Santa Rally Still MIA. Price Stuck Under VWAP. Bears Still In Control.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

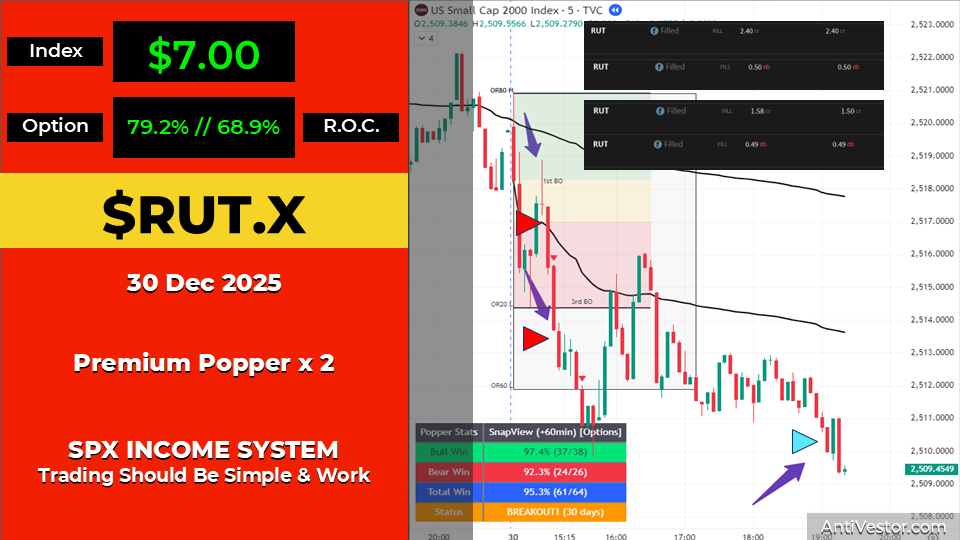

December 30th delivered 2 Premium Popper trade setups on RUT.

Now interestingly, I was fully expecting to see price turn bullish for the much anticipated Santa Rally.

However, price remained firmly under the 2-day VWAP.

And using that as my directional bias, my first trade uses the current day’s VWAP to “sell the rally.”

Other factors here not on the chart were that price pushed through the prior day’s lows – a classic pullback entry setup. Not quite an A+ setup as it’s not too clean looking. Perhaps a B+.

At its most basic? This is a VWAP setup.

My second entry is a classic ORB20 breakout setup. The stats on the screen show this has high confidence and a 95.3% win rate in the last 30 days.

Keep scrolling for why a $7 move made premium sellers rich whilst futures traders twiddled their thumbs…

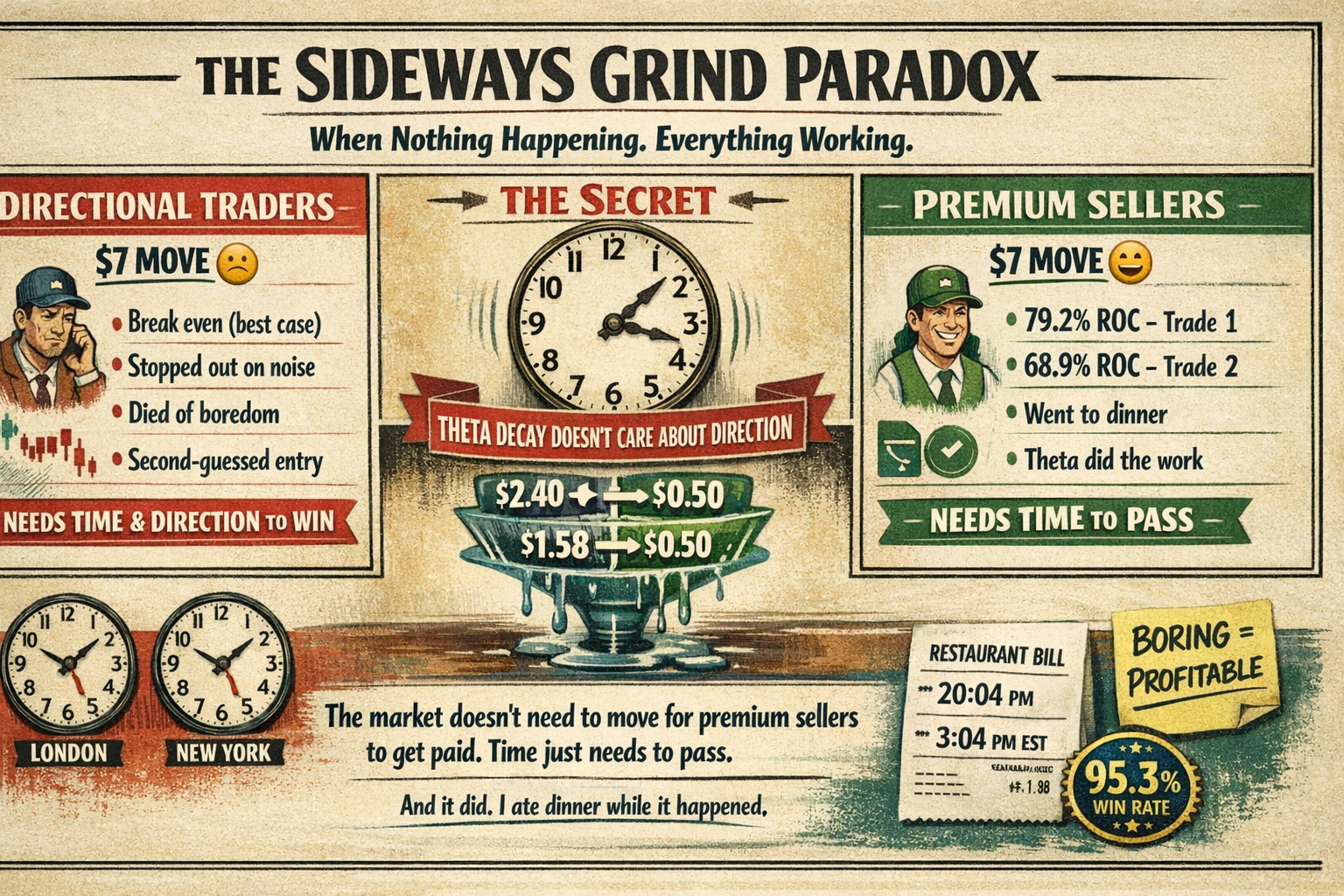

When price grinds sideways, premium sellers shine.

DeBriefing:

The Trades

| Field | Trade 1 | Trade 2 |

|---|---|---|

| Ticker | $RUT.X | $RUT.X |

| Strategy | Premium Popper (VWAP) | Premium Popper (ORB20) |

| Direction | Bear | Bear |

| Setup Grade | B+ (Pullback Entry) | A (Classic Breakout) |

| Premium Collected | $2.40 | $1.58 |

| Exit Price | $0.50 | $0.50 |

| Index Move | $7.00 | $7.00 |

| Return on Capital | 79.2% | 68.9% |

| Status | ✅ WINNER | ✅ WINNER |

The Setups

Trade 1 – VWAP “Sell The Rally”:

- Price firmly under 2-day VWAP = bearish bias locked

- Current day’s VWAP used as entry trigger

- Prior day’s lows broken = classic pullback setup

- Not the cleanest entry (B+ not A+) but the setup is the setup

Trade 2 – ORB20 Breakout:

- Classic 20-minute opening range breakout

- Stats backing: 95.3% win rate (61 of 64) in last 30 days

- High confidence entry

- Clean mechanical trigger

The Magic Of Premium Selling

Here’s where premium selling shines again.

Price essentially grinded sideways with a meagre $7 move after the initial clear setups.

The same setups on Futures or stock would have produced a break even or tiny gain – assuming stops weren’t hit or boredom didn’t kick in.

Premium Poppers? Benefited from the sideways grind and watched the premium pop.

For myself – I went out for a bite to eat with Mrs N and met up with friends.

Remember: US lunch is my evening meal time because I’m 5 hours ahead in the UK.

Both bought back for $0.50 later on in the day.

79.2% and 68.9% ROC respectively.

The Stats That Matter

RUT Premium Popper Performance (Last 30 Days):

- Bull Win Rate: 97.4% (37 of 38)

- Bear Win Rate: 92.3% (24 of 26)

- Total Win Rate: 95.3% (61 of 64)

Final Notes

Two setups. Two winners. One sideways grind.

$7 of movement that would bore a futures trader to tears.

148% combined ROC whilst having dinner with Mrs N.

That’s the premium selling advantage.

Expert Insights:

Two Premium Popper entries on RUT whilst price remained under 2-day VWAP despite Santa Rally expectations.

VWAP (Volume Weighted Average Price) serves as a powerful directional bias tool. When price remains firmly below the 2-day VWAP, it indicates sellers remain in control regardless of seasonal expectations. The ORB20 (20-minute Opening Range Breakout) provides a mechanical entry trigger with historical backing – in this case, a 95.3% win rate over the last 30 days (61 of 64 trades).

The key insight here is that premium selling strategies don’t require large directional moves to profit. A $7 sideways grind that would frustrate directional traders becomes a theta collection paradise for premium sellers. As time passes, option premium decays regardless of whether price moves significantly – this is why “boring” trading days often produce the cleanest premium selling wins.

[Source: AntiVestor SPX Income System – Premium Popper Framework]

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted analysing the $7 sideways grind with his pigeons, declaring it “The Most Profitable Bore Fest Of The Year” whilst updating his VWAP directional bias protocols.

Hazel immediately created flowcharts titled “When $7 Moves Produce 148% Combined ROC” with sub-sections for “Futures Traders Crying vs Premium Sellers Dining.”

Mac raised his evening whisky and declared, “When Mrs N gets dinner AND the premium gets popped, that’s what I call work-life balance! 79.2% and 68.9% ROC whilst eating – now that’s systematic trading!”

Kash attempted to calculate whether “95.3% win rate technically qualifies as a money printer or merely an extremely reliable cash generation mechanism” before getting distracted by the B+ vs A+ setup grading mathematics.

Wallie grumbled that in his day, “we didn’t have fancy VWAP indicators telling us directional bias – we just watched the tape and knew when sellers were in control!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Why Premium Sellers Love Sideways Grinds

A $7 index move would barely cover commissions for futures traders. For premium sellers? It’s theta collection paradise. 148% combined ROC on a “boring” day.

Here’s the dirty secret about premium selling that directional traders never learn: we don’t need the market to move.

In fact, we often prefer it when it doesn’t.

A $7 sideways grind after a clear setup would have futures traders checking their phones, second-guessing their entries, maybe getting stopped out on noise, or simply dying of boredom.

Premium sellers? We collected $2.40 and $1.58, watched theta do its thing whilst having dinner with Mrs N, and bought both back for $0.50.

That’s 79.2% and 68.9% ROC on what most traders would call “nothing happening.”

The market doesn’t need to move for us to get paid. Time just needs to pass. And last time I checked, time passes whether you’re watching charts or eating dinner.

- Sideways grind? Paid.

- Theta decay? Working.

- Mrs N happy? Priceless.

[Source: AntiVestor SPX Income System – Premium Popper Framework]

Meme of the Day:

“Futures Trader: ‘$7 move?! I waited all day for THIS?!’

Premium Seller: closes both trades for 148% combined ROC

Futures Trader: ‘But nothing happened!’

Premium Seller: ‘Exactly.’ goes to dinner with Mrs N“

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.