princess Bride

Having an opinion comes with a price sometimes. Sometimes you’re right. Sometimes you’re wrong. Sometimes you’re only “mostly wrong.”

Monday’s newsletter said markets were doing SFA, standing around the campfire kicking stones. Uncle Russ was the only one leading lower. Everyone else hesitating.

I was calling for bear moves. Markets weren’t cooperating. Yet.

This time, I was only mostly wrong for a short while.

Tuesday morning arrives: The bear quadrangle are all finally moving in lockstep.

ES Futures: 6805.50 (down from ~6900 Monday)

YM Futures: 47,200 (down from ~47,800 Monday)

NQ Futures: 25,722.25 (down significantly)

RTY Futures: 2441.2 (continuing the journey south)

All four major indexes showing >1% overnight moves lower. Not just Uncle Russ anymore. Everyone’s heading south together.

Prices are moving inside the established patterns. The range highs to range lows journey is underway. The bearish breakouts from last week aren’t failing. They’re following through.

There will potentially be a huge gap at the opening bell should these >1% moves hold from the overnight sessions. Gap-down opens create Premium Popper opportunities. Volatility expansion. Mechanical entry criteria. Systematic execution regardless of narrative.

VIX clue from yesterday (elevated at 17.75, now 19.66) was indeed justified. Markets don’t elevate VIX for no reason. The nervous tic wasn’t just twitching. It was warning.

Sooooo we were kinda right. And as usual, we never know when we were right.

The bear thesis was correct. The timing was “mostly wrong” until suddenly it wasn’t. Now all four indexes are cooperating. Moving in lockstep. Validating the systematic positioning.

Current Status: Bear quadrangle moving in lockstep, >1% overnight drops across ES/YM/NQ/RTY, VIX 19.66 justified, only mostly wrong for short while

Gold Bug Guru Was Right – Took 12 Years

It reminds me of a gold bug guru back in the 90s.

This character was sending out newsletters or those magalogue things for their services. Now, this was at a time when gold was around $250-ish per ounce. Gordon Brown, the then UK Chancellor, had just kneecapped the UK by selling the lion’s share of the gold reserves.

Context: Between 1999 and 2002, Gordon Brown sold roughly 395 tonnes of UK gold reserves at prices between $275-$296 per ounce. Widely considered one of the worst financial decisions in British history. The timing was spectacularly bad – selling at multi-decade lows just before a massive bull run.

OK, so that sets the scene.

This gold bug guru was for several years touting gold at $1000 from $250-ish at a time when nobody was interested in gold. Central banks were selling. Investors thought gold was a barbarous relic. Tech stocks were the future. Who needed shiny metal?

The gold bug kept calling for $1000. Year after year. Newsletter after newsletter. “$1000 gold is coming!” whilst everyone laughed and gold stayed around $250-300.

Then 2008 happened. Then 2011 happened. Gold hit $1900+ per ounce.

Turns out, with around 12 years of hindsight later, he was right.

But for those 12 years? He was “wrong.” His subscribers probably cancelled. His predictions looked ridiculous. “$1000 gold? This guy’s insane! It’s been at $250 for years!”

Sometimes you can be both right on your view and wrong on the time.

And people only remember that it wasn’t right now. They don’t remember you called it 12 years early. They remember you were “wrong” for 12 years.

This is the challenge of systematic positioning: Being right directionally but early on timing creates the same P&L pain as being wrong directionally. The market doesn’t care that you’ll be vindicated in 12 years. It cares about today’s price action.

Current Status: Gordon Brown sold UK gold $275-296 (worst timing ever), gold bug guru called $1000 from $250 (took 12 years but right), being right on view but wrong on time hurts

Right On View, Wrong On Time – People Only Remember Now

Sometimes you can be both right on your view and wrong on the time. And people only remember that it wasn’t right now.

This is the systematic trader’s perpetual challenge.

You call for bearish breakdown. Markets ignore you. You look wrong. Then suddenly, they break. You were right. But nobody remembers the weeks you looked wrong. They only see the current result.

Or worse: You call for bearish breakdown. You’re early. Markets rally another 5% first. You take heat. “Wrong again!” Then markets crash 10%. You were right directionally. But the timing cost money. And people remember the early call, not the eventual vindication.

The gold bug guru calling $1000 gold from $250 in 1999:

- 2000: “Still wrong”

- 2001: “Still wrong”

- 2002: “Still wrong”

- 2003: “Still wrong”

- 2004: “Still wrong”

- 2005: “Getting closer but still wrong”

- 2006: “Getting closer…”

- 2007: “Almost…”

- 2008: “Getting close…”

- 2009: “There it is! $1000!”

- 2011: “$1900! He was right!”

But for those 10 years, subscribers cancelled. People mocked him. “That gold bug who keeps predicting $1000.” Turned into a punchline.

Then he was spectacularly vindicated.

This is why systematic frameworks focus on mechanical rules rather than directional predictions. We don’t predict the bear move happens Tuesday vs Monday. We position for bear conditions when setup criteria trigger. We execute mechanical rules when price confirms.

Monday: “Markets doing SFA, Uncle Russ leading lower, others hesitating.”

Tuesday: “All four indexes moving in lockstep, >1% drops overnight.”

Was I wrong Monday? Or just early? The mechanical setups were there. The follow-through took 24 hours longer than hoped. Now it’s happening.

Current Status: Right on view but early on timing, people remember “wrong” periods not eventual vindication, systematic rules remove prediction requirement

Off White Tuesday Instead Of Black Monday

I can at least stop banging my big bear drum and celebrate.

If not a Black Monday, perhaps I’ll be allowed an off white Tuesday.

Black Monday refers to 19 October 1987, when the Dow Jones crashed 22.6% in a single day. The largest single-day percentage decline in stock market history. Absolute carnage.

Tuesday 4 November 2025 isn’t that. We’re not seeing 20%+ crashes. We’re seeing >1% overnight drops across four major indexes. Meaningful moves. Gap-down potential. But not historic carnage.

Off white Tuesday feels appropriate. Not the dramatic black crash. Just a nice, steady, bear-move-in-lockstep kind of Tuesday. All four indexes cooperating. Prices moving inside established patterns. Range highs to range lows journey underway.

The bear thesis is playing out:

✅ Uncle Russ led lower first (as anticipated)

✅ Other indexes hesitated at campfire (as observed Monday)

✅ VIX showed elevated nervous tic (clue something brewing)

✅ Now all four moving together (vindication)

✅ Oil running for $60 target (as predicted)

✅ Gold stalling sideways (as speculated)

Was I wrong calling bears when markets were “doing SFA”? Or was I just early by 24 hours?

Systematic frameworks don’t require perfect timing. They require mechanical execution when setup criteria confirm. The bearish breakouts from last week set the stage. Monday’s hesitation tested patience. Tuesday’s follow-through validates positioning.

Off white Tuesday it is. Not historic. Just systematically correct.

Current Status: Off white Tuesday vs Black Monday, >1% drops not 20%+ crashes, bear thesis playing out across all four indexes, timing vindication without drama

Oil Run For $60 – Gold Stalling Sideways Continues

Oil (CL): $60.14. Making a run for $60 and its next leg down.

Monday: “Oil developing lower high, targeting break below $60.”

Tuesday: “$60.14 – almost there.”

The $60 psychological level is within reach. Once crude breaks and holds below $60, the next leg down targets $56-58 range. The Oil Bear position remains active. The mechanical setup is playing out exactly as anticipated.

Lower high development from last week confirmed. Crude couldn’t reclaim $62-63 levels. Formed lower high around $61. Now testing $60 breakdown. Textbook bear continuation pattern.

Gold (GC): $4087.1. Continuing to stall sideways.

Monday: “Gold stalling, sideways range speculation.”

Tuesday: “Still stalling at $4087.1.”

Gold’s not breaking higher. Not selling off aggressively. Just… stalling. The consolidation after +47% year-over-year gains continues. Range boundaries developing. Higher lows, lower highs. Classic sideways digestion.

Both commodities doing exactly what systematic frameworks anticipated:

Oil: Bearish pattern playing out, targeting $60 break

Gold: Consolidation pattern developing, awaiting breakout direction

We were kinda right. And as usual, we never know when we were right.

The setups were there. The patterns were developing. The mechanical rules triggered positioning. Now price action is confirming. But we didn’t know Monday night that Tuesday would deliver vindication. We just executed systematic rules regardless of timing uncertainty.

That’s the entire game. Be right on view. Accept uncertainty on time. Execute mechanical rules. Let price action validate or invalidate. Adjust positioning accordingly.

Current Status: Oil $60.14 running for $60 break and next leg, gold $4087.1 stalling sideways digestion continuing, kinda right but never knowing when

Huge Gap Potential – Premium Popper Opportunities

There will potentially be a huge gap at the opening bell should these >1% moves hold from the overnight sessions.

ES: 6805.50 (from ~6900 Monday close)

YM: 47,200 (from ~47,800 Monday close)

NQ: 25,722.25 (significant drop)

RTY: 2441.2 (continuing lower)

If these levels hold through the opening bell, we’re looking at gap-down opens across all four major indexes. This creates specific opportunities:

Premium Popper setups: Gap-downs with elevated VIX (19.66) create volatility expansion. Mechanical entry criteria for 0-DTE collection. Scalping the open for quick premium. PopPop opportunities whilst others panic about gap psychology.

Tag ‘n Turn consideration: If gap-down finds support at range lows, potential multi-day reversal setup. If gap-down continues through support, bear continuation confirmed targeting next levels.

The mechanical rules don’t predict which scenario plays out. They respond to what price confirms at the open. Gap-down holds support? Execute range-low reversal positioning. Gap-down breaks through? Execute bear continuation positioning.

VIX at 19.66 (up from 17.75 Monday, up from 16.9 Friday) confirms volatility expansion. This isn’t nervous tic anymore. This is genuine uncertainty creating option premium opportunities.

Systematic traders love gap environments. Others see chaos and hesitate. We see mechanical setups and execute. The gap itself doesn’t matter. The volatility it creates does.

Current Status: >1% overnight drops creating huge gap potential, VIX 19.66 confirming volatility expansion, Premium Popper opportunities at open, mechanical positioning regardless of gap direction

In Other News…

FinNuts Market Flash: The Valuation Paradox

“Infrastructure spending feels real. Software valuations feel… theoretical.”

Tuesday morning futures stumbled as investors suddenly remembered that 490x P/E ratios might be “a bit ambitious,” even for companies crushing every metric. Amazon celebrated its record close whilst Palantir discovered that perfect earnings can’t defy gravity forever. Markets processing the uncomfortable reality that infrastructure you can touch feels safer than software you can’t.

️ When Physical Servers Beat Digital Dreams

Amazon’s $38B seven-year AWS deal with OpenAI sent cloud stocks soaring because actual hardware feels reassuringly real in an increasingly theoretical market. Microsoft’s $9.7B GPU pact with Iren confirmed the trend: investors will pay for infrastructure you can cool with air conditioning.

Meanwhile, Palantir initially surged 7% after crushing Q3—63% revenue growth, 121% U.S. commercial explosion, Rule of 40 score hitting 114%—then plunged 4% when analysts noticed the 225x forward P/E and quietly asked:

“Does anyone remember how valuations work?”

The Magnificent Seven Monopoly Intensifies

Seven stocks generated 41% of S&P gains year-to-date whilst over 300 stocks closed red Monday—the financial equivalent of the entire party happening in the executive washroom whilst everyone else queues for the regular loos. Breadth weakness screaming concentration risk, but apparently nobody’s listening as long as AI infrastructure keeps validating itself through circular spending agreements.

Manufacturing contracted for the eighth consecutive month at 48.7, but markets treating old economy like Wallie’s productivity reports—acknowledged briefly, then promptly filed under “irrelevant.”

The $1.4 Trillion Question Nobody’s Asking

OpenAI committed $1.4 trillion to partners without profitability path, raising uncomfortable questions about whether entire AI buildout is elaborate game of financial pass-the-parcel. Money circling in ouroboros pattern: OpenAI → AWS → OpenAI → repeat.

CEO Karp addressed “detractors” in Palantir shareholder letter—those detractors presumably being anyone with functioning calculator concerned that 54% government revenue faces shutdown threat Day 34.

Tonight brings Super Micro, Tuesday delivers AMD, testing whether chip sector has any remaining tolerance for reality.

Fed Flying Blind Into December

Rate cut probability collapsed from 90% to 67% after Powell’s October 29 hawkish tilt, proving economic weakness no longer guarantees monetary easing. Shutdown delays jobs data indefinitely, meaning Fed’s December 10 decision happens without instruments—but apparently flying blind passes for monetary policy nowadays.

Treasury curve stable, dollar near three-month highs, credit spreads widening modestly. Options flow shows defensive positioning in QQQ and SPY because even optimists hedge when valuations defy mathematics.

☕ Hazel’s Final Thought

Wall Street’s celebrating infrastructure spending whilst questioning software valuations, treating physical servers like they’re somehow less speculative than the algorithms running on them.

When the AI buildout finally demands returns, it won’t be gradual recalibration—it’ll be a “where’s the profit?” reckoning that makes Palantir’s 4% drop look quaint.

—Hazel Ledger, FinNuts Bureau of Valuation Reality Checks

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Mostly Wrong For Short While Formation Flying Into Off White Tuesday” whilst analysing bear quadrangle lockstep movement and claiming they had mastered “Gordon Brown Gold Sale Timing Disaster Advanced Cooing With 12-Year Vindication Recognition.”

Hazel updated her crisis management protocols to include “Right On View Wrong On Time Emergency Procedures” alongside contingency plans for “Huge Gap Opening Bell Integration With VIX Elevated Justification Monitoring And Bear Celebration Without Hubris Protocols.”

Mac raised his Tuesday whisky (in an off-white glass) and declared, “When all four indexes finally move in lockstep after Uncle Russ led the way and systematic traders celebrate off white Tuesday instead of Black Monday whilst gold bugs get 12-year vindication, timing humility becomes delightfully superior to prediction arrogance!”

Kash attempted livestreaming about “being only mostly wrong being basically like DeFi protocol temporary impermanent loss but with actual bear vindication eventual outcomes” but got distracted calculating how many years until his predictions prove correct.

Wallie grumbled that in his day, bear moves meant “proper Black Monday carnage rather than this modern off white Tuesday nonsense with >1% drops and Gordon Brown gold sale regret stories!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.