FOMC Came And Went With Uncle Russell Making A NATH Guest Appearance

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Despite the FOMC wibble wobble yesterday and a NATH guest appearance on Uncle Russell – the markets didn’t really do anything new.

The overnight futures have reclaimed most of yesterday’s gains on S&P and Nasdaq, and partially on Dow and Russell. Back to square one then.

No Premium Poppers or trading at all for me yesterday for what I hope are obvious reasons. FOMC day. Sitting on hands was the play.

Looking for a few Premium Poppers at or near the opening bell today.

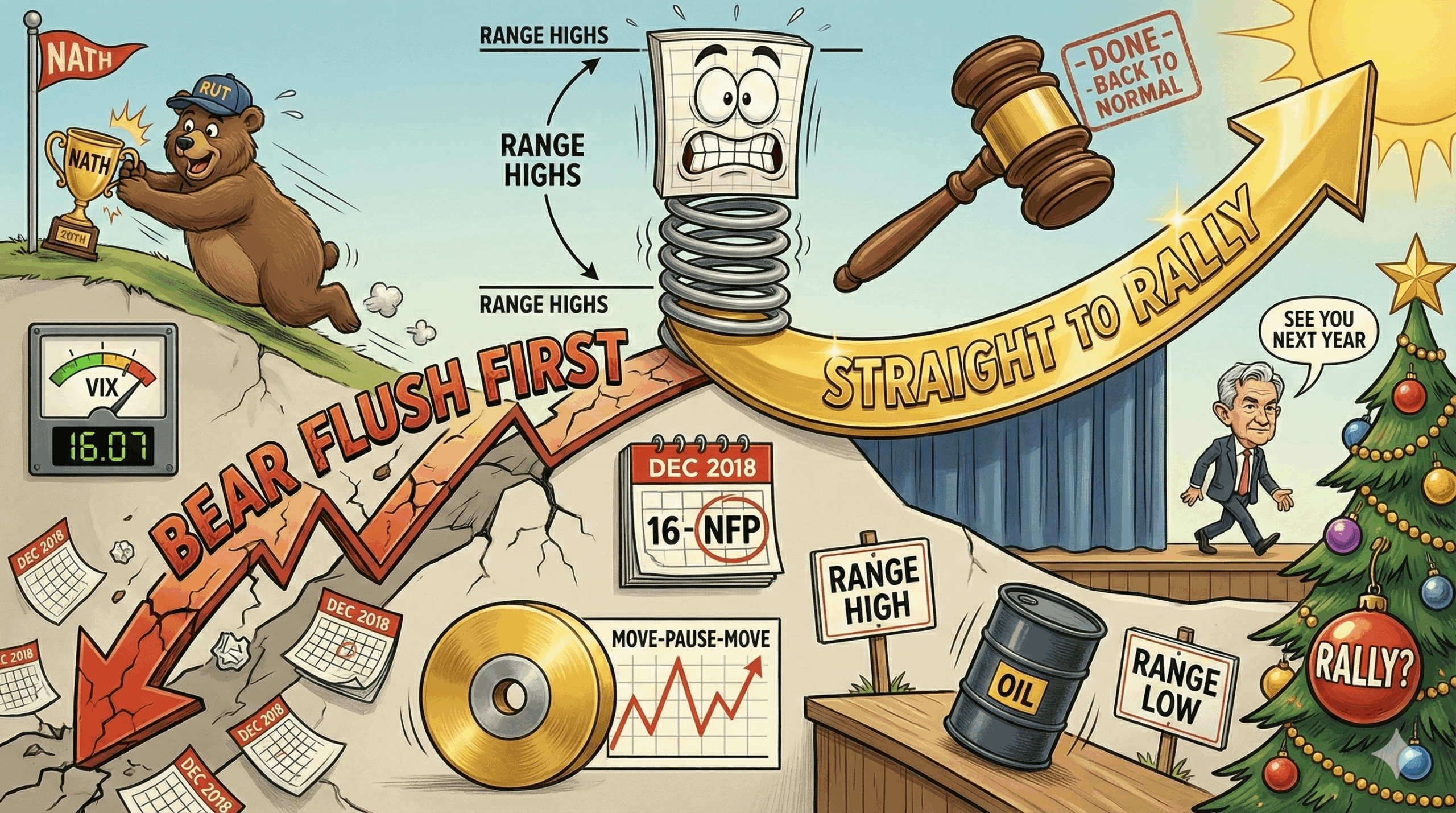

Keep scrolling for why I’m leaning bearish before the Christmas rally…

Market Briefing:

Current Multi-Market Status:

- SPX: Bullish Above 6849.59, PFZ 6824.69, Target 6884.2 – at range highs, potential bear setup forming

- RUT: Bearish Below 2560.11, PFZ 2576.31, Target 2510.17 – bear signal on last bar

- VIX: 16.07 – calmed down post-FOMC

- GC: 4,246.9 – chugging along, move pause move pause

- CL: 57.55 – back to range highs to range lows (6 Money Making Patterns)

- ES: 6,856.25

- NQ: 25,608.75

The Coiled Spring

I still get the feeling the markets as a whole are going to pop.

It’s really just a case of which way and how hard.

Will we get a bear flush like we did in 2018 around this time before the Christmas rally? NFP catch up on the 16th from the shutdown – could this trigger things?

My own view is that I’m leaning towards a bear move first before we see the Christmas rally. Just my opinion!

SPX – Range Highs, Bear Setup Forming

SPX has moved from the range lows to the range highs and we are just about to potentially see a new bear setup.

The software is showing Bullish Above 6849.59 with the flip point (PFZ) at 6824.69. Target remains 6884.2.

Watch for the bear trigger.

RUT – Already Did The Work

RUT broke through the highlighted range – smashed its way post-news to target and is now giving the bear signal on the last bar of yesterday.

Nothing to do with this until the markets open. The signal came on the close. We wait for confirmation at the open.

Bearish Below 2560.11, PFZ 2576.31, Target 2510.17

Crude Oil – 6 Money Making Patterns In Action

Crude oil is back to moving from the range highs to the range lows. One of my 6 Money Making Patterns in action.

This is what systematic trading looks like – identify the pattern, execute the setup, bank the profits. Rinse and repeat.

Gold – Chugging Along

Gold is just chugging along. Move. Pause. Move. Pause.

Nothing exciting but nothing to complain about either.

Calendar Today

- 8:30am: Initial Jobless Claims

- 8:30am: PPI (Forecast 0.2% vs Previous 0.2%)

- 8:30am: Core PPI (Forecast 0.2% vs Previous 0.3%)

Upcoming: NFP catch up on December 16th from the shutdown delay.

Expert Insights:

Markets coiled at range boundaries, leaning bearish before Christmas rally – 2018 comparison.

December 2018 provides the perfect template for what Phil is anticipating. That December was the worst since 1931, with the S&P 500 losing nearly 10% of its value. Christmas Eve 2018 saw major indexes fall another 2% as markets reeled from Fed rate hikes and trade tensions.

But then came the reversal – December 26th saw the Dow add over 1,000 points in the biggest post-Christmas rally in stock market history.

The lesson? The Santa Claus rally (traditionally the last five trading days of December and first two of January) occurs approximately 80% of the time since 1950 according to the Stock Trader’s Almanac – but it doesn’t mean the path there is smooth. Sometimes the flush comes first.

[Source: CME Group OpenMarkets – “The History of the Santa Claus Rally”]

In Other News…

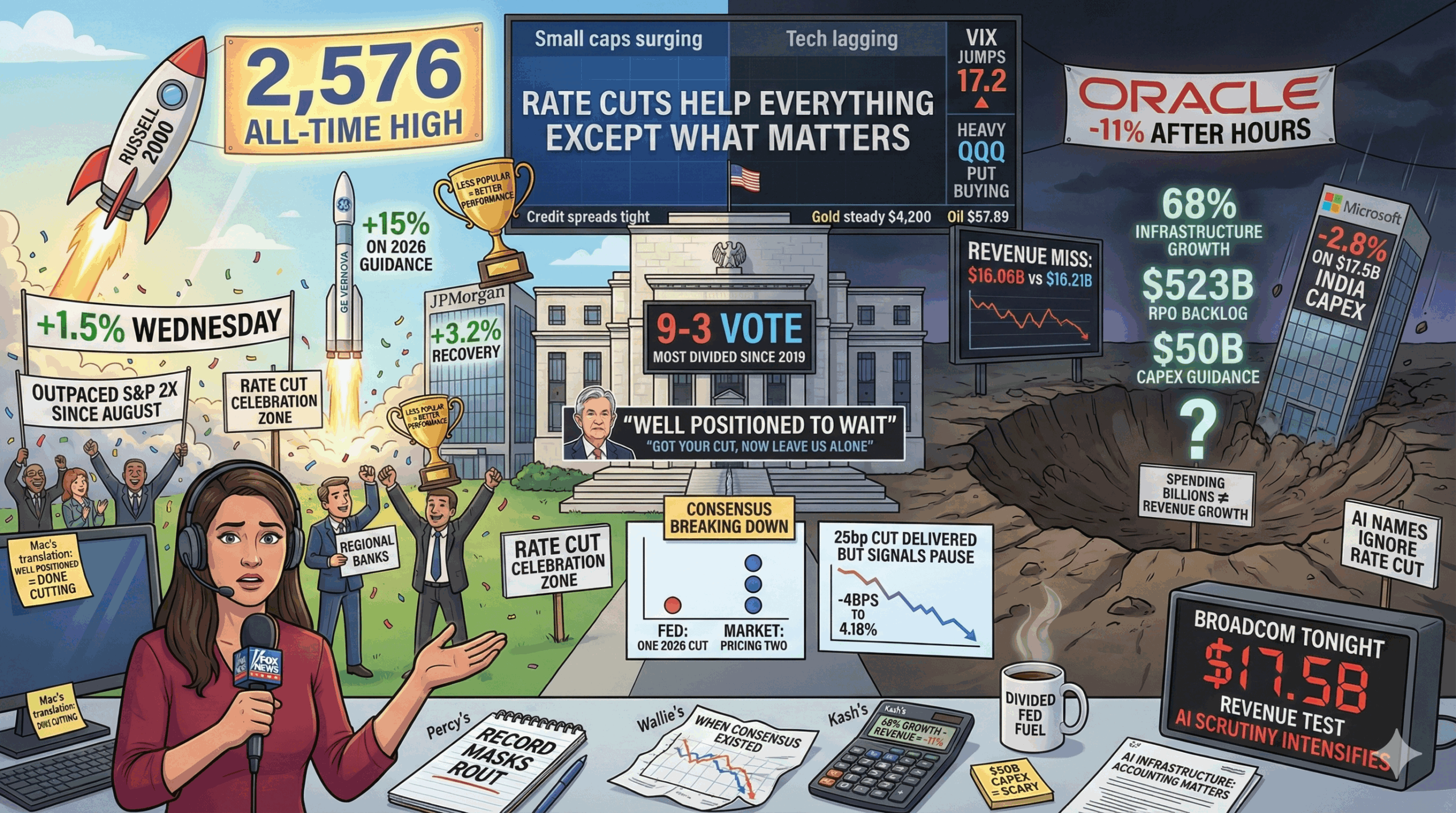

Russell 2000 Celebrates Record Whilst Oracle Crashes 11%

Fed’s 9-3 divided vote delivers cut. Small caps surge. AI infrastructure discovers $50B capex scary.

Russell 2000 smashed all-time high 2,576 Wednesday (+1.5%) as rate-sensitive small caps rallied on Fed’s 25bp cut—most divided vote since 2019 at 9-3 suggesting consensus breaking down. Oracle crashed 11% after hours despite 68% infrastructure growth because $16.06B revenue missed $16.21B and $50B capex guidance spooked Street proving spending billions still requires actual revenue. Markets now await Broadcom tonight testing whether AI infrastructure thesis survives earnings reality or joins Oracle crater.

When Record Small Caps Hide Tech Carnage

Russell 2000’s record masked tech rout: Oracle -11% after hours, Microsoft -2.8% on $17.5B India capex, sector lagging despite rate cut. Regional banks and industrials led celebration whilst AI names stumbled proving rate cuts help everything except companies everyone cares about. GE Vernova +15% on guidance, JPMorgan +3.2% recovery—small caps outpaced S&P 2x since August because apparently less popular equals better performance.

Fed’s “Well Positioned to Wait” Translation

Powell delivered 25bp cut in 9-3 vote (most divided since 2019) then declared Fed “well positioned to wait”—translation: “got your cut, now leave us alone.” Dot plot shows one 2026 cut whilst market pricing two creating familiar pattern where Fed signals less, market prices more. Treasuries rallied 4bps proving even divided, hawkish cut still counts as dovish when alternatives exhausted.

Oracle’s $50B Capex Paradox

Oracle reported 68% infrastructure growth and $523B RPO backlog but $50B capex guidance scared everyone away because spending that much money apparently requires faith markets currently lack. Revenue miss $16.06B vs $16.21B proves infrastructure growth doesn’t automatically mean revenue growth. Broadcom reports tonight with $17.5B revenue expected—AI scrutiny intensifying as sector discovers accounting matters.

☕ Hazel’s Take

Russell 2000 records, Oracle craters 11%, Fed’s 9-3 divided vote signals pause. When small caps celebrate rate cut AI names ignore whilst 68% infrastructure growth paired with revenue miss = -11%, probably acknowledging Broadcom test tonight determines sector fate.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted training his pigeons in “FOMC Aftermath Flight Patterns” whilst explaining that yesterday’s volatility required “Post-Fed Positioning Adjustment Protocols with NATH Guest Appearance Integration.”

Hazel immediately updated her crisis flowcharts to include “Bear Flush Before Christmas Rally Contingency Planning” alongside “December 2018 Historical Pattern Recognition Procedures.”

Mac took a philosophical sip of his morning whisky and declared, “Sitting out FOMC day isn’t cowardice, lad – it’s wisdom. Or laziness. Same thing really.”

Kash attempted to explain that “crude oil range trading is basically like yield farming but with actual barrels and less rug pulls” before getting distracted by gold’s move-pause-move-pause pattern.

Wallie grumbled that in his day, “December selloffs were PROPER selloffs, not this coiled spring waiting game nonsense with fancy software telling you when to trade!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The 2018 Template: Sometimes The Flush Comes First

December 2018 was the worst December since 1931 – then came the biggest post-Christmas rally in stock market history!

Here’s the uncomfortable truth about Christmas rallies that the permabulls don’t want you to hear: sometimes the market needs to puke before it parties!

December 2018 saw the S&P 500 lose nearly 10% of its value in the worst December since the Great Depression. Christmas Eve 2018? Major indexes dropped another 2% while Trump tweeted about the Fed being “like a powerful golfer who can’t score because he has no touch.”

Absolute carnage. But then December 26th arrived and the Dow added over 1,000 points – the biggest post-Christmas rally in stock market history. The Santa Claus rally period (last 5 trading days of December, first 2 of January) still occurs about 80% of the time since 1950, but the path there isn’t always pretty.

So when I say I’m leaning bearish before the Christmas rally? I’m not being a Grinch. I’m just reading the historical playbook. Bear flush first, then rally. Just my opinion!

[Source: CME Group OpenMarkets ]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.